Weekly update - The interest rate outlook has changed slightly

At the end of 2023 market commentators were convinced that both US and UK interest rates had peaked and the US would be first to cut rates in 2024, perhaps as soon as the March meeting. The UK was expected to start cutting rates a bit later in the year, with markets expecting the US to cut rates by 150 basis points and the UK by at least 100.

However, the first two months of 2024 have led to a re-assessment of these expectations. In short, economic data has been stronger than expected.

In the US January headline nonfarm payrolls (which measure the change in the number of people employed, excluding the farming industry) increased by 353,000 compared to an expected 185,000. The previous month was also revised upwards which suggests that the US labour market is still reasonably tight, which should support wage pressure. In addition, the US CPI data in January was stronger than expected with both core and headline increasing rather than falling.

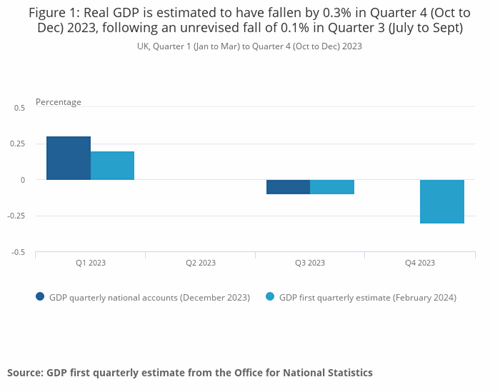

In the UK, whilst official quarterly GDP data has suggested that the UK was in a shallow recession in the second half of 2023, more recent data has been stronger. The latest composite PMI number was 52.9, which compares to the 52.5 that markets had been expecting. Inflation as measured by CPI was 4.0% in December, slightly above the consensus expectation of 3.8%, and in January that figure held steady at 4.0%, slightly below the consensus of 4.1%. Whilst the media focused on the fact that food price inflation dropped it won’t be lost on the Monetary Policy Committee (“MPC”) that inflation is still above the 2% target. Whilst individually these numbers are not that much stronger than expected, collectively they appear to show some resilience and most forecasters now think that the UK economy is growing again.

So, markets have begun to alter their expectations of when and how quickly central banks will move.

The biggest shift is in the US. Most commentators still expect the next move to be a rate cut, although there are some warnings that the prospect of another rate rise should not be ruled out. However, the stronger data has dealt a severe blow to those expecting early rate cuts. Markets are now pencilling in a cut at either the June or July meetings and expectations of the total size of rate cuts in 2024 have reduced to 90 basis points.

The minutes from the last Fed rate-setting committee meeting reinforce this more cautious approach. The theme from these minutes is that the committee want to see more evidence that the fall in inflationary pressure is both tangible and permanent. Some members were worried that the positive news on inflation last year could be due to ’idiosyncratic movements in a few series’.

Closer to home, the MPC voted to leave official UK Interest rates unchanged at 5.25% at their January meeting. The vote was quite disjointed, with two members voting to raise interest rates, six to leave them unchanged and one to cut rates.

The theme from the minutes was that the committee as a whole is increasingly confident that UK Interest rates have peaked and the language also changed. Previously the committee had emphasised that ‘further tightening will be required if inflation did not fall’. This has been replaced with a comment that rates would need to ‘remain restrictive for sufficiently long to return inflation to the 2% target’.

So, the door to interest rate cuts is open but inflation still needs to fall and the slightly better economic news perhaps reduces the urgency for the MPC to act. An example of the uncertainty around potential economic outcomes in the UK is that the energy price cap will fall in April, which will have a positive impact on UK inflation. However, falling inflation and rising wage growth will increase real household disposable income. The key then will be how households react to this – if they save more, it could reduce economic activity but if they choose to spend it will have the opposite effect and could ultimately be inflationary.

Market expectations for UK Interest rates were always that the first cut would probably not happen until the middle of the year. Given that there has been a bigger shift in expectations in the US is it increasingly likely that the UK could cut before the US.

However, the decisions of both central banks will be data-dependant. If the data remains strong and inflation sticky then rate cuts will be on hold. This is as it should be and is further evidence of our theme of the ‘normalisation’ of monetary policy. We expect the next interest rate cycle to be a more rational response to economic conditions rather than driven by an emergency reaction to external shocks. Assuming this is the case then, whilst we continue to expect interest rate cuts, we do not expect interest rates over the next few years to fall back to the ultra-low levels experienced in the last interest rate cycle.

Have a good week everyone.

Data sources:

- Federal Open Market Committee minutes

- Monetary Policy Committee minutes

- Economic data as reported by third-party providers