Ravenscroft weekly update - Scream if you want to go faster.... or scream if you want to get off!

Good morning everyone … and Happy New Year!

The first week of 2019 summed up the last quarter of 2018, to be honest, with some proper decent volatility persisting thanks to a number of not-insignificant and still-yet-unresolved issues hanging over the markets, such as Brexit and trade wars, to name but two! Furthermore, on Thursday, Apple Inc. did the unthinkable and warned its shareholders that future revenues might suffer owing, inter alia, to signs of economic slowdown in China. The stock had its worst single trading day since 2013 and the once USD1.1trillion company ended Thursday valued at less than USD700billion with all of the major US stock indices dragged down behind it, lower by 3% or so on the day.

But then Friday came around … and, would you believe it, almost all was forgiven as:

The job numbers of which he tweeted were the non farm payrolls, which increased by 312,000 last month, much more than expected, as US employers hired the most workers for over 10 months in December whilst also increasing wages. All of this seemed to allay a recent upsurge in fears about the US economy’s health. The good news was, perhaps not coincidentally, added to within hours by a more dovish Fed Chairman Jerome Powell who stated that that the Fed will be flexible on policy and is in no hurry to raise interest rates.

And lo, those very same US stock indices rose by 3% or so on the day!

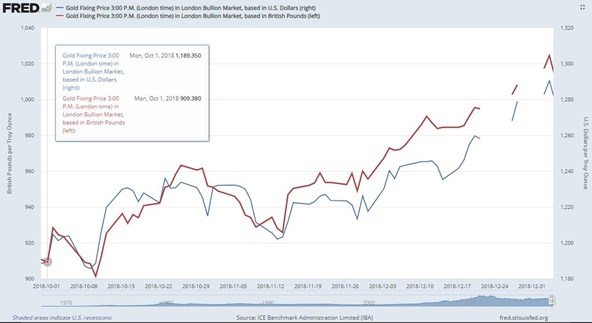

Meanwhile, in the gold market (closest to my heart), the reason we at BullionRock argue time and again for holding the metal, as a non-correlated but liquid asset to diversify an investment portfolio, has been playing out in front of our eyes for the last couple of months. All of the reasons that have been proving headwinds for equities have provided tailwinds for precious metals. Even the slight pullback on Friday is to be rejoiced (in a strange way) … gold has been behaving as gold should.

We must remember that whilst gold is traded in USD, its GBP price is found by converting using the exchange rate of the day. Sometimes this provides sterling investors with a double-whammy (up and down) and sometimes it proves to mitigate performance. Since November, we have had a rising gold price in USD and a stronger USD (moving versus GBP from 1.30 to 1.26) which has provided our sterling-thinking clients with an extra boost to the value of their gold allocation.

As ever, Ravenscroft continues to advocate the merits of a well-diversified portfolio of quality investments held for the longer-term.