Weekly update - Turbulent times

This week’s update is written by Matt Girard in our Precious Metals team.

We are often asked, “Is it a good time to buy gold?” and although we would love to sit here and tell everyone ‘Yes, fill your boots!’ or ‘No, give it another couple of months and you’ll save yourself $50 an ounce’ …. we would be lying. If the last two years have taught us anything, we should know that financial markets can be extremely unpredictable – particularly in the short term.

Since January 2020 we have experienced numerous lockdowns across the world, war broke out between Ukraine and Russia and, more recently, inflation levels have reached 40-year highs in both the UK and US. During this time, the gold price has gone from around $1,550 per ounce (January 2020) to where it is today at $1,780 p/oz. Uncertainty in the markets normally means good news for gold as investors seek safe-haven assets, so what is slowing it down?

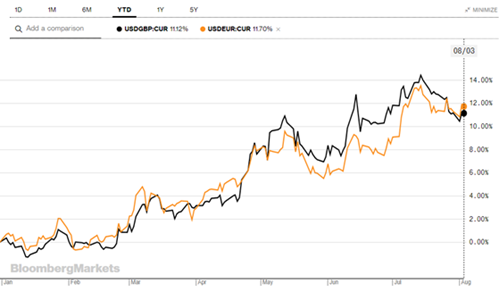

The big headwind for gold over the last few months has been the strength of the US Dollar. Along with Japanese Yen and Swiss franc, the dollar is viewed as a safe-haven currency and, like gold, benefits from market turbulence. This causes some investors, who may have sought gold, to look towards holding cash in efforts to preserve wealth. Precious metals are primarily traded in USD, which makes trading more expensive for potential buyers who are holding other currencies.

The World Gold Council released their Gold Demand Trends report for Q2 at the end of last month, which provides some more insight into global trading. Investor trading in China and Europe has slowed, however, central bank demand has remained strong, with Turkey being the biggest net purchasers year-to-date.

“COVID-induced lockdowns triggered the worst Q2 for Chinese retail gold investment since 2010. China’s gold jewellery demand fell by 29% to 103t in the second quarter.”

“Central banks bought 180t of gold in Q2, lifting H1 net purchases to 270t. Gold’s performance during a crisis and its role as a store of value are key drivers of central bank demand for gold.”

(Source: https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q2-2022)

In July, the central bank of Zimbabwe took a different approach to curb inflation by launching its own 1oz gold coin. The 22-carat “Mois-Oa-Tunya” has been named with reference to Victoria Falls and translates to “Smoke that thunders”. The initial release was 1,500 coins but following high demand they are set to release a further 2,000 coins. With local currency collapsing and inflation reaching over 190%, it will be interesting to see the response over the coming months.

Wishing you all a good week.