Weekly update - What a treasure

In this issue we look at the role of the humble Treasury Bill which is used by the UK Debt Management Office (DMO) as part of the UK Government’s overall funding requirements.

The COVID-19 pandemic sent shock waves through financial markets because of the inevitable economic damage that has been, and will be, caused by lockdowns across the developed world.

Despite banks being in a strong capital position following measures introduced in the wake of the 2008/2009 Global Financial Crisis their share prices have taken a battering and remote working has restricted liquidity due to operational friction. Accordingly, there has been an increased demand for Treasury Bills from institutional cash investors.

So, what is a Treasury Bill?

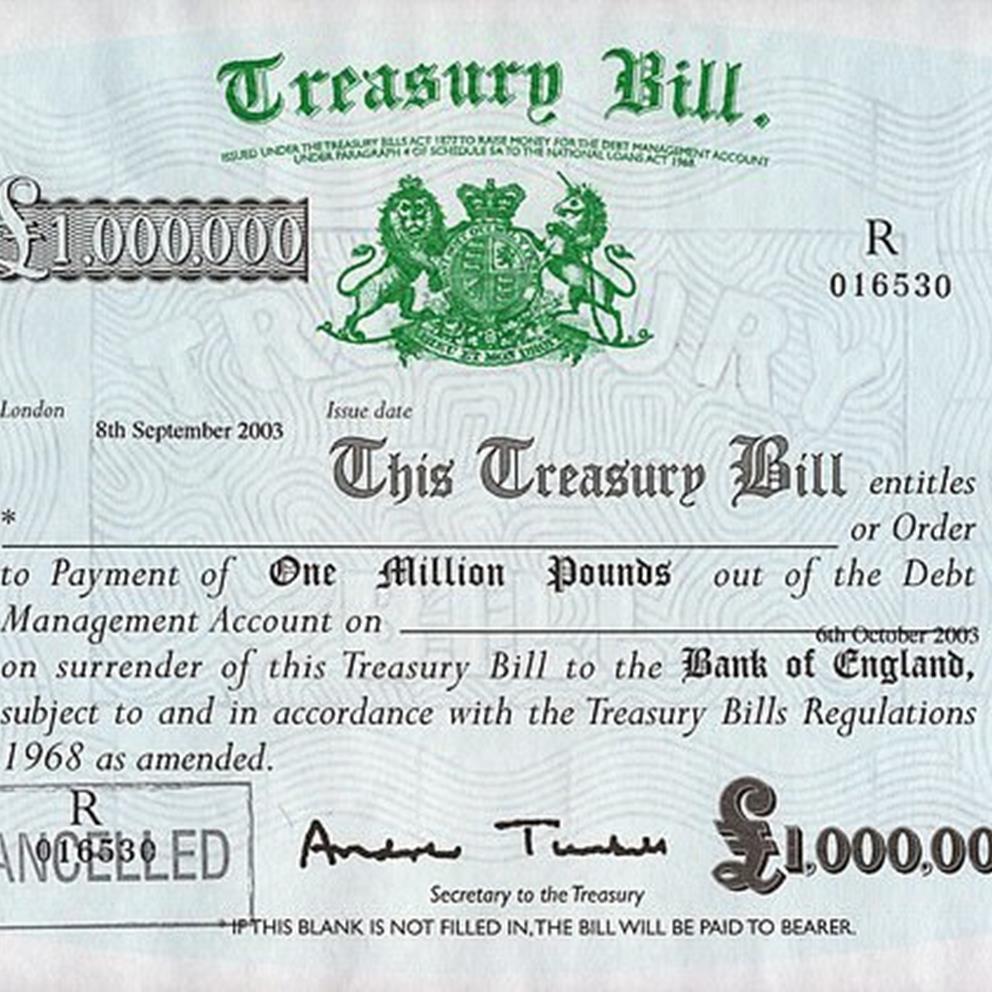

All UK Treasury Bills are sterling-denominated, unconditional obligations of the UK government with recourse to the National Loans Fund (NLF) and the Consolidated Fund. They are issued from, and are liabilities of, the Debt Management Account. Treasury Bills are zero-coupon eligible debt securities. The DMO issues Treasury Bills through regular weekly or ad hoc tenders, or it may issue bills bilaterally upon request from recognised counterparties, subject to certain conditions.

Treasury Bills may be issued with a minimum maturity of one day and a maximum maturity of 364 days. However, regular weekly tenders are typically for maturities of one month, three months and six months. Further issues of Treasury Bills will carry the same ISIN code and be fungible with any existing bills of the same maturity date.

Treasury Bills are transferable in multiples of one penny and they can be held in the CREST and Euroclear central depositaries.

How are Treasury Bills priced?

As mentioned above Treasury Bills are “zero-coupon” securities i.e. the interest rate on a Treasury Bill is 0% so how does an investor earn any return on a zero-coupon Treasury Bill? The answer is that Treasury Bills are priced with reference to prevailing interest rates then the investor buys a Treasury Bill at a discount to its face value. In other words, if an investor buys £1 million Treasury Bills, they will pay less than £1 million in settlement but will receive exactly £1 million when the Treasury Bill matures.

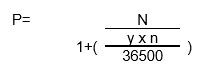

For readers of a mathematical persuasion the formula is:

where:

- P = Settlement proceeds in pounds sterling

- N = Nominal value in pounds sterling

- y = Yield, quoted as a percentage to three decimal places

- n = Number of calendar days from the settlement date to the maturity date

So, if the three month interest rate was say 0.5% then the cost for a three month Treasury Bill, purchased on 1st May with a maturity date of 1st August and with a yield of 0.5% would be £998,741.31. At maturity on 1st August, you would receive £1 million and therefore £1,258.69 would have been earned over the three month period.

The interest rate and dates used above are for illustration only as interest rates are currently lower than 0.5% and 1st August is a Saturday but hopefully you get the idea!

So, with the maths lesson over; why are Treasury Bills in such high demand at the moment? The answer is in the description that Treasury Bills are “unconditional obligations of the UK government” which is, gold bullion aside, about the best form of security available. This undoubted security means that it should always be possible to find a willing buyer should you wish to cash in your Treasury Bills before maturity.

Treasury Bills have the same security as a gilt which is another form of debt issued by the DMO on behalf of HM Treasury. The big difference between Treasury Bills and gilts is duration. Treasury Bills are generally issued for terms of between one and six months although up to 12 months is possible. Gilts however are generally issued for much longer terms from between two to 30 years. Historically, perpetual or undated gilts had been in issue where HM Treasury was not obliged to redeem the stock unless it chose to do so. However, taking advantage of the low interest environment following the 2008/2009 financial crisis the UK Government decided to redeem all perpetual gilts with the last outstanding stock being paid off in full on 5th July 2015.

Hopefully you have found this issue of some interest and it has helped while away some of the enforced time spent at home during lockdown.

Guernsey-based readers will of course be aware that the States of Guernsey has been debating options for financing the revenue shortfall and increased expenses created by the various business support schemes initiated in response to the Covid-19 lockdown. The options include raising funds from a debt issue, which in effect would represent a States of Guernsey gilt – Go Guernsey!