Amelia Henaghen explores the world of alternative assets and their potential impact on an investment portfolio.

Between 1976 and 2021, whenever equities experienced negative returns, bonds yielded positive returns. This long-standing and historically reliable correlation formed the foundation of the 60/40 portfolio strategy, designed for investors to protect against portfolio volatility.

However, 2022 saw this dramatically change, and the benefit of this strategy ended when both equities and bonds yielded negative returns. As a result, the 60/40 portfolio experienced the second-worst yearly return since the 70s. This forced investors to explore alternative ways to diversify their portfolios, turning towards alternative asset classes that had the potential to achieve greater returns during periods of decline in traditional investments.

What are alternative investments?

From private equity and hedge funds to assets such as gold, collectibles like art, and emerging options like cryptocurrencies, alternative investments offer unique opportunities for investors to exploit market inefficiencies, hedge against volatility, and potentially achieve attractive returns.

With the shift in focus to alternative investments, there are many compelling reasons to explore how these assets can work within an investor’s portfolio.

How do alternative investments fit into an investment portfolio?

Diversification & correlation

A key advantage of alternative assets is that they often have lower correlations to traditional markets. A lower correlation indicates that alternative assets and traditional markets do not necessarily move in the same way; for instance, when general equity markets are down, alternative assets do not automatically follow suit. The inclusion of the right alternatives alongside bonds and equities can reduce overall portfolio risk, enhance diversification, and potentially reduce volatility over the long term.

Potential for higher returns

The lure of alternative investments for investors is the potential for higher returns in excess of typical equity markets. Some alternatives such as private equity and venture capital can have significant growth potential. Certain strategies employed by hedge funds can capture alpha and generate attractive risk-adjusted returns, offering opportunities for overall enhanced portfolio performance.

But these types of alternatives are not suitable for all investors, and, as with any investment, the risk-reward trade-off must be taken into consideration.

There are unique risks associated with each alternative investment. Generally speaking, most alternatives offer less flexibility and often tie up investors’ money for longer periods. They can also be more complex in nature with a lower level of regulation and transparency. Often, investments in private equity and hedge funds may require a larger initial capital investment and would therefore be less attractive and accessible to your average investor.

Hedging against market volatility

The popularity of alternative investments has unquestionably grown over the last 20 years, particularly in areas such as infrastructure and private equity.

There are many factors that fuel the popularity of alternatives, one of them being inflation. In the last three years, we have experienced a dramatic rise in inflation far beyond the 2% Bank of England target.

A well-established alternative asset, gold, has long been used as an effective safeguard against inflation.

This commodity has historically performed well during periods of economic turbulence, providing investors with downside protection, and preserving capital value when equity markets fall.

When comparing gold to traditional equities, they tend to move in opposite directions. This means that when included in the same portfolio, they could create a smoothing effect through various market cycles.

Income generation

A key driver for investors turning to alternatives is the possibility of attractive income-generation potential, making them appealing to income-focused investors.

Real estate investment trusts (REITs), infrastructure funds, and private debt investments, for instance, can provide higher-than-average income streams through dividends, rental payments or interest payments.

In a conventional income portfolio comprising bonds and dividend-paying equities, incorporating income generation that is less susceptible to market fluctuations could be appealing to investors as it provides an alternative yield source, particularly in a low-interest-rate environment.

Portfolio customisation

While not all investors are drawn to alternatives, some turn to them for customisation, to provide an element of interest to their portfolio of generic stocks and bonds.

Alternatives can now be found in the form of funds for wind farms, song royalties and even art.

