Weekly update – Blown away

This week’s update is written by Jenson Holmes in our Jersey office.

Last week, the S&P 500 and the Dow Jones Industrial Average (DJIA) experienced a bit of a rollercoaster ride. The S&P 500 reached a high of 4138.26 on Monday 8th May before dropping nearly 0.5% on Tuesday1 amid concerns over inflation and economic growth. However, by Friday, the index had recovered most of those losses and ended the week flat. The DJIA followed a similar pattern, hitting a high on Wednesday before dropping 2%. The index recovered slightly on Friday before ending the week down 1.2%.

One of the major drivers of these fluctuations was the release of April’s Consumer Price Index (CPI) data on Wednesday. The CPI, which measures the average change in prices paid by consumers for goods and services, came in slightly lower than expected at 4.9% as opposed to 5%, indicating that inflation is slowing down2. This news allowed markets to recover from a downturn earlier in the week as investors gained confidence in the US economy and the increasing chances of a FED pivot in the near future. Inflation is the biggest target for central banks, and they will do near enough anything to get the headline figure to their target of 2%. Often the markets focus on headline inflation figures, but core inflation, which excludes volatile food and energy prices, is a more relevant indicator of underlying inflation trends.

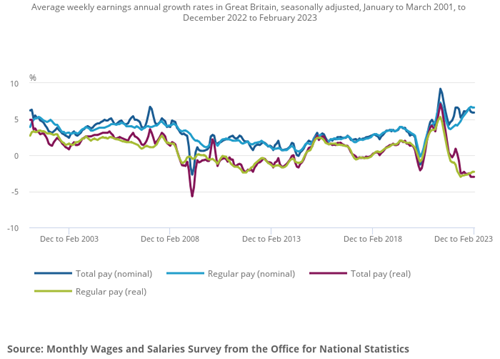

The labour market is a key aspect when trying to control and understand core inflation. When jobs data is strong and there are more jobs being created as well as increasing wages it is very difficult to bring down core inflation. Wage growth is a big indicator of how the labour market is holding up and currently UK wage growth is hitting just over 6%3 (this is almost double what is needed to see 2% inflation). The US jobs and wage data have held up strongly in recent weeks, leading to core inflation sticking at higher levels as headline inflation carries on declining. In the UK, we are still behind on the falling inflation curve as CPI figures are not seen to be dropping so far. This news has not helped investor sentiment and neither has the Bank of England as they increase base rates by 25bps to now 4.5%.

In other news, wind energy is taking over the industry after Q1 saw the first time that wind power output was on the rise, with 32.4% of Britain's electricity coming from wind farms compared to 31.7% from gas-fired power plants4. Although there are still many obstacles to overcome until the grid is entirely free of fossil fuels, this is a real milestone, according to Imperial College London's Iain Staffell. Research indicates that wind power increased by 3% compared to the first quarter of 2022, while gas-fired generation decreased by 5%4. Overall, in the first quarter of 2023, about 42% of Britain's electricity came from renewable sources, including wind, solar, biomass, and hydro, while 33% came from fossil fuels like gas and coal4. This statistic represents huge progress in the UK’s goals seeking to be net zero emissions by 2050 as well as to be more independent on energy sources as imported supplies are becoming increasingly expensive since the disruption of Russia invading Ukraine.

Companies that are able to meet greater demand will possibly stand to gain from higher energy prices and infrastructure investment. In order to achieve net zero, National Grid issued a Pathway to 2030 suggesting a £54 billion investment in network infrastructure. Companies that offer energy storage solutions are seen to be defensive against market instability as a result of the rising demand for energy. By storing and trading electricity, energy storage corrects supply-demand imbalances on the electrical grid and enables businesses to generate revenue from a variety of sources. In addition to being generally steady, they also produce predictable cash flow, which is returned to investors through dividends. Infrastructure funds have also shown to be a well-rewarded asset for investors, profiting from long-term contracts, frequently being backed by the government, and investing in a variety of infrastructure assets. A future with net zero carbon emissions will be achieved with increased investment in renewable infrastructure.

Overall, investment in renewable energy represents a major opportunity for investors looking to capitalize on the shift towards cleaner sources of energy. As renewable energy becomes increasingly cost-competitive with traditional energy sources, we can expect to see continued growth in this sector and increased interest from investors.

In conclusion, last week was a busy one in the world of finance, with a number of significant events taking place that could have important implications for the markets in the weeks and months ahead. Investors will continue to keep a close eye on inflation figures and expectations for the growth of economies.

We hope you have a good week.

Sources:

- 1 Google Finance

- 2 Investing.com

- 3 Sky

- 4 Reuters