Despite a strong start to 2024, last week was a choppy one as investors digested a stronger-than-expected inflation print and rising global conflict, causing stocks to fall for a second consecutive week.

The sell-off began after the news of the most recent inflation report from the US last Wednesday. It showed consumer prices remained sticky, throwing into doubt the likelihood that the Fed would cut interest rates as aggressively as some had believed. The US Consumer Price Index (CPI) surprised on the upside for the third month in a row and the majority of subcategories posted worse numbers than expected. Consumer prices rose 3.5% over the 12 months to March, up from 3.2% in February1, with higher costs for fuel, housing, dining out and clothing responsible for the increase. Many had expected imminent rate cuts but recent economic data, including strong job creation figures, has raised doubts of when the decision will be made.

The data not only has implications for the Fed, but for the US elections. Biden wants to tell a story to voters about a strong economy over his presidency but stubborn inflation keeps getting in the way. Higher interest rates have meant more expensive home mortgages, food and fuel costs putting a squeeze on voters. With many now expecting the first rate cut of the year in September at a crucial point in election campaigns, many will be keeping a close eye on how inflation evolves over this period.

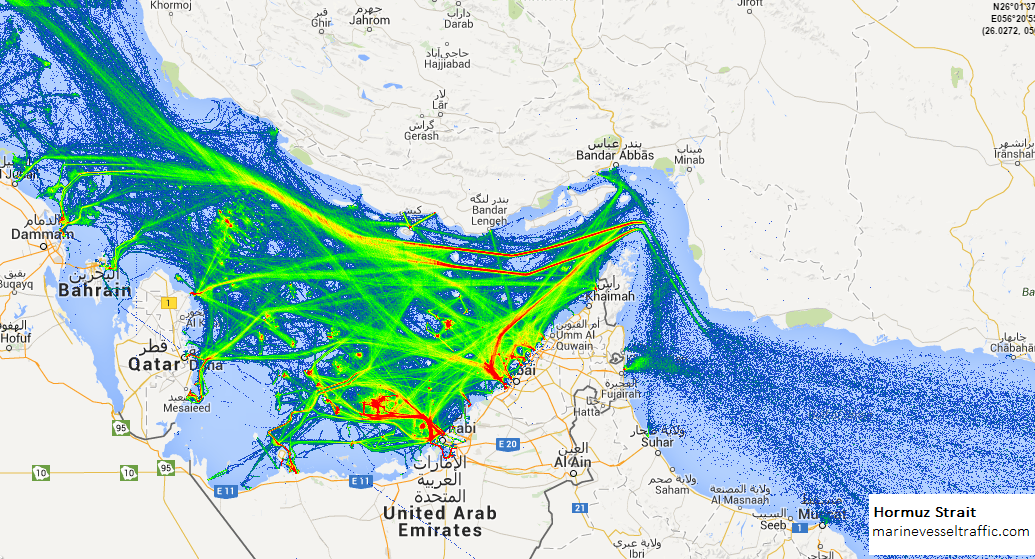

There was further volatility over the weekend as Iran launched a reprisal attack on Israel in the form of more than 300 drones and missiles. Amidst the uncertainty, safe haven assets like gold rose sharply, and 10-year Treasury yields jumped. The situation remains fraught and, beyond the humanitarian implications, an escalation to more widespread conflict in the Middle East could see huge supply chain disruptions and energy security issues. Iran is the seventh largest oil producer in the world as well as the third largest member of OPEC and speculation around disruption on a crucial shipping route, the Strait, has caused volatility in energy markets. When Russia invaded Ukraine in 2022, oil prices soared to $120 a barrel over supply fears as Western nations imposed sanctions on Russia, one of the world's major oil exporters. The jump led to not only higher prices at the pumps, but also countless other goods as businesses adjusted their prices to cover higher costs. Fuel and energy prices have been a major driver behind the higher cost of living worldwide in the past couple of years so, unsurprisingly, big shifts in oil prices can impact central policy.

As the direction of inflation and interest rates continue to dominate investment headlines and, in turn, market sentiment towards various asset classes, this will cause more volatility in the short term. Regular readers will know that although we recognise the importance of these developments and spend time assessing their impact, we do not try to make short-term asset allocation bets based on the macroeconomic environment. It is easy to be seduced by noisy headlines but we, instead, focus our efforts on ensuring we have built our portfolios’ diversified selection of assets aligned with long-term themes. This should enable us to perform well in the long term while remaining nimble.

In the meantime, we continue to find silver (or should I say gold?) linings, as our long-term themes continue to unfold around us. The world is growing, ageing and needing more healthcare and resources from the planet and we are adopting innovations like artificial intelligence at an incredible pace. We have therefore built portfolios around these long-term trends to ensure they are able to hopefully withstand this volatility and uncertainty.

Have a good week.

Sources:

1 BBC