In his latest macro update, Kevin Boscher, our MD, Jersey and Group CIO, focuses on the positives as he explains why now is an opportune moment for investors.

At the half-year point, it is looking increasingly likely that the US will enjoy a “soft landing” and that major economies will avoid recession at the same time as disinflation will allow central banks to start a rate-cutting cycle very soon. This is unambiguously bullish for risk assets, and equities in particular, despite the uncertain and volatile geopolitical backdrop. There are, of course, numerous risks that could derail this rosy outlook, but markets always tend to “climb a wall of worry”. In addition, we will have to get used to investing in a challenging and uncertain environment as it is highly likely that the post-pandemic world will continue to change and evolve in many ways, some of which we can’t even foresee yet.

A US “soft landing” is very likely

In the US, economic activity is robust thanks largely to a strong consumer, who continues to benefit from low unemployment, decent wage growth, a positive wealth effect thanks to higher equity markets and property prices, and a reasonable level of savings. Importantly, the US government has also supported growth with a significant increase in spending over the past two years, resulting in a fiscal deficit which has moved from around 2% of GDP to closer to 8% over this period. A third source of economic strength has been the fact that many large companies are cash-rich and have benefitted from higher interest rates and lower tax rates over recent years.

However, there are some early signs that consumers are beginning to feel more stretched as higher prices and falling savings begin to bite and employment markets begin to weaken. Also, whilst the fiscal deficit will remain elevated whoever wins the election, the impact on growth will be less positive moving forward. In the absence of a major policy mistake by the Fed or the emergence of a new global economic shock, the US will enjoy a soft landing and growth should begin to re-accelerate into next year as monetary policy is eased and the global economy strengthens.

Importantly, the inflation outlook in the US and elsewhere continues to improve, either meeting or beating market expectations. US unit labour costs have collapsed, partly thanks to rising productivity, and the labour market is softening. This should lead to an easing of the sticky services sector inflation, enabling the prevailing disinflationary trends to continue. The current core PCE inflation rate of 2.5% is considerably lower than the Fed’s year-end target of 2.8%. This suggests that there is now little reason for the Fed not to start cutting rates soon. This is especially true as the Fed has a dual mandate to support employment as well. There is clear evidence that households are refocusing on building their savings due to concerns over a softer employment market, a higher cost of living and weakening growth.

The growth and inflation story in the UK and Europe is similar but for partially different reasons. Although both economies have suffered mild recessions, the combination of easing inflation pressures, lower energy prices, strong employment, falling rates and a recovering global economy has already forced the European Central Bank to reduce rates with the Bank of England (“BoE”) likely to follow suit in August or September. This will lead to an improved growth outlook as the year progresses.

A new Labour government means “little change”

It is worth commenting on the recent UK election result, which has seen Labour win the biggest landslide since 1906, much as expected. Despite the incoming government promoting its manifesto as “change”, the ironic reality is that there will likely be little change in either how Britain is run or in the medium-term economic prospects. This is in direct contradiction to its electoral promise, Labour has committed to four key policies that are almost identical to the Conservatives and which will set the boundaries around everything that the new government can or cannot do: government borrowing and spending: changing the relationship with Europe; conflict with China and Russia; and reform of a hugely disproportional electoral system. The first three of these, in particular, could have a significant impact on UK economic, business and financial conditions.

I remain a long-term optimist on the UK and Labour may prove me wrong but I’m a sceptic. If they are to achieve real change, they need to “go for growth” and persuade domestic and foreign investors to drive a capital investment boom, which boosts productivity and long-term potential growth, similar to what appears to be underway in the US. This looks like a very difficult task unless they reverse their policies on Europe and China and focus on making the UK “investable” again. Market reaction to the result is very muted so far and I expect this to remain the case. What happens in the US, China, Fed and BoE policy will be much more important for the UK economy and financial markets. This weekend’s French elections and the US election in November are also far more important events that could materially reshape the global economic and political order. In the meantime, we continue to see increasing evidence of voter revolts against populist governments that have much further to go with income, wealth and social inequality at the heart of their discontent. This is further evidence of the changing world order and why the next decade or so will be very different to the last one.

The outlook for bonds is improving

Many bond markets currently offer an attractive combination of yields similar to, or in excess of, cash returns together with the prospect of some capital appreciation as interest rates fall. However, care is required and investors in longer-dated maturities are demanding a higher yield (risk premium) for a number of reasons. Firstly, western governments are running bigger fiscal deficits as they tackle their numerous spending challenges, led by the US. This will likely result in an imbalance between the supply of and demand for rising bond issuance as well as the potential for currency devaluations. Secondly, it remains unclear whether the global economy is transitioning back towards the powerful secular disinflationary forces that prevailed prior to the pandemic (Ice) or whether we are moving towards a period of higher inflation similar to the 1970s and early 80s (Fire). Hence bond markets are having to price in the risk of higher inflation volatility beyond the next 12-18 months. A third reason for caution is that credit market spreads (excess yield over the equivalent government issue) are at near-record low levels leaving plenty of room for disappointment should the growth outlook come in worse than expected. Given these risks, we continue to favour shorter-dated maturities, quality corporate credits and specialist opportunities for our bond exposure.

Equities are in a long-term bull market

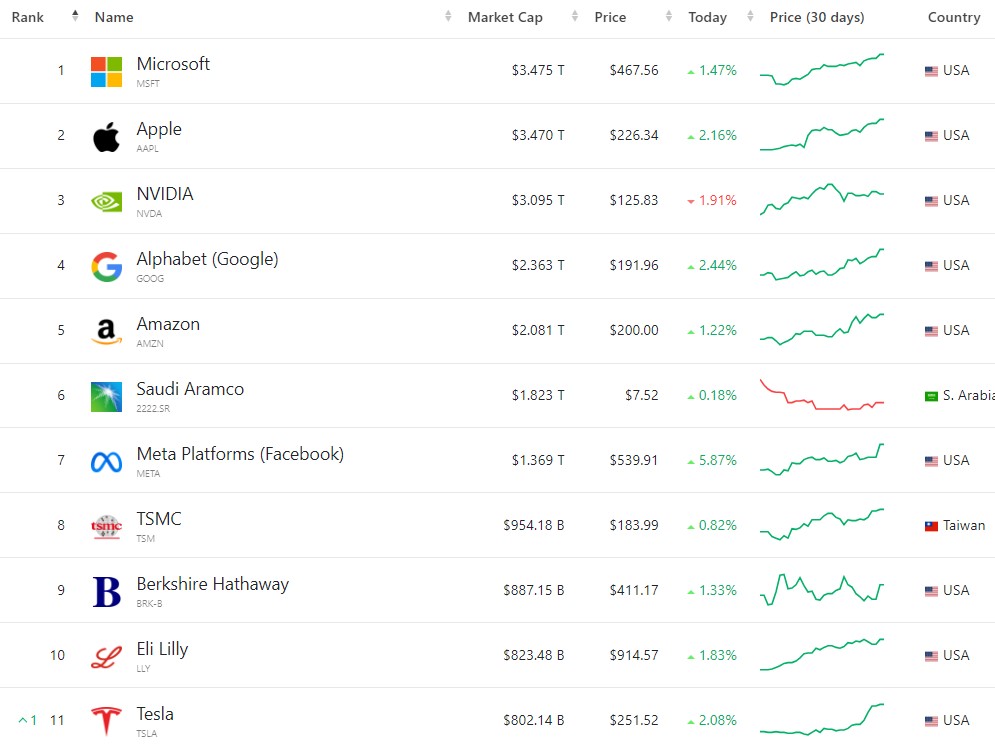

Equities are likely in a long-term bull market for several reasons. Firstly, rising corporate profits are the key long-term driver of equity returns and the current profit cycle is young. Usually, stocks do well when earnings are rising and expectations are improving. Since the pandemic crisis four years ago, earnings have suffered a double-dip recession. It would be very rare for corporate profits to go through a triple dip within such a short period. Secondly, and as already mentioned, we are in a period of disinflation, which is likely to continue and enable the Fed and other central banks to embark on a rate-cutting cycle in the very near future. This will help investors focus on an improving growth and liquidity outlook later this year. Thirdly, whilst valuations look expensive in some areas, namely some of the Magnificent Seven and other mega-cap growth stocks, they look much more reasonable in many markets and sectors. Equities have enjoyed a good recovery since last October and are pricing in quite a lot of good news. Hence, we could get a setback over the next few months due to a number of threats, but given the broadly supportive macro backdrop, any pullbacks should be used as an opportunity to add to equity weightings.

Another reason for optimism is that we appear to be in the early stages of a new cycle of increased capital investment by businesses, which could have the impact of increasing potential growth through rising productivity but in a non-inflationary way. For example, in the US and elsewhere, the combination of “onshoring”, changing supply chains, rising costs and new technologies are encouraging companies to embark on a capital spending boom. The last time we saw such a development in the US, was in the mid-1990s when the US economy was able to grow more than 4% in real terms at the same time as inflation and interest rates were falling. The major catalyst for this development back then was the growth of the internet. This time, it is likely the advent of AI as well as cloud computing, Biotech and other new technologies. This would certainly be a very positive development for the global economy and markets.

The equity recovery should broaden out and gain strength

It is well understood that the breadth of the US stock market rally over the past year or so is very narrow and that this presents a threat going forward. The Magnificent Seven now represents some 34% of the S&P500, up from 21% in early 2023. Even within these market leaders, divergence is starting to appear. Whilst much of this strength and outperformance is justified, given the relatively favourable financial fundamentals that many of these stocks exhibit, it is also true that the vast majority of US, and indeed global stocks have either fallen or stagnated for some time. For example, most US stocks are still lower than their 2021 inflation-adjusted highs. This is largely reflective of the impact that higher rates and a tight monetary policy have had on slowing the economy. Falling interest rates, easing liquidity pressures and an improving growth outlook should lead to a broader market recovery and include sectors that have so far struggled, including cyclicals, value and even some underperforming quality growth stocks, such as healthcare. The macro backdrop remains favourable for all of our core themes, including emerging markets, which should benefit from easing monetary policy, a strengthening China reflation policy, a softer Dollar and rising commodity prices.

In summary, inflation is moving closer to the central bank’s target, economies are expanding but at a slower pace and the case for Fed and other interest rate cuts is strengthening. Overall, the broad environment is still bullish for stocks and improving for fixed-interest securities. The main risks for this rosy scenario are an escalation in geopolitical tensions, especially if this results in materially higher energy and commodity prices, a policy error by the Fed whereby it keeps monetary policy too tight for too long or social unrest around the US election. We also need to remember that the changing world order and evolving post-pandemic world is resulting in an unusually elevated period of economic and political uncertainty, making it very difficult for governments and central banks to have any conviction in their forecasts or in setting policy. The only certainty is that the next decade or so is very unlikely to be similar to the previous one. In addition, another key question for the global economy and markets is whether we are returning to “Ice” or moving towards “Fire”. However, despite this, the next few years should be a positive environment for both bonds and equities and now would appear to be a good time to increase exposure to risk assets. Cash will remain a very important asset class and we are not about to return to a zero-rate world, but cash returns will fall as rates decline at the same time as investors should be handsomely rewarded for taking on more risk in bonds and equities.