We find ourselves over halfway through the year and once again it has been a rollercoaster ride for precious metals heading into quarter three. Gold has seen highs of over $2,000 per troy ounce on multiple occasions, nearing the historic record of $2,074, and silver seems to have settled somewhat and is currently sitting just under $23 p/oz1. This follows 2023 lows of $20 p/oz in March1. It’s been a more disappointing six months for both platinum and palladium as both are down below their January prices. Palladium has seen the most notable change following an opening price in January of $1,804 p/oz but now sits over 30% lower at $1,2501.

Platinum group metals (PGMs) are often overlooked in mainstream media, and this is understandable given that they don’t have the history or notoriety that gold and silver do. Having said that, they can play an important role in diversifying an investment portfolio as their uses differ considerably from other metals.

The largest demand comes from the automotive sector as PGMs have highly effective catalytic properties. As tighter restrictions are introduced for vehicle emissions, more PGMs are needed to meet these requirements. In March the World Platinum Investment Council highlighted why we may see some changes in price for both platinum and palladium:-

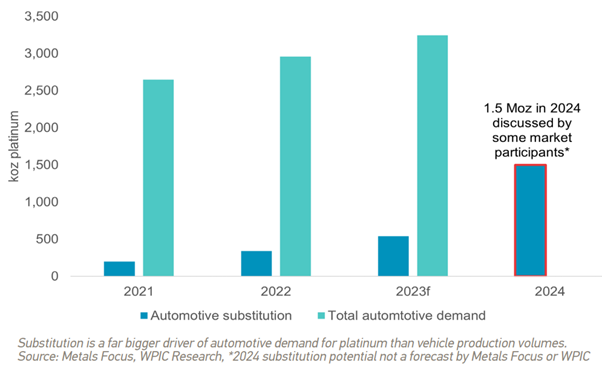

“A key driver behind the growth in automotive demand for platinum is the increase in platinum-for-palladium substitution in gasoline auto catalysts, which is expected to rise by 50% to 540,000 oz this year from 360,000 oz in 2022, itself an 80% increase on the previous year.”

At first glance, an argument could be made that as technology advances and we become less reliant on internal combustion engine vehicles (ICEs), demand for PGMs may fall. However, significant changes aren’t expected to happen any time soon, with ICEs predicted to play a large part in the automobile industry well into the 2030s. Until then, the volume of platinum per vehicle is likely to increase.

There are currently two alternatives to combustion engines: electric or hydrogen. Popularity of electric vehicles (EVs) is soaring, with Tesla now a household name in the industry and electric cars accounting for almost a fifth of all new car sales in 20222. This growth is expected to continue over the next few years as battery life increases and more charging infrastructure becomes available.

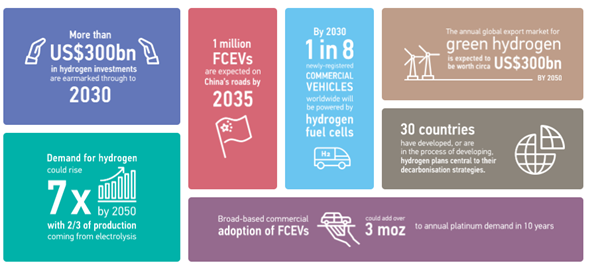

Hydrogen is another possible replacement and can provide power with near-zero greenhouse gas emissions. Although the technology is still in relatively early stages of development, it is showing potential to compete with EVs for a greener future. Platinum finds itself in a unique position as it is a key component of fuel cell technology due to its catalytic and conductive properties. It’s reasonable to assume that as demand for hydrogen powered vehicles increases this will also drive the platinum price.

Another major difference for PGMs is where they are sourced. Although there are some mining hotspots for gold, like China and Australia, there are still huge quantities mined globally so supply chains are well established and very reliable. In comparison, South Africa and Russia are the only two countries producing notable volumes of PGMs. This makes things extremely volatile when relationships between countries become strained. We saw this last year when Russia invaded Ukraine and palladium hit an all-time high, with its price peaking at over $3,300 per ounce3, and again in 2008 when platinum prices reached record highs of $2,200 per ounce3 following production concerns from South African miners.

The reliance for these countries to produce and export is huge, and what might be a small blip for gold or silver can often be exaggerated when dealing with PGMs. To put it in perspective, it is estimated that if we were able to pour all the gold that has ever been mined into an Olympic sized pool, we’d be able to fill it three times over. Platinum, on the other hand, would just about cover your ankles. Its scarcity can pose issues at times, but it also creates an opportunity in the metals marketplace which gold and silver cannot replicate.

Sources: