Weekly update – House price head scratcher

This week’s update is courtesy of Chris Bell, in our Isle of Man office.

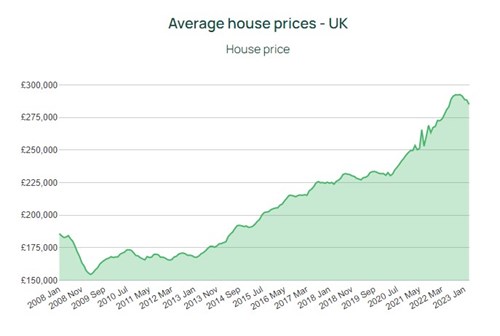

We hope you had a pleasant bank holiday and for those homeowners out there it probably felt even sweeter following recent data that suggests the market is still relatively robust, although affordability is the main longer-term challenge.

Asking prices for the month of May in the UK rose by 1.8%, to leave the average asking price for a home at £372,894 according to the estate agent, Rightmove1. This is a record-high figure and is surprising given the sharp move-up in interest rates in recent months. Inflation data for April released last week continued to show that it is looking sticky, albeit falling, although a rate of 8.7% for consumer prices is still uncomfortable.

Indeed, the Resolution Foundation has recently estimated that approximately 1.6 million households are yet to face an average increase of £2,300 in their fixed-rate mortgage bills over the next two years as deals mature2. It is fascinating to see in the same report that fixed-rate mortgage deals now account for 90% of the market as opposed to 40% pre the financial crisis in 2008.

There is some evidence that mortgage rates have pulled off their highs but for new home buyers the amount of earnings that have to go on payments could well be as high as 40%. According to Berenberg, the 20-year average is 35% of earnings, whereas in Autumn 2022 these had climbed to an unsustainable 50% of earnings.

Source: propertydata.co.uk

Rightmove believes that the incredibly ‘hot’ market that was unleashed in the wake of the Covid pandemic will normalise this year. I was surprised to read that the average discount to achieve a sale is only just over 3%. Interestingly the number of buyers making enquiries about homes for sale is now 3% higher than at the same time in 2019, although at the larger end, properties are now taking much longer to sell than in 20221.

Buoyancy in employment levels should mean that potential sellers are not forced to sell but sceptics would point out that such data is backward looking. The most bearish house price forecast comes from Nomura, who believe that by mid-2024, prices will have declined by approximately 15% from their peak3. Savills believe the price decline will be 10%, as do Knight Frank4.

Longer term, the market is likely to reflect the continuing supply/demand imbalance in the UK housing stock. Some estimates believe that approximately 340,000 new homes are needed every year, with just under half that figure representing affordable stock5. In recent years the actual figure of homes that were built was just over 230,0005. The Government believe much of the blame for the imbalance lies with the planning system and there is a Bill currently in front of Parliament, Levelling Up and Regeneration, which aims to simplify a number of areas. These include the contributions of local authorities, bringing public land forward more quickly, adequately resourcing the planning departments and widening the breadth of building firms.

Indeed, the topic has become a political hot potato with the opposition leader, Keir Starmer, highlighting that the Labour Party would become the ‘builders, not the blockers’. They would aim to bring house prices down by boosting supply, even opening up the thorny topic of building on greenbelt land. The emphasis on very local planning makes sense but could be tricky to work on a practical level.

Elsewhere, the markets were somewhat weaker as the US debt ceiling talks continued to dominate sentiment. Over the weekend a deal has been agreed to suspend the debt ceiling until January 2025. Whether this is ‘good’ news remains to be seen; it will mean an additional $4 trillion of debt6. Our CIO, Kevin Boscher, is concerned that the required bond issuance will come at a time of already declining liquidity.

As highlighted previously the UK inflation data made it more likely that the Bank of England will continue to raise interest rates. As you would expect, the bond market did not react well, and the benchmark 10-year gilt yield finished the week over 4%.

The focus on the technology sector in the US continued with a very strong update from AI-centric Nvidia, with share prices soaring last week, beating analysts expectations7. It will be interesting to see how many investors continue to pile into the theme - a classic FOMO (fear of missing out) rally!

This coming week will see another important US payroll figure for May released on Friday.

We wish you a good, shortened week.

Sources: