Weekly update – The reality of artificial intelligence

This week’s update is penned by Chris Bell in the Isle of Man.

An entirely non-serious question to begin with: can you remember what happened on 29th August 1997 (at precisely 2:14am EST)?

No?

It was the exact time that Skynet became self-aware before promptly launching a nuclear attack against Russia who, in retaliation, launched their own missiles towards the United States. I am quite sure you would remember that happening.

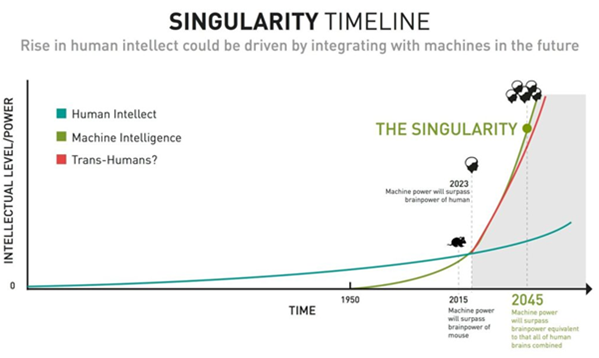

Thankfully, this never happened outside of James Cameron’s brace of Terminator films. Whilst not real, the nucleus of the films is the idea that an artificial intelligence (AI) evolves to the point where it becomes cognizant and turns on humanity. This point (minus the total annihilation of the human race) has been theorised for decades and is known as singularity – a future point in time at which technological growth becomes uncontrollable and irreversible, resulting in unforeseeable changes to human civilisation. The timing of such an event, although expected, is widely disputed, ranging from 2060 to as little as seven years away.

Source: Anders Sorman-Nilsson

A little more recently you may have read about Microsoft’s $10bn investment into ChatGPT, an AI conversational language bot. Much like a search engine, but one designed to provide more human-like responses covering any topic it may be asked. It is even able to produce entire essays written in the style of specific authors – much to the dismay of universities around the world. ChatGPT is designed to learn with each question asked and develop its responses to become more natural and detailed over time.

Literary plagiarism aside, AI is being developed to push the boundaries across most industries, vastly speeding up time taken to perform the most complex of tasks, reducing costs and the ability to operate without interruption or breaks.

For us, one of the most important questions is the impact on our own industry and one which we thought we would ask ChatGPT to answer. This is the full text from the response:

“Artificial intelligence (AI) is set to have a significant impact on the investing environment. One of the main ways AI is already impacting investing is through the use of robo-advisors. These are digital platforms that use algorithms and AI to provide investment advice and automatically manage portfolios. They can analyse large amounts of data and make investment decisions faster and more accurately than humans and are often much cheaper than traditional human financial advisors.

Another way AI is impacting investing is through the use of predictive analytics. By analysing large amounts of data, AI can make predictions about the future performance of stocks and other investments. This can help investors make more informed decisions about where to put their money.

AI is also being used to improve the efficiency of the trading process. For example, AI-powered trading algorithms can analyse market data and execute trades faster than humans, which can help traders take advantage of market opportunities. This is particularly useful in high-frequency trading, where the speed of decision-making can be the difference between making a profit and a loss.

In addition to these specific applications, AI has the potential to revolutionise the way we think about investing. For example, AI-powered systems may be able to identify patterns in market data that humans would not be able to detect. This could lead to the development of new investment strategies and the discovery of new opportunities.

However, the use of AI in investing is not without its risks. One concern is that AI-powered systems may make investment decisions based on biased data or algorithms. This could lead to unfair or inefficient allocation of resources. Additionally, AI systems may be vulnerable to hacking, which could result in the loss of funds or other damage.

Overall, AI is set to have a significant impact on the investing environment. It has the potential to make investment decisions faster, more accurate, and more efficient, but it is important to be aware of the risks and to ensure that AI-powered systems are used responsibly.”

Impressed? While we could spend forever theorising the what ifs and when of AI, even AI itself makes it clear that there are pros and cons to it, particularly when it comes to investing.

Turning our attention away from the future of technology and back to the reality of now, asset markets were mixed last week as lingering concerns over even higher US interest rates meant the US 10-year yield was closing in on the 4% level. This clearly acts as a headwind for equities. In geopolitics, we witnessed the first anniversary of the Ukraine war and there was a highly symbolic visit by the US President to Kyiv. After a raft of financial results from the UK banking sector, results this week include some of the housebuilders such as Persimmon and Taylor Wimpey, also final results from ITV, Reckitt Benckiser, and Schroders.

We wish you a good week.