2020 Q3 Newsletter

“Come gather ‘round people

Wherever you roam

And admit that the waters

Around you have grown

And accept it that soon

You’ll be drenched to the bone.

If your time to you

Is worth savin’

Then you better start swimmin’

Or you’ll sink like a stone

For the times they are a-changin’.”

The times they are a-changin’ - Bob Dylan 1964

Change is coming; it’s everywhere you look. From socio-politics and economic theory to globalisation and, given the current impact of Covid-19, to the very way we go about our everyday life: the way we work, the way we communicate and even the future of the way we co-exist. Of course, we don’t know exactly what change will come to fruition, but we know it is coming and, whether we like it or not, it will have an impact on our everyday lives.

Our job is not to speculate, but to fulfil our role as investment managers; ensuring that our clients’ portfolios remain fit for purpose and meet their objectives. At the very heart of this are our investment themes that run through all our client portfolios: technology and innovation, demographics and healthcare, the emerging consumer and global consumption. It is important, and never more so than today, that we scrutinise our themes to ensure that they remain relevant - not only for today, but tomorrow and many tomorrows after that.

To ensure that this is the case, we have revisited all of our investment themes. Following a thorough review and open debate amongst the Investment Committee, the conclusion is that we remain as committed to these themes as ever. We will shortly be documenting this process and publishing a “white paper” review for our investors. However, what we can’t fail to notice is that, in terms of valuation, our themes are a long way from being cheap on a historical basis. There is good reason for this - our preferred themes have performed well through lockdown and in many respects we have (rather inadvertently) created a pandemic portfolio.

At the heart of our portfolios are consumer staples (shopping trolley stocks - including loo roll), technology and healthcare. All three sectors have been bid up dramatically over the last few months and indeed have been the outperforming sectors for many years; they are now trading more expensively than they have for some time.

We therefore find ourselves in a position where we continue to believe in the legitimacy and growth prospects of our themes but also have to admit that they are less attractive from a valuation perspective than they have been historically. Of course, this doesn’t mean that they won’t continue to perform but it does mean that the likelihood of a correction is heightened.

So what to do? Warren Buffet makes a reasonable point:

“A short quiz: If you plan to eat hamburgers throughoutyour life and are not a cattle producer, should you wishfor higher or lower prices for beef?

Berkshire Hathaway, Chairman’s Letter 1997.

It would be disingenuous of me to claim that I was hoping for lower markets but it would be fair to say that we are positioned to act should our core themes fall in value. As we have explained, probably to the point where our readers are bored of reading it, over the last few years we have been gradually trimming our positions in the most expensive sectors of our portfolios. We have been running elevated cash and cash-like positions for some time and this is unlikely to change until we see real value and opportunity in our preferred investments.

BOSCHER’S (BITE-SIZED) BIG PICTURE

by Kevin Boscher

The performance of global equity markets has been mixed over the past quarter. The US and emerging markets have generally continued their recovery, whilst the UK and Europe have lagged. In addition, September has been a tougher month for many stock markets due to a number of factors, including a renewed spike in the number of confirmed Covid-19 cases across Europe, the failure of US Congress to agree another fiscal package and the looming November presidential election.

Covid-19 in Europe

It is true that rising coronavirus infections in Europe are an obvious concern and threaten the ongoing economic recovery. However, very importantly, hospitalisations and, in particular mortality rates are staying surprisingly low. Fatality rates across most developed countries are significantly lower than was feared and predicted at the start of the pandemic. There are most likely a number of reasons for this such as increasing infections in younger and healthier people, better treatment protocols and procedures and improved preparedness of hospitals and health staff. In addition, the rapid increase in testing has inevitably led to higher detection levels, which has enabled the case fatality rate to converge to the true rate, which might have been low to begin with.

Whatever the reasons, the sharp decline in mortality rates has strong implications for public policy. Although the policy response varies from country to country, any restrictions or lockdowns are likely to be significantly less draconian and more measured than what occurred back in March. With improved knowledge and more accurate data, governments are better able to balance the short-term health risks against the longer term and severe threats to the economy, jobs, social structure and health. The imminent availability of a vaccine, which remains a realistic hope, would be a game changer for the global economy, policy and financial markets.

