2021 Q2 Newsletter

“ Cum on, feel the noize

Girls, rock your boys

We’ll get wild, wild, wild

Wild, wild, wild”

Cum On Feel the Noize - Slade (1973)

Introduction by Mark Bousfield

For those who read and enjoyed Daniel Kahneman’s “Thinking Fast and Slow”, he has recently released a new book called “Noise – A Flaw in Human Judgement”. It highlights cases where individuals, given the same information, arrive at different answers. For instance, the book points out that “In a 1981 study, for example, 208 federal judges were asked to determine the appropriate sentences for the same 16 cases. The cases were described by the characteristics of the offense (robbery or fraud, violent or not etc.) and of the defendant (young or old, repeat or first-time offender, accomplice or principal). You might have expected judges to agree closely about such vignettes, which were stripped of distracting details and contained only relevant information. But the judges did not agree. The average difference between the sentences that two randomly chosen judges gave for the same crime was more than 3.5 years. Considering that the mean sentence was seven years, that was a disconcerting amount of noise”.

If we extrapolate this idea to markets and investing, it won’t be a surprise to you that investment outlooks and forecasts can also be noisy and disparate. Moreover, they can’t all be right. We are very aware of how important it is that we don’t get caught up in this noise. We research, write about and discuss huge amounts of information regarding macroeconomics and worldwide events, which we then utilise as a tool when constructing portfolios. However, we are always aware of the many differing interpretations and alternative outcomes that can’t be ignored. The current environment, which Kevin Boscher discusses, is a great example: market commentators have recently been forecasting a wide range of potential outcomes – from rampant inflation and a commodities super-cycle, to a short-lived inflationary spike and return to low inflation and falling bond yields, to stagflation! This has all been reflected in markets where we have seen some serious gyrations in bond yields, deep cyclicals (such as mining stocks, which rallied strongly but underperformed more recently) and the reverse in tech stocks. In this environment, we, as ever, step back from the noise and think about building portfolios as pragmatically as possible.

Long term, we remain confident that our investment themes such as technology, healthcare and environment solutions will stand the test of time and deliver outperformance for you. We are also aware that these sectors are trading at higher-than-normal valuations and have therefore blended them with value-orientated investments such as Polar UK Value. On the bond-side, we continue to focus on credit but have taken the possibility of rising inflation into account by investing into US Treasury Inflation-Protected Securities (TIPS). These are only a couple of examples of our thought process, but I hope that they serve to highlight our focus on building portfolios that are capable of navigating a variety of short-term outcomes for our clients and, of course, reducing the noise.

Cautious Portfolios:

Lower Risk

by Alex Chambers

Objective: The Cautious portfolio’s objective is to increase its value by predominantly allocating capital to fixed-income investments. The portfolio can also invest into global blue-chip equities with strong cash-flows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity-weighting of approximately 35%. The cash generated can be re-invested to provide capital growth or taken as an income stream.

The second quarter of 2021 was more positive when compared to the preceding quarter and the strategy returned a pleasing 2.5% (1). We commented on the fact that the first quarter was a tough period for bond markets and this was based on two things: President Biden’s big vaccine roll out programme, which allowed many suppressed areas of the market to recover, and the bond market broadly factoring-in no Federal Reserve rate hikes until 2024 (roughly translated as letting inflation run). The rhetoric has shifted somewhat in the second quarter, and this has been more positive for bond markets. Things have settled down now and a rise of 0.6% is expected by the end of 2023. While this doesn’t seem like too much of a big deal, markets were more comfortable with the idea that the Federal Reserve would not let inflation run without restraint. So, while rising interest rates is not necessarily a positive thing for bonds (in isolation), bond markets demonstrated their preference.

The topic of rising bond-yields has long been a concern for us. This is why we have gradually been reducing the duration exposure of the overall bond exposure over the past couple of years. Having longer duration exposure can be accretive when yields fall; however, we are in the opposite scenario where meaningful gains from falling yields seem extremely unlikely – and thus that the risk of losing money as a result of yields rising seems more likely. That said, bonds still serve a very important purpose and we feel the aforementioned risk can be managed by reducing that aspect of a bond’s return and focussing more on the credit portion: the return derived from the quality of the underlying company where ‘stock selection’ plays its part.

Another point to note is that credit spreads are extremely ‘tight’ in a lot of areas of the bond market at present. This measure is simply the yield above the equivalent-dated government bond (which is considered risk free) that investors receive for owning bonds with a lesser credit-rating (based largely on issuer fundamentals). This component of a bond’s yield can have a sizeable impact on its price, particularly in times of market stress where the price of, say, high-yield bonds will typically be more affected than corporate bonds, since more of the return is derived from the ‘credit’ aspect. The fact that these are currently tight in most cases means that there is little capital gain to be had from a further tightening. Thus spread-widening (overall yield rising) is another risk. Where we do have exposure to high-yield bonds is in the shorter-dated area and we are currently avoiding the longer-dated bonds. Essentially, the longer the time one lends money to a company/issuer, the more uncertain the financial position of that entity is – which adds to volatility over the short term. We feel it prudent to keep our exposure at the shorter-dated end, where we feel there are relatively attractive returns on offer relative to the risk taken.

Looking at equities, we saw a strong resurgence in value stocks continue over the first few months of the year. Nevertheless, growth stocks rallied again at the end of the second quarter, far outdoing their value-focused counterparts. This meant that Guinness Global Equity Income and Ninety One Global Quality Equity Income had a particularly good quarter and nearly returned double-digit growth. Strong equity performance has boosted performance of the strategy and this is why we fundamentally believe that an appropriately sized position in equities remains beneficial to a cautious portfolio even though it adds a small amount of additional volatility over shorter periods.

Looking to the next quarter, we are cautiously optimistic and happy that we will perform relatively well in an inflationary environment. We are, of course, sticking to our knitting in that we will remain invested in line with our investment process, owning high-quality global businesses combined with a carefully selected range of different bond exposures to deliver a regular income while protecting the purchasing power of invested capital.

Balanced Portfolios:

Medium Risk

By Georgie Fletcher

Objective: The Balanced portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

After a tough first quarter, it was pleasing to see the Balanced strategy claw back some of the ground it lost during the first three months, outperforming the IA Mixed Investment 20-60% Shares Sector at 4.5% (2) versus 3.6% (3) for Q2. This brings the strategy to 3.3% (4) year-to-date.

We introduced the strategy’s first pure-play UK exposure in February, via Polar Capital UK Value Opportunities, driven by our desire to continue balancing the portfolio in terms of valuation against the attractive investment opportunities in the UK. Since its inclusion within the portfolio, the holding had performed exceptionally well (returning 11.5% (5)) and done the job we bought it for. Mid-way through April we had another very good conference call with the management team and increased the position size to 7.5%. The top-up was funded via trimming TwentyFour Corporate Bond Fund by 2.5%; it now also sits at 7.5%.

Elsewhere within the bond space, income yields on core government bonds remained extremely low and we had concerns that any future market shocks would be inflationary. Maintaining a position in inflation linked bonds was therefore important.

On this basis, we made the decision to sell the portfolio’s 5% long gilt position and rotate the proceeds into US Treasury Inflation Protected bonds. Treasury bonds are higher yielding when compared with gilts. Additionally, whilst they tend not to rally hard in an inflationary environment, they also do not sell-off. Thus the new investment minimised inflation risk surrounding the portfolio’s sovereign fixed-income exposure whilst still maintaining an inflation-linked bond position. If the BREXIT discount continues to close, we will likely see UK equities continue to perform well, leaving longer-dated gilts, especially, trading at a premium. Finally, this change created a more beneficial alignment with the Polar UK Value Opportunities trade implemented earlier in the quarter.

May was a rather stagnant month, so it was unsurprising that our value biased holdings outperformed. Lazard Global Equity Franchise and Polar Capital UK Value Opportunities were purchased specifically to provide this diversification to the underlying portfolio.

Since the start of 2021 we have continued to see a rotation into the previously unloved areas of the market: investors favouring value stocks over quality growth holdings alongside rallies in the sectors we actively shun (Utilities, Financials, Energy). Understandably, this created a tough backdrop for the strategy, further accentuated by deliberate exposure to emerging markets and an underweight allocation to the UK (where its peers allocate approximately 12.5%). In a market where the UK rallied whilst emerging markets were weak, Balanced held up relatively well.

The last couple of months, however, have seen the market switch its preference back. Growth-centric technology and emerging markets, especially, have outperformed. Brown Advisory Latin America was the strategy’s best performing thematic holding, posting 17.3% (6) for the quarter, with Polar Capital Global Technology coming in second at 8.2% (7). Brown Advisory’s outperformance of over 9% in sterling terms versus the portfolio’s other thematic equity holdings was an extremely pleasing Q2 result. We had a very positive call with the team mid-way through the quarter and they expect the next 12 to 18 months to be an exciting period for region and fund alike. Covid-19 cases have plateaued within the region and the vaccination programme is now being rolled out at pace. In addition, over the last 18 months every holding representing above 3% of Brown’s underlying portfolio has adapted to the changing environment and transformed its business model; there has also been lots of M&A activity and new concessions won.

We move into the third quarter of the year at the higher end of our equity weighting (57.5%). However, with a modest cash allocation (5.5%) and plentiful liquidity, the portfolio remains well-positioned to respond to the changing investing environment without hesitation.

Growth Portfolios:

Higher Risk

By Samantha Dovey

Objective: The Growth Portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

One thing is certain: things can change very rapidly in 12 months! If we look back to the second quarter of 2020, we were just beginning to understand the gravity of the pandemic and reeling from the impact it had on markets. Conversely, the second quarter of this year has been relatively quiet and, when looking at returns, it is easy to forget about the roller coaster of 2020.

The Growth strategy posted 6.2% (8) for the quarter versus the IA Mixed Investment 40-85% Shares Sector at 4.9% (9), whereas in 2020, we were writing about returns of 14.1% (10) and 13.1% (11) respectively across the second quarter. Having said this, however, year-to-date the strategy now stands at 5.5% (12) versus -1.20% (13) this time last year.

Regular readers will be familiar with the importance we place on implementing levers into our strategies as part of our portfolio construction process. We discuss this frequently in our commentary, and this quarter highlighted it nicely. In a quarter which had both value, growth and somewhere in between driving markets, the strategy weathered this backdrop particularly nicely, which is reflected in the portfolio’s outperformance versus the sector over the quarter.

What does this really mean for the underlying exposures within the strategy and the impact on portfolio construction? We thought the best way to illustrate this was via a table of returns, highlighting the importance of the “levers”.

Table of returns for Fundsmith Global Equity and Lazard Global Equity Franchise (14):

We have been investors in Fundsmith since launch. Terry Smith (and his team) has a tremendous track record over the last 10 years and he has never made any bones about the way he invests. Fundsmith invests in high-quality businesses for the long term and this mantra reigns true for two of our other global equity funds, GuardCap and Lindsell Train – this is where 26% of our global equity allocation resides.

The reason we introduced Lazard into the portfolio was due to the different way that Bertrand and his team look at the world compared with Terry – which, unsurprisingly, gives Lazard a slightly different return profile (highlighted in the table above). Using the same quality metrics that Fundsmith would search for, Lazard specifically looks for companies that exhibit an “economic franchise” and those companies that are either unloved or need a catalyst to realise their full potential.

This is also borne out in the value (or price) exhibited in the Fund. Over the last few years Fundsmith has become very expensive – the price earnings (PE) metric comes in at 35x. However, as is often said, you pay up for quality (although this is still quite expensive, even given its history of outperformance). Lazard on the other hand trades at 17x, which, while more expensive than it has been, is not nearly as dear as Fundsmith on a crude PE metric.

Now, you do get different underlying exposures and performance profiles; this is the beauty of holding Lazard and why we added this “lever”. We still truly believe in the long-term irrefutable theme of consumption – and both funds exploit this theme, just in slightly different ways.

We also take this approach in the portfolio’s thematic global equity and fixed-income allocations.

The strategy’s thematic allocation has what we would describe as “out-and- out growth exposure” via the likes of Polar Capital Global Technology as well as more value-biased funds in the emerging market space, such as Brown Advisory Latin American or Ashmore Frontier Markets. Shannon has written about Ashmore Frontier Markets in her “Fund in Focus” piece; the holding happens to be not just our best performing thematic equity fund for 2021, but our best performing equity fund, full stop.

In the blink of an eye we have made it halfway through 2021 without either a major pandemic or natural disaster! As we head into the second half, we remain happy with a composition that seems to be navigating us well through these uncertain times. As ever, we will continue to “stick to our knitting”, remaining vigilant and ready to respond to the everchanging world around us.

Global Blue Chip Portfolios:

Higher Risk

By Samuel Corbet

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chip companies, that are in line with our long-term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

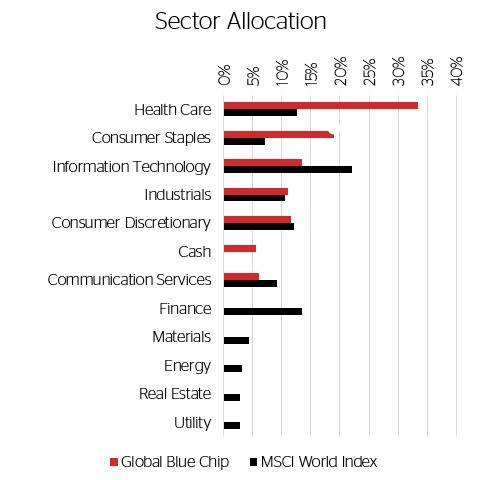

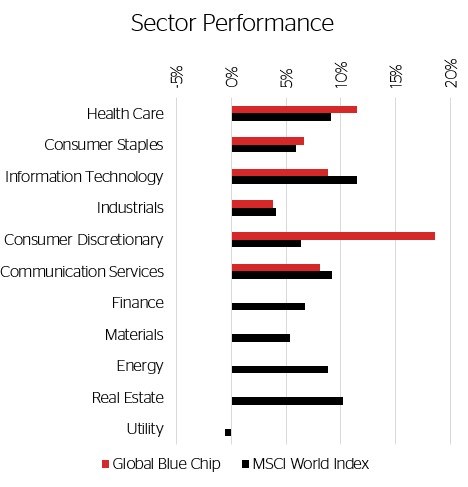

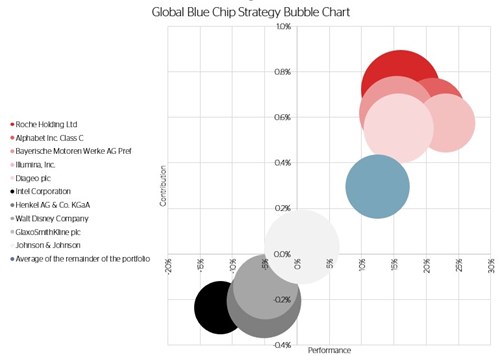

The Global Blue Chip Strategy returned close to 9% (15) during the quarter. In comparison, the MSCI World Index produced a total return of 7.6% (16). The outperformance is largely attributable to the strong performance of the strategy’s Consumer Discretionary holdings (eBay +27.7%, Richemont + 26.7%, LVMH + 18.0%, Nike +16.3% and BMW +14.4%) which, in aggregate, delivered a quarterly return of 18.6% – significantly higher than the index component which returned 6.4%. The strategy’s healthcare holdings also performed well. On the flip side, the strategy’s technology stocks (+8.8%) underperformed the index component (+11.5%) with only Dropbox (+15.7%) and Microsoft (+15.0%) outperforming. Last quarter’s best performer, Intel, was down 11.9% during Q2 and this weighed heavily on the overall performance of the strategy’s technology component.

Turning to the underlying businesses, Roche was this quarter’s highest contributor delivering a 16.0% return and contributing 0.7% to the overall performance. The strong performance does not appear to be as a result of any stock-specific news, but rather an increased demand for Swiss-listed stocks that has helped elevate prices across Swiss equities more broadly. We continue to monitor the situation. Whilst we are not concerned about Roche’s valuation, we may look to trim our Swiss exposure elsewhere in the portfolio should market movements cause prices to diverge significantly from our perception of their intrinsic value.

Alphabet (+21.0%, 0.63%) posted another strong quarter driven by the 46% growth in its cloud division revenues and 34% growth from its services division. The company announced that over 1 billion hours of video are watched on YouTube every day and that 18-to-49 year olds are watching more YouTube than all linear TV channels combined.

BMW (+15.4%, +0.6%) continued to perform well as the market continues to warm to its EV strategy. Q1 sales were up 6% from 2019 levels and EBIT margin (9.8%) fell back within the 8-10% through-cycle target stated by management. The company remains on track to have a total of 1 million fully electric vehicles and plug-in hybrids by the end of the year.

Illumina (+15.4%, +0.6%) benefitted as long-duration growth came back into fashion after the inflation scare earlier in 2021.

In its recent trading update, Diageo (+15.8%, +0.6%) announced that organic sales had returned to growth and the company now expects full-year organic operating growth to be at least 14%. The company announced that it was recommencing its capital return programme with the stated goal of returning £4.5 billion to shareholders since its original announcement in July 2019.

Looking now at the largest detractors, only three companies detracted from overall performance during the quarter: Intel (-11.9, -0.2%), Henkel (-5.2%, -0.2%) and Walt Disney (-4.9%, -0.15%). Despite Q2 earnings that crushed expectations, Disney stock fell as Disney+ subscriber numbers came up short by some 5.4m or 5.2%. Sentiment towards streaming companies started to sour following Netflix’s disappointing subscriber expectations, claiming the pandemic had pulled forward a significant proportion of future growth. In other words, investors had their cake sooner rather than later and built in an expectation of second-helpings that failed to arrive. Now Disney+ has cemented itself as the number 1 competitor to Netflix we expect this sentiment to play a greater part of owning such a hotly-followed sector. We have previously written and presented on the battle for consumer living-rooms and entertainment budgets – it’s nice to see things heat-up as expected. Intel and Henkel both look compelling from a valuation basis. We have previously expressed concerns about Intel’s waning competitive advantage and continue to monitor the situation closely. Recently, Henkel has demonstrated impressive organic sales growth (particularly in the emerging markets) and we continue to believe the company is trading at a price that makes it attractive for long-term owners.

We introduced three new holdings into the portfolio during the quarter: GlaxoSmithKline (+1.1%, +0.0%), Dropbox (+15.7%, +0.2%) and eBay (+27.7%, +0.3%), which also happened to be Q2’s best outright performer.

Sources: Stock performance (17).

Early in April we introduced GlaxoSmithKline (“GSK”) into the portfolio. GSK is a company we have been studying for the past three years. In this quarters’ Stock in Focus, Oli explains what prompted us to take actions and discusses our investment rationale in detail.

eBay is a global online auction and shopping marketplace. The company seeks to instil trust between strangers in order to overcome the obstacles that prevent buyers and sellers transacting. Unlike other well-known marketplaces, eBay does not compete for sales with the vendors on its platform. eBay is therefore a partner to its sellers – allowing vendors to build their own brand equity on a platform with a large global customer base – creating a network effect that provides an attractive proposition for vendors, customers and eBay alike. The company has recently undergone a period of significant change where its non-core operating assets (StubHub and its Classifieds Ads business) were divested. The focus throughout the company now rests firmly on revitalising its core marketplace business and we are excited by the early results. The stock price sold-off heavily following the company’s recent earnings call (where management guided to the possibility of near-term growth headwinds as lockdown restrictions end and bricks-and-mortar shopping resumes) and this allowed us the opportunity to acquire shares at what we consider to be an attractive level for long-term holders. Currently, less than 20% of total commerce takes place online globally and this provides a significant opportunity for e-commerce business and companies like eBay in the years ahead.

Dropbox is a leading global Software as a Service (“SaaS”) collaboration platform, based in San Francisco and led by its CEO-founder Drew Houston. We think there is plenty of room for Dropbox’s profitability and revenue growth to work out better than expected, but even using only modest projections the shares are by no means expensive. Starting with profitability there are several levers to pull. As a largely self-service offering with viral adoption, the company can get away with spending much less on customer service and sales functions than most SaaS businesses, providing operating leverage as the business expands. While the company’s recent adoption of working-from-home (“WFH”) on a permanent basis will result in additional cost reductions. On the revenue side, in addition to benefitting from new secular trends in WFH that will increase the attraction of its products, Dropbox has a number of early-stage initiatives to re-accelerate growth – which are not yet factored into guidance.

GSK was initiated at a 2% weighting and eBay and Dropbox were introduced as 1% positions. These additions were funded by the combination of a partial sale of luxury goods company Richemont (on valuation grounds) and the strategy’s cash allocation.

Stock In Focus:

GlaxoSmithKline

By Oliver Tostevin

After three years of studying GSK, we added the shares to the portfolio in April. Let us explain why the time is right.

Our interest was initially piqued in late 2017 when GSK announced Hal Barron as their new Chief Scientific Officer. Dr Barron had progressed through the ranks of biotech pioneer Genentech (held in Blue Chip, via Roche) during its glory years. While we didn’t really know what was going on at GSK, this was a major hire and they had our attention. We’ve been observing Barron for a number of years now and believe him to be a science leader of the highest calibre.

In 2017, GSK also had a new leader in Emma Walmsley who had taken over from long-time CEO Andrew Witty earlier in the year. For readers who regularly scan the business pages, it’ll be no secret that GSK had started to flounder under Witty.

GSK or “GlaxoSmithKline” resulted from a series of mergers in the years leading up to the millennium. The most important constituents were Glaxo, Wellcome, SmithKline Beckman and The Beecham Group – culminating in the landmark merger of GlaxoWellcome and SmithKline Beecham in 2000, when GSK took its current general form. All of these businesses were innovators in their day and have left a lasting legacy. For example, Glaxo was a leader in respiratory medicine, Wellcome a pioneer in HIV, SmithKline a leader in vaccines while Beecham was well-known for its consumer healthcare (CHC) brands. Today GSK is number one or two in all these categories.

But with hindsight, the purported benefits of the 2000 merger were oversold. By 2017 it was evident that shareholder returns had been disappointing. Financial performance was stagnating and increasingly difficult to understand due to a series of atypical financial arrangements and joint ventures entered into by Witty. Moreover, the company’s biggest drug was about to lose patent protection, the pipeline of new medicines was disappointing and it looked like the dividend might have to be cut. The outlook was not bright!

With Barron coming aboard, we decided to take a closer look at Walmsley’s plans, and increasingly, we liked what we saw. But turnarounds of this nature can be open-ended with years before sufficient progress warrants the first step. As the great investor Howard Marks says: “being too far ahead of your time is indistinguishable from being wrong”. Eventually, in 2021, a catalyst appeared on the horizon and we acted. But let’s first look at Walmsley’s strategy.

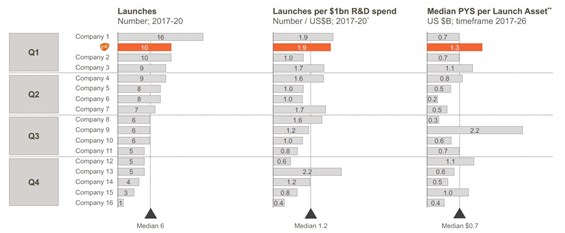

It was clear that GSK had a research and development problem – R&D being the very essence of any good pharma business. Certainly, Witty had scaled back the R&D budget and this is one explanation as to why the pipeline was lacking. But the problem ran deeper, probably resulting from the company’s patchwork history. R&D productivity had fallen such that GSK was getting among the lowest returns among its peers. Walmsley set about correcting this by elevating science and innovation to the very top of the company and its priorities. She gave us a major hint on this front when she not only recruited Barron but had him appointed to the board.

No other Big Pharma business has their top scientist on the board – it’s highly unusual. In fact the only other major pharma business we can find with the head scientist as a director is Regeneron (a Blue Chip holding) which we consider to be among the very top few most innovative pharma businesses. In short, this was no superficial move. Barron would be given the broadest of mandates to overhaul GSK’s R&D organisation and pipeline and to be heard at the highest level.

Taking a cursory glance at GSK today, it doesn’t seem like much has changed – and we suspect this is why the shares remain a stock market pariah. But this masks a sea of change beneath the surface. For one thing, 85% of GSK’s top 125 executives are new-in-role since 2017, and 30% are external hires. Make no mistake: the tree has been shaken. For all the criticism that Walmsley endures from pundits, we’ve come to the conclusion she’s excellent at hiring and surrounding herself by the right people. We’ve been impressed by the calibre of her team.

And if you look more closely, there are already signs of improvement. In addition to implementing positive cultural changes that are likely to be lasting, Barron has been ruthless in culling weaker drug programs while investing heavily in those with the brightest prospects. Productivity is on the up and the near-term pipeline is looking significantly better. For the longer-term the company has been building industry-leading capabilities in cutting edge areas such as next generation immuno-oncology, synthetic lethality and machine learning-assisted functional genomics research. We could write an entire Stock in Focus on the specifics of the R&D turnaround, but that’s for another time.

When management recently claimed that the business will now grow for the foreseeable future, we think they’re credible. Coupled with a low starting valuation, the scene is set for compelling shareholder returns and for the quality of the underlying franchises in HIV, vaccines and other categories to become clear.

Earlier this year GSK committed to divesting its CHC business in mid-2022, and this was the catalyst we were waiting for. The separation will achieve a multitude of ends. First, it will make GSK’s financials easier to understand.

Second, it will likely release significant value because as a business with very dependable cash flows CHC is likely to attract a value premium similar to Unilever or Reckitt Benckiser. Third, for the same reason CHC can support a larger allocation of the group’s debt, leaving increased financial resources for the pharma business to invest in growth. Finally, with the separation due to be by “spin-off” we will directly receive shares in the world’s largest CHC business and effectively get them for free, on account of the low price we paid – not a bad deal!

Fund In Focus:

Ashmore Frontier Markets

By Shannon Lancaster

Over the first half of 2021 we witnessed the recovery of some previously unloved regions. During the first quarter of this year, Polar UK Value Opportunities enjoyed strong performance as the UK rallied. The UK has performed exceptionally well since the start of November when Boris announced the region’s lockdown pathway exit strategy.

Across the pond, and a quarter on, two other unpopular regions have performed very well. In our Balanced and Growth strategies we have some exposure to Latin America through our Brown Advisory Latin America Fund, which has enjoyed healthy returns over the past six months – mainly because of positive news from Brazil. Latin America markets fell very hard over 2020; however, they seem to be turning a corner and the Fund remains a useful thematic lever in our portfolios.

We have spoken in previous commentaries about how frontier markets tend to lag both developed and emerging markets, and this is exactly what we have witnessed this year. After a period of sluggish performance, Ashmore Frontier Markets was one of our portfolios’ best performers across the quarter, up 7.2% (18), once again highlighting the importance of “sticking to your knitting” and maintaining a diversified portfolio.

What Exactly is a Frontier Market?

Frontier markets are economies in the developing world that are less established than emerging markets. Many frontier markets do not have mature stock markets, are usually smaller in size, less accessible, and ordinarily riskier than emerging markets.

Frontier markets are home to fast-growing economies, relatively cheaper valuations and can be a great source of diversification for portfolios. There are several unique characteristics and challenges that investors in frontier markets must consider, including: political instability, poor liquidity, inadequate regulation, substandard financial reporting, and large currency fluctuations. A team with a strong bottom-up process and excellent onthe- ground knowledge can be very beneficial and something we would consider essential when investing in this space. Ashmore’s roots can be traced back to the 1980s and, as a house, it specialises in both emerging and frontier markets. It has a truly global presence and team-members are based all over the world – from the fund manager we visit in London to the analysts who reside in Saudi Arabia.

What Does the Fund Own?

Ashmore has holdings across many countries such as United Arab Emirates, Kenya and Pakistan. Its largest country exposure is Vietnam, which has developed its manufacturing and trade capabilities in recent years to become an important part of the global manufacturing supply chain. This has brought increased foreign investment in domestic businesses, enabled a strong currency, accelerated Gross Domestic Product growth, increased exports, and elevated the beginnings of a middle-class consumer. All these improvements lead to attractive investment opportunities.

The Fund also has exposure to Qatar, a small wealthy nation with one of the largest natural gas reserves in the world. It has recently shown its resilience by successfully navigating an embargo from its Gulf neighbours (which arguably only made it stronger) – size and wealth enabling it to easily manage Covid-19.

The Fund owns businesses that enable frontier-to-emerging-market progress, for example: banks that allow populations to open account to spend and/or save; online payment providers or ecommerce businesses that promote the move to digitalisation; and, health care companies that allow consumers access to modern medicine.

Outlook

The Ashmore team has a positive outlook for frontier markets based on the belief in faster-than-average economic growth, strong demographics and multiple opportunities for structural change, combined with low hanging fruit in governance, regulation and policy reform. As the regions develop, the investment opportunities will continue to grow. While progress in frontier markets will almost certainly not be a straight line, they can follow the path made by innumerable emerging-market countries who have already made the journey.

Overall, the Ashmore team exhibits all the qualities we seek. They are fundamental, bottom-up, stock-pickers with in-depth, local, knowledge of the region and a repeatable process. We are very positive about both the outlook for the Fund and our ongoing investment.

Boscher's (Bite-Sized) Big Picture:

Inflation is the key issue but the jury's still out

By Kevin Boscher

Equity markets have continued to make solid gains this year despite headwinds including higher bond yields and rising inflation – and the delayed vaccine rollout in a number of countries. Whilst there is little debate on the strength of the recovery in activity, views are becoming increasingly polarised on the future path of inflation. In my view, the most important issue facing investors is whether or not the current rise in headline inflation numbers is transitory or set to evolve into a longer lasting and stronger trend.

As the US and other global economies re-open and start to normalise, it is clear that a range of economic indicators are being significantly distorted by surging demand across a number of goods and services together with supply-side bottlenecks and shortages. In the post-pandemic world, it will take some time for these distortions to work their way through the system. Alternatively, they could represent the start of a sustained inflation uptrend that will have major consequences for the global economy and financial markets.

Central banks, led by the Fed, believe that recent price moves are not necessarily reflective of a long and enduring demand or supply shock. They are also acutely aware of the secular forces at play putting downward pressure on inflation, including high debt levels, an ageing demographic, excess savings and technological disruption across many industries. For all of these reasons, central banks – correctly, in my view – see the rise in inflation as transitory and will stay accommodative. Markets tend to agree with this assessment at present.

The main argument for inflation becoming a more persistent and longer term issue revolves around the fact that the powerful economic recovery will bump up against supply-side constraints and put upward pressure on inflation. This has similarity to the 1970s, but the main difference is that, now, the economy is recovering from a deep shock and recession; back then, it was already booming and the inflation “genie” was out of the bottle.

Rising commodity prices are also a risk but should not be exaggerated. Psychology could also play an important role here as inflation expectations start to rise, encouraging consumers to bring forward purchases, hold less cash and demand wage rises at the same time as companies, expecting higher input costs and selling prices, hold more inventory and working capital.

It’s true that US household savings (and global savings generally) are at record levels thanks to higher asset prices, reduced consumption and Covid emergency payments. However, there is no certainty that consumers