Weekly Update - Do you believe in the bounce?

Reasons to buy, and reasons to sell, the stock markets

“Should I sell into this market bounce or hold my nose and take the plunge?”

(and please excuse the phraseology!)

We have used the combined 200+ years of Ravenscroft experience to try and answer, but opinion has differed depending on who you ask, reflecting both our different investment styles and approach within the firm as well as personal beliefs! Answers proffered, quite rightly, also noted that this needs to be seen in relation to the particular circumstances of our, yet more diverse, client portfolios.

Sorry to disappoint those who thought this would be a bullet point ‘how to survive 2020’ guide; although, for those that have depleted their bookshelves, we would recommend Joel Greenblatt’s ‘The little Book That Still Beats the Market’ as a good place to start.

Risk

The initial, and most important, concept is that of risk, which ultimately relates back to our ability to ‘afford’ to buy the market.

Style

Once our risk has been discerned, assessing our style is the next important step. A blended approach is, typically, preferable as we construct a well-diversified portfolio; employing defensive, income, and more aggressive, capital growth, investments.

Conditions

Our next key consideration would be the assessment of current market conditions. For those at the low-end of the investment risk scale, the markets currently feel tempestuous, to say the least. For those on the higher-end of the risk scale, current market valuations might feel, finally, a little more palatable than this time last year: long-term, value investors might consider this a great opportunity to buy after a relatively heavy fall in a short space of time.

What none of us can answer is how badly companies and countries will have been damaged by Covid-19. It is clear that lockdown will have had an unwelcome and detrimental effect on the global economy, in particular the micro enterprise and gig economy.

Whilst some places begin to return to work, the lag effect caused by others who remain in lockdown prevents a return to ‘business as usual’ and any form of meaningful forecast.

Action or Inaction

We know that it really is difficult to navigate uncharted waters, but we must try and retain our overall sense of direction, even when the market remains volatile. If we are buying, we might consider ‘pound cost averaging’, making incremental purchases of investments that we like over a period of time.

Whilst noted on numerous previous occasions by Ravenscroft colleagues, we should like to reiterate that buying quality assets and knowing what you own and why you own them remains important.

One message which has been extensively covered by the investment media in recent weeks, and is echoed by our advisory desk and chief investment officer Kevin Boscher, is that gold might be worth a look in this environment. Gold is an asset class that could transcend risk classification and should prosper in the low interest rate environment that now prevails with either resultant deflation or inflation.

Conclusion

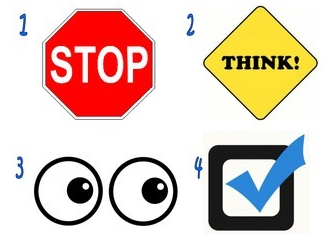

Only we as individuals can decide whether it is right for us to reduce exposure to, come out of, or dive into financial markets at the moment:

S - Stop

T - Take a breath

O - Observe

P - Proceed

We hope and trust that this helps you to make informed decisions, using all of the facts at your disposal and based on your attitude to risk and reward. As always, we are here to speak to whenever you want to chat through your thinking.

Take care and stay safe.

If you would like to know more about pound cost averaging, watch our short explanation video HERE hosted by Rachael Bearder from our innovation team.

BUYING AND SELLING PRECIOUS METALS. Please be aware that the price of precious metals can be very volatile, and can go down as well as up, sometimes significantly, over short periods of time. The price of precious metals is affected by a number of external factors, for example: the supply available from the mining industry, speculative activity in the derivatives markets, consumer demand for jewellery as well as actual, and anticipated, movements in interest rates, bond yields, foreign exchange rates and inflation. This list is by no means exhaustive. There may be periods where you have difficulty selling your assets, including physical metal, at a reasonable price.

BullionRock is the trading name of Ravenscroft Precious Metals Limited and Coinbox Limited, which are registered with the Guernsey Financial Services Commission as Non-Regulated Financial Services Businesses. BullionRock is not regulated in the UK and therefore is not covered by the Financial Services Compensation Scheme.

FINANCIAL PROMOTION: The value of investments and the income derived from them may go down as well as up and you may not receive back all the money which you invested. Any information relating to past performance of an investment service is not a guide to future performance.