Stand and Deliver

Portfolio manager Bob Tannahill explains how we choose our funds and why we care about our fund managers' processes.

Why do you want to know what a fund manager’s favourite colour is?

This is the question that was posed to us by a colleague the first time they saw our, admittedly lengthy, fund research document known as an “FRD”. Now while this question is clearly somewhat tongue in cheek it is a fair one. We employ active fund managers to be the expert in their space and to manage their portfolios. So, if we trust them to do that why are we obsessed with their processes, in effect looking over their shoulder. Isn’t it their job to run the fund? Our answer to that is that we care about fund managers’ processes because it enables us to do our job of getting our clients the best returns and this note aims to explain why we think that and offer some evidence of our success.

When picking an actively managed fund there are two key aspects that will affect the outcome: the overall return of the asset class within the fund’s investable space and the value added (or detracted) by the active manager. The first element is more an asset allocation decision and so beyond the scope of this note. It is, of course, always helpful to have a deep understanding of the exact exposure a fund offers you when making such asset allocations call. It is the second element, active manager value add, that is the key one that drives us to get into the weeds of a fund manager’s process. That is very much our job and in short:

Our job is to predict which active managers will add value in the future

The challenge we face here is that investing is an activity with elements of luck and skill. If you think of this blend as a spectrum, you have activities like roulette out at the luck dominated end and chess at the skill dominated end. Activities like investment, however, sit somewhere in the middle and the exact mix changes with your timeframe. Skill dominates in the long run, but luck dominates in the short term. So your mate in the pub may well pick a better stock for the next month than your seasoned broker but few fancy trying to beat Warren Buffet’s multi decade track record.

More on this can be found in the great book by Michael Mauboussin, The Success Equation: Untangling Skill and Luck in Business, Sports and Investing.

This combination of luck and skill is important to be aware of as it means that fund managers with the best past performance, especially over the short term, may not be the best bets for delivering future performance. So how much data would you need to be sure that a past track record was reliable evidence of manager skill? I am afraid the answer is a surprisingly long time – years’ worth of data!

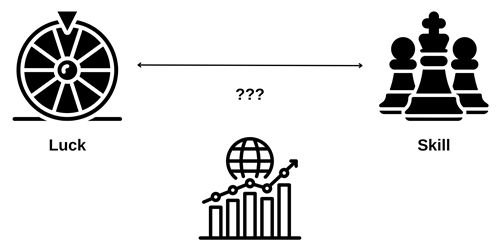

To illustrate this, let’s imagine a bad fund manager. They may talk a good game in client presentations about fundamental research, investment themes and Fibonacci retracements but it’s all just smoke and mirrors. Let’s imagine they really just flip a coin at each month end. Heads they lever the portfolio 10% and tails they cash up 10% and they repeat this each month. This would mean that the fund would perform either well or badly purely at random. If they sent you monthly data how long would it take you to be fairly sure that this process lacked any skill? I chose this slightly contrived example because in this situation we can actually do the maths…

It could take 11 years to spot a fund driven by chance from past performance

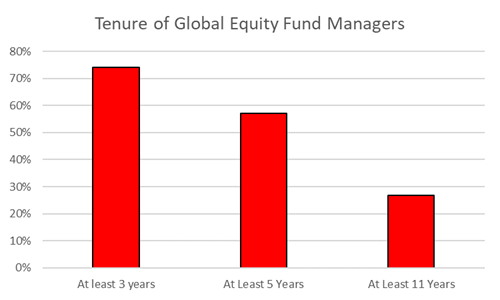

How many fund managers have an 11-year track record? Even before accounting for complications such as changes in fund strategy, the answer is not many. Something like one in four global equity fund managers have such a track record, according to data from FE Fundinfo:

Source: Collated on 1st Dec 2021 based on Investment Association Global sector from FE Fundinfo

So while it might be safe to say that Warren Buffet has some skill, with his 50-year track record, the list of managers whom we can judge from the numbers alone is pretty short. This is the problem with judging performance in a noise environment. As regulators are keen for us to remind everyone, past performance (outcomes in a noisy environment) is not necessarily a good guide to the future.

So we need a better indicator of future performance than past performance alone

If we look to other areas that have to judge performance in environments that have a significant degree of chance involved, we can learn some lessons. They generally look to assess the inputs rather than the noisy outputs – whether the right things are being done to create the potential for success or if people are doing the right things in order to make their own ‘luck’. Be that shots on-target in football or the number of client calls a salesperson makes.

For fund managers the right input is a high-quality investment process. This has led us to build a three-step approach to assessing funds:

- Understand the process

- Verify that this process has been the driver of past performance

- Monitor that this process is adhered to in the future

This is why we, metaphorically, want to know what a manager’s favourite colour is.

By understanding a manager’s process, we can work out if it has driven their past successes and therefore have some confidence that it can deliver in the future

While we focus on the inputs in manager selection our job is of course to deliver the output to clients. So as Winston Churchill once said: “However beautiful the strategy, you should occasionally look at the results”.

To assess the success or failure of our fund selection in isolation we took all the active funds we have worked with in the last decade, including those we had sold for performance reasons[1]. We then stripped this down to funds that we picked at least five years ago to avoid short term market noise skewing the results and here is what we found:

- 70% of these funds[2] have beaten their benchmark over our holding period

- On average they outperformed their benchmarks, after fees, by 1.1% per annum

As we know well from the infamous active vs passive debate the general results for most active managers is pretty poor. While there are different estimates out there, almost all put the share of active funds beating their indices at less than half. Morningstar, for example, calculated that only 7%[3] of global large company funds beat their index. We are proud of this track record and the evidence it provides that our fund selection process is adding value for you, our clients.

We estimate that using active funds with our selection process has improved our client’s returns compared to using passive funds

That is our job and that is why we like to know what a manager’s favourite colour is!

This article is the focus of our podcast 'Why understanding a fund manager’s process is a wise investment, where Bob and Sam discuss take a closer look at our fund selection process. You can listen to the full podcast here.

- [1] Further details of the methodology behind these statistics is available upon request

- [2] 14 out of 20 funds in sample based on Ravenscroft calculations

- [3] https://www.morningstar.co.uk/uk/news/205109/which-funds-beat-their-benchmark.aspx