Weekly update - The heat is on…

Chris Bell, a portfolio manager our Isle of Man team, pens this week’s update.

As temperatures soar and records look close to being broken in the UK this week, a global view highlights this as a widespread trend this summer and further heightens the damaging consequence of global climate change. Last week over 75% of US states were experiencing some form of drought conditions, a truly shocking statistic. The Governor of Texas has issued a disaster proclamation as much of the state faces extreme heat and in Alaska it is believed that more acres have already burned this year than in both 2020/21 combined1.

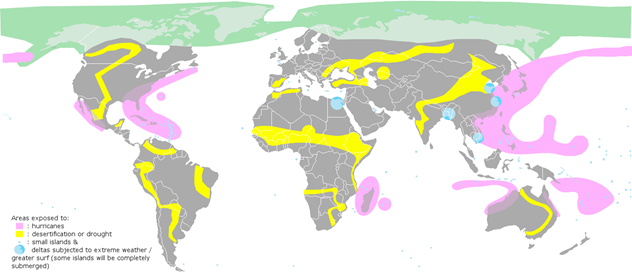

In Europe, a lack of winter snows has ultimately led to less runoff into rivers, and areas such as northern Italy are feeling the negative impact. Five northern regions have recently declared a state of emergency, and this is impacting crops like premium rice, which is used in risotto. Both Portugal and Spain have been experiencing severe wildfires in recent days as temperatures have consistently nudged towards 110 degrees (43°C). Longer term, this trend will add to fears that some areas of the planet will simply become inhabitable.

The term ‘climate refugee’ is not a new one; the United Nations first used the term back in 1985. The United Nations High Commissioner for Refugees now estimates that in an average year there will be over 21.5 million people displaced by weather. The Institute for Economics and Peace believe that with current trends by 2050 we could see over one billion people displaced.

Source: Wikipedia

Crucially, in what has already been a year of terrible timing, the droughts are only exacerbating the level of inflation being experienced in foodstuffs. The Australian government has been at the vanguard of trying to boost food security and the resilience of the farming sector. The National Drought Agreement provides not only immediate support but improved weather intelligence and increased water infrastructure spending.

The future of water security and trying to avoid the inevitably increasing scarcity brings investment opportunities. Clean water is vital, especially considering so much water on the planet is either saltwater or polluted. The desalination of saltwater to drinkable water has been done on a commercial scale since the 1930s and whilst still a costly process the price per consumable litre has continued to reduce as technology advances. It is not just water for human consumption that is a necessity, industries such as agriculture rely on clean water for crop irrigation and livestock and pharmaceutical companies use sterile water in their production of medicinal products.

A good example of a company that is driving innovation forward in the treatment and sustainable use of water is Xylem, which we have exposure to in the Global Solutions Fund (only available to offshore investors). Xylem utilises its technology across the life cycle of water; collection, distribution, reuse and return to nature. Through its solutions, be it with low-tech water pumps or complex treatment plants, the company is pushing to deliver a more sustainable and safer source of drinking water around the globe, where previously it has not been possible.

Another of the biggest challenges, aside from treatment of contaminated water, and one which there is a lot of industry focus on, is how we use what we have more efficiently through reduction of waste using smart monitors and the effective reuse of water where possible.

Last week saw US consumer prices rise by 9.1%2 - a new forty-year high which left investors fearful that the Federal Reserve may well increase interest rates by a full percentage point at the July meeting. On a more positive tack, we have witnessed a meaningful pull back in many commodity prices, including foodstuffs, which could mean we have already witnessed the peak prices. The Conservative leadership race rumbles on and there was also excitement in the currency markets as the USD/EUR rate hit parity. This was the first time this has happened in 20 years and highlights the problems Europe is facing with the Ukraine war and its ramifications.

Good luck on keeping cool this week…

Sources:

- 1 Fox News

- 2 CNBC