Weekly update - More of the same please

During the last weekly update, Stocks on sale, Ross spoke about investors’ unwillingness to act when assets appeared to be on sale. It should come as no surprise that our two teams offer a contrasting set of services; each designed to align with the goals and objectives most important to our respective clients - you. Our differing approaches mean there will inevitably be times where we diverge on the outlook and the appropriate course of action. Given that, during the March sell-off, the Global Blue Chip strategy only introduced one new holding (Edwards Lifesciences), we have a persistent bias for quality, own a number of “irrepressible tech titans” and “those can’t do without healthcare stocks” I couldn’t help but feel we might fit the description of those “investors” which Ross was referring to!

With the above in mind and following on from FAANGtastic or Fanatical? Revisited earlier this year, I thought this might serve as a good opportunity for a brief diversion into the Global Blue Chip team’s valuation process and what this meant in terms of the opportunities we saw during the March sell-off.

Like many investors, we consider the value of a company to be calculable by reference to all the cash that it will bring in over the rest of its life. When looking at a company, we use conservative assumptions and come up with an estimate of what those cash flows will be. However, money is well known to have a time value – cash on hand is generally more valuable to you today than the same sum would be a few years from now (“a bird in hand is worth two in the bush”, so the saying goes). We therefore discount our cash flow projections using a “discount rate” to reflect this opportunity cost, which ultimately asks the question “what’s the minimum return we could expect on our money if we invested elsewhere?” If a company’s shares then offer us a greater rate of return than our opportunity cost, we consider them to be good value.

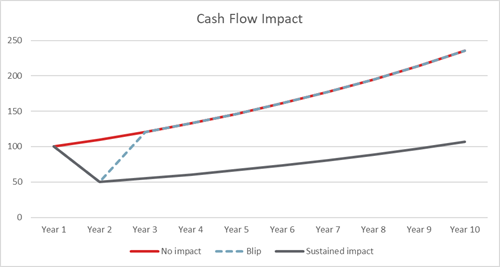

What then does this approach mean for company valuations during a pandemic like the one we are currently experiencing? Well, that is largely dependent on the type of business in question. We have defined three broad buckets (“no impact”, “blip”, “sustained impact”) in which to categorise businesses. The first category represents those companies whose business operations have been relatively unaffected by the pandemic (and thus the impact on their future stream of cash flows is likely to be de minimis). The second represents those companies that will likely suffer a temporary setback (perhaps as a result of supply chain disruptions but where the underlying demand for their products/services remaining robust). Finally, we have those companies whose entire business practices will be thrown into question. These businesses have less certainty surrounding their ability to generate future cash flows (and to what extent) and are most at risk of undergoing a significant fall in our assessment of their intrinsic value.

Given the emphasis on only owning quality companies within the strategy, we believe our underlying businesses fall within the first two categories.

This should be viewed positively as it means the value we assign most of our holdings has been largely unaffected by coronavirus.

In fact, some of our businesses have actually been benefactors of an acceleration in pre-existing trends (as we touched on in What are our companies up to?) and their future cash flow profiles may have improved as a result.

Conversely, our inaction during the sell-off (at least in terms of the introduction of new holdings) is largely because of the robustness of our existing portfolio. Being high conviction investors, we are limited on the number of positions we can bring in to the portfolio and we normally operate on a one-in/one-out basis. At any one time, the strategy should contain the most attractive investments within our wider opportunity set (subject of course to good portfolio diversification practices) and consequently the bar new ideas have to overcome in order to make it into the portfolio remains high.

When equity prices were around their March lows, some of the ideas on our bench list started to look compelling (in isolation). However, the returns on offer were often trumped by existing holdings whose prices had also fallen. That said, on reflection we do think we had an opportunity to reallocate more capital between some of our existing holdings as Ben explained in Navigating the exit from lockdown.

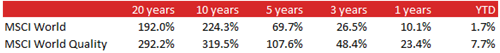

To conclude, the table below shows the performance of the MSCI World Quality Index against the broader MSCI World Index. Over the last 20 years, this variant has outperformed the broader index over all periods. We remain unconvinced that this is a temporary effect and that lower quality, cyclical, business will suddenly start outperforming for a sustainable period. We will continue to stick to our knitting: identifying business that exhibit the characteristics of quality we look for and ensuring that we do not overpay for the exposure to such companies.

Source: Bloomberg - 8th June 2020

To find out more about the Huntress Global Blue Chip fund please click here