Weekly update - It’s all about the spread…

This week’s update is written by Adrian Clayton in our Advisory Investment team in Guernsey.

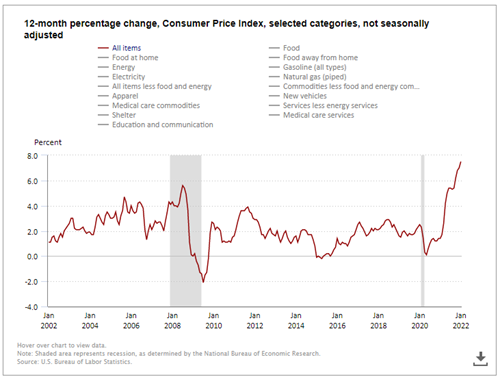

The main talking point this week has been the US Consumer Price Index (CPI), which was announced on Thursday and showed that over the last year prices in the US have increased by 7.5%[1]. The last time we had inflation running that fast was 1982 and Bucks Fizz topped the UK charts.

US Consumer Price Index

Source: U.S Bureau of Labor Statistics

This phenomenon is not exclusive to the US as we are all part of a globally connected world that depends on the smooth running of supply chains and steady and dependable energy resources. Both have broken down in recent months and have contributed to a spike in rising prices all around the world.

As the above chart shows, inflation can be controlled and does remain stable for long periods, as we have seen over the last three decades. On the whole, financial markets tend to like these periods as the greater price certainty leads to better corporate decision making and greater certainty of profit growth. It is when inflation becomes more volatile that economic problems start to creep in.

Inflation is not good for anyone and so this week’s big number is a wakeup call for both Central Banks and Governments, in that, regardless of the cause, action to combat these price rises will need to be taken, and taken quickly. This action will certainly come in the form of higher interest rates. The current market expectation is for seven rate hikes of 0.25% in the US, which means the implied rate will go from 0.25% currently to 2%[2]. As we know, interest rates and inflation have an inverse relationship so a higher interest rate, which is effectively a brake on the economy, will lead to a cooling in price growth and thus inflation.

The question investors face is will this rise in rates slow the economy enough to push inflation down and if so, will it also hurt corporate profitability? Slowing or contracting profits is also known as a recession, which is technically two consecutive quarters of lower or negative GDP growth. At the moment we are currently a long way from negative GDP growth, as Friday’s latest release of UK GDP showed the economy grew by 1% in Q4 2021 and 6.5% over the entire year[3].

So, what are we to think? One indicator that strategists are looking at quite closely is the spread between the yield of the two-year US Treasury to that of the 10-year US Treasury. When the spread goes negative, i.e. the yield on the two-year bond is higher than the 10-year bond, it is as a result of increased risk and liquidity premiums for long-term investments. When the yield curve inverts, short-term interest rates become higher than long-term rates. This type of yield curve is the rarest of the three main curve types and is considered to be a predictor of economic recession.

Recently this spread has been falling (see chart below) and the probability that a rise in interest rates will push this further cannot be discounted.

Percentage Spread Between Two Year US Treasury and 10 Year US Treasury Yields

Source: CNBC

For investors, it can be difficult to face a period of uncertainty and we may well be faced with just such a scenario. As always, we advocate diversification within your portfolio and certainty that your time horizon for your investments is for the long-term. The ability to hold through some shorter-term volatility will be important, so if you have any big bills coming up, make sure you have factored those into your plans.

The other point I make is that the world is facing a supply crunch with energy and commodities prices rising, potentially pushing up inflation higher for longer. In this environment, having some exposure to both these sectors is a consideration as good quality, profitable mining and energy companies could pay out growing dividend streams.

Sources: