This week’s update is written by Matt Girard, who is in our precious metals team.

We live in a world where people want instant information and there a huge number of sources available to access this. Some are reliable, genuine, and most importantly, verifiable. Others are created simply for views or clicks to cause as much controversy as possible. It takes five minutes of Google searching to find out that “Gold is expected to hit $3,000 by the end of 2023” or “Metals are doomed as investors turn to Bitcoin as an alternative asset”. Unfortunately, these headlines are thought to be necessary even though they are often misleading. This isn’t to say that these extremes are always completely wrong, but it’s sensible to wade through some of the nonsense to get to meaningful information.

There will always be speculation on the price of precious metals but when trying to establish an assets value, particularly if it’s tangible, a significant consideration should be given to supply and demand.

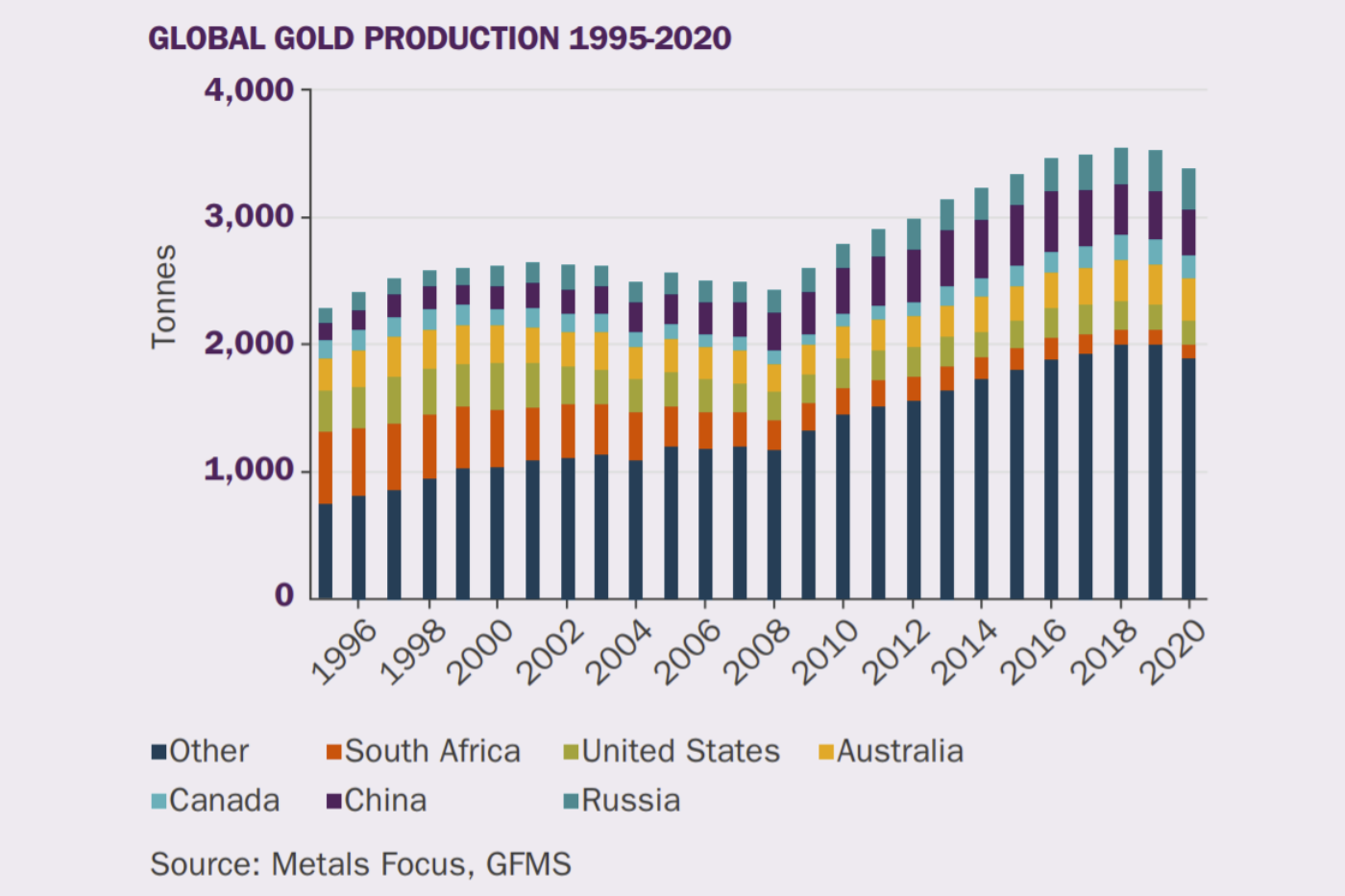

In 2022, it’s estimated that global gold production was 3,100 tonnes1 with China and Russia being the top two gold-producing countries in the world. Historically, supply was reliant on South Africa, USA and Australia, but in recent times developing countries have emerged, meaning this has become increasingly diverse. Although the current figures are healthy and there are a larger number of sources which we can draw from, sustainability is still a concern (read our article on the ESG credentials of gold here).

To keep up with current production, new deposits will need to be located through exploration. As existing mines begin to ‘dry up’ they will need to be replaced and discoveries have slowed significantly over recent years. Since 1990, 278 major gold deposits were discovered, but only 25 of these were discovered in the last decade, and none between 2017 and 20192.

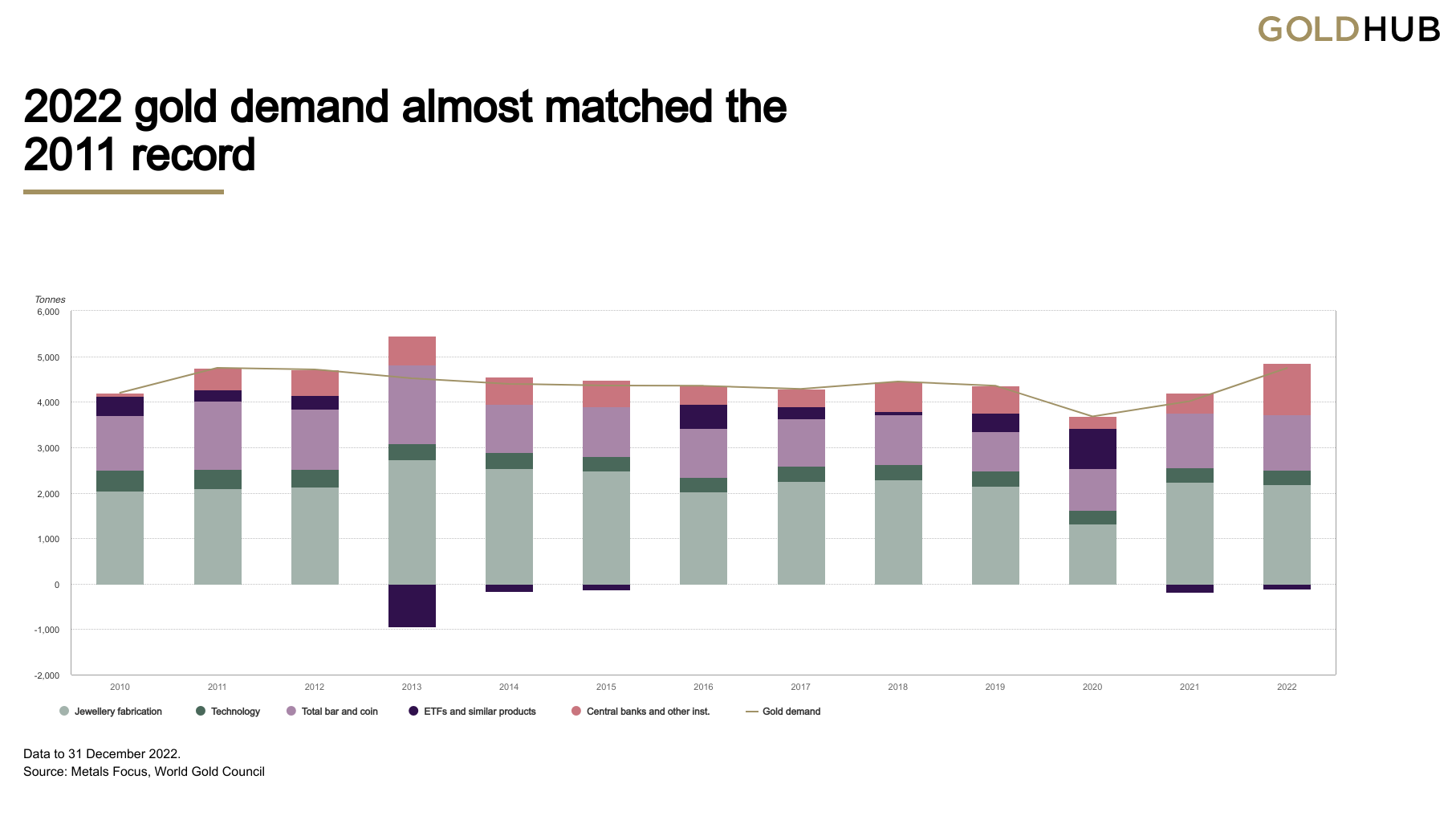

In terms of demand, there are five major contributors: jewellery, bar and coin investment, central banks, technology, and ETF’s. The World Gold Council’s 2022 trends report revealed that annual gold demand is at its highest level since 2011 with the biggest change over the last 12 months being a sizeable increase in central bank buying3. The ongoing geopolitical tensions suggest this may continue throughout 2023 but demand can’t be solely propped up by a single avenue – and it’s not.

The unique properties of gold make it highly sought after in both the tech and industrial space. It is highly conductive, corrosion resistant, and at the same time can be manipulated into sheets that are 0.1 micrometre. To put this into perspective, a micrometre is equivalent to 0.001 of a millimetre. This makes it incredibly useful for electronics with most devices and vehicles containing some form of gold, even if it is in small quantities. The latest electric and hybrid cars require considerably more high-end electronic components than traditional vehicles which presents a great opportunity for gold as efforts to combat climate change increase.

Although it’s not an imminent danger, there is no way of knowing exactly how long we will be able to cost-effectively source gold and, coupled with the constant innovation in technology, there’s potential for the scales to tip sooner than anticipated.

We hope you have a good week.

Sources:

- 1 USGS

- 2 LBMA

- 3 World Gold Council