Sophie Yabsley explains how understanding the two fundamental components of risk and timeframe can help you make informed decisions for both your short-term and long-term financial goals.

When I meet with people who are just starting out on their investment journey; be they old or young, working or retired, I always explain to them that there are two fundamental components to consider before you make a decision about how to invest your money. They might seem obvious but I think there is always merit in taking things back to basics…

What to consider when investing

The first is how you feel about risk. Risk appetite is rarely limited to how you feel about money – you tend to find that some people are more naturally “gung-ho”, “risk on” or “punchy” about life. And of course, the other end of the spectrum is the turf of the more “cautious”, the “nervy” or “easily spooked”. Neither is right or wrong and, as with any spectrum, there is everything in between. What’s important is that you will know yourself better than anyone else will, and it’s crucial that you make financial decisions that are true to who you are. There are investment solutions for all and you certainly don’t want to be kept awake at night because of a decision that you - or someone on your behalf – has made.

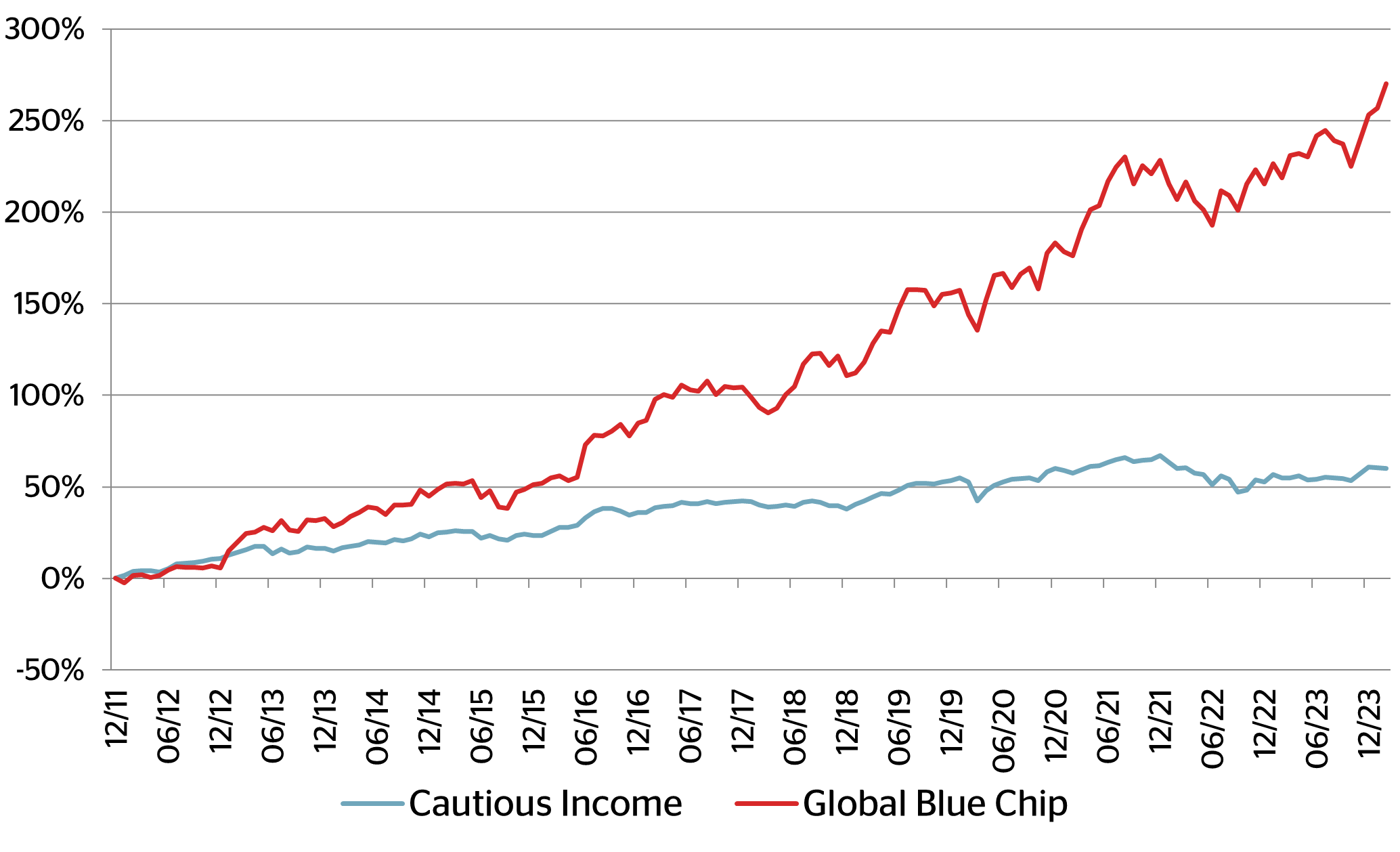

The second key consideration is timeframe. If you only have a short timeframe for investment, you will likely need to stick to lower-risk investments, even if you are “gung-ho” by nature. Higher-risk investments tend to be more volatile, i.e. the value of the money you have invested will bump up and down more. This is illustrated in the chart below: the red line represents our Global Blue Chip strategy, which we would consider to be higher risk – you can see that the trade-off for the higher return over time (in the case of this chart, 12 years) is a much bumpier journey. If you had invested in a fund like this for a very short period at the start of 2021, for example, the outcome over your invested period might not have been positive. The key with a higher-risk strategy is having the time to allow your investment to recover from market shocks, which can knock value off your investment in the short term no matter how capable your investment manager is.

In contrast, the blue line represents our Cautious Income fund, which we deem suitable for clients with lower-risk appetites. You can see that the return on this investment has been much less bumpy – not everyone has multiple years before they plan to use their invested funds. Over shorter periods, there is a much lower chance of suffering a negative outcome in a less volatile strategy.

Finding the right balance

What the chart also shows us is that there is also a significant danger to underinvesting over the longer term. If you have a very long timeframe – for example, if you are investing for your retirement – you can risk your future financial soundness by accepting too little risk.

One last, and very important point to note, is that timeframe is not the same as illiquidity. Having a long timeframe for investment doesn’t necessarily mean that you want to lock your funds away without access for that entire period. It just means that you plan to leave them there, largely untouched, if possible.

If I’ve learnt one thing in my role it’s that people change, and their situations change. We believe it’s important to make it easy for investors to reflect those changes in their investment strategy as they happen. Always remember that no matter what you invest into, or who you invest with, the money is yours and it must be working for you, exactly how you need it to.

If you’d like to find out more about investing with Ravenscroft, or if you have any questions you’d like us to answer, please contact us.