The past quarter has been one of significant change; presenting both challenges and opportunities for investors. While we remain committed to our long-term investment philosophy, we continue to adapt proactively to the evolving market environment.

Given the significance of recent events and their potential implications, this update is slightly longer than usual. We have aimed to provide a clear and thoughtful overview of the key developments, what they mean for the Global Blue Chip Fund, where we see opportunities going forward, and the adjustments we have made to the fund’s holdings.

In this update we will cover the following:

- Performance commentary for Q1

- Stock in focus – RWE

Global Blue Chip Q1 2025 performance commentary

The first quarter of 2025 was dominated by volatility generated by the rapid changes in US policy aimed at addressing America’s unsustainable fiscal situation driven forcefully by US President Donald Trump and US Treasury Secretary Scott Bessent. Initially, the selling pressure was from hot money exiting carry trades and being repatriated home. The subsequent weakness in the US Dollar implied a degree of popularity behind the trade. Then there was a bigger, broader move lower when tariff uncertainty entered the narrative as the administration warmed everybody up for “Liberation Day” on 2nd April.

The MSCI World declined 4.6% in GBP terms, with the technology sector leading consumer discretionary and communication services sectors lower. These sectors are home to the majority of the largest capitalised stocks in the market who felt the brunt of the rotation out of US equity markets. Only energy and utilities showed signs of positivity.

In contrast, the Global Blue Chip Fund returned -6.8% as the lack of energy exposure, the primary performing sector in March, meant the strategy did not hold up as well amidst the general weakness.

During the quarter we effected an adaptation to the strategy focused on realigning against the new backdrop and reducing susceptibility to heightened stock-specific volatility, especially at times of new information flow such as earnings reports. This resulted in a heightened level of trading, which we will detail next.

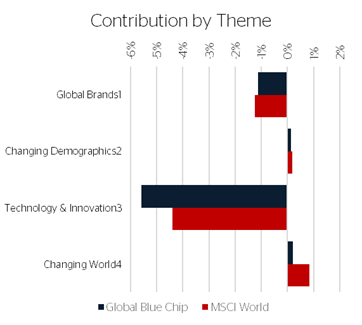

All three primary investment themes – global brands, changing demographics, and technology & innovation - unfortunately lagged their benchmark counterparts. Changing world, a new theme we introduced into our portfolio this quarter, fared better. We explain this theme in more detail later in this newsletter.

Global brands – Consumer discretionary and consumer staple stocks

The portfolio’s consumer stocks marginally outperformed their benchmark components, thanks largely to a strong earnings report from Heineken and positive news flow from eBay. However, the collective delivered a negative return overall as trade policy uncertainty questioned future profitability.

There was nothing particularly special about Heineken’s report other than the timing of the announcement, which came during a period when investors were looking beyond the US for investible European names as carry trades (a strategy that involves borrowing at lower interest rates and reinvesting in a currency or financial product with a higher rate of return) were in the process of unwinding. The company’s share price had come under considerable pressure – despite growing sales-by-volume and earnings-per-share. Persuasive narratives about the growing use of GLP-1’s and their effectiveness at curtailing alcohol consumption, declining drinking trends amongst younger generations, and the toxicity of European assets during the age of ‘American Exceptionalism’, kept the shorts pressing on this impressive, family-owned business. The coincidence of good numbers at a time when a not insignificant amount of money was looking for a new home, forced a short squeeze. Time will tell whether the market is willing to re-rate Heineken’s shares but given the underlying health of the business, we have the patience to find out.

Shares in eBay enjoyed a nice pop when it was announced by Meta that it would show eBay listings on Facebook’s Marketplace. The move was not a kind gesture to a competitor but a move to appease European regulators after being fined for unfair ad competition.

With fiscal conditions changing rapidly and the future becoming far more uncertain, we decided to call time on companies with operational problems or those likely to get caught up in the tariff uncertainty. We conducted the following changes within this theme:

- Sold Etsy. Earnings growth is set to decline should economic growth in the US slow. Gross merchandise sales trends, a keenly watched metric by investors, also failed to impress following the Q4 2024 earnings announcement. Active sellers and buyers have also rolled over, meaning the incremental improvements are being driven by other non-core initiatives such as advertising, which may slow should the economy roll-over.