US Fiscal Response

The failure to pass another US fiscal package poses a material threat to the economic recovery, since removing fiscal subsidies today could lead to a significant decline in disposable income. US consumption accounts for about 70% of GBP, so any hit to consumers would likely have a material impact on growth. To some extent, most middle-income Americans can run down their savings to sustain their spending, but the lower income earners would again bear the brunt. Hence, more fiscal subsidies are required to bridge the income gap, which is why Fed chairman Powell is pleading with politicians to take aggressive action quickly. The good news is that both sides are still talking but there is a growing risk that electioneering and the Senate focus on appointing a new Supreme Court judge will delay any deal until well past the election. If this is the case, then it is not all bad news since falling unemployment, rising consumer confidence and increasing investment should partly offset the decline in fiscal support.

US Election

The November presidential election remains too close to call and Trump appears to be closing the gap. Trump looks to have been more effective in energising his base whilst Biden’s campaign has been largely uninspiring so far. It would appear that the race will likely be very tight and the probability of either candidate winning a landslide is small. This means that the odds of a contested result are rising and the risk of political or social instability are increasing. In a recent press briefing, President Trump refused to commit to a “peaceful transfer of power”, raising the spectre of a potential constitutional crisis or social unrest. In my view, this is the biggest risk for the US and global economies and financial markets at present. Having said that, the US system is designed to force a result within weeks of an election and it will be unlikely that Trump can cling to power if he loses. Whilst there is a risk that an unconvincing or unpopular result will trigger street protests, hopefully this would not be long lasting and history suggests that such an outcome would have little longer-term impact on markets. In addition, whatever the result, the new President and Congress will need to focus on ensuring the recovery continues and both monetary and fiscal support will stay very supportive.

CAUTIOUS PORTFOLIOS:

LOWER RISK

by Alex Chambers

Objective: The Cautious portfolio’s objective is to increase its value by predominantly allocating capital to fixed income investments. The portfolio can also invest into global blue chip equities with strong cash flows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity weighting of 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

The Income strategy returned 1.4% over the quarter, which was a more modest gain when compared to Q2, but still a pleasing figure leading into the final quarter of 2020. This brings the performance for the year to 1.2%, up from a trough in the middle of March when the strategy was down more than 10%. During the beginning of Q3, markets continued their steady upward trend and then they flattened out during the latter part of the period and global markets are mostly around pre-pandemic levels.

In July, we made a decision to reduce the equity in the portfolio by 2.5% and this was done by decreasing the allocation to the Fidelity Global Dividend Fund. The reason behind this was purely based on the Fund’s strong performance and on a valuation basis, it had become seemingly expensive relative to its own historic valuation. The proceeds from the sale were held in cash with a view to being used for a new core corporate bond fund that we hope to implement early in Q4 along with a couple of other smaller changes that we will explain in future commentaries.

We also implemented a new position in US Treasury Inflation-Protected Securities (GBP Hedged) during the first week of September. This position will give a risk-off exposure during any periods of significant market volatility. Given the extremely low yields on core government bonds at present and the chance that any future market shocks could be inflationary in nature, inflation linked bonds have been chosen on this basis. Currently they are paying around one percent less than the Consumer Price Index (CPI), and as such, it would only take a small amount of inflation to beat nominal bond yields. We have chosen treasury bonds (US government securities) over UK gilts in order to minimise any exposure to government securities that have the potential to be volatile because of Brexit and in turn, maximise the chance of benefitting from any ‘flight to quality’ bid. The initial size of the position will be 2.5% with the view to increasing this to a 5% position in time.

Turning to the performance of the underlying holdings in the portfolio - it was a mixed quarter. High yield and emerging market bonds were the best performing holdings and the shorter-dated, higher quality bonds did not perform as well. However, this is to be expected, as they are typically lower return and lower volatility by design. On the equity side, after such a strong Q2, equities did not perform as strongly in comparison but they did return around 1.4% over the quarter.

Going forward, the portfolio maintains its relatively defensive stance, as we are cognisant of the fact that there could be more volatility to come in global financial markets while the world economy navigates choppy waters. This stance has helped the strategy to outperform the sector (IA Mixed Investment 0-35% Shares) by around 1.4% over the year so far and this is mainly down to the sectors the strategy invests in, the global stance it takes and the high quality businesses it seeks to own.

BALANCED PORTFOLIOS:

MEDIUM RISK

by Tiffany Gervaise-Brazier

Objective: The Balanced Portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

The Balanced strategy returned approximately 1% over the quarter, taking the year-to-date performance to 4.8%.

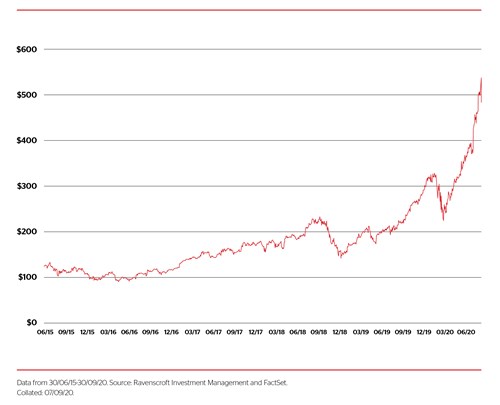

Since our last update in June, we made the decision to take profit from our technology exposure held via the Polar Capital Global Technology Fund, which has returned over 35% this year. The reason for this is that the Fund has benefitted from the reliance that the pandemic has placed on the sector in terms of communications, software, online payments and distribution companies. The growth during lockdown in some of the underlying companies held in the Polar Capital Global Technology Fund embodies how the Covid-19 pandemic has brought forward in just a matter of weeks working practices, software applications and mindsets that would otherwise have taken years to materialise.

As you will know, we are valuation driven investors, which means that we are very conscious of not overpaying for companies that are trading beyond their true value, this is not necessarily the case with the Polar Capital Global Technology Fund but this huge outperformance has led to the Fund trading at an expensive premium to its historic trading average. Therefore, we feel that it is pragmatic to take profits and reduce the position back to 5%. Technology continues to be an investment theme that we believe will remain innovative, relevant and profitable over the long term.

In August, we made the decision to purchase the Lazard Global Equity Franchise Fund within the global equity allocation of the portfolio, at a 2.5% position. The Fund, the Manager and their process is well known to us and the reason why we are investing into it is predominately due to its focus on finding companies showing true value.

Currently, the strategy has a significant allocation (~20%) to consumer staples goods (or shopping trolley stocks, as Mark refers to them) and as many of you will have heard us say before, the core of our portfolios are centred around increasing global consumption, which we see as an irrefutable trend. Consequently, these types of exposures tend to be associated with stocks and funds that have a capital growth (appreciation) focus.

Purchasing the Lazard Global Equity Franchise Fund allows us to diversify our equity (shares in companies) exposure as it has minimal crossover of holdings, and has a more attractive valuation relative to the current holdings within this allocation.

In September, the thematic exposure to Brown Advisory Latin America, technology and healthcare (via Polar Capital) were detractors from performance and large currency movements between sterling and the dollar also affected these positions. Despite the reliance on the latter two sectors during the pandemic and strong performance year-to-date, the exposures were predominantly affected by concerns over the policies in relation to the US election and resurgence of Covid-19 cases.

The past few weeks have seen an increase in market volatility, as investors seems to have focused on the reacceleration in confirmed Covid-19 cases and policymakers around the world juggle with fiscal and monetary packages. It is important to be mindful that the rebound from the late - March lows was quick and strong, and that this recovery has been one of the fastest in market history, in some cases, some market indices have reached all-time highs again.

Uncertainty tends to incite market volatility, and as we have seen before, the US election brings a lot of uncertainty of outcomes. However, the impact felt on specific sectors from any policy changes will occur over the course of the next four years and likely not in the immediate future. Volatility (movement in capital values) is normal but over the longer term, markets tend be resilient. The strategy is positioned defensively and remains invested to participate in the upside that capital markets have to offer long term, whilst aiming to offer some protection on the downside by owning quality companies at sensible valuations.

We have also made the decision to make some small changes within the fixed income allocation in the strategy, which we believe we allow further diversification and return potential over the long term. We will provide a rationale in next quarter’s commentary.

We are aware that the continual tensions between monetary stimulus, economic activity and the changing narrative that justifies an increasingly expensive equity market could be played out in financial markets for months, if not years, to come. As a result, we continue to focus on building a well-diversified portfolio, which will stand the test of any Brexit negotiations, a US election and a global pandemic. The portfolio continues to be in a defensive position with 46% invested in equites, compared to its maximum equity weighting of 60%.

GROWTH PORTFOLIOS:

HIGHER RISK

by Georgie Fletcher

Objective: The Growth Portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

Just six months ago investors were envisioning the end to the longest bull market in history as stocks fell some 35% at the end of March. Fast forward to the end of Q3 2020, and some US markets have experienced their best quarter in over 20 years; gold reached new highs not seen since 2011 and many market sectors posted double digit returns. Despite many countries and regions going back into local lockdown and Covid-19 case numbers spiking again, the reporting period has been kind to most asset classes.

