Weekly update - What on earth is going on with interest rates?

Robert Tannahill, from our discretionary investment team in Guernsey, writes this week’s update.

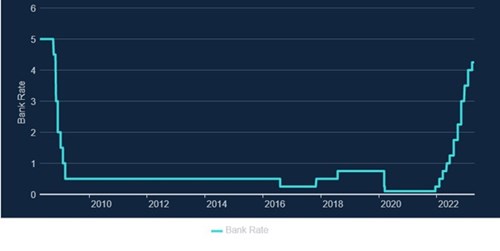

It is amazing to think that for most of their adult life, the typical 30-year-old today has never really had any need to think about interest rates. For those who turned 18 around the time of the global financial crisis interest rates have not really been a thing. For 13 years from 2009 through to early 2022 the Bank of England benchmark interest rate, known as “bank rate”, moved very little and seemed stuck between 0% and 1%, as you can see below:

Source: Bank of England

However, the last year or so is shaping up to be a rude awakening. With many people and businesses drawn into taking on additional debt by years of low interest rates, these hikes are going to be painful. In the UK, fixed rate mortgages are due to start expiring in earnest this spring/summer, meaning households will be feeling the pinch. At the same time we are entering utility bill reset season with non-energy bills potentially resetting materially higher thanks to UK RPI having run at 13.5%(1) over the last 12 months. All this is set to put a huge squeeze on consumer spending, which of course is the stated intention of central banks.

The Bank of England is faced with the worst surge in inflation since the 1970s and the only way it can respond to that is by trying to slow the economy via higher interest rates. In theory this should be fine because a hot economy causes inflation and so the central bank gently applying the brakes is tolerable (and actually desirable) to stop the economy overheating and leading to worse problems. The trouble we have this time is that UK inflation is not being caused by a red-hot UK economy. The key drivers of recent inflation centre around issues such as energy prices, supply chain disruptions (from both the war and the pandemic) and labour shortages. Very little of this is directly in the power of central banks to control. Unable to stand by and accept double digit inflation, however, central banks are left with little choice but to try and slow the economy and hope that this takes the edge off demand and dampens inflation without tipping us into a full-blown recession. For all our sakes, we wish them luck with that!

This policy is being pursed in all major western countries, however indebted consumers and businesses are starting to creak, with the recent collapses of Silicon Valley Bank and Credit Suisse often cited as examples of this. These signs of stress in the system have coincided with falling headline inflation rates, as the worst of the 2022 shock drops out of the year-on-year change numbers. Leading to a general opinion that we are somewhere near the high point in interest rates for this cycle. While it might be (theoretically, at least) possible to get 4.5% interest on short-term cash at the moment, the general expectation in markets today is that within 12 months central banks will start reducing interest rates to support weakening economies. This all assumes, of course, that inflation comes back under control. The failure of inflation to behave as expected is the key risk to this outlook and, notably, the country where this risk is highest, based on the latest data, looks to be the UK.

Now, interest rates are not expected to come crashing back down to near zero. Inflation looks to be sticky enough that it is assumed that higher levels of interest rates look likely to persist even once the economy slows, however it is expected to be lower than the current levels. As always, such predictions shouldn’t be overly relied on as the future is a fickle beast and liable to change. If, however, you have a fixed-rate mortgage coming up for renewal in a year or two then it should offer some comfort that this reset might not be quite as painful as it may look currently.

The big positive that has come out of this sudden change in the interest rate environment is that it is possible to once again earn attractive levels of income from your portfolio and in some cases even do so with some chance of capital appreciation as well. For the first time in years talking about portfolios yielding 6% or specific assets offering high single digit or even low double digit income yields could be possible again. Of course, if you would like to discuss the options for income investing that are suitable for you, we would always be happy to chat to you.

We wish you a good week.

Please note that our next update will be on Tuesday 2nd May.

Sources:

- 1 The Office of National Statistics