Ravenscroft weekly update - Quo Vadis

This week's update comes from Robin Newbould, managing director of BullionRock, Ravenscroft's precious metals business.

Where next? We are always trying to answer this question in the investment world, whilst also accepting, regrettably, that none of us has a crystal ball. When I wrote my last update at the start of the year, equity markets had just been badly bruised by a November and December kicking and the-then-largest-stock-of-them-all Apple Inc. had, well, upset the applecart by warning its (many) investors that sales were not going as well as expected, particularly in China.

I also mentioned that some decent US job numbers, and a Federal Reserve chairman’s statement which seemed to imply that interest rate rises might be on hold for a while longer than anticipated, had started a New Year rally … one which is now into its second month and has seen major indices already rise in the region of 10% year-to-date … quite the move!

The current investment outlook is still dominated primarily (I am sure I have written about this three times already) by an unresolved Brexit and unresolved trade tariff ‘discussions’ between the US and China, amongst others. So why are the markets pushing higher? In short, because they are not looking for reasons not to. Most economies are still growing (that is, they are not in recession), employment data is positive, inflation is low and interest rates are low, non-existent or negative and look like they are staying that way. As noted by Bloomberg this weekend (although I have added the comic book image!):

When you are searching online for images for hawk and dove only to find that The Hawk and the Dove were gifted with super-powers by a mysterious voice that sets them on their quest for justice...but their approaches to this mission could not be more different. In the course of these late 1960s stories, the duo battles inner-city crime and corruption as they struggle to get along.

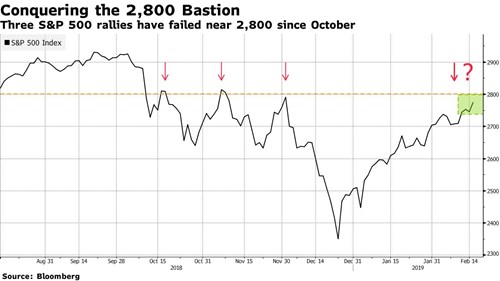

If anyone was looking for a reason to sell at this point, then equity valuations might be one place to find numbers to ponder. The broader S&P 500 equity index is reaching a key level that has proven difficult to overcome.

Whilst 2,800 is only a number, what it really represents is a line in the sand for investors to reflect upon how much they are paying for the companies within the index. If the S&P 500 tops 2,800, its valuation based on 2019 average per-share earnings estimates will be 16.5 times forward earnings – and whilst that’s the average reading over the past five years, it is a level at which some analysts say stocks will have become expensive. This is particularly relevant if, as has been the case, corporate earnings estimates continue to come down. After 2018 proved one of the strongest years for earnings during a record bull run, companies are indeed expected to post negative year-over-year growth in the first half of 2019, meaning that, all things being equal, the index should be lower.

So back to the question at hand, “where next?” The answer is less certain than any time I can really remember, to be honest. None of us really knows. I did however particularly like this, written by Joe Davis, the global chief economist and head of investment strategy for the Vanguard Group…

… ignore the headlines, keep calm and keep your focus on the long term … changing your investment strategy in reaction to short-term market moves can backfire. In fact, typically when investors have a strong urge to make changes, the benefits of making that change are the weakest …

Like him, Ravenscroft continues to advocate the merits of a well-diversified portfolio of quality investments held for the longer term.