Live long and prosper - Markets almost stunned by pension funding

Markets almost stunned by pension funding

This week’s update is written by Jon Pope, in our cash management team.

The aftermath of the Bank of England’s decision to intervene in the long end of the Gilt market continues to make headlines. The stark position the Bank of England found itself in was laid bare last Thursday in an 11-page letter from Deputy Governor Sir Jon Cunliffe to the Commons Treasury select committee, sent in response to queries from the committee chairman, Mel Stride.

The reasons why the Bank of England had to intervene in the first place are perhaps not immediately apparent to most investors, but, again, are a consequence of the long period of ultra-low interest rates. Final salary pension schemes in particular were badly affected because they have fixed liabilities over a long timeframe; the pensions they support are a set proportion of the retiree’s final salary and so not dependent on market movements. Traditionally these schemes would have bought lots of long-term Gilts to provide income in the form of the coupons received and so provide certainty of return. However, when Gilt yields were at record lows (because official interest rates in turn were so low) their corresponding liabilities remained fixed, potentially creating funding deficits.

One solution to solve this problem was Liability Driven Investing (LDI). This involved the use of derivatives to introduce leverage into portfolios to improve returns whilst better matching investment horizons with known liabilities. Typically pension funds appointed an investment manager or invested in an LDI fund, which in turn had to place collateral with the banks to manage the complex derivatives used. As long as interest rates remained low and markets moved within modest parameters these positions went largely unnoticed by most people in the markets, meanwhile, the LDI market grew to £1 trillion in size.

Some commentators had raised concerns about what might happen if interest rate expectations rose quickly but by and large these concerns had not been addressed. However, over the last year as inflation concerns mounted and central banks raised interest rates, Gilt yields have risen (yields moving inversely to prices). This has meant that the leverage in these LDI funds has increased and so the banks holding the derivative contracts have required more money to be placed with them as collateral.

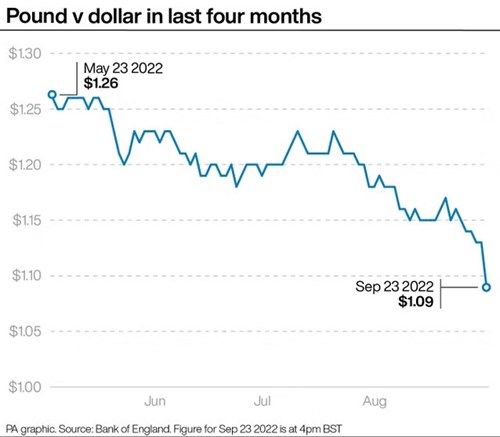

Matters came to a head in the days after the government’s mini-budget. Markets took fright about the £45 billion of unfunded tax cuts with the pound sinking and markets fretting that borrowing costs would increase significantly. Markets immediately factored in higher official interest rates, high street banks rushed to reprice mortgages and Gilt yields increased very sharply.

The impact on LDI funds was that they were faced with more margin calls from banks to maintain their positions. The LDI fund managers were faced with two possible options, either sell long-dated Gilts into an increasingly illiquid market or call on their pension fund clients to provide more cash. There was widespread selling of other assets in markets as funds tried to fill the holes in their positions but it became clear to the Bank of England that there was a real danger that some of these funds would not be able to raise enough cash. This would potentially cause the funds to default on their obligations which in turn would cause the Banks to dump the collateral (long-dated Gilts) they no longer needed. So a largely un-noticed corner of the financial system once again threatened to cause another financial crisis.

The Bank of England then was forced to take action and announced an emergency intervention in the Gilt market as it effectively became the temporary ‘purchaser of last resort’ for longer dated Gilts. By providing liquidity to the market Gilt yields fell and LDI funds have been provided time to either sell Gilts orderly or receive fresh funds from their investors. Importantly, of course, it does not solve the problems LDI investors might be grappling with but it does improve financial stability. This leads onto another key point that Sir Jon Cunliffe makes; that these ‘temporary and targeted measures’ were not taken by the Monetary Policy Committee but by those in charge of financial stability. So planned increases in official interest rates will continue to go ahead although potentially whilst Gilts are still being bought by the Bank of England.

The LDI corner of the market is a reasonably obscure and specialised one, which most investors will not have reason to know too much about. However once again there are some lessons which all of us can learn from this episode; arguably though they should already have been learnt and so this should be a reminder. First of all, understand exactly what you are investing in – how many pension trustees understood exactly what LDI schemes were? And also, remember markets tend to revert to mean over a longer period of time. It might have seemed unlikely two years ago that interest rates in the UK would rise significantly but when viewed over a longer time frame interest rates of 0.50% were abnormally low.

Hopefully, the action taken by the Bank of England has averted a wider crisis but the events of the last fortnight do highlight the issues markets are faced with, if, indeed, the recent interest rate rises do herald a return to more normal rates.

We hope you have a good week.