2020 Q4 Newsletter

“ It’s a new dawn

It’s a new day

It’s a new life, for me,

And I’m feeling good.”

Feeling Good - Nina Simone (1965)

Every New Year is met with enthusiasm as we pack one year away and look forward to the next. Of course, this year emotions are particularly raw – and expectations correspondingly high – since 2020 was so tough. Nevertheless, here we are in January 2021: a new dawn, a new day!

Throughout the last year, Ravenscroft’s focus, as always, has been to ensure that clients continue to receive our customary high levels of service while ensuring that assets continue to be managed with the appropriate balance of risk and reward in pursuit of investment objectives. We believe that we have achieved this by outperforming markets during the early stages of the crisis, while delivering positive returns across all strategies through to the year end.

Looking forward, there are clearly huge hurdles yet to come; but, it is important that we don’t lose sight of the positives. An awful lot was achieved last year, which is likely both to set the scene for 2021 and the longer-term future.

Whilst politically the world seems to be as divided as ever, there has been encouraging collaboration in areas such as healthcare and technology coupled with a growing desire for a more environmentally friendly global approach. These trends are, and always have been, core elements of our portfolios. Admittedly, valuations are now high in relative terms (something reflected in our asset allocation) but the long-term outlook for these themes remains positive.

We are, as we have been for some time, proceeding with caution. Your needs remain at the forefront of our considerations and we look forward to navigating through another exciting and in all likelihood volatile year!

BOSCHER’S (BITE-SIZED) BIG PICTURE:

A POST-PANDEMIC BOOM IS POSSIBLE

by KEVIN BOSCHER

As we approach the end of an extraordinary year, in which nobody could possibly have predicted the unprecedented events that have unfolded, it is time to look forward to what 2021 may hold in store for the global economy and financial markets. The good news is that I remain optimistic that we will likely see a recovery boom over the next year or so and that this will be a positive backdrop for equities, in particular.

History has repeatedly shown that equities require three main attributes to generate favourable returns: decent growth (both economic and earnings), plentiful liquidity and reasonable valuations.

Global Growth

Beginning with the growth outlook, activity is recovering much better than expected with Asia leading the way. As savings rates have risen dramatically in the US, Europe and elsewhere over recent months, this will help fund a consumption boom over the next year or two. At the same time, companies will need to increase investment to keep up with accelerating demand and boost productivity whilst governments will continue to spend heavily, financed by central banks.

Another positive factor is that although this pandemic-induced crisis is a transitory shock, it has resulted in structural shifts in policy. So far, fiscal support has largely been focused on providing income support for individuals or businesses. Going forward, the emphasis will shift to rebuilding the economy and boosting long-term productivity and growth. This additional fiscal support will simply add more fuel to the potential recovery in spending and investment over the next few years.

Liquidity

From a liquidity perspective, this is likely to remain plentiful and helpful for financial assets. Central banks have little option other than to help finance increased government spending, thereby effectively monetising the debt and keeping financing costs extremely low for governments, corporates and consumers.

All of this newly created money is unlikely to create inflation over the next year or so but it will flow into financial assets and eventually, economic activity. Eventually, inflation will almost certainly pick up as aggregate global demand starts to move ahead of supply and as credit demand and the circulation of money starts to accelerate. However, this would be a welcome development for policymakers as they target higher nominal growth in order to inflate away the debt problem.

Valuations

Looking at valuations, it is true that the mega-cap technology and growth stocks look expensive; however, there are many markets, sectors and stocks that look good value – both in absolute terms and relative to their own history. A couple of other factors support the valuation argument: earnings could bounce back strongly in line with activity and equities continue to look good value relative to bonds and cash.

As already explained, whilst I am optimistic on the outlook, I also acknowledge that the background macro picture remains challenging. For me, the biggest threat to markets or the economic recovery going forward is policy error. A second risk is that the planned vaccine programme disappoints in any way. Any adverse media from such outcomes could spook investors and the stock market, although I doubt they would kill the recovery or alter the positive medium-term trend. Other key risks include the rise of political extremism, increasing hostility towards China in the West, a possible increase in business failures once government support ceases or an earlier pick-up in inflation than anticipated.

The key drivers for markets over the next year or so will likely be the unprecedented monetary and fiscal expansion together with the success of the vaccines. Assuming this goes as expected, 2021 should be another good year for equities and other risk assets.

As I have written about previously, the core irrefutable and long-term themes, which have performed so well for us at Ravenscroft over recent years, remain very attractive and are likely to generate superior returns for years to come.

In the meantime, we remain cognisant of the multiple threats to this rosy picture and will continue to look for surprises which could negatively impact the outlook.

This has been a year like no other from an investment perspective and although it has felt tough at times, I think we are all somewhat relieved at how quickly things have recovered. I am hopeful that the global economy and financial markets can continue to improve in 2021 and beyond and that we can again generate attractive returns for our clients through a combination of active management, strong research and our thematic approach.

Here’s to a happy, healthy and prosperous 2021!

CAUTIOUS PORTFOLIOS:

LOWER RISK

by Alex Chambers

Objective: The Cautious portfolio’s objective is to increase its value by predominantly allocating capital to fixed-income investments. The portfolio can also invest into global blue-chip equities with strong cash-flows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity-weighting of approximately 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

The Income strategy returned 2.9% (1) over the last quarter of 2020. This was a strong gain and one that contributed to a pleasing year’s performance, especially given the circumstances. Performance for the year was 4.1% (2), which is the level that we would expect the strategy to return over the longer term.

Our non-cyclical and global allocation meant that we generally fared pretty well throughout the first three quarters of the year when compared to peers. The strategy did lose some of the ground it had made against the sector in the final three months of the year, however, as the hugely positive news of vaccines was announced. Pfizer were the first of a few to confirm vaccines with 90% efficacy: this ultimately led to a shift in market dynamics, providing a shot-in-the-arm(!) to certain areas of the market. Cyclical sectors that had been more suppressed over the year, such as commodities and energy, had a strong bout of performance in the run up to 31 December. While we are sticking to our long-standing process of not trying to second-guess short-term sector moves, we nevertheless continue to seek to understand the impact that market dynamics have on our portfolios and those of the peer group.

The strategy beat the sector by 0.2% (3) over the year.

Looking further at underlying holdings in the portfolio, the funds largely performed as expected over the year: equities were the strongest performers, the bulk of the bond funds were in the middle of the pack and defensive inflation protection exposure was at the bottom. Schroder Strategic Credit and Rathbone Ethical Bond Funds had very good years and we were pleased with their performance. Guinness Global Equity Income deserves a special mention too, with stellar performance throughout the sell-off in February and March while its recovery was equally as impressive, managing to maintain and increase its lead of the IA Global Equity Income Sector.

We implemented a new holding in the Vontobel Global Corporate Bond Mid Yield Fund during the quarter using proceeds from the sale of T.Rowe Price Global Investment Grade Corporate Bond Fund and trimming of the PIMCO Global Investment Grade Credit Fund to facilitate the purchase. T.Rowe Price did not grow the Fund to a sufficient size for the Income strategy to maintain its allocation; this dictated a new alternative. The Vontobel fund is a vanilla, relatively concentrated, bond fund that focuses on adding value through superior stock selection. The team has a solid investment process and a strong track record of delivering good investment performance. We look forward to working with the team at Vontobel over the coming years.

Looking forward, although we are hopeful of a less volatile year, the portfolio is at its neutral weight, which reflects our view of valuations and the uncertain times ahead. We remain confident in the quality assets we hold and believe in their ability to generate returns for investors over time. On that note, we would like to thank all of our investors and clients for your continued support and to wish you all a happy and prosperous 2021.

BALANCED PORTFOLIOS:

MEDIUM RISK

by Tiffany Gervaise-Brazier

Objective: The Balanced Portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

2020 has been a truly unforgettable year, not only for stock markets but also for humanity. The rapid spread of Covid-19, worldwide lockdowns, aggressive government policy responses and the distribution of vaccines that many hope will end the pandemic in 2021, are just a few examples of triggers for the sharp movements in assets that investors have experienced.

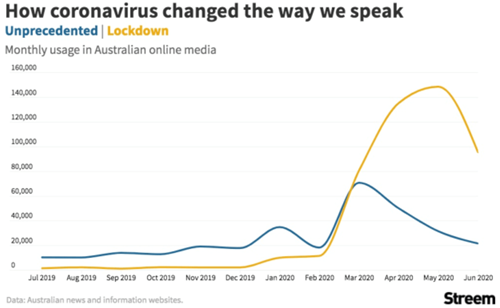

To that end, I think I have seen the word ‘unprecedented’ written more times this year than I have seen in my lifetime. A whole new language has been created! Terms such as social distancing, lockdown, elbow bump and pivot (as in to switch business models) are now commonplace…

The rebound from the late-March lows was so fast that it capped the shortest bear market in history (1 month) and marked the fastest rebound to all-time highs.