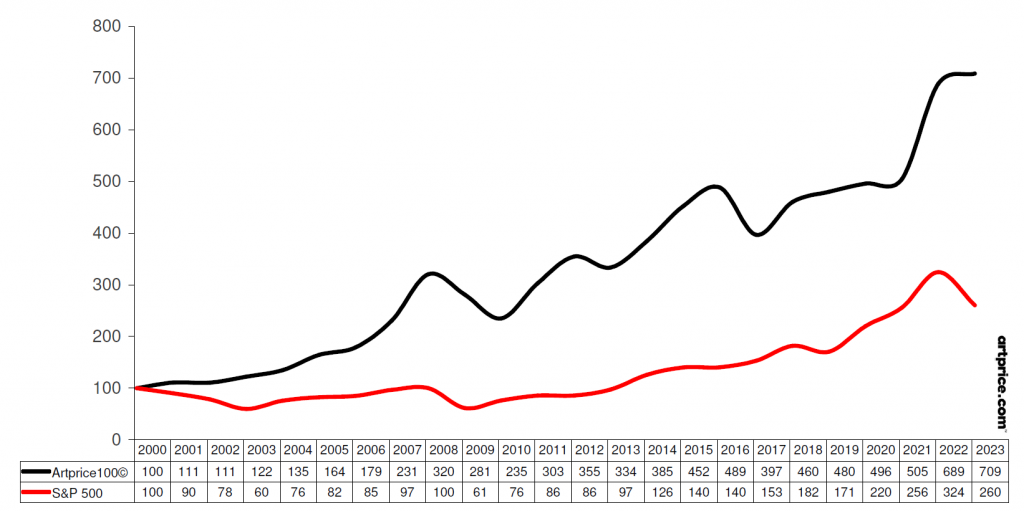

When comparing the Artprice100 index to the S&P500 over the last 23 years, we can see the potential for higher returns but also an increase in potential volatility (note how much smoother the S&P line is by comparison).

Source: Artprice.com

Investing in art as an alternative asset class can serve as a long-term hedge against inflation, with the added appeal of owning a tangible asset with the potential for high returns over the long term.

However, it is worth noting that this is not yet a generally accepted asset class. The art market can be hampered by illiquidity, subjective valuation, and the need for specialised expertise, making it less accessible to retail investors, and it can be challenging to predict future returns. Moreover, art investing entails market volatility, risks of damage or depreciation, and high costs associated with acquisition, maintenance, and transaction fees. Regulatory risks, including forgeries and a lack of transparency, further complicate this investment landscape.

As such, while art investment can be rewarding both financially and aesthetically, it demands careful consideration of its inherent risks and complexities.

Risk management

As already mentioned, alternative investments can play a crucial role in managing portfolio risk. By diversifying across a range of different asset classes, investors can spread risk and reduce exposure to market fluctuations. It is, however, essential to evaluate the risk-return characteristics of each alternative investment and consider their potential impact on portfolio volatility and downside risk.

The emergence of cryptocurrency as an alternative asset class has demonstrated opportunities for significant returns on investment, albeit with increased risk and the potential to see dramatic losses. Bitcoin offers several distinct advantages over traditional asset classes. These include decentralisation, which serves as a hedge against geopolitical risks and centralised control, and the potential to preserve value during turbulent market periods. Moreover, cryptocurrencies utilise blockchain technology, ensuring transaction transparency, a quality that investors value.

Source: Investopedia

Whilst the positives are attractive, it is important to also acknowledge the inherent risks associated with cryptocurrencies, including regulatory uncertainties, security vulnerabilities, and market manipulation, making thorough research and risk management important for investors venturing into this asset class.

The launch of Bitcoin ETFs this year has increased accessibility to the cryptocurrency asset class allowing investors to hold it alongside their more traditional investments.

In conclusion, alternative investments offer investors a compelling opportunity to enhance portfolio diversification, potentially achieve greater returns, and manage risk effectively. By incorporating alternative assets alongside traditional stocks and bonds, investors can construct a well-diversified portfolio aligned with their investment goals and risk level.

While investors should approach some alternative investments with caution, they can be a valuable tool to navigate market uncertainties and build robust, resilient portfolios. For investors who may want to include alternative investments in their portfolio but aren’t sure where to start, consider speaking to an investment manager who can help identify opportunities or manage your portfolio on your behalf.

If you’d like to find out more about investing with Ravenscroft, or if you have any questions you’d like us to answer, please contact us.