2023 Q4 Newsletter

“All things must pass,

none of life’s strings can last.

So I must be on my way

and face another day.”

All things must pass – George Harrison, 1970

Please click here to view/download the PDF version of this update.

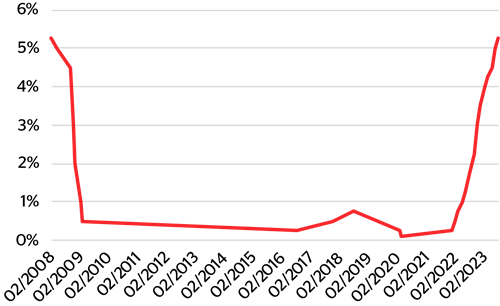

At the risk of sounding like a broken record we thought it worthwhile, once again, to put what has happened over the last 15 years in investment markets into some historical context. To oversimplify, the story that has had the greatest impact on bond and equity markets over the last 15 years has been the fall and then rise of global interest rates.

The chart (below) of the UK base rate reflects the action taken by the majority of central banks as they slashed rates in the face of the 2008 financial crisis – and then kept them low for the following decade or so. Then, in 2020, with the onset of the Covid-19 pandemic, they collapsed again to almost zero. In hindsight, and again to oversimplify, it is arguable that this elongated period of low interest rates supported a prolonged period of rising equity and bond markets.

The Bank of England base rate

Source: https://www.bankofengland.co.uk/

But, as George Harrison correctly points out: “all things must pass, none of life’s strings can last,” and so it was with interest rates. More recently, on the back of the enormous liquidity rush created from a zero-rate environment, coupled with rising geo-political tensions, inflation rose for the first time in decades. This rise swiftly triggered (albeit a little late) an equally steep rise in interest rates. This interest-rate reversal created a serious headwind for both equity markets and, particularly, bond markets. In fact, over the last couple of years we have just witnessed the biggest bond sell-off for decades.

However, with interest-rate expectations now beginning to peak, the bond sector has once again started to attract investors from both an income and (should rates continue to fall) a capital growth perspective.

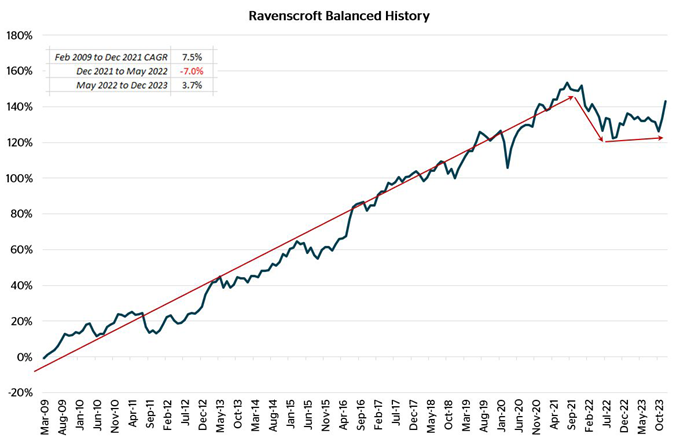

Sticking with oversimplification, you can see how these two periods of time (falling interest-rates and low inflation transitioning into rising interest-rates and rising inflation) played out in our portfolios. The following chart shows the performance of our core discretionary Balanced strategy since March 2009. As you can see, the strategy rose steadily from March 2009 to March 2021; yes, there were periods where the portfolio sold off (Covid lockdown in March and April 2020, for instance) but, on the whole, the period saw solid performance annualising at about 7.5% (as below).

The general upward trajectory changed in 2022, which coincided with the start of the rising interest-rate cycle triggering a sell-off in equities, and, in particular, those with a growth orientation. Cyclical stocks, such as mining and oil companies, did better. Of course, this also chimed with Russia’s invasion of Ukraine in February 2022, which turbo-charged the inflation threat.

After a very strong decade, we entered a period where our strategy lagged. We owned long-term investment themes like healthcare, technology and consumption stocks, whilst maintaining an underweight to financials and cyclicals. Our themes underperformed while cyclicals outperformed and bonds sold off.

The final stage in this chart, broadly speaking, illustrates mid-2022 to date: interest rates have continued to rise, albeit that they appear to have plateaued recently. As readers will know, we have increased the diversification of assets across our strategies; this will allow improved manoeuvrability in a period of rising inflation volatility. All that said – and as you would expect – we have stayed true to our thematic investment approach and these remain at the heart of all our portfolios. We have merely adapted the way we are playing them to provide extra flexibility.

We believe this to be a very pragmatic approach to investing in the current climate but, as ever, the market doesn’t always consider an investment manager’s insight, rather preferring to do its own thing.

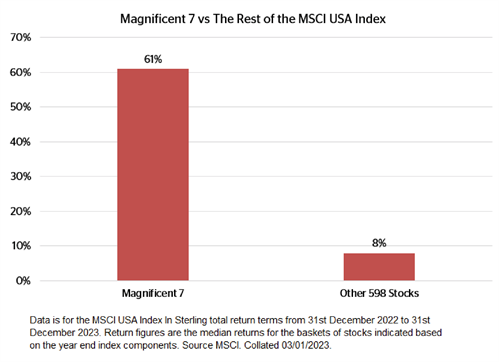

From a high-level perspective, and up until very recently, 2023 hasn’t been a year to be diversified. On the contrary, it’s been a year to be very focused indeed. As we have highlighted before, this year has been all about the US-listed ‘Magnificent Seven,’ which have returned almost 60% this year. Meanwhile, the rest of the S&P is about flat on the year – truly extraordinary! More recently, however, central bank rhetoric has indicated a more dovish stance; and this has resulted in a far broader equity and bond rally.

As Alanis Morisette sang: “You live, you learn. You love, you learn. You cry, you learn. You lose, you learn. You bleed, you learn. You scream, you learn.” And that, of course, is the key: we need to ensure that we are always learning, particularly through periods of change, painful or otherwise. Looking into 2024, our portfolios are well positioned to benefit from the possibility of peak interest-rates (and thus potential for rates to fall) via both bond holdings and thematic equity exposure – themes that, as we never tire of saying, we believe will stand the test of time.

As always, we thank you for your continued support and wish you a Happy New Year.

Cautious Portfolios

Lower Risk

by Tom Craske

Objective: The Cautious portfolio’s objective is to increase its value by predominantly allocating capital to fixed income investments. The portfolio can also invest into global blue-chip equities with strong cashflows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity-weighting of approximately 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

At the end of the third quarter, we wrote about the uncertainty and lack of market direction that has prevailed throughout 2023. The fourth quarter changed all that. Market sentiment markedly improved following a flurry of data pointing to a stronger than expected US economy and a central bank seemingly changing tack, signalling rate cuts to come in 2024.

In this environment, our Cautious (Income) portfolios rallied, returning 4.6% (1) and taking full calendar year performance to 5.4% (2). Our relatively defensive stance meant we did slightly lag the peer average this year, though we are confident that the underlying value of our chosen investments will help close that gap into 2024. The IA 0-35% returned 5.6% (3) in Q4 and 6% (4) in 2023.

The renewed optimism of the fourth quarter lifted all boats, with every underlying fund in the Income strategy, except for Prusik Asian Equity Income, gaining over the quarter. Jupiter Dynamic Bond was the main contributor to performance, returning 8.5% (5). KBI Global Infrastructure, a fund that fell victim to the poor sentiment surrounding the renewables sector earlier in the year, rallied in Q4, returning 8.3% (6) as sentiment significantly improved.

Prusik Asian Equity Income was the only fund in the strategy that declined as we moved into the winter months. The fund’s overweight positioning to Hong Kong and energy—both sectors suffering from poor sentiment—resulted in a performance of -1.1% (7) over Q4. The underlying companies remain great value and we expect to see positive returns going into 2024. Other funds that lagged peers over the quarter were iShares Ultrashort and Ruffer Total Return International. Given both funds’ conservative approach and the strong bullish sentiment over the quarter, the performance was in line with expectations, and both remain important levers in the overall portfolio.

2023 Contributors and Detractors

There was a lot of uncertainty heading into 2023, and we constructed the portfolio to remain robust to all eventualities. This stance meant some funds would perform better than others depending on how events unfolded. We included some managers with a defensive bias: Allianz Strategic Bond and Ruffer Total Return to act as protection should market conditions deteriorate. With much delight, we can report that the much feared recession has, as yet, failed to materialise, which means the two defensive funds underperformed relative to peers: Allianz returning -4.4% (8) and Ruffer, -6.4% (9). With the benefit of hindsight, our conservative approach was not needed, and the decision to include these funds detracted from performance relative to the index. But it is not a decision we are unhappy with. Heading into an uncertain 2023, and after a difficult 2022 for both Cautious and Income investors, ensuring the portfolio could weather any further financial storms – even if they did not materialise – at the expense of a few tenths of a percentage point relative to the index is a decision we could live with – especially if it sheltered low risk investors against further volatility or capital depreciation in their investment.

Our defensive stance, however, did not mean 2023 was short of success stories. The fund’s top performers came from three different sectors. GAM Star Cat Bond was one of the top performers in nearly every month of 2023 and returned 15.6% (10) over the year. The fund invests in a portfolio of carefully managed insurance-linked bonds and is largely unaffected by the changing macroeconomic landscape in the way that traditional investment assets are. Two other top performers were Fidelity Global Dividend - an equity fund that focuses on high-quality dividend-paying businesses, which returned 14.5% (11) - and fixed income fund Titan Hybrid Capital Bond, which returned 13.1% (12). The fact that a bond fund kept pace with an equity manager shows the inherent value in the sector.

Q4 Portfolio Changes

Quarter Four saw one change made to the strategy. Investors will recall that we have spent much of the year diligently adding touches of active management to the fixed-income element of the Income Strategy as we looked to better navigate a period of interest-rate volatility not experienced in the thirteen years following the 2008 Global Financial Crisis. TwentyFour’s Corporate Bond Fund was replaced with M&G’s Global Corporate Bond Fund as we transition to a more active approach to fixed income investing. The switch brought further benefits, adding a layer of diversification through a broader global corporate bond mandate and another through focusing on debt of higher credit quality.

2024

We entered 2023 having experienced a challenging equity market and the worst year for bonds in recent history. While the year did not produce the prompt recovery we had hoped for, improving market conditions in the fourth quarter bode well for a continued recovery in 2024. Attractive fixed-income and equity valuations mean cautious and income-focused portfolios are, we believe, well positioned to provide stable returns in the coming years.

Higher Income:

Medium Risk

by Robert (Bob) Tannahill

Objective: The Higher Income portfolio’s objective is to provide investors with a current income that is higher than cash rates. The current income target is 6%. The portfolio invests across a diverse range of assets including dividend paying equities, investment grade and high yield bond and infrastructure investments. The cash generated is taken as an income stream.

In what has been a volatile and challenging year for investors, it is a pleasure to be able to write this year-end commentary and confirm that the Higher Income portfolio is on track to deliver on the goals we outlined to you when we launched the strategy and fund in May. In our first seven and half months of operation we have declared and paid dividends that equate to a yield of just over 6% (13), which was our target for the first full year. On a total return basis, which includes both income and capital returns, the fund returned 4.4% (14) over 2023.

Within the portfolio all assets were positive since launch except for one, which we will touch on below. The top performers were: our emerging market equity income position (Pacific North of South Emerging Market Equity Income Opportunities) at 14.9% (15); our financial bonds (Titan Hybrid Capital Bond) at 10.5% (16); and our insurance-linked bonds (GAM Star CAT Bond) at 9.7% (17). The Pacific fund benefited from the strong performance of Latin America versus other markets, combined with strong stock selection from the team, which was very pleasing to see. Titan did well because some of the value we saw emerge in the space over 2022 started to be reflected in pricing; this had taken longer than we hoped because confidence in even the best financial bonds was rocked in March by the banking issues that culminated in the takeover of Credit Suisse. This fund focuses on the strongest names in the space, which gives us the confidence to hold through such tricky periods. It was great to see the market start to reprice those names in the second half of this year, driving the fund’s strong returns. Finally, the GAM fund was purchased due to what we saw as very attractive yields in this niche area of the bond market. A relatively quiet period for insurance claims over the year led to us being able to take that very attractive income without issue.

The laggard was The Renewables Infrastructure Group, which ended the year down -4.5% (18) from the launch of Higher Income in May. While this drop is material, it is in line with other assets in the renewable energy space in what has been a tough year for the industry. Higher interest rates and input costs put the whole sector under a lot of pressure, and some firms, such as market darling Orsted, have been found to have sailed too close to the wind. While our managers who specialise in the area largely avoided the land-mines in 2023, the whole space was sold off by the market; leading to broadly negative returns. We await the year-end results, due in the New Year, and will then arrange to re-kick the tyres to make sure everything is operating as we would expect.

Looking forward, we have one new fund that we would like to introduce to the portfolio. We came across it in the course of the large number of fund-manager meetings we do each year and were struck by the unusual approach and depth of experience of the manager. The fund is effectively a “best ideas” type of product run by a veteran sterling corporate-bond investor that leverages extensive experience to build a diverse portfolio from niche corners of the bond market – and thus doesn’t fit benchmark-focused portfolios. More will follow in due course. We plan to fund the position by trimming the investment trusts within the portfolio, which should dampen some of the volatility due to their inherent premium/ discount mechanisms. We will take our time on this, however, and aim to trim the trusts into strength.

Looking forward, the portfolio has an estimated distribution yield (expected income level to be paid out in cash) of 6.3% (19) and the underlying bonds have a weighted-average-yield-to-maturity* of ~10% (20). This attractive valuation reflects material value that was created in bond markets by the turmoil of 2022 and should support both a strong distribution-yield and the potential for some capital gains in the Higher Income strategy over the next few years.

*Yield to maturity is a measure of the expected total return of a bond if you hold it to maturity, the bond makes all payments on time and you include both capital gains/ losses and income. In a simplified example, if you buy a one-year bond at a price of £98 and it has an interest rate (or coupon) of 4% then at the end of the year you will receive a £100 payment of principal and a £4 payment of interest. The yield-to-maturity at purchase would therefore be: (£100 + £4)/£98 = 6.1%.

Balanced Portfolios:

Medium Risk

by David Le Cornu

Objective: The Balanced portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

Despite generating cash-like returns, 2023 has been another challenging year. I am not sorry to say goodbye to 2023, double-digit inflation, heightened geo-political tension and unsettled UK politics. I am, however, a bit sad to say goodbye to Credit Suisse: the Swiss powerhouse falling victim to people doing things (and taking risks) they didn’t wholly understand, in unforgiving derivative markets. Please rest assured Ravenscroft and our strategies embrace the KISS - "Keep it simple, stupid!" principle, so we won’t be investing in high-risk, highly leveraged or opaque investments.

The 2023 scorecard reflects that the GBP Balanced strategy delivered a return of 3.4% (21) whilst courtesy of a weakening dollar, our USD investors fared a bit better returning 5.0% (22). This compares to the IA Mixed Investment 20-60% (representing peers with equity exposure ranging from 20-60%) return of 4.6% (23). It was a year where we were overly cautious, anticipating a recession that, as yet, hasn’t arrived. Moreover, as active investors with a strong valuation discipline, we were materially underweight to the Magnificent 7 (key US technology stocks such as Nvidia and Meta), which delivered returns of between 40% and 200%. There was a huge divergence in performance between stocks, sectors and regions this year. For the Balanced strategy, Sanlam Global AI led the performance pack delivering a return of 37.0% (24), whilst Allianz and Ruffer, our defensive allocations, lagged in a relatively buoyant market, returning -4.4% (25) and -6.4% (26), respectively.

2024 will be an interesting year with elections taking place both sides of the pond. Over the years I have come to the conclusion that governments tend not to be the greatest influence on the performance of investment markets, so I am not overly concerned about the outcomes. With governments’ finances stretched they will have even less influence than usual on the level of investment returns that will be generated in 2024. To my mind, entrepreneurship, hard work, free flowing capital, capitalism and a considered investment process are far more important for investment returns than a government with a 4-year term of office.

What about 2024? The Balanced strategy will be taking its lead from Marty McFly: it’s “Back to the Future!”

The resetting of (and peak in?) interest-rates means that fixed-income investments are far more attractive than they have been for many years. The embedded yield in the fixed-income investments that populate the lower-risk part of the Balanced strategy has risen circa 5% and will help to underpin portfolio returns. As long as interest-rates don’t begin to rise again, they will show the defensive qualities that they used to and return “balance” to balanced strategies, thereby reducing volatility and giving them more of an absolute return feel. As interest-rates fall there is also the potential for capital gains. Over the course of 2023, we have added to the fixed-income asset class and intend to maintain exposure for the foreseeable future, clipping the very attractive coupons that are available.

Equities mostly appear reasonably valued by historic standards. Since investment markets are forward-looking discounting machines, they are already looking ahead 12 to 18 months (through any putative economic slowdown in 2024) to better times ahead. The equity exposure in the Balanced strategy is presently 51% and the intention is modestly to add to that in the New Year.

We will continue to invest roughly half of the equity content in actively-managed concentrated global equity funds with a proven track record to provide a stable core for the growth engine of the Balanced strategy. This will continue to be complimented by equity funds attuned to long-term irrefutable trends with supportive tailwinds that improve our chances of delivering attractive returns (AKA thematic equity funds).

As previously stated, we are of the view that AI (Artificial Intelligence) is the 4th industrial revolution and will be the most important investment theme for the coming years. We are working hard to identify the second and third-round beneficiaries of the AI boom since valuations are still modest despite the fact that they will drive performance in coming years. Early in 2024 we will be increasing exposure to the technology and innovation theme, which embraces AI by introducing another technology fund – one which has delivered returns similar to the broad technology indices without leaning too heavily on the Magnificent 7 – enabling us to increase exposure to this area of investment markets whilst retaining our valuation discipline.

Growth Portfolios:

Higher Risk

by Samantha Dovey

Objective: The Growth portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

Quarter four was the strategy’s best of the year, and a preferred way to end what has been another difficult year.

For Q4, the strategy posted 4.1% (27) versus the IA Mixed Investment 40-85% (representing peers with equity exposure ranging from 40-85%), which returned 5.8% (28). This takes 2023 full calendar-year returns for the strategy to 6.3% (29) and peers to 8.1% (30).

It is disappointing to be behind peers year-to-date. That underperformance happened during this quarter, which I will explain below. But before I do…

We did relatively little trading over the quarter, although we did say goodbye to the Lazard Global Thematic Inflation Opportunities Fund (GTIO) and hello to a new fund, BlueBox Global Technology. I have outlined the trade rationale below, but for more information on BlueBox itself, Tom Yarwood explains all in our Fund-in-Focus section.

Trade Rationale

The decision was taken to sell our entire holding in GTIO and place the proceeds into BlueBox Global Technology.

We bought GTIO back in June 2022. The strategy is designed to benefit from an environment of higher structural inflation, coupled with volatility.

The strategy utilises a set of themes designed to capture the symptoms and causes of this specific inflationary environment. The result is a differentiated and complementary portfolio that goes beyond the basics of pricing power or quantitative correlations. The portfolio is actively managed at both theme and stock levels by an experienced team utilising a proven thematic process, albeit adapted to target an environment of higher structural inflation.

Changes implemented across the Growth strategy over the last 12 months now mean that this focused “inflation” portfolio is surplus to requirements and proceeds have been placed into the new holding in BlueBox Global Technology Fund. The fund is managed by William de Gale who, prior to its launch in March 2018, spent 20 years at BlackRock running its technology fund.

So what happened in Q4 2023?

We have slightly underperformed this quarter due to the more cyclical exposures within the portfolio. Whilst the MSCI World was up 6.7% (31) on the quarter, two of our funds were negative: Schroder Global Energy, down -4.5% (32), and Ashmore Frontier Markets, down -2.2% (33); causing 1% of the relative underperformance.

It should be highlighted that on a year-to-date basis both funds are positive and have been very helpful when other parts of the portfolio struggled. That is, of course, the beauty of portfolio construction; it just so happens Q4 2023 was difficult for them.

Being marginally underweight duration in fixed-income cost 0.7% on a relative basis this quarter. This is due to the fact that the weighted duration of fixed-income in the Growth strategy is relatively short (at 2.3 years (34)). As such, it did not keep up with the rally we saw in longer-dated bonds.

For those doing the maths, this accounts for more than the difference – and that is because our other holding did really well! Our best performer for the quarter and, indeed, the year, was Sanlam Global AI Fund, which was 12.0% (35) on the quarter and 37.0% (36) on the year.

Looking forward to 2024

There are a few changes on the table for 2024 and they cover both equities and fixed-income.

Markets have been tricky over the last three years and, as Kevin Boscher our CIO would say, never have we had (at least in modern historical terms) a global pandemic, followed by a war, raging inflation and energy security issues.

The volatility we have experienced over this year has to do with interest rates, the tool conventionally used to calm inflation. Kevin covers this in depth in this outlook.

Nevertheless, we remain confident in the changes that have made over the last 12 months (and those yet to be made in early 2024) will enable us to weather anything thrown at us in these rather tumultuous times.

Global Blue Chip Portfolios:

Higher Risk

by Ben Byrom

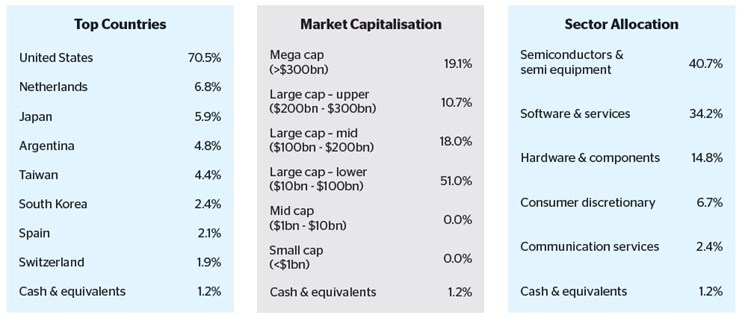

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chips that are in line with our long-term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

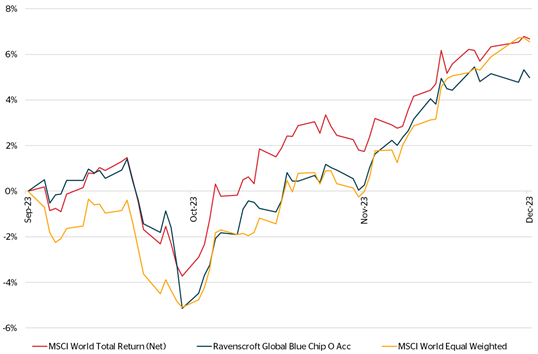

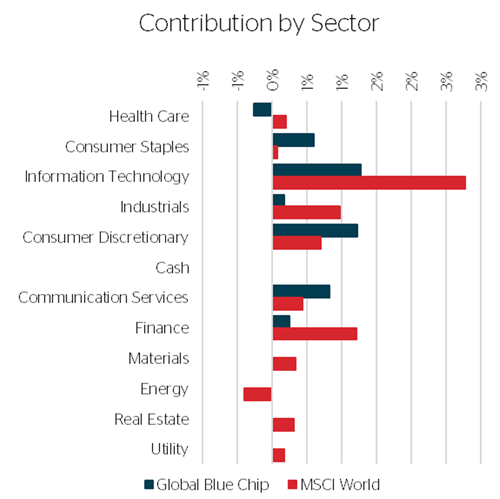

The fourth quarter arguably brought with it investor’s biggest test of the year when the weakness in September mutated into a brutal capitulation in October as bond yields continued to soar on the fear that interest rates may stay elevated. By the end of October, market positioning had become overly bearish, and sentiment was at a particularly low ebb - conditions were ripe for a relief rally. The spark that lit the touch paper under equities was falling inflation data which sent bond yields sharply lower. Jerome Powell, the Federal Reserve Chairman, threw petrol onto the fire when his dovish comments suggested they were prepared to pivot on interest rate policy. Attempts by Fed officials to play down this expectation only fanned the flames higher. What ensued in terms of price action will go down in the record books as a vary rare event with nine straight winning weeks registered across a number of major equity market indices.

To illustrate the strength and breadth of this rally we have included the MSCI World Equal Weight Index in the chart above. The equal weight ensures all companies have equal representation irrespective of their size. It, therefore, removes the influence bigger companies, such as the ‘Magnificent 7’, may have on the performance of the index offering a different perspective on the health of the market. Given the portfolio’s defensive positioning it was pleasing to see it compete favourably in this type of environment, although the wind was unexpectedly taken out of its sails towards the end of the quarter after Oracle and Nike announced their quarterly earnings. Nonetheless, the portfolio delivered a 4.7% (37) return for the quarter with both MSCI World indices finishing the period up around 6.6%-6.8% (38).

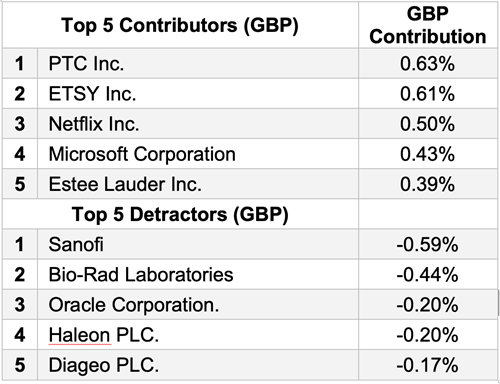

Our biggest contributor to performance was PTC Inc, the designer of product software for use within the industrial environment. We upped our position following its Q4 and Full Year earnings announcement in early November which showcased the resilience of its software business in the face of deteriorating economic indicators as it continued to grow profitably at attractive rates. The shares clearly got caught up in the strong equity rally and we reduced the position in mid-December on valuation grounds.

Sanofi was the Fund’s largest detractor during the period thanks largely to a surprise announcement made by management during their Q3 trading update. They forewarned that 2024 earnings would not grow after deciding to up their pipeline investments in a bid to secure growth beyond the end of the decade. The sacrifice of roughly 7% near-term earnings growth for an uncertain, but much greater, reward later on down the road proved too much for investors, who sent the shares down sharply some 20% (39). We discuss Sanofi, such as what we decided to do about our position, in our more in-depth Global Blue Chip Quarterly Insights newsletter, which can be found on our website.

In terms of changes to the portfolio, we introduced Heineken, Estee Lauder, and eBay and removed in their entirety Relx, Roche, L’Oréal, and Unilever.

We sold Relx and L’Oréal, two exceptional businesses, on valuation grounds. We had waited until the last bit of value had been drained from their shares until all that was left was valuation risk. We do hope we are gifted an opportunity to own these companies again in the future!

The decision to remove both Unilever and Roche was based on the premise that there were better risk vs. reward propositions in the portfolio more worthy of the capital tied up in their shares.

We bought Heineken, a Company we have been following for over 6 years, after we noticed meaningful value was materialising in the shares. Nothing much moves fast in the beer industry but Heineken has continued to build intrinsic value by re-orientating the Company’s focus on emerging markets and Africa in particular, where beer consumption is set to rise for many years to come.

We also reintroduced eBay, a Company which continues to execute on its Focus Category Playbook which doubles down on innovation in a bid to reinvent the shopping experience in categories where it can differentiate its services beyond connecting buyers and sellers. Despite the clear evidence of early success, eBay remains overlooked by the market with its stock trading on a single digit multiple.

Estée Lauder’s inclusion is purely down to a compelling valuation driven by an exceptional set of circumstances that we go into in more detail in this Quarter’s Stock in Focus, that can be found in our Global Blue Chip Quarterly Insights Newsletter.

Global Solutions:

Higher Risk

by Shannon Lancaster

Strategy not available to UK investors.

Objective: To generate capital growth over the long term (over 5-10 years). The strategy invests into 10-20 carefully selected third party equity funds; following the same, stringent investment process as the other multi-manager portfolios in our range. It is a highly focused portfolio which invests in companies providing goods and services dedicated to finding solutions to the challenges the world faces today.

Rates, Renewables and Resource Scarcity

In Q4 2023, the strategy returned 4.6% (40) vs 6.3% (41) MSCI ACWI bringing the year to date returns to -0.1% (42).

The final quarter of the year brought some much-needed relief across many of the sectors we invest in. The environmental solutions and energy transition themes contributed positively, while small and mid-cap exposure did particularly well. The recovery in renewables was highly correlated with the fall in long-term US interest-rates as the wind, solar and energy generation sectors performed very well. Conversely, China continued negatively to impact our emerging-markets exposure after an already challenging year.

Since we invest with a long-term, thematic approach, we recognise while the trends are structural, strong and in motion, there will be rocky periods on our journey. During the year, we lost investing-great Charlie Munger, who famously said on the topic of market volatility that “big money is not in the buying and selling, but in the waiting.” Following a similar principle, we remain calm during periods of uncertainty and avoid impulsive decisions based on short-term moves in the market. We have made one change to the portfolio in 2023 to introduce a fund that truly brings something different in terms of underlying exposures. We bought Nordea Climate Engagement in September and it has contributed positively to returns over that period, returning over 6.4% (43) in Q4.

Despite the strong thematic tailwind, some businesses in the energy transition sector struggled this year so it was pleasing to see a rebound in the final few months of 2023. Some renewables businesses struggled to digest the impact of higher interest-rates, increasing input-costs and supply-chain disruptions.

What went wrong? For one thing, higher rates led to an increase in financing costs. Alongside bottlenecks in supply chains, this pushed up equipment and installation costs, which then slowed deployment. For some sectors, like utilities, higher rates not only increased their cost but also depressed their valuations. Other areas of the energy transition value-chain were impacted by slower construction. Technologies like solar power, heat pumps and energy storage, which are closely linked to activities in construction and renovation, have faced additional headwinds. Sluggish demand, combined with the accumulation of stocks – particularly of Chinese components – has led to full warehouses and an industry caught in a much needed, but painful, destocking cycle. We met with our fund managers to discuss the developments in the space and were pleased with their responses. Many have used the periods of volatility to add to these businesses at attractive prices, in addition to the creation of more widely diversified portfolios that seek to invest in businesses at points all along the transition value chain focused on the distribution, transmission and consumption of energy. Pleasingly, we have seen some of the negative headwinds unwind over the past few months and the outlook for 2024 is looking promising.

These long-term structural growth opportunities have powerful momentum behind them. Growing policy support, heightening pressures from regulators and changing consumer behaviour are coming together to disrupt our processes and value chains across industries, which provides us with exciting investment opportunities in innovative businesses. We expect to see impacts of the US Inflation Reduction Act incentives filter through to the businesses we invest in next year and hope to see similar patterns of regulation from the rest of the world including Europe. Valuations across the Global Solutions portfolio look relatively attractive on a long-term view, as the earnings outlook continues to improve in the mid-term even in the face of short-term challenges.

As a team, we remain conscious about multiple market risks in the near term, including longer-term growth, inflationary threats and fast-changing financial conditions. We will continue to stick to our knitting and focus on what we do best: building diversified portfolios around investment themes that can withstand volatility, with a long-term mindset.

Fund in Focus:

BlueBox Global Technology

by Tom Yarwood

As mentioned in earlier commentary, the decision has been made to increase the technology exposure within our Growth portfolios through the purchase of BlueBox Global Technology.

This technology-focused fund complements our existing holding in Sanlam Artificial Intelligence (AI) and avoids certain areas of the market that we consider look stretched in terms of their valuation and ownership. The Fund was introduced as a 5% position in Growth portfolios during December.

BlueBox Global Technology is a long-only, global thematic equity fund that provides exposure to Ravenscroft’s key theme of Technology & Innovation. There are many index-like technology portfolios out there, but this is far from one of them, with the team differentiating themselves through their ability to identify and invest in high-quality ‘Direct Connection’ companies that provide exposure to the most exciting technology investments. These technology-enabler companies allow the strategy to aim for mid/high-teens annualised returns over 3-5 years.

The portfolio is actively managed by William de Gale, who has been running money in this sector since 2000 where he was the manager for BlackRock’s offshore Global Technology Fund from 2008 to 2017. William has a deputy manager in the form of Rupert de Borchgrave, who boasts 11 years of experience himself. Together, they exhibit all the qualities we look for when managing money: fundamental bottom-up stock picking, a robust repeatable investment process and in-depth knowledge of the sector and theme. It’s fair to say they are a safe pair of hands when it comes to investing in tech.

So, what is ‘Direct Connection’?

Over the past 15 years there has been a fundamental shift in the way that computing interacts with the world and, more importantly, humans. BlueBox call this the ‘Direct Connection’ of computers to the real world.

Computers have directly changed the real world, with humans taken out of the loop and processes now running millions of times faster. This massive acceleration in processing has supported the explosion of technology earnings and its outperformance over the last decade; the BlueBox team believe this trend will continue with a secular tailwind. They therefore look to take advantage of this by identifying businesses that enable or support Direct Connection; as a result, this trend underlies much of the portfolio.

With technology penetrating industry after industry, tomorrow’s winners will be those using new innovations like AI, industrial automation and robotics, autonomous vehicles or anything else that can be disruptive. BlueBox argue that all these innovative themes are derivatives of this overarching trend and, for that reason, investing in the companies that enable this Direct Connection means the portfolio can both support the themes of now as well as the disruptive themes of the future.

BlueBox invest, not in technology, but in technology enabler businesses that create value for their shareholders; businesses that enable other companies, usually from other industries, to disrupt their end-market. This is where the money is spent and the profits are made, with Direct Connection serving as a constant tailwind to growth and allowing these businesses to enable one disruption after another.

Conversely, disruptors have to spend money to grow and invest their own excess returns into R&D to stay relevant. In BlueBox’s opinion, this doesn’t return value to investors. These hot names tend to flare and burn out, usually only able to disrupt once (and are often disrupted in return).

Investing in the enablers means they don’t need to chase the latest hot trends, resulting in relatively low turnover and a focus on steady companies that create long-term value for investors. Moreover, given that the Fund is not benchmark driven, it looks very different to the index, both at market cap exposure and underlying company name.

The BlueBox process results in a high conviction portfolio of 30-40 stocks with strong earnings growth in the mid/high teens over the long term and is well-diversified by subsector, region and market capitalisation.

So how has this looked in terms of performance?

The recent excitement surrounding AI has been a great tailwind for the technology sector this year, with the Fund returning 37.0% (44) in GBP terms year-to-date. Even more importantly, performance over 3 and 5 years has been impressive with the Fund returning 21.8% (45) and 162.0% (46), respectively.

Being unique pays off and BlueBox has been rewarded with investor capital, with the strategy’s AUM now exceeding £900m, 4 years post launch. It’s pleasing to see the strategy performing as we would expect it to, given the current market conditions, and we are confident it will prove to be a useful thematic lever in our portfolios going forward.

Stock in Focus:

Estee Lauder

by Oli Tostevin

“From Cleopatra’s fabled milk bath to the ancient Egyptians’ pot of black kohl, from the rouged flapper cheeks of the 1920s and the hard, lollipop colours of the Hollywood vamp to Estée Lauder’s soft magic, women have always enhanced their god given looks. It has always been so. It will always be so”

Estée Lauder, founder of Estée Lauder & Companies, (1985)

It would be difficult to start any discussion on Estée Lauder (or the beauty industry more broadly) without referencing the quotation above. This was taken directly from Estée Lauder’s autobiography and succinctly explains why using beauty products is akin to opening pandora’s box – once the benefits have been experienced, consumers are reluctant to go back to the ways of dry skin, lacklustre lips, and a scentless existence. These innovations become part of people’s daily beauty regimes and consumers tend to exhibit sticky purchasing habits as a result. The repeat purchase nature of cosmetic products positioned as an “affordable luxury” has generated predictable sales patterns and high profits for decades. It is no wonder the sector has been a compelling fishing ground for quality focused investors.

This is a theme that Blue Chip holders have been a beneficiary of for a number of years via our holding in L’Oreal. Whilst we continued to admire Estée Lauder from a far (predominantly as a competitor to L’Oreal), the Company had always been too richly valued for us to consider seriously for investment purposes. Then, midway through 2022, the Company’s fortunes began to change.

Following Covid, Estée management had anticipated a quick recovery in the Chinese consumers’ desire to travel and assumed pent up demand would result in a rebound to solid growth at its Asia Travel Retail business. Unfortunately, the lockdowns persisted for longer than the company had expected, and a more gradual recovery ensued. This miscalculation meant that Estée’s travel retail channel was saturated with inventory their retail partners could not shift.

This precarious situation was particularly prominent in Hainan – a popular duty free holiday destination for the ~80% of the Chinese population who do not possess a passport. The combination of a slower easing of lockdown restrictions and a crackdown on illegal daigou activity (the smuggling of duty-free goods back for sale in mainland China via agents) weighed heavily on demand. In a highly competitive environment, Estée’s retail partners panicked, and they quickly adopted a strategy based on price promotion to reduce inventory levels that better met the subdued consumption environment.

In its last fiscal year, the situation contributed to a 34% fall in the sales associated with Estée’s Global Travel Retail business (which accounts for 20% of Estée’s overall sales). Whilst the numbers made for pretty grim reading, the real question was whether this period of heavy discounting had resulted in any lasting implications for the desirability and allure of the underlying brands.

The precipitous fall in the Company’s stock price (circa 70% from its 2021 highs) reveals the markets’ view, but we think it is too soon to draw the conclusion that there has been a broader, more permanent impairment of Estee’s brand to justify such a reaction. There are other issues to consider such as the ‘Bull Whip’ effect – where small changes in consumer demand have amplified ramifications for retailers and manufacturers – which are becoming an increasing issue in a post Covid world.

We have listened to management’s comments on this issue for well over a year and they now believe the end is in sight. A deeper analysis on the 80% of the business not impacted by these issues reveals continued strong demand. We therefore drew the conclusion that the severity of the adverse share price movement was providing an opportunity to acquire stock in a world class business at an undemanding valuation. This is the type of risk/reward payoff we favour, and we continue to feel that the margin of safety offered is sufficient to compensate us for any uncertainty surrounding this issue.

On top of this, Hainan currently serves as a destination that provides Estée a solution for expanding its reach beyond the, roughly, 150 Chinese cities where it currently has a physical presence. As the Company continues building out its store network in mainland China (to include Tier 2 and Tier 3 cities) we would naturally expect some of the demand that is currently served by Hainan to be replaced by consumption closer to home. There are early indications that this is the case and provided this continues, it will reduce the influence of Estée’s travel business on the overall results.

Whilst there is no denying that the normalising of the inventory position has created headwinds for Estée Lauder, longer-term we fully expect the consumer’s love of Estee’s products to shine through. Our ability to look through these transitory issues is a perfect example of time arbitrage in action. We view our ability to think about and appraise businesses over longer time frames as one of, if not the, greatest source of edge we have, and it is the driving factor behind some of our best investment returns.

We’re still (hopefully) in the early innings of our ownership period of Estée, but the results have been pleasing (up 30% since initiating our position in November). Whilst we would love to confidently declare we knew this was going to transpire, the reality is that, in the short-term, share price movements are highly erratic. Attributing this early success to anything other than luck would be slightly disingenuous. That said, the chances of producing market beating returns over the long-run are higher when acquiring excellent companies at depressed levels and we are optimistic, based on our fundamental analysis, that this may prove to be the case with Estée Lauder. We look forward to updating you on the Company’s progress in future periods.

Boscher's Big Picture:

Was inflation transitory after all?

by Kevin Boscher

After another difficult year for the global economy and financial markets, both bonds and equities have rallied strongly since the end of October in anticipation of a more dovish Fed and lower interest‑rates next year.

Although markets have been disappointed several times over the past couple of years by either stubbornly persistent inflation or the resultant “higher for longer” policy of central banks, this time seems for real as inflation is falling rapidly, global growth is slowing, labour market tightness is easing, and the Fed is openly contemplating lower rates. The global macro backdrop remains hugely uncertain and fraught with risks, but 2024 should be a year of disinflation, lower interest rates, higher bond prices and a continuation and broadening out of the equity recovery. The risk of recession remains but investors should be looking forward to a more favourable growth outlook as the year progresses.

It is now clear that what we have lived through since 2020 has not been a normal economic cycle. The pandemic was a macro-economic earthquake that dramatically disrupted the normal functioning of economic, geo-political and financial forces. It has been extraordinarily challenging to analyse trends in growth and inflation over this period. The pandemic lockdowns forced the world into a historic bust, then re-openings plus unprecedented fiscal and monetary stimulus provided the US and other developed economies with a rocket-like rebound across economic activity and financial markets. In late 2021 the boom turned to bust as monetary policy switched from super easy to the fastest tightening on record. What had previously gone up strongly, fell precipitately. As but one example, most equity markets have gone sideways for the past 2 years.

Although the US and other leading economies are holding up much better than expected, and employment remains strong, it is also clear that inflation in the US (and Europe) is melting faster and further than the Fed acknowledges. Below-trend growth, cooling labour markets and falling goods prices should see inflation head towards or below target over the next few months. So far, inflation has fallen largely thanks to easing bottlenecks, a recovery in labour force participation and lower commodity prices. The lagged effects from monetary tightening, which are likely to be significant, are still in the pipeline but starting to emerge. In addition, the non-US environment is already disinflationary with China flirting with deflation and parts of Europe heading below 2%.

Beyond the next year or so, the “Fire” (permanently higher inflation) vs “Ice” (return to pre-pandemic disinflation trends) debate rages on. Market based indicators suggest that inflation expectations remain well anchored around the 2% level – but I can still make a good case either way; as I have stated previously, the truth is that nobody knows. On balance, I think it is most likely that as the economic cycle continues to normalise after the macro shock of the past three years, cyclical inflation may indeed prove to be transitory. However, the secular picture is less clear with demographics, a fracturing global economy, climate change and income, wealth and social inequality all combining to cloud the picture. We will continue to keep an open mind and monitor how the inflation story unravels, but we certainly think it is the key macro factor for markets in the long term.

The combination of tight monetary policy and fading tailwinds that propped up activity during the past year, namely, aggressive US fiscal easing, unusually high consumer savings, a strong employment market and the resilience of company profitability will conspire to weaken growth across developed economies in 2024. The major economies likely remain on a recessionary path, but the unusual nature of this cycle means that a soft landing or mild recession is still a distinct possibility. In addition, the Fed and other central banks can support growth and take pre-emptive action to start cutting rates early.

A cyclical transition from disinflation to renewed policy reflation will likely be the key macro story for 2024. As already discussed, either undue economic weakness or a faster-than-anticipated fall in core inflation should persuade the Fed to start cutting rates early. Markets have already shifted their interest rate expectations materially over the past few weeks and at the time of writing, rates in the US and Europe are forecast to be somewhere between 1-1.5% lower by the end of next year. Japan is also expected to end its zero-interest rate and QE policy next year whilst China will likely further ease both fiscal and monetary policy.

After nearly 3 years and a 50% peak-to-trough drawdown in long-term Treasury (and other sovereign bond) total returns, sovereign bonds should continue to rebound given the macro backdrop. Fixed-income generally could deliver very attractive total returns over the next year or so, especially if growth slows more than anticipated or the Fed is forced to cut rates aggressively. Corporate credit should also do well, although caution is required in the near-term given how narrow spreads (excess yield over the equivalent sovereign) are and the fact that slowing growth will bring a rise in corporate bankruptcies and defaults.

Although slowing growth presents a near-term risk, equities should continue to make decent gains over the next couple of years as interest rates and bond-yields fall and enthusiasm about AI grows. Outside of a small number of mega-cap stocks in the US, valuations generally look reasonable, and liquidity should also improve as monetary policy is eased whilst lower rates will strengthen the medium-term growth and earnings outlook. The recovery in equities should continue to broaden-out over the course of 2024 and beyond as investor confidence returns and the macro backdrop improves. All of our core long-term themes remain compelling, with technology benefiting from another surge in productivity-led investment, healthcare looking relatively cheap and consumers enjoying an increase in real disposable incomes as inflation falls faster than wages. In addition, emerging markets look excellent value after a decade of underperformance and should benefit from falling rates, lower global bond-yields, a weaker Dollar (should the Fed ease aggressively) and a stronger China.

The extremely abnormal nature of this cycle together with the rapidly changing world order will continue to make the global macro-economic outlook changeable and uncertain. In addition to the many geo-political upheavals, the main threats to a rosier outlook may be a hard landing or worse outcome for growth, Fed overkill by keeping policy too tight for too long or a very loose US fiscal policy leading to either a Dollar or Treasury crisis. In addition, there are a lot of elections due over the next 12 months, most notably in the US, UK and Taiwan. The good news is that US equities usually do well in an election year.

After a very challenging few years for investors, we are hopeful that 2024 will be a better year for both bonds and equities as inflation melts, allowing central banks to cut interest-rates whilst avoiding a tough recession. Longer-term, we will continue to closely monitor how the macro environment evolves – with a particular focus on the “Fire” vs “Ice” debate in order appropriately to adjust our investment strategy. In the meantime, we are confident that our core investment themes should continue to deliver stellar returns for our clients and that our fund and stock selection will add value in a world where active managers should outperform.