Volatility (movement in capital values) is normal, but over the longer term markets tend be resilient. Ultimately, uncertainty tends to incite market volatility; this quarter was no different with the US election taking place and a new President-elect. Broadly speaking, markets reacted well to this and have continued to do so in the transitional period. However, we feel that the impact of any policy changes upon specific sectors will become apparent over the course of the next four years rather than immediately.

In terms of attribution, performance has been led by sectors where consumers and businesses are able to spend: technology, healthcare, communication services that have a greater bias towards growth. At the other extreme have been sectors such as mining stocks and financials. Our investment process (centred on understanding and being able to value the companies we own) dictates that we have little exposure to these areas within the strategy.

The best performing Fund for the quarter was the newly-introduced Lazard Global Equity Fund, which has had a sharp recovery since the March lows; we recently increased the position to a 5% allocation.

During the quarter, we also made the decision to make some small changes within the fixed-income allocation, which we believe will allow further diversification and return potential over the long term.

The Smith and Williamson Fund has delivered on its objectives. It has continued to be a defensive asset by holding good quality, short-dated corporate bonds in what has been a difficult environment for fixed income assets, thereby providing us with plenty of liquidity whilst generating a return. However, and despite the Q1 sell off, assets are once again trading at expensive prices. This, combined with the continued pressure on yields (as a result of the accommodative central bank polices that are being rolled out in response to the pandemic), means that we believe that a portion of the allocation (2.5%) is better placed elsewhere for now.

We have also trimmed our holding in the PIMCO Global Investment Grade Credit Fund by 2.5%. The proceeds of both sales were invested into a new position in the Vontobel Global Corporate Bond Mid Yield Fund. The PIMCO Global Investment Grade Credit Fund has been owned within the strategy since 2011 and it has performed very well. Whilst we have no concerns with PIMCO (and continue to invest at a 7.5% position), we think the diversification benefits and focused exposure in the corporate bond space make a compelling investment case for the Vontobel fund amongst the cross-section of fixed income funds currently held.

Vontobel invests globally, which we feel offers the greatest diversification potential and allows the portfolio to stand the test of time. The Fund benefits from a boutique, team-orientated approach and its investment process aligns with ours: to create a diverse portfolio across market sectors and geographic regions. The ‘mid-yield’ portion is the more opportunistic part of the portfolio where the return adequately compensates for the risk taken. Furthermore, the transparency that we have experienced with its managers during our due diligence and research processes has been impressive. Vontobel will be held at a 5% target position.

We remain focused on the valuations of our preferred assets to ensure that portfolios are best positioned not only to ride-out this winter, but also to prosper far into the future. The strategy is positioned defensively at 50% equities (compared to the maximum 60%) and remains invested to participate in the upside that capital markets have to offer in the long term.

Finally, we would like to thank you for your ongoing support. We look forward to continuing to work for you in 2021 and wish you and your families all the best for the New Year.

GROWTH PORTFOLIOS:

HIGHER RISK

by Georgie Fletcher

Objective: The Growth Portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

We end 2020 in positive territory with the Growth strategy posting 8.5% (4) year-to-date versus the sector at 5.3% (5). Given events this year, had investors asked us in March if we would be where we are today – in positive territory – we would have anticipated the answer to be no! This only serves to highlight the unpredictable nature of markets and importance of both sticking to your knitting and knowing what you own and why you own it (the crux of our investment philosophy).

The last quarter of 2020 began with a weak start. Historically, the tenth month has been described as having the ‘October Effect’ and the perception that markets are likely to weaken throughout the month is still a psychological expectation amongst some investors. Combining this with the run-up to a closely contested US election and a global pandemic meant that October wasn’t the most pleasant period for markets. Aside from utilities (which were only up 1.8%) (6), all sectors ended October in negative territory with our preferred areas of the market coming out bottom of the pile (consumer staples -3.9% (7), healthcare -4.9% (8) and technology -5.2% (9)).

In previous 2020 commentaries, we have discussed how markets have heavily favoured growth stocks over value holdings throughout the year. Regular readers will know that we own Lazard Global Equity Franchise (a value-biased portfolio) for the diversification benefits it provides within the global equity (GE) space; we tend to find that value and growth stocks behave differently under certain market conditions, which ordinarily works to dampen volatility levels within the GE allocation. As a result of the market’s preference for growth, Lazard had been a drag on the strategy’s overall performance and, at the end of Q3 2020, was down -14.6% (10).

However, October saw the market’s disparity begin to switch, as investors diverted their preference, favouring value stocks over growth. This appetite was maintained throughout November and December and we saw the benefits of our diversification (in holding Lazard’s) come to fruition. Lazard bounced back in October and rallied hard in November as it posted 14.1% (11) (the Fund’s highest ever single-month return). If we look at Q4 in isolation, Lazard has performed the best out of all of the strategy’s GE positions. After being down some 30% in mid-March, Lazard is ending 2020 just shy of a positive figure, posting a respectable -2.3% (12).

As Lazard’s November return has indicated, the month as a whole was a strong period for markets. The rise in sentiment was largely driven by positive Covid-19 vaccine news from three separate pharmaceutical companies and investors began looking ahead to 2021 in the hopes of life returning to some sort of normalcy.

November saw an 18.0% (13) recovery in the Latin America region with a further 9.3% (14) rally in December. The strategy’s holding in Brown Advisory Latin American (which had been down heavily up to this point) followed suit.

The positive vaccine news, coupled with a weak US dollar, created an attractive backdrop for stocks within the region and our exposure held via Brown Advisory reacted accordingly, returning 15.6% (15) for the month.

Year-to-date Brown Advisory is still down -28.7% (16) in sterling terms and has been a drag on the strategy’s performance throughout 2020. Nonetheless, we remain confident in the manager’s ability and are happy with the Fund’s recovery this quarter. We tend to find that emerging markets are next to recover after developed markets, so, looking forward to 2021, positive vaccine news coupled with a weak US dollar should be supportive of currencies in Latin America.

Portfolio Changes

Towards the end of November we made some changes. We sold our entire position in the Royal London Short Duration Global High Yield Bond Fund (“RLAM”) and reinvested the proceeds into equity, a relative-value asset allocation decision that we felt was more in line with the strategy’s capital growth objective. Since widening during the February/March equity sell-off, credit spreads have tightened once again and the yield we were receiving from RLAM was in the region of 4%. The decision for us was whether we could obtain a higher return from equity in the future, which we felt we could. We used the proceeds to increase GuardCap Global Equity to 10% and Pictet Global Environmental Opportunities (Pictet-GEO) to 6%.

On the back of the positive vaccine news in November, we considered that the more cyclical exposures within the GuardCap portfolio (such as MasterCard and Booking Holdings) would benefit in the event of being able to travel more freely. The portfolio has been structured to focus on the “survivors” post Covid-19; we believe it is well placed for the future and one that will provide attractive returns over the medium term.

Pictet-GEO focuses on “environmental solutions”. While finding solutions to environmental concerns is increasingly at the top of the agenda for countries all over the world, it is equally apparent that legislation is only getting tighter. We believe this to be a long-term structural theme that is set to become an integral way of life.

Finally, following a constructive call with the managers in December, we also topped-up the strategy’s position in Polar Capital Healthcare to 6%. The Polar team believes a major trend in 2021 will be the re-onshoring of supply chains and considers valuations for big pharma to be cheap (back to 2008/09 levels – nearly at all-time lows); both should create exciting opportunities for investment.

GLOBAL BLUE CHIP PORTFOLIOS:

HIGHER RISK

by Ben Byrom

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chip companies, that are in line with our long-term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

The fourth quarter of 2020 was a choppy one for equity markets as investors grappled with a hotly contested US election, additional US stimulus, Brexit uncertainty and out-of-control coronavirus. Nonetheless the Global Blue Chip strategy finished the quarter up 4.4% (17), posting all time highs in the process. The MSCI World performance of 7.8% (18), which also notched all time highs, was buoyed by positive sentiment prevailing as the major risks (contested election and Brexit) melted away and investors focused on the promise of US stimulus and talk of a Democrat clean sweep in the upcoming Georgia Senate run-offs. The strategy’s relative underperformance was down to retail investor demand driving small and mid-cap ‘story’ stocks, vaccine-related biotechs, and continued interest in technology (an area in which we remain under-represented for valuation reasons). A powerful rotation into cyclical areas of the market also occurred as promising vaccine data was released and subsequent approvals ignited a mass vaccination programme that implied a return to normal and a release of pent-up demand spawning an economic revival throughout 2021.

It’s not been a bad quarter given the year we have endured! Imagine if you had embarked on a spaceship in December 2019 and spent 2020 in isolation on the International Space Station (ISS). If, after returning one year later, you glanced at the stock market to get a gauge of how things were doing, you would be forgiven for thinking that it had been simply another ‘normal’ year of steady global growth. After all, the MSCI World is up 12.3% (19) in GBP terms – better than usual. Yet 2020 was anything but ‘better than usual’. It was probably one of the most disruptive, intrusive, years the world has faced since World War II.

What you choose to take away from 2020 will be largely down to your own experience and perspective of the pandemic. From our viewpoint, writing as investment managers charged with managing your Global Blue Chip strategy, the pandemic has turned the investment environment upside down and it may never be the same again as we tack down a path of accelerated modern monetary theory (the ability of governments to spend their fiat currencies as fast as their central banks can print them).

We didn’t go into 2020 thinking we’d need a pandemic-proof portfolio; but, through our thematic filter, we had unintentionally built one.

Owning what we humans need, generates long-term sustainable demand – and the best products create their own competitive edges and pricing power. Protecting that edge is a choice management need to make and we favour those who chose to do so.

Nonetheless, valuations of such stocks have, to no-one’s surprise, been bid-up since central banks stepped in to shore up liquidity during those dark days in March. The central banks have yet to step away and we should expect them to stick around for a while longer. The economic damage being wreaked the world over is still ongoing at the time of writing. This money needs a home and most of it is finding its way into asset prices, including commodities and equities, and we need to navigate this next market phase.

We’re not expecting to have to dramatically change our long-term strategy. We will continue to invest in what people need or what will help address our challenges or add value to our endeavours. Nonetheless, during the quarter, we lightened up on some of our staples positions since the rise in commodity prices and the slowdown in consumption will crimp margins, while many companies will struggle to raise prices to compensate in the current environment. Out went Kimberly-Clark and we reduced Nestle and PepsiCo along the way.

We may do more, but the challenge we are having is finding quality at a reasonable price. We tailed proceeds into a number of underweights in the portfolio and we continue to work on new ideas.

Whilst central banks may have our back, they haven’t explicitly stated for how long and there is the real threat of execution risk – Jerome Powell’s faux pas during 2018 gave the wrong signals and sent stock spinning for the best part of 20% through the fourth quarter of that year. The same may well happen again and, with exuberance where it is at the moment, market setbacks could be sharp and steep. With readily available cash, we continue to survey our opportunity set from a position of strength waiting for weakness and better valuations to materialise.

All in all, we feel the Global Blue Chip strategy’s 9.5% return (20) for 2020 is a respectable outcome and we hope it met your expectations too. We look forward to the challenges ahead in 2021 and we hope you feel sufficiently assured that you can embark on your next shuttle ride to the ISS for another year.

THEMES IN FOCUS:

by Shannon Lancaster

So that’s a wrap for 2020 – the longest, and shortest, year of our lives. No one could be blamed for hastily shutting the book on the past year and not looking back, but the truth is it wasn’t just the year of the pandemic. There were plenty of other headline stories: Australian bushfires, the death of George Floyd and the Beirut port explosion to name but a few. More positively, 2020 delivered the first woman and first woman of colour as Vice President (following the Biden victory), some positive Brexit progress (depending upon your political perspective), and hitherto incredible vaccine announcements. The news was full of innovation and collaboration like we have never seen before. People came together to keep the world moving as we explored in our Q1 2020 commentary “In Search of Silver Linings”.

If you had somehow miraculously made it to 2020 without technology playing a major role in your life, this past twelve months would have dragged you into the digital age whether you liked it or not. “You are on mute!” became the catchphrase of the year as we Zoomed our way through our remote-working days from our kitchen tables and spare bedrooms. We shifted to ordering almost everything online and businesses that previously did not offer these services were quick to adapt. These changes in business and consumer behaviour will likely continue after the pandemic. Businesses fast-tracked changes that were already underway, like transitioning to the Cloud, allowing employees to remotely work or more widespread use of automation. While we are mindful of potential regulation, we believe technology will always be a part of our lives and has further growth in its future, whether we are in lockdown or not. The Polar Capital Global Technology Fund returned 54.1% (21) in 2020, benefiting from the acceleration in technology adoption globally.

