Weekly update - Some good news at last

This week’s update comes from Jo Jehan in our advisory team in Guernsey.

There was an upbeat tone to the markets last week, which is refreshing after what has been a disappointing performance in 2022.

The midweek uptick in the US markets was helped when US Fed Chairman Jerome Powell announced that they may slow the pace of interest rate hikes, after increasing it by 75bp on Wednesday for the second time in two months. Powell suggested they might make another large rate increase at the Fed’s next meeting September, but would be guided by data and closely monitor the situation in the interim.

US equities rallied despite the rate hike, and they weren’t dampened by GDP data released on Thursday, which signalled the US economy contracted for a second consecutive quarter – meeting one definition of a recession.

It was a busy week for corporate earnings announcements on both sides of the pond, with strong results from some of the constituents of our Advisory recommended list.

Diageo, a global leader in production of alcoholic beverages, reported an annual sales increase of 21.4%[1]. Sales of Johnnie Walker whisky were up a whopping 34%[2] and Diageo revealed that consumers were choosing premium brand drinks such as the Johnnie Walker Blue Label rather than switching to cheaper beverages.

Despite the uncertain economic backdrop and threat of recession, consumers are showing little sign of easing off on spending across various sectors. Visa’s Q3 earnings beat last week proved that consumers are increasingly looking to buy on credit, as the company reported that net revenues had increased 19% year on year[3]. Indeed, figures from the Bank of England showed that credit card borrowing last month increased at the fastest annual rate since 2005[4].

Shell posted phenomenal adjusted second quarter earnings of $11.5bn, which surpassed their previous record of $9.1bn in Q1[5] and they announced a $6bn share buyback scheme. The company benefitted from higher prices, which reflected the soaring cost of crude as a result of the war in the Ukraine. This round of share buybacks follows the $8.5bn of buybacks in the first half of the year.

Many other companies have announced plans to buy back their own shares over recent weeks, taking advantage of depressed share prices, notably BAE Systems (£1.5bn), Total Energies ($2bn) and Nike ($18bn over a four-year period).

Not all earnings news was positive though. The strong US dollar has gained against almost every other currency in recent months, resulting in billions of dollars being wiped off the Q2 sales of US companies. This has caused many companies to cut their guidance for the remainder of the year.

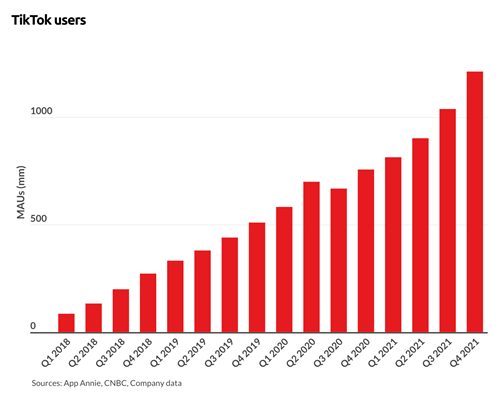

Facebook parent Meta reported their first ever revenue drop, following the lead of Twitter and Snap who also posted disappointing results a week earlier[6]. Meta cited weak “advertising demand” driven by economic uncertainty and expect this to continue into Q3 where they have also issued a disappointing forecast[6]. Meta shares have lost about half of their value since the beginning of this year[6], and this has not been helped by the phenomenal increasing popularity of short video app TikTok, which is drawing away users and taking advertising market share.

Source: https://www.businessofapps.com/data/tik-tok-statistics/

With the majority of S&P500 market cap having reported already, half of those companies, including Apple, Microsoft, Amazon and Alphabet, have beaten estimates and the S&P500 recorded its best month since November 2020[7].

The week ended on a high note as the England Lionesses won the European final in front of a record-breaking crowd at Wembley last night, beating Germany 2-1 in extra time. It’s the first time in 56 years that England have won any major football tournament, following the 1966 World Cup final, so many congratulations to the team!

Have a great week.

Sources: