Weekly update – Is there value in the bond market?

This week’s update is written by Anthony McGovern, who is in our Advisory team in Jersey.

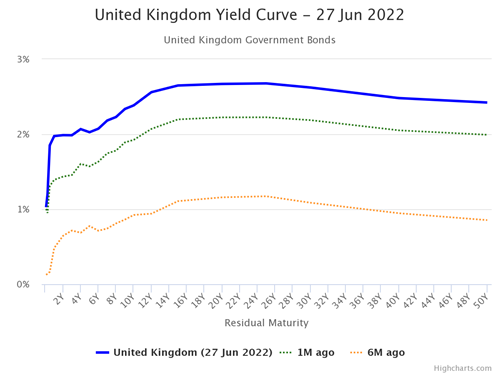

Last year I wrote a piece on the very challenging UK corporate bond market and the inability to find attractive yields. For example, when running bond lists from the UK market universe we would struggle to find even a 3% yield for suitable credits1. At the time markets were pricing in no rate rises for 2022 and only a couple of rate moves towards the latter end of 2023. At the same time, 10-year yields in UK government bonds or gilts were around 0.7%, benchmark 10-year US Treasury yielded 1.4% and over a quarter of all government debt globally had a negative yield1. How things have changed!

A year later, we now have 10-year government bonds yielding 2.6% in the UK and 3.3% in the US1 (coupon is fixed during the life of the bond), which has meant steep falls in the capital value of these bonds as prices move inversely to yield. Even just looking at the moves in government bonds shows the extent of the change in expectations that bond markets have needed to absorb and the quick and aggressive repricing we have witnessed in the past year. We can now run corporate bond lists starting with a minimum of 3% yields for investment-grade bond issues which provide numerous options for income/yield-oriented investors from senior ranked, short-dated bond issues down to subordinated ranked specialist financial Additional Tier 1 and Restricted Tier 1 bond markets.

Starting with very short duration bonds, which have the lowest sensitivity risk to interest rate hikes, the yields achievable are looking attractive again. For example, you can achieve a blended yield to maturity of ~3.8%1 (coupon is fixed during the life of the bond) for a weighted duration of just two years for a portfolio of bonds with an average credit rating of A-, meaning all holdings are comfortably investment-grade. Looking at yields in US$ and remaining within short-duration bonds, a blended portfolio of A-rated bonds with an average weighted duration of three years you can achieve a US dollar yield of 4.15%1 (coupon is fixed during the life of the bond). This is quite a remarkable turnaround from this time last year and even from the start of this year.

For those investors looking for higher yields who are comfortable with longer duration in this rate-raising cycle, whilst still remaining in sterling investment-grade bond issues, it is now possible to obtain a blended yield from senior unsecured issues with fixed maturities from 2026 to 2027 of between 6.5% to 7% yield to maturity (YTM)1.

Moving to the more specialist subordinated issue area of the bond market, but again remaining in UK investment-grade bond issues, the yields achievable become increasingly tempting providing one is prepared to accept more risk and price volatility. In my previous note, I covered a relatively new structure of debt from the insurance sector, Restricted Tier 1 debt (RT1), where bond issuance has proliferated post the 2008 financial crisis due to regulatory capital changes. Whilst many coupons may be in the 4-5% area, given recent price falls the yields in this space can often now be +8%. A very recent example of the moves in yields in this type of debt was provided earlier this month when FTSE 100 and Advisory Equity BUY list constituent Aviva issued £500m in their debut RT1 bond issue which was priced with a relatively generous 6.875% coupon. Unsurprisingly demand for this bond in the primary market was strong, with books oversubscribed by four times the maximum issue size, resulting in a final book size of £2bn+. However, despite the £1.5bn of surplus orders, following the first afternoon of secondary trading prices started to drift lower. So much so that at current trading levels of 93.50 these bonds now offer a yield to first call in December 2031 of 8% for an investment-grade BBB rated bond. Aviva recently reported a Solvency ratio of 205%, significantly ahead of minimum regulatory capital requirements and thus providing a buffer to ‘trigger’ Solvency Ratios of some £16.2bn.

This is just one example of a number of FTSE 100 RT1 bond issues or similarly the banking equivalent “AT1” sector where, if anything, yields have moved closer to 10%1 (coupon is fixed during the life of the bond). To reiterate these are investment-grade rated bonds with relatively short durations under five years. Such yields are now becoming fairly common and are even higher in yield for US$, rapidly widening credit spreads are usually indicative of extreme level of risk aversion. Whilst spreads (essentially the extra yield offered relative to government bonds for taking on greater default risks) continue to ‘widen’, the underlying companies have continued to build on their already very strong capital levels and buffers to ‘trigger events to ordinary shares’. We would note that in previous crises such as Covid a similar sharp widening of credit spreads was witnessed, although in this case they tightened back in again very quickly as central banks embarked on expansionary monetary policy.

This time bond markets remain much more volatile than normal with increased expectations that inflation will result in aggressive central bank rate increases, usually likely to result in bond prices continuing to come under pressure and therefore pushing yields higher. As demonstrated above though, the yields that are currently available, even in senior shorter duration bonds at last provides bond and income investors with attractive yield options from what is a lower risk and less volatile asset class. After many years of ultra-low rates and the traditional 60:40 portfolio long since a thing of the past, most investment portfolios are now underweight fixed interest and so the asset class has some useful diversification benefits and some certainty of income in what are uncertain times. If, as many predict, the major Western economies slip into recession, typically such an environment would be more supportive for bonds than for equities where many will see earnings fall. A prolonged recession would also increase the likelihood of central banks becoming more dovish and stimulative, again usually good for bonds.

For those investors not comfortable with holding fixed-rate debt in a higher inflationary period, we continue to see value for income-orientated mandates in the large liquid listed infrastructure funds. We have been long-term investors in the space which now spans social infrastructure (schools, hospitals, roads), renewable energy infrastructure (biomass, solar, wind, battery storage) and now digital infrastructure (datacentres, fibreoptic networks, 5G masts). It is simply a matter of time before a number of the larger funds enter the UK’s benchmark FTSE-100 index, further broadening their appeal.

Last of all, investors holding high levels of cash who are too nervous to consider investing in the bond market or listed infrastructure funds are fully aware of seeing their cash purchasing power diminish with the latest 40-year high UK inflation print of 9.1% and may consider yields currently available in Certificate of Deposits offerings.

As ever please contact your relationship manager should you wish to discuss in more detail.

We hope you have a good week.

Source:

- 1 Bloomberg