Understandably, the importance of healthcare was in the spotlight during the pandemic as supply chains came under pressure, new methods for providing “virtual” care emerged and companies raced to find a vaccine. Some healthcare companies have seen activity fall amid cancelled surgical procedures and non-essential appointments. However, testing and diagnostics specialists have also seen hugely increased demand for Covid-19 testing that offset the decline in tests for other illnesses. We had the extremely positive news of vaccines later in the year and with that comes an enormous amount of resource required, which translates into more production, sales and investment. Over the long term, we believe healthcare will remain in focus as ageing populations require more treatment and the wealth effect in emerging market countries will encourage people to spend more on healthcare. Our exposure to this theme is through the Polar Capital Healthcare Opportunities Fund, which returned 15.1% (22) in 2020.

Consumers in emerging countries were catapulted into consuming in a more digital way over the year. The framework was already in place for this growth and many were already in the process of moving to a more digital way of life. The combination of easily accessible internet, trustworthy cashless payment options and favourable demographics ready to embrace change meant that emerging markets made leaps in technology adoption.

When Satya Nadella, Microsoft CEO, said, “we’ve seen two years’ worth of digital transformation in two months”, I assumed he was talking about developed markets – imagine how much innovation was crammed into a matter of months for these emerging market countries.

The world sighed a breath of (almost) fresh air as the world came to a standstill in March. Green policy momentum continues to build and we can see supportive regulation in the UK, EU and US. China has also committed to achieving ambitious climate related goals, so it is a truly global movement. Corporate management of social and governance considerations such as remote or flexible working, healthcare for employees, sick leave and employee wellbeing came under scrutiny over the year. When we spoke to our fund managers we specifically asked them if they had come across any particularly good or poor social or governance examples in their underlying companies. Thankfully the anecdotes were on the positive side. Our exposure to environmental solutions is the Pictet Global Environmental Opportunities Fund, Pictet- GEO for short, which returned 30.8% (23) over 2020.

In times of crisis humans tend to focus on what they can control. While in this protection mode, we are less likely to try new things, but more comfortable using familiar trustworthy brands. With lots of shopping moving online customers were unable to hold and compare products, so knowing what you were buying provided added security. These large companies are already resilient, but we were pleased to see they could be agile and nimble despite their size. Of course, we own global brands in many of our funds, the Fundsmith Global Equity Fund returned 18.4% (24) in 2020.

No matter what the next 12 months bring, we are confident that our themes will still be intact over a much longer timeframe. While I would personally be delighted if I never had to join another Zoom family quiz again, the changes that were brought on by the virus in 2020 will likely become a more permanent feature of our daily lives. We believe that the themes we invest in are robust with the ability to withstand political turmoil, wars and pandemics; 2020 has only reinforced that belief. As we continue to navigate our (personal and investing) lives through this global emergency, we wish you a very Happy New Year and hope that you stay safe and healthy in 2021.

STOCK IN FOCUS:

by Samuel Corbet

In September, we introduced Bavarian auto manufacturer, BMW, into the Global Blue Chip strategy. BMW is the world’s leading premium car company, producing in excess of 2.3 million cars over the last 12 months alone.

BMW was an interesting addition for us in that the auto sector typically has lower margins than the hurdle we ordinarily look to exceed when appraising companies for investment. Despite this headwind, BMW is consistently among the most profitable auto manufacturers. At the group level, management actively targets an earnings-before-tax margin of 10%; BMW’s track record in achieving this throughout the cycle is impressive. This past year, BMW has been able to maintain profitability despite the impact Covid-19 has had on the auto industry. Moreover, and perhaps equally as impressive, the Company also did so during the depths of the 2008 financial crisis. It was this pedigree that provided us with the comfort that BMW possessed the hallmarks of a quality business (a prerequisite to any investment) despite a structurally lower profitability margin.

The combination of increased regulatory pressure and the expansion of readily accessible charging infrastructure are providing a tailwind to the adoption of electric vehicles (“EVs”) and there is little doubt that the auto industry is in the early innings of a period of significant change. The ultimate direction of travel is relatively clear (over the next decade EV’s will undoubtedly represent a greater portion of total vehicles on the roads than they do today). However, the pace of adoption is unknown and will vary wildly across different jurisdictions. The unpredictability makes navigating this change a difficult task.

BMW made a conscious decision early on to invest in a flexible architecture. This investment has enabled the Company to be led by consumer demand. In the years ahead, you will be able to order your preferred BMW model irrespective of your desired method of propulsion: internal combustion engine (“ICE”), plug-in hybrid (“PHEV”) or battery electric vehicle (“BEV”). These variants will be manufactured on the same production line with minimal change required to alter the mix between engine variants. This enables the Company to maximise factory utilisation and maintain profitability regardless of the actual pace of any change.

We view this as a significant strength and one that has enabled BMW to continue to invest heavily in R&D to maintain its technological lead.

As far as we can tell, this approach is unique to BMW with other manufacturers preferring to invest in dedicated (BEV-only) platforms. This flexibility is often misinterpreted by the analytical community who regularly accuse BMW of being slow to embrace change. We expect this narrative will change from 2021 when BMW bolsters its EV offering with the launch of two next generation vehicles – the i4 and iX (both of which will match Tesla’s Model S in terms of range).

Globally, BMW already has a 7% share of the EV market (second only to Tesla, which has a 21% share). By 2023, it aims to have 25 electrified vehicles on the market – of which at least 13 will be fully electric variants. Furthermore, BMW is trading at a price that we believe offers long-term investors a compelling value proposition both on a relative and absolute basis. Over the past 12 months, BMW has delivered over 5 times as many vehicles as Tesla, albeit with a market capitalisation worth less than 1/10th. On a discounted-cashflow basis with conservative growth assumptions (our preferred method for valuing business within the Global Blue Chip strategy) we anticipate a double-digit annualised return over the next 10 years.

In a world where most quality businesses are generally on heightened valuations, a company such as BMW is a rare find. We look forward to watching the Company’s EV strategy play out and hope to see the share price converge with our assessment of the business’ intrinsic value – unlocking good returns for our investors in the process.

Data Sources:

1. Ravenscroft Global Income Fund O Acc, Total Return 30/09/2020 to 31/12/2020. Source: FE fundinfo.

2. Ravenscroft Global Income Fund O Acc, Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

3. Difference between Ravenscroft Global Income Fund O Acc and IA Mixed Investment 0-35% Shares Sector, Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

4. Ravenscroft Global Growth Fund O Acc, Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

5. IA Mixed Investment 40-85% Shares Sector, Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

6. MSCI World/Utilities, GBP Total Return 30/09/2020 to 31/10/2020. Source: FE fundinfo.

7. MSCI World/Consumer Staples, GBP Total Return 30/09/2020 to 31/10/2020. Source: FE fundinfo.

8. MSCI World/Healthcare, GBP Total Return 30/09/2020 to 31/10/2020. Source: FE fundinfo.

9. MSCI World/Information Technology, GBP Total Return 30/09/2020 to 31/10/2020. Source: FE fundinfo.

10. Lazard Global Equity Franchise, GBP Total Return 31/12/2019 to 30/09/2020. Source: FE fundinfo.

11. Lazard Global Equity Franchise, GBP Total Return 31/10/2020 to 30/11/2020. Source: FE fundinfo.

12. Lazard Global Equity Franchise, GBP Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

13. MSCI Emerging Markets Latin America, GBP Total Return 31/10/2020 to 30/11/2020. Source: FE fundinfo.

14. MSCI Emerging Markets Latin America, GBP Total Return 30/11/2020 to 31/12/2020. Source: FE fundinfo.

15. Brown Advisory Latin American, GBP Total Return 31/10/2020 to 31/11/2020. Source: FE fundinfo.

16. Brown Advisory Latin American, GBP Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

17. Ravenscroft Global Blue Chip Fund O Acc, Total Return 30/09/2020 to 31/12/2020. Source: FE fundinfo.

18. MSCI World, GBP Total Return 30/09/2020 to 31/12/2020. Source: FE fundinfo.

19. MSCI World, GBP Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

20. Ravenscroft Global Blue Chip Fund O Acc, Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

21. Polar Capital Global Technology, GBP Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

22. Polar Capital Healthcare Opportunities, GBP Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

23. Pictet Global Environmental Opportunities, GBP Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

24. Fundsmith Global Equity, GBP Total Return 31/12/2019 to 31/12/2020. Source: FE fundinfo.

All performance data above was collated on 05/01/2021.