An illogical question, perhaps, but one which has been on my mind this week in relation markets. We all know that, much to most investors’ wholehearted dismay, markets have, for want of a more romantic description, gone down like a plumb line. It’s pretty easy to identify and understand what (ahem… who) has caused this. But – if I may be so bold as to speak on behalf of the masses – what we would now like to know, please, is when are they going to be coming back up?

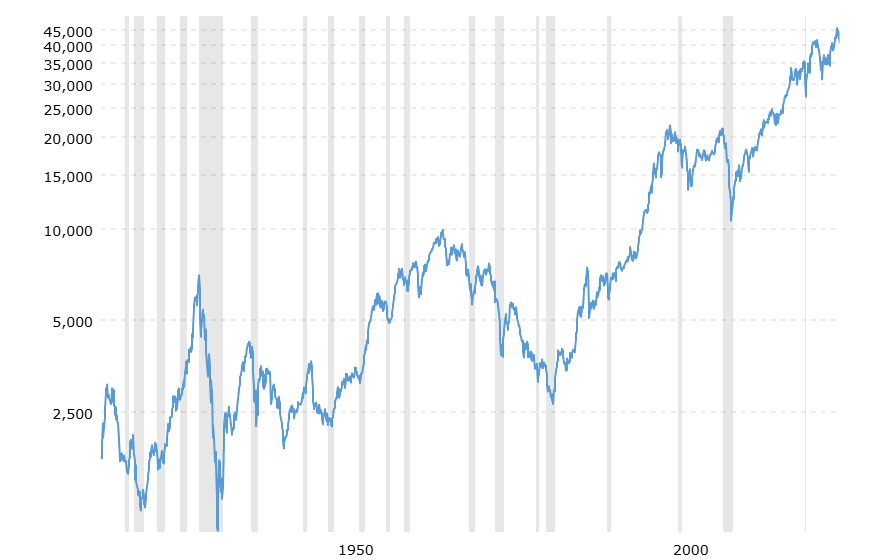

I was thinking about the market shocks of yesteryear and wondering if there was such as things as a “normal” recovery time. Unsurprisingly, this took me down a bit of a rabbit hole and it turns out – spoiler alert – that there really isn’t one. Seemingly, there is a trend though… If we look back at some of the biggest market crashes over the last century, recoveries seem to be speeding up (although I must make it clear that this is a musing, as opposed to a promise).

- 1929 – Wall Street crash - After the 1929 crash (and subsequent Great Depression), it took markets a whopping 25 years to get back to previous highs. That fact is both great and depressing.

- 1987 – Black Monday – One of the most notorious days in financial history, which saw the Dow lose 22.6% in a single day, it took just two years for the Dow to recover completely.

- 2000 and 2008 – The early 2000s experienced a double whammy (that was a fun decade, wasn’t it?) and it took six years for markets to recover from both the dotcom bubble and then the global financial crisis.

- 2011 - The European debt crisis – This saw the market slice 11% off its value on 6th August and by 15th August it was like nothing had ever happened! If you’d been having a nice summer break in Capri you might not have even noticed that one. Perhaps why it’s not really considered a “proper” crash…

- 2020 – Covid - The Covid downturn of March 2020 was another fast cycle. Though the initial drop was dramatic, the market ultimately recovered in just four months—the fastest recovery of any (proper) market crash over the past 150 years.

As you can see, there’s been multiple examples of markets falling throughout history and there are, of course, hundreds of different factors at play in each. But, for every financial crisis, recession or drop, we have seen markets bounce back. I can’t help but wonder whether some of this accelerated recovery comes down to the speed of information flow. We live in a much faster, more accessible world than we ever have done, and investors now have access to an unprecedented amount of research and information. Back in 1929, not only were there less investors (and investments) in the marketplace, but it was also harder to gain access to it. If you wanted to learn about stock markets you would have been limited to newspapers, radios and libraries, and stocks and shares weren’t perceived as being accessible to the layperson on the street. In 1929, it would have been difficult for someone to access past data and identify that in fact, times of crisis can be a great opportunity to invest, with a downtrodden market often providing a cheaper entry point and therefore much greater potential for investment upside.

In stark contrast, when it came to Covid, we were all stuck at home in front of our screens with real-time information flying at us left, right and centre. Anyone with any kind of phone or tablet could access the stock market – the barriers to entry no longer exist. I remember working from home during the pandemic and Ravenscroft was opening an unprecedented number of execution-only portfolios, with new investors wanting to take advantage of the heightened volatility. The bravery of those investing at the moment was almost certainly rewarded over the short term.

Sadly, while my research has provided some comfort in the form of a reminder that markets do recover, what is has not provided me with is a formal end date for this market shock, but let’s all hope that we’re heading there at a gallop rather than a trot.