The Growth strategy followed suit with the wider market; putting good ground between itself and the sector. The strategy posted 2.4% for the quarter, bringing the year-to-date return to 1.2%, whilst the sector lagged; posting 1.9% for the quarter and -2.5% year-to-date.

Portfolio changes

We have made several changes over the quarter. Investors may remember we made the decision to hedge our technology exposure held via Polar Capital Global Technology (at $1.18) towards the end of March on the back of the weak GBP/USD rate. During the Q1 equity sell-off, this currency fluctuation contributed positively to our return from Polar Capital Global Technology and switching into the hedged class was thought to be a prudent move should the rate bounce back – some days later this bounce back occurred ($1.24). Over the last six months, the rate has continued to creep higher and higher and in July we decided to look at the impact this hedging decision had made on our overall return from Polar Capital Global Technology. Since the switch occurred the hedged class has returned 51%, if we had remained invested in the unhedged share class this would have still been an impressive 38%, however switching our exposure added an additional 13% in performance. Whilst we knew the US dollar could have continued to weaken and positive Brexit talks may have further strengthened sterling, when the GBP/USD rate hit $1.30 on the 30 July, we made the decision to protect this return and remove the hedge. Despite the short period from the date we took the hedge off to the end of the quarter, this decision has already proven fruitful as our unhedged exposure is ahead.

Within the bond space we have also made some changes. We made the decision to sell the portfolio’s entire holding in the PIMCO Global Investment Grade Bond Fund and invest the proceeds into a new position, Vontobel Global Corporate Bond Mid Yield Fund. PIMCO has been owned within the portfolio since inception and has performed very well. Whilst we had no concerns with the Fund, in the current environment, our preference is to focus investing the portfolio into debt issued by corporate entities which Vontobel specialises in. The Fund is a portfolio of carefully selected global corporate bonds, which we feel is better aligned with the strategy’s capital growth objectives. Vontobel’s investment thesis aligns with ours and they also invest globally, offering the greatest diversification potential and allows the portfolio to stand the test of time. The ‘mid yield’ portion is the more opportunistic part of the portfolio where the return adequately compensates for the risk taken. The Fund will sit at a 7.5% position within the portfolio.

Winners and losers

Over the quarter all of our global equity holdings posted positive returns. There was a distinct difference between investors’ appetite for growth versus value stocks; the MSCI Growth Index posted 7.0% for the quarter whilst the MSCI Value Index posted -0.7%. There were periods when value performed well, however these levels were just not sustained throughout the period. Having said this, despite value stocks being out of favour with the market, it was very pleasing to see our value-focused fund, Lazard Global Equity Franchise, outperform the index and end the quarter in positive territory. As regular readers will know, we own Lazard for the diversification benefits it provides within the global equity space, as typically, growth and value stocks act differently. If we see a shift towards value over the coming months, we would expect Lazard to outperform its global equity peers and the market.

Within the thematic space, Arisaig Global Emerging Consumer had a great quarter. The strong performance can be accredited to Arisaig’s digital holdings, which highlights how events this year have not only accelerated e-commerce adoption, but also changed the way in which it is used, with shoppers increasingly turning to online platforms for higher frequency, daily use purchases.

Conversely, Brown Advisory Latin America was our weakest performer this quarter. However, much of this pain can be attributed to weakness in the Brazilian real. Last quarter, the Brown Advisory team exited its final Argentinian holding and reinvested the proceeds into its best Brazilian ideas. We are in regular contact with Managers and remain confident in their abilities, as well as the region, and hope to see their decisions prove fruitful over the coming months.

Finally, within the bond allocation of the portfolio, investors favoured shorter-dated fixed income assets over longer-dated exposures. We are very pleased to report that all of our bond managers did their job as all of our holdings posted positive results for the quarter and outperformed the index.

2020 thus far has been unprecedented; what it is has reiterated for us is the importance of sticking to our knitting and being stringent with our process. As we head into the final quarter of the year, we will continue to do just this. We have no intended changes scheduled to take place, however as we have been communicating to investors, if we see a pullback in markets and the opportunity arises to add to certain thematic exposures, we will seize the chance to do so.

GLOBAL BLUE CHIP PORTFOLIOS:

HIGHER RISK

by Ben Byrom

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chips that are in line with our long-term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

During the third quarter 2020, the Global Blue Chip strategy eked out a positive return of 1.2% amidst a backdrop that was broadly positive for global equities with the MSCI World rising 3.3% on a total return basis (in sterling terms).

The pace of change in equity price appreciation was somewhat subdued when compared to the second quarter where much of the ‘pricing-in’ of a post Covid V-shape recovery took place. In addition, fortunes differed greatly by sector during the third quarter.

As we noted in our last quarterly, the defensive positioning meant we did not participate as enthusiastically as the broader market, this again would appear to be the case with the MSCI healthcare and staples sectors registering miserly returns.

The broader market’s performance was driven by its cyclical elements, including: materials +6%, industrials +6.4%, consumer discretionary +10.6%, and information technology +6.7%. Global Blue Chip does not have exposure to businesses within the materials sector and is underweight the other three. Nonetheless, there were noticeable performances at the stock level.

For example, Nike, a consumer discretionary holding, had an exceptional quarter jumping over 22% in sterling terms. The Company announced a stellar set of quarterly results with both top and bottom-lines beating stock analyst expectations. Much of what we like about Nike: innovative products, solid digital and e-commerce platforms, which boost engagement and sales of iconic brand footwear and sporting apparel, was at the very centre of its successful quarterly performance. Another strong performer for the strategy was Apple, which we sold towards the end of the quarter – reasons highlighted later.

Of course, no portfolio is inch perfect and some holdings have not performed as expected. Both Illumina and Intel lagged significantly through the quarter.

Intel dropped a bomb on shareholders when its CEO, Bob Swan, announced a further delay to its next generation chips after the Company had identified a defect in its manufacturing process. The new chips are now not expected to hit the market place until 2022. The news sent shares in Intel sharply lower to below $50 a share. At these levels, Intel looked attractive and we added to the holding.

Shares in Illumina plunged the best part of 30% from its all-time high of $400 following the announcement it will acquire GRAIL for $8bn. GRAIL, founded by Illumina and spun out in 2016, is close to launching the first liquid biopsy test for the early detection of a multitude of cancers – a potentially huge opportunity, which Illumina believes will be the single biggest application for its sequencing technology. Whilst the price tag may seem a bit steep for a company that is essentially pre-revenue, Illumina has form in such bold bets. For example back in 2007, the Company paid a high price to acquire Solexa, another pre-revenue firm whose sequencing technology has formed the basis of Illumina products ever since. If GRAIL proves to be just as lucrative, both the $8bn price tag and the $250 a share we were paying to build up our holding will look a snip.

During the quarter, we also initiated positions in Regeneron and BMW.

In May, Sanofi (a Global Blue Chip holding) announced that it intended to offload the vast majority of its holding in US biotech business Regeneron, where the two businesses had enjoyed a symbiotic relationship built on collaboration and cemented through Sanofi’s stake. The changing of the guard at Sanofi (with Paul Hudson assuming the CEO role) has brought with it a change in approach. The $13bn sale of Sanofi’s 22% stake in Regeneron formed part of Paul’s new vision. This quarter’s Stock in Focus is on Regeneron, detailing the reasons why we took a direct position following Sanofi’s decision to sell.

Our decision to invest into German auto marque BMW may at first glance seem a strange choice for our strategy, however, our research has uncovered what we think to be a true diamond in the rough. Whilst a lot of headline print has been given up to Tesla, a business with a media savvy CEO not shy from making outrageous statements, BMW has been quietly squirreling away billions of euros into its electrification strategy and we believe the Company’s capabilities have been largely overlooked by the broader market. Nonetheless, BMW’s shares are being mis-priced by some 50% as determined by our ‘sum-of-the-parts’ valuation estimate. The Company's next iteration of vehicles in 2021 will have similar ranges to those of the equivalent Tesla models and with it the potential to rewrite the narrative around BMW and close the valuation gap. We will be writing more about BMW in up and coming newsletters and quarterlies.

Finally, it would be remiss not to touch on our disposal of Apple towards the end of the quarter. Fundamentally, we see absolutely no value in the shares at current prices. The P/E multiple has expanded from 9x, when we were building a position in 2015/2016, to 36x on a one year forward looking basis. This is a multiple usually reserved for companies growing revenues at double digit rates - Apple’s historical rate during our ownership has been 3.7%. There are also mounting threats to the very core of Apple’s recent success and our investment case.

We have been watching for some time the growing discontent around Apple’s charging practices and monopolistic behaviour within its Services division. The Company is now being challenged by a number of big app/service providers that are baulking at the cut Apple demands for access to their ecosystem and user base. Some developers claim the whole thing is anti-competitive and damaging to their business model and fundamental to their ongoing survival.

One combatant in particular, Epic Games, broke Apple’s rules; allowing users to purchase in-app products outside of the app environment at a discount, benefitting only the consumer and Epic (who took greater share of the profit). This action resulted in Apple, now out of the loop on the transaction, banning the app for its store. Epic, believing they have proved their point that Apple's practices are anti-competitive have now taken their quarrel to court, to settle it once and for all. The result could have far reaching implications on the profitability of Apple’s Services business and overall margin. Given the importance of Services to the growth and profitability of the overall business, and our investment case, any adverse outcome could impact the shares as the new reality is priced in. Nonetheless, even if Apple wins, shares are expensive either way.

Our Apple journey started in 2015/early 2016 when we took, at the time, a contrarian view on Apple’s future prospects. We recognised the power of the ecosystem, sprawled global user base and its burgeoning services division at a time when the market thought its innovation engine was dead under Steve Job’s successor Tim Cook. All of this potential was ‘on sale’ with a price earnings valuation of 9x. Our Discounted Cash Flow (DCF) model at the time intimated there was at least 50% upside in shares even if Apple was unable to grow revenues by a cent more. The Company had, and continued to produce, a staggering amount of cash and whilst iPhone shipments were slowing we felt the real growth story was in its Services division. This duly played out and now we are leaving a Company whose narrative has changed to one that can do no wrong, even as it faces rising unrest from its partners - the app developer community and increasing scrutiny from anti-trust authorities. At 36x forward earnings, the Company is no longer cheap. We prefer to own businesses that don’t require a lot to go right for us to make money. We certainly don’t want to be in businesses that are outright expensive whilst the very reason for being there is under threat. What would get us back in? Almost certainly a decent sell-off in shares that offered investors some value and preferably a favourable outcome in the Epic Games Lawsuit that is expected to go to court next summer.

FUND IN FOCUS:

by Shannon Lancaster

While we are all still digesting the impact of Covid-19 and worldwide lockdowns, what is clear is that while some areas look extremely challenged fundamentally and obviously so much has significantly changed in 2020, our ability to predict almost anything remains about as useful as a chocolate teapot. Although we can’t claim to be certain of what the future will bring, we can focus on controlling the controllable by ensuring we continue to know what we own and why we own it.

One bond fund that exemplifies this approach is Vontobel Global Corporate Mid Yield Bond Fund. The Fund has exposure to just 136 issuers and 215 bonds, which is in line with their bottom up driven approach. Finding the most attractive opportunities is key to the credit selection centred process which is why they spend a lot of time looking at the underlying bonds and the issuers. We really appreciate this concentrated approach to bond fund management which is a breath of fresh air.

We have expanded our core bond fund allocation over the quarter to include this Fund in some of our strategies after being extremely impressed with the Manager and the process. We first came across Vontobel a few years ago when looking at thematic exposures in the equity space. At the end of 2019, when we were still enjoying hopping on and off planes, Sam and Bob visited the Vontobel office in London in December to hold a video call with the Fund Manager Christian Hantel, who is based in Switzerland. We spent the following months getting to grips with the Fund and its portfolio.

The Fund’s investment philosophy is based on the belief that the global corporate credit markets are diverse across segments and geography. Investing across a global universe offers the greatest risk and return diversification potential and scope to build robust portfolios. In particular, they find relative value opportunities can exist across different currency bonds issued by a single corporation which we found particularly interesting. Having the flexibility to invest across multiple currencies provides additional opportunity to generate outperformance. They view the mid yield, (BBB to BB), range as the most attractive part of the investment grade landscape and where the credit spread most compensates for the risk taken. Therefore, by constructing a portfolio of carefully selected global corporate bonds in this mid yield segment, diversified across sectors, geographies and currencies, they believe they can deliver outperformance versus the global corporate bond benchmark. The Fund has returned 5.7% vs the index return of 5.4% in USD terms so we are pleased that it is behaving in the way we would expect.

Our aim with these changes is to allow the fund managers within our bond allocation to add more value through the stock selection work. While this time consuming, bottom up, credit research might not be viewed as glamorous, in a world of expensive valuations and potentially rising bond yields, we believe that active management will be a crucial part of navigating the next stage of the cycle and these changes should contribute to that.

STOCK IN FOCUS:

by Oliver Tostevin

In September we bought shares in Regeneron Pharmaceuticals, a biotech company based in Tarrytown, New York. Established in 1988, the Company is still run by its founders. There are a number of things we like about Regeneron, including a high participation by employees in the ownership of the Company, as well as a very low employee turnover, which help to preserve one of the most innovative cultures in the industry. In this note we will talk mostly about the Company’s approach to inventing new medicines.

While precise industry estimates vary, no more than 10% of drug candidates that enter clinical trials end up being approved for use. Moreover, of those drugs that are ultimately successful, only around one third are actually “best in class”.

We have gone through every molecule that Regeneron has ever put into clinical trials for testing, and of the 37 molecules investigated so far, more than 30% have been successful (or, in our view, are highly likely to be). This indicates a rate of success that is more than three times higher than average. And note that every drug that Regeneron has had approved thus far has been best in class. Moreover, numerous Regeneron drugs are proving to be of the sought-after “pipeline-in-a-molecule” type with efficacy in a range of indications. For example, blockbuster drug Eylea is highly effective in treating a range of eye diseases, while another blockbuster, Dupixent, is revolutionising the treatment of many allergic diseases from asthma to eczema.

The industry has always had a problem with internally-generated innovation, such that almost all major pharma companies have to resort to acquisitions in order to prop up sales. Frequently they overpay and their returns on invested capital (“ROIC”) sink ever lower – and when ROIC sinks, shareholder returns usually head in the same direction. The main alternative is to hike prices every year and we consider this to be unsustainable, not to mention the ethical issues. Almost uniquely, Regeneron does not have this problem - 100% of product sales are driven by medicines that were invented in-house, while all the growth comes from increased volumes, not prices. With a highly efficient R&D process, along with medicines that get “bang for their buck”, Regeneron is able to reinvest its profits at a very high ROIC, hence why the Company keeps growing so well:

The team’s process has three core pillars:

1. Better technology:

For over 30 years Regeneron has been pioneering its “VelociSuite” technologies, while others have generally been slow in trying to establish anything equivalent. We do not think it an exaggeration to say that Regeneron is years ahead of the competition. VelociSuite gives Regeneron:

• An effectively unlimited supply of novel human antibodies that can be targeted against all manner of diseases from cancers to cat allergy to Covid-19

• The ability to pre-select the very best antibody candidates - Regeneron usually has a pretty good idea if a drug will work before even trying it on anyone

2. Better data:

For years Regeneron has been sequencing hundreds of thousands of human genomes, which are linked anonymously to patient records. Few others have attempted anything similar (it’s costly and does not lead to any profits for years), such that Regeneron now has a vast array of genetically validated “druggable targets” against which it can deploy its leading antibody technology.

3. Better trial process:

Clinical trials are expensive. In Phase 1 trials the number of human subjects will be in the tens. Phase 1 is primarily used to established safety, but valuable insights into efficacy can also be gleaned. Phase 3, on the other hand, generally involves hundreds or even thousands of patients and can continue for extended periods to gain the necessary confidence that a drug is sufficiently safe and effective to be approved for use – for these reasons, Phase 3 is extremely costly and a failure at this stage is highly disappointing. Phase 2 sits somewhere in the middle. Once a molecule enters this phased process, most companies do everything they can to keep it going – hoping to eventually limp over the finish line with something they can sell. Regeneron does the opposite – it kills off drugs early unless they show particular promise. 83% of the molecules they’ve discontinued, have been killed off early in cheaper Phase 1 trials. They’ve only had one Phase 3 failure in 30 years. In exceptional circumstances of unmet patient need, a Phase 2 trial can support an application for approval where the data are particularly compelling - Regeneron has form in this regard too.

It seems to us that Regeneron is a standout business when compared to its peers, but from a valuation perspective it tends to be lumped in with the rest. We think that Regeneron shares ought to carry a premium valuation, such as one often sees in the technology sector. After all, in our view, Regeneron is very much a technology business at the cutting edge. While we refrain from making shorter-term predictions, we do believe that Regeneron’s successes are unlikely to go unnoticed over the coming years and we’re happy to wait patiently for the story to unfold. We’re particularly encouraged by the Company’s highly differentiated approach to the treatment of cancer and see this as an underappreciated growth driver in the years ahead.