Risk-on, risk-off, risk-in, risk-out,

You do the hokey cokey,

And you turn around,

That's what it's all about.

It feels like there has been a good deal more optimism in the first few weeks of 2023 than there was in all of 2021 and 2022 combined. From the ashes of the doom-laden ‘negative’ Santa Rally in December, which brought what had already been a diabolical year to a close, the capital markets ramped up in January around the magnificently bullish narrative that there will be a perfect trinity of falling inflation, falling rates and a soft landing.

Sometimes in light volume markets, movements can be exaggerated by relatively small transactions, but certainly in the US the retail investors were getting seriously involved (as shown in the chart below). So, we can only wonder if this is the end of the bear market, or a magnificent bear trap? Previous rally attempts last year had resulted in lower lows, but the S&P has now had one ‘higher’ low… so fingers crossed.

US Retail Investor Equity Inflows

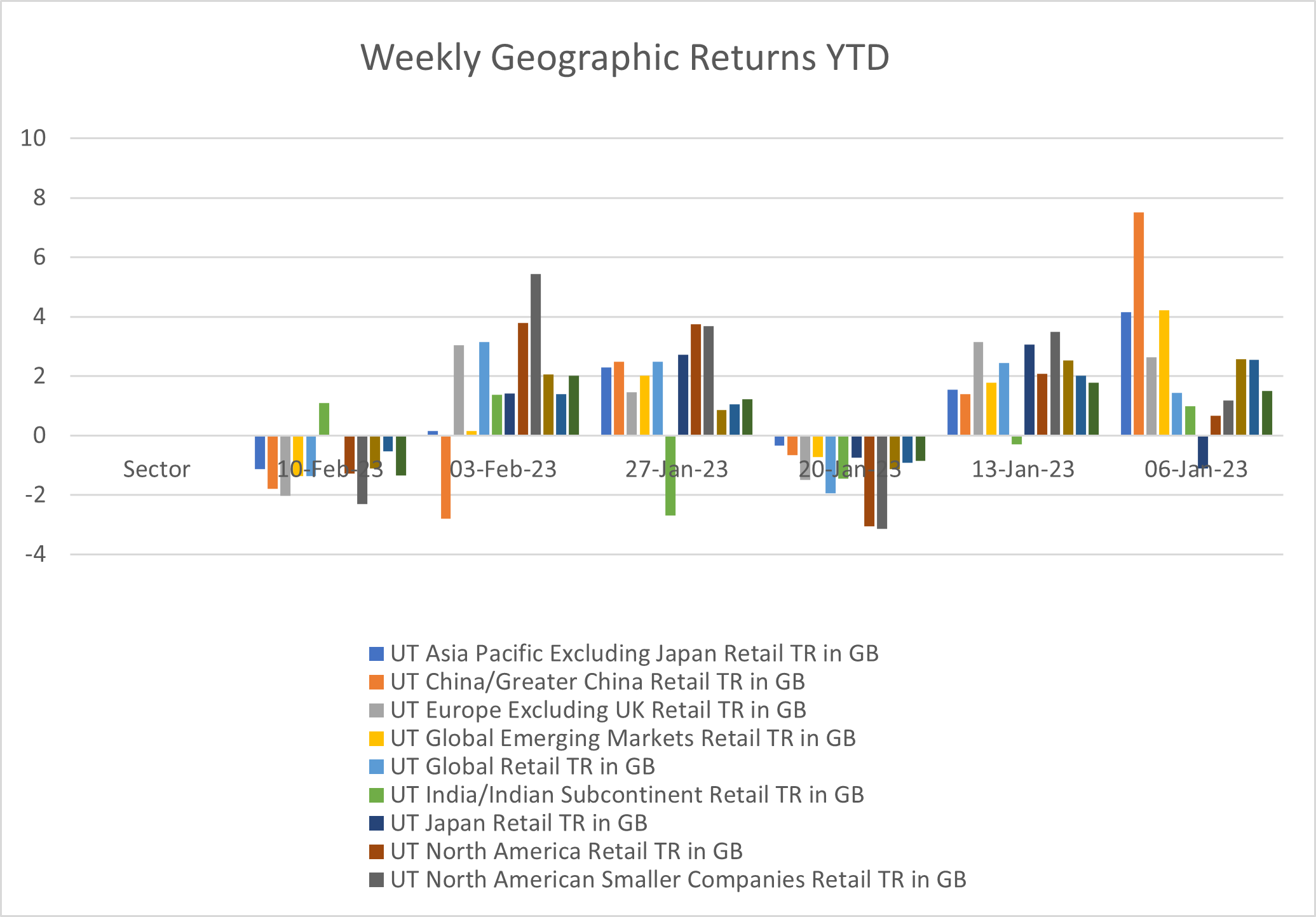

Inevitably not everyone is buying into this narrative. Indeed, it is hard to say what everyone is buying into because the sectoral rotation is more akin to a washing machine action than a new secular trend forming. The chart below shows the weekly returns for the YTD on the Unit Trust sectors by geography:

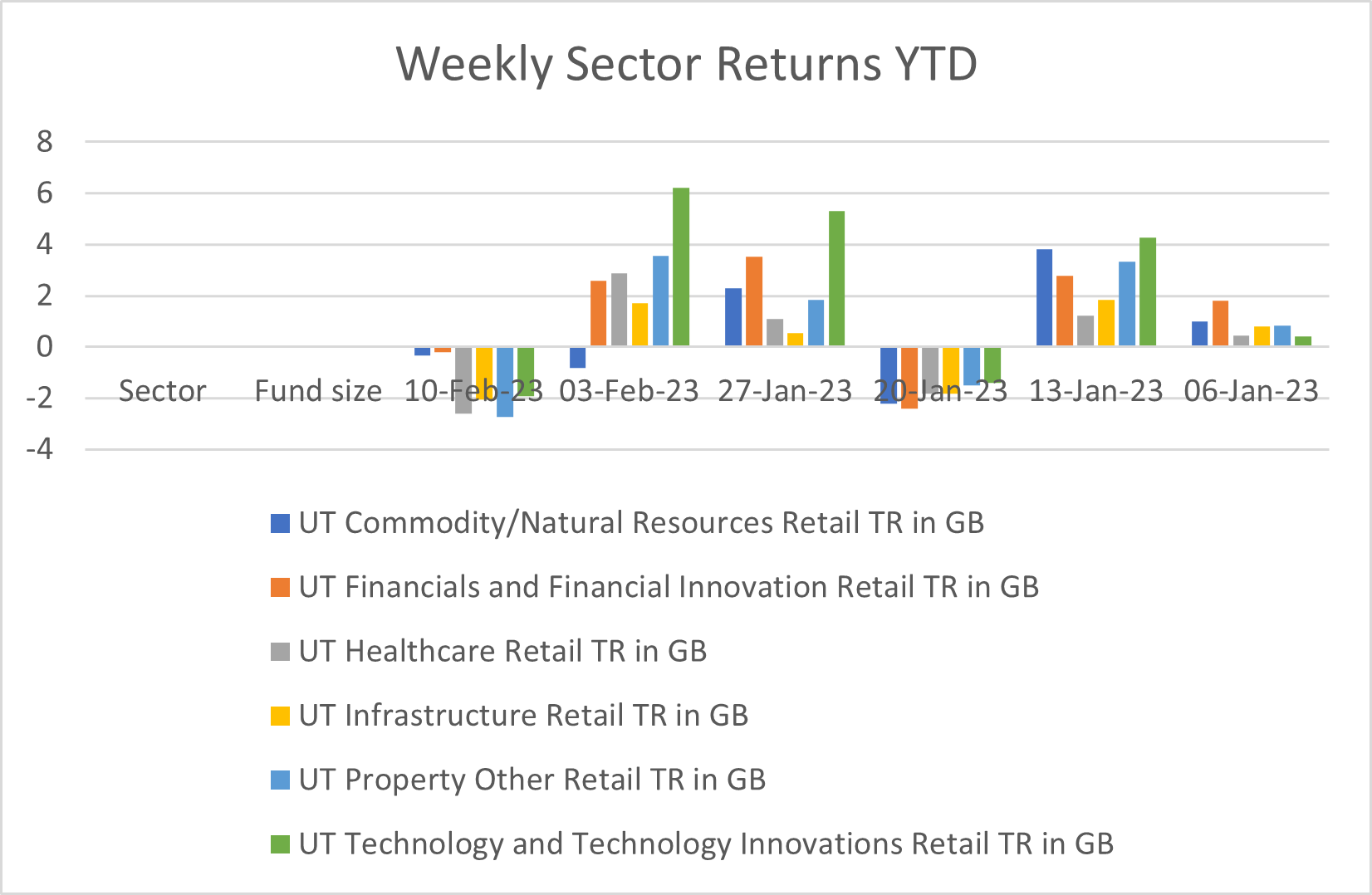

The picture is no clearer when looking at the specialist fund segments:

There are not many FAANGs (FAANG refers to the top performing technology stocks: Facebook (now Meta), Amazon, Apple, Netflix and Google (now Alphabet)), but they do have a disproportionate impact on global indices and investors’ psychology, so it is always worth keeping an eye on them and similar companies in their orbit (Microsoft and Tesla, for example).

The YTD FAANG whipsaw action has been acute. As of the time of writing (16th February 2023), GOOG was up 23% in January but has given back all but 7% YTD1. Likewise, Amazon posted +32% for January but 14% YTD2. Tesla (not technically a FAANG, I know) is up 86% YTD and given back nothing3. It is hard to know what to make of moves like these beyond the obviously simple explanation that the market does not know how to value any of these companies. Considering these are the most pored over, researched and analysed companies in history, this probably tells us that we remain in a heightened ‘fear and greed’ mode. Considering the ongoing uncertainty, a psychologist specialising in crowd behaviour may be more likely to pick next month’s winners than a fundamental stock analyst carefully counting the beans.

However, these periods of heightened activity tend to be short lived, and common sense and reality (AKA fundamentals) will kick in eventually; perhaps even quite soon. Furthermore, these volatility events can often create opportunities and pockets of value – negative and positive. In a bull market everyone is a guru, in a bear market we are all fools. In the transition the good analysts and fund managers can really earn their bread, and in this particular transition my hunch is that they will have a career defining chance to shine.

We hope you have a good week.

Sources: