Grinch Mum

In this article, which originally appeared in GYOne magazine, head of client services Sophie Yabsley explains why a piggy bank may not be the best place for your children's pennies.

They haven’t exactly said it out loud in so many words, but I’m pretty sure my parents view eight grandchildren as plenty. I only own two of them (which I also deem to be plenty) and they provide me with more than enough sleepless nights, heart-stopping moments and headaches, as well as all the obvious smiles, memories, belly laughs and proud moments. They have also, unbeknownst to them, piqued my interest in financial education. In short, whether they like it or not, they are going to learn about money, and not just the fun parts.

You hear it all the time amongst adults, don’t you: “Why are we never taught about how to do a tax return in school?”, “Why did no one ever explain to me what a budget is?” and so on. Please don’t interpret this as me bemoaning the education system – I’m really not – I’ve simply identified an area outside of that where I think that I (or we, if I may) can add some value for my/our small humans.

So here’s what I do. When my parents, aunties, uncles, in-laws give the children some money for their birthdays or for Christmas, I intersect it. Then I invest it, on their behalf, into an investment portfolio in my name, which is designated for them.

I’m not talking thousands of pounds here – gifts can be anywhere from £5 up so I tend to let a bit tot up before I invest it and pop it into the investment portfolio, say, once a year. Whilst what you invest into is clearly important and knowing what you own and why is key, one of the most influential factors influencing investment returns is time invested. Time, which hopefully young children have plenty of, but don’t yet know how to take advantage of. Having time on your side allows you to benefit from the effects of compounding. Compounding, simply put, enables you to grow your wealth by reinvesting the returns you make - and earning returns on your returns. By continuously re-investing the earnings you receive, you can increase the returns you can expect. And history shows us that this is true.

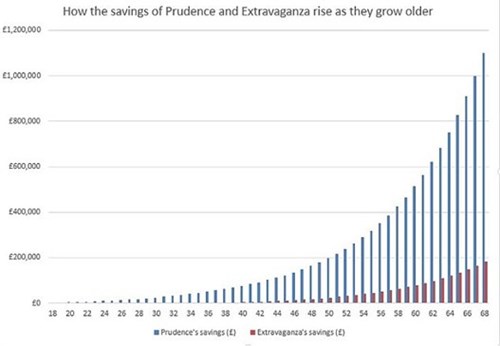

I know how powerful the effect of compounding over time can be (illustrated in the chart below) and I want to give my kids the chance to benefit from that. I also don’t want their money to sit in cash and be eaten away by rising inflation. Albert Einstein heralded compound interest as the most powerful force in the universe. In his words, “compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it.”

The key to benefiting from compound interest is not necessarily how much money someone can put aside, as much as it is how soon they should start doing so. The longer the amount of time that savings can be left to grow, the better. To explain this, let us look at two sisters, Prudence and Extravaganza.

Prudence starts saving at just 18 years old; diligently putting away £20 per week. This example assumes, for simplicity, that her investments, over time, return a round average of 10% per year. Now not only is her initial investment growing by 10% per year, but she is also still adding £20 per week; just over £1,000 per year. Extravaganza doesn’t get around to saving her £20 per week until she’s 38 – so a full 20 years later than her sister. Assuming the same investment returns as Prudence, the two scenarios are illustrated in the chart below. (Source: www.thisismoney.co.uk)

This shows that it’s not necessarily how much you save, as long as you are saving and investing regularly (be that weekly, monthly, quarterly or annually) and start doing so as soon as you can.

I don’t really know what the money I’ve put away for my kids will be for, or when they will be given it. Maybe it will help them buy their first car, or maybe they will add to it when they start working; perhaps to try to achieve a deposit for a house. Or maybe they will withdraw the lot and jet off to Ibiza for a summer of fun! What I do know is that, when they are old enough, I plan to give them read-only online access so they can see the portfolio. I want them to learn about it, to understand it, to get used to having some exposure to financial markets and to the volatility that comes along with that. I don’t want money to be a taboo topic in our house, I want it to be a tool in their life-kit.

Maybe one day they will thank me for this. For now, they just want to know where all their 50 pence pieces have gone!

“It came without ribbons, it came without tags. It came without packages, boxes, or bags,” The Grinch.

If you have questions about how Ravenscroft can help with investing then please give our team a call on 729100.