Weekly update - Cash as an asset class in its own right

Understanding interest rates and the value of your hard-earned cash

What is a real interest rate? A bit of a daft question and maybe your first answer might be to say that a negative interest rate is not real. Sadly, negative interest rates became a reality in some countries following the financial crisis. Several central banks, notably the Swiss National Bank, the European Central Bank and the Bank of Japan, implemented negative interest rates in addition to quantitative easing as a means of providing economic stimulus. Fancy that – putting your hard-earned cash on deposit with a bank and, because of negative interest rates, your bank balance shrinks!

The Bank of England and the US Federal Reserve Bank both came very close to introducing negative interest rates but fortunately for our Sterling and US Dollar-denominated clients this policy never materialised.

The above Alice in Wonderland scenario fortunately remained a bad dream and in the real world manufacturers, producers, consumers and governments were beavering away to dispel the doldrums and reinvigorate global economic activity. A key catalyst for this change was the Covid stimulus packages brought in to ensure, even if people were laid off, working from home, not travelling, not going to restaurants and not going to the gym, that the negative impact was minimised.

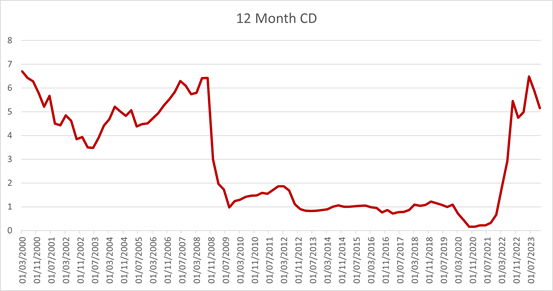

With hindsight, it is clear that as welcome as these stimulus packages were, they had the effect of overheating the economy at a time when supply chains were disrupted, inevitably leading to inflation. As a result, the central banks had to act quickly to reverse quantitative easing and raise interest rates to combat inflation. The chart below is a great way to illustrate the interest rate doldrums that prevailed from 2009 to 2021:-

Source: Ravenscroft (data from Bloomberg)

With the UK base rate at 5.25%, the income being generated on cash is higher than it has been for well over a decade. Of course, the counterargument here is that because inflation is so high the real interest rate (nominal interest rate minus inflation) is negative. This is very true, and particularly harsh for low earners, some pensioners and those living off savings. This really goes to show that life isn’t a bed of roses, but, having said that, there is always hope or a glimmer of sunshine and at present we are enjoying a spell (probably brief) when market interest rates are higher than inflation.

The latest Consumer Price Inflation (“CPI”) figures for the UK and US are 4% and 3.20% respectively. With the UK bank rate at 5.25% and the US Fed funds rate at 5.25% (lower band of the 5.25% to 5.50% range), this means that real interest rates in the UK and US are 1.25% and 2.05% respectively. Long may this continue; such is the lot of a cash manager to get excited about such small margins!

Moving on from negative interest rates (nominal or real) and returning to the subject of cash as an asset class in its own right, it is worth repeating a phrase from earlier in this article: “hard-earned cash”. It’s a fairly hackneyed phrase, used in many circumstances most often when complaining about government spending and/or the ravages of taxes on income or capital. Whatever the situation, it is a phrase we all understand. We work hard to earn our cash and, if we can, we put some of it aside, usually by placing it with a bank in a savings account or on a fixed deposit. These days such accounts have the benefit of a modestly positive interest rate, which is an additional incentive to save. In other words, your “hard-earned cash” has value because a bank is prepared to pay you to put it on deposit with them.

You might think it is a barmy thing to say that “cash has a value” – of course it does, as anyone who has lost their wallet will testify. The point here is that during the aforementioned doldrums, it felt like central banks thought that cash had no worth; there was no reason to save it as a store of value, it should be spent to drive economic recovery and for those foolish enough to accumulate cash at a bank then the central banks wanted to penalise the wise by cutting interest rates to virtually zero or even negative (as in Japan, Switzerland and Europe). At the moment this point of view is, fortuitously, redundant because interest rates have normalised. Savers are no longer being penalised and cash really does have more than an intrinsic value.

Treating cash as an asset class in its own right is something that we at Ravenscroft Cash Management set out to do 30 years ago when the business started. Regardless of whether you are a private individual or trustee responsible for hundreds of thousands of pounds or whether you are an administrator or director controlling an entity of hundreds of millions, we recognise that ultimately this is someone’s hard-earned cash and that it needs to be afforded the same systematic and robust procedures to ensure that its worth is enhanced and that it remains secure for future generations.

Please note that the Ravenscroft cash management service is only suitable for offshore investors.

Sources:

- Economic data as reported by third party providers