Weekly update – Steadying the ship

Pierre Paul, from our cash management team, writes this week’s update.

Our last note, entitled “A Tale of Two Central Banks”, contrasted the actions of the Bank of England with the Federal Reserve Bank and surmised whether the Fed is behind the curve with regard to tightening monetary policy in response to rampant inflation. This time we look at a third Central Bank, namely the European Central Bank (ECB) and what we can expect EU interest rates to do in the weeks ahead.

Holders of Euro bank balances will be painfully aware that Euro interest rates have been zero or, if you are an institutional customer, actually negative, meaning that you are paying your bank for the privilege of holding your cash. In other words, as an institutional customer you will definitely lose money by placing Euros on deposit with an EU bank.

Clearly, seeing that the UK and US Central Banks have started to raise rates has raised expectations of a similar course of action from the ECB. Sadly, those expectations are unlikely to be met in the short-term. A big difference is that Ukraine is on the EU’s doorstep, therefore the economic ramifications of Russia’s aggressive invasion are much greater for the EU than for the UK and the US. Admittedly the inflationary effect of rising energy prices is being felt globally, but nowhere else is there such reliance on Russian oil and gas than there is in Germany and other EU member states. As well as the trade in energy between the EU and Russia there is the close proximity of land borders and the physical trade that passes across these borders.

The ECB states that “The Russian invasion of Ukraine is a watershed for Europe. The Governing Council expresses its full support to the people of Ukraine. It will ensure smooth liquidity conditions and implement the sanctions decided by the European Union and European governments. The Governing Council will take whatever action is needed to fulfil the ECB’s mandate to pursue price stability and to safeguard financial stability”1.

With regard to monetary policy the ECB’s approach is going to be gradual and well signposted to minimise any fallout in the financial markets and, as expected, the ECB opted to leave interest rates unchanged at its last meeting, with Christine Lagarde noting that “downside risks to the growth have increased substantially as a result of the war in Ukraine”.

After the last ECB rate setting meeting the statement released said that if inflation is not forecast to weaken then asset purchases (QE) would conclude QE by the 3rd quarter of 2022 with a tapering of asset purchases from €40 billion in April, €30 billion in May and €20 billion in June.

The ECB’s relatively dovish position has led to a sell-off in both the Euro and Euro denominated bonds with the Euro falling to a near two-year low in April to below $1.08 for the first time since May 2020. The sell-off in bonds meant that the yield (bond yields move inversely to prices) on the German 10-year Bund increased 0.13% this week to 0.84% having started the year at minus 0.18%.

So, even though the ECB hasn’t officially started raising interest rates the money markets have started to factor in higher official rates and this anticipation has fed into the interest rates that high street banks are paying for deposits. In fact, we have now started to see banks actually paying a positive interest rate on longer dated fixed deposits, which is something we have not seen for three or four years.

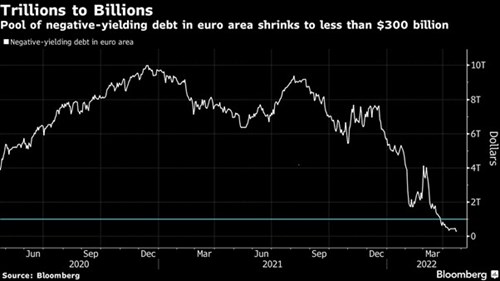

Outside of the formal ECB policy setting meetings a number of ECB officials have made more hawkish comments creating a sea of change in the region’s bond markets, where the pool of negative-yielding debt has collapsed to the equivalent of less than $300 billion from a peak of nearly $10 trillion in 2020. Market pricing indicates the deposit rate could hit 1.5% toward the end of next year, from minus 0.5% currently. That compares with price action in prior weeks, when traders scaled back rate hike expectations after Russia’s invasion of Ukraine. The change in the pool of negative yielding debt is graphically illustrated in the chart below:-

Source: Bloomberg

So, the ECB will continue with its very deliberate and considered monetary policy – after all, it is mandated to maintain financial stability in the Euro block. Nevertheless, the fact that QE is being tapered and several ECB members are openly talking about raising interest rates has resulting in a significant change with regard to the interest rates we are seeing from local banks. This then is bringing EU rates into line with the US and the UK, covered in our last note.

We hope you have a good week.

Sources:

1 European Central Bank