- Sold Estée Lauder. Estee’s failure to turn matters around point to either deeper rooted problems or an extremely challenging environment in China, one of its core markets. We suspect it’s a combination of both and with the company likely to get swept up in amongst the looming tariff war we have exited the business and will watch from the sidelines.

- Sold Nike. Nike’s recent run in poor performance has stemmed from a business decision during Covid to focus on its direct-to-consumer sales channel. This came at the expense of its wholesale channel that it underserved and where it subsequently lost ground to competitors. Hindering matters has been the slowdown in China, a major international market outside of the US. The company is certainly in the firing line for retaliatory tariffs from China who seems to be in little mood to appease Trump (as things stand at the moment).

- Sold Stellantis and BMW on tariff concerns pre “Liberation Day”.

Meanwhile, we bought Amazon, an old friend to the strategy, which offers a broad capture-all exposure, primarily to the western consumer, offering a fast, value-orientated and highly reliable online e-commerce service. It is also a leader in web services and AI datacentre architecture.

Changing demographics – Healthcare stocks

Our collection of healthcare stocks struggled relative to their sector due to the solid progress being made by some of our pharmaceutical businesses being offset by weakness in our life-science holdings. Nonetheless, these positions collectively generated a positive return.

Shares in Solventum, a medical device company, experienced a strong boost following the announcement of the proposed sale of its purification and filtration business to Thermo Fisher, during an investor day. Sanofi, GSK, and Johnson & Johnson also responded well to earnings and benefitted from a market rotation into defensives.

Despite strong business outperformance, Bruker shares drifted persistently lower in Q1 due to uncertainty and gloom surrounding the outlook for US government and academic spending in the life science tools sector, following Trump’s election. Bruker’s management has said that in an unrealistic worst-case scenario, where spending falls by 25%, it would merely reduce Bruker’s 2025 revenue outlook from +5% to +7% , to +3% to +5%. Shares are trading at 13-year valuation lows, suggesting investors are assuming something far worse is in the offing but management have yet to either realise it or admit it.

In relation to the broader strategy shift to decrease position sizes we reduced all our healthcare holdings to proportionally lower weights within the portfolio. We continue to favour our steadier, cheaper pharma businesses over the more volatile life science holdings which have a commensurately smaller weight in the portfolio. Despite their collective performance, we remain confident in the role they play in the innovation of new medicines and the potential value they offer to the portfolio. That said, if we see opportunities elsewhere within our investment opportunity set, we may well use these stocks to fund new positions.

We initiated a small position in Eli Lilly on weakness and we sold Bio-Rad during the quarter. Lilly gives us exposure to an innovative line-up of GLP-1 weight loss and diabetes treatments. Bio-Rad was sold after the company disappointed in its Q4 earnings. We were expecting a good set of numbers from Bio-Rad after hearing positive business developments from Sartorius Stedim, a bio-processing business Bio-Rad owns a substantial stake in. Unfortunately, Bio-Rad’s own underlying business failed to meet expectations and management revised guidance lower – to our disappointment.

Technology & Innovation – Incorporating technology, communication services, and industrial stocks

The year began optimistically for technology stocks, buoyed by Trump's inauguration being attended prominently by tech billionaires and his subsequent announcement of the Stargate project—an ambitious AI infrastructure initiative expected to draw private investment of up to $500 billion to reinforce America's dominance in AI. However, market sentiment shifted abruptly following the timely release of DeepSeek's R1 model on Inauguration Day, prompting investor panic over concerns that America's technological advantage had been undermined by a cheaper rival, causing a sharp sell-off across AI-related stocks. Confidence was soon restored, however, as investors embraced the Jevons paradox argument, reasoning that cheaper alternatives would ultimately expand technology adoption, enhancing consumer choice. The stabilising of investor nerves saw big tech’s premium valuations quickly reestablished. Statements of increased capex spending by the hyperscalers during their earnings announcements also helped shore-up confidence.

Adobe was the biggest detractor within this theme. Its quarterly underperformance is down to the fact that it did not increase its outlook for the full year (sticking with its previously stated 9% revenue and 10% earnings per share growth) when it reported its Q1 numbers in March. The market was clearly hoping for signs of an acceleration in Adobe’s AI-related revenues as it continues to integrate additional AI capability into customer workflows.

Without knowing which way NVIDIA’s results would go, and whether it would drive another leg higher in the AI trade, we used the relative weakness to build out our technology exposure by initiating positions in Apple, another old friend to the strategy, and AMD, Broadcom, and NVIDIA – stocks we have watched and followed closely for a number of quarters.

Weakness post NVIDIA’s earnings across much of the market, in particular tech, started to pick up pace as carry trade unwind and nervousness over tariffs accelerated. The subsequent weakness was used to top up these positions along with other new entrants in the portfolio, including Alphabet (another old friend to the strategy) and Meta, a closely watched stock.

To fund the purchases, we toned down the weights in some of the existing positions and also utilised sale proceeds from elsewhere in the portfolio.

Changing world – Incorporating financials, materials, mining, energy, and utility stocks

In response to the rapid shifts in US policy and the acceleration towards a world defined by zones of influence rather than globalised trade, we believe there will be a number of opportunities from sectors we have not necessarily been attracted to in the past as governments, corporates, and investors adjust. We write more on these potential opportunities later in this update.

As a case in point, on the back of Trump’s comprehensive deregulation agenda, we looked towards investment banks that are likely to benefit from looser lending regulations and increased M&A deals that they can advise on. We stepped tentatively into this sector with the purchase of JP Morgan, the biggest, most conservative, most diverse, and best-run bank in America. We had owned Visa, the payment network provider, for a number of years already. Collectively these holdings outperformed the broader financials sector but our substantial underweight meant the contribution to the overall portfolio was less material.

Finally, we initiated two positions in German utility companies RWE and E.ON. Both are relatively defensive companies which would offset some of the risk elsewhere in the portfolio, although this was not the primary reason for buying them. We discuss RWE and the opportunity set in our stock in focus section.

Summary of fund changes

| Sold | Bought |

|

BMW |

Alphabet |

|

Estée Lauder |

Amazon |

|

Etsy |

Eli Lilly |

|

Nike |

E.On |

|

Stellantis |

JP Morgan |

|

|

Meta |

|

|

RWE |

Putting current portfolio changes into perspective

On several occasions, we have highlighted how heightened volatility at the individual stock level impacts returns, particularly during periods of increased information flow. Reducing the position size per stock can mitigate these impacts when they occur. For this strategy to be effective, however, it necessitates increasing the number of stocks within the portfolio. Another major impact to performance in 2024 was holding onto underperforming assets for too long, which took the shine away from other, stronger holdings. Recognising the importance of adapting to the current, less forgiving investment environment, we have therefore taken a disciplined approach and have been proactive in removing a number of holdings from the portfolio. This has led to a greater level of portfolio activity than would usually be the case.

Given the hostility in markets as the Trump administration goes about its “America First” agenda we took the decision to not make any bold calls on what outcomes we will likely face. The headline risk is too great and we have seen huge gyrations in market movements based on one man’s comments and social media posts. The positioning of the fund has, for the time being, moved more in-line with the MSCI World as we build out our AI exposure, thereby building up our tech weighting and reducing our discretionary and healthcare exposures through a mixture of cutting out underperforming stocks and reducing overall position sizes.

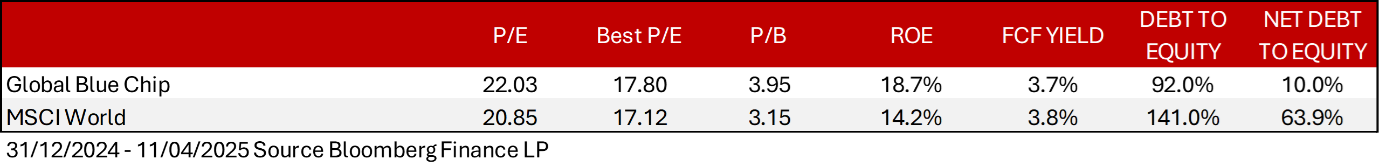

The result of these changes (see table below) on the portfolio’s characteristics has been a net positive. The portfolio is bigger in weighted market cap, has higher returns on investment, greater profit margins and is less leveraged. From a valuation perspective this quality is also well priced relative to the broader market.

Stock in Focus – RWE

Positioned for Germany’s industrial rebirth

RWE is one of Europe’s largest and most strategically important energy companies. Founded in 1898 as a regional utility, Rheinisch-Westfälische Elektrizitätswerk evolved through the 20th century into a dominant provider of coal and nuclear power. However, it is RWE’s 21st century pivot – from carbon-intensive assets to a more balanced portfolio consisting of green energy sources as well as lignite and gas – that positions it at the centre of the continent’s reindustrialisation and energy security drive.

Today, RWE’s portfolio includes wind, solar, hydro, gas, lignite, and large-scale battery storage. Following a landmark asset swap with E.ON in 2019, RWE divested its grid and retail arms and acquired a significant renewables pipeline, marking its reinvention as a power producer focused on generation and trading. RWE’s deep understanding, asset diversity, and capabilities are a competitive advantage as replicating them would take huge amounts of capital and time.

RWE’s revenue model is as simple as power x price of power. Its growth strategy is to add more capacity through disciplined investment and opportunistic acquisitions.

Policy tailwinds: Energy infrastructure at the core of growth

As fund managers, we believe RWE is uniquely positioned to benefit from the German coalition government’s renewed emphasis on infrastructure-led growth. Faced with slowing economic momentum and geopolitical shocks, Germany has committed to a €1 trillion investment plan, with half going towards infrastructure investment. In order to obtain the support needed to push the plans through the Bundestag, the coalition government offered the Green Party significant concessions of up to €100 million for climate related spending. In addition, the coalition government is keen to build out a further 20 gigawatts of gas-powered electricity generation. Whilst it is not guaranteed that RWE will be a beneficiary of these plans, its size and expertise certainly puts it in the frame whilst it will almost certainly benefit from any initiative that drives up sustainable energy demand.

Commercial model: Earning power in a changing market

RWE generates revenues from multiple sources. The majority comes from electricity generation, which is sold into wholesale power markets either on a spot basis or via forward contracts. Its trading desk also generates revenues from commodity and energy trading, including gas and carbon credits. RWE also enters into long-term power purchase agreements (PPAs) with corporates and utilities. These contracts provide stable, inflation-linked cash flows over 10–20 years and are a required component to ensure renewable energy sources are profitable. In a recent earnings call the company said it had signed a PPA with Tesla.

Additionally, RWE earns capacity payments for plants that provide back-up power - particularly in the UK and other markets - and provides ancillary services such as grid balancing and frequency regulation through its flexible assets (gas turbines) and battery systems. This blend of short-term market exposure and long-term contracted income makes RWE both opportunistic and resilient.

Importantly, RWE no longer owns distribution networks or supplies electricity to retail customers in Germany, reducing regulatory exposure and allowing it to focus entirely on generation and trading. However, it’s increasing reliance on wholesale markets does leave revenues vulnerable when energy prices fall.

There are also portfolio considerations for wanting to own RWE. Utilities tend to be defensive assets which will help offset some of the additional risk taken elsewhere in the portfolio. We would argue that it is reasonably cheap at 14x one year forward earnings and it is conservatively managed.

For example, RWE management are prepared to optimise their asset portfolio including the ‘farming down’ of their involvement in certain wholly owned projects (typically renewable) to help share the investment risk and free up capital for other, possibly more profitable ventures.

In a recent earnings call, the company cut its capex budget after it reassessed the value proposition of several pipeline assets – a prudent move in lieu of the current climate where investment risk has jumped appreciably in the US market. The company is also seeking higher returns on pipeline assets in this higher risk and higher interest rate environment. Interestingly for equity holders some of the saved capex will be deployed in buying back shares.

Time will tell whether the Germans get to reinvigorate their economy but at current prices and with catalysts such as cost savings, share buybacks and an attractive dividend we are being paid to wait, especially at current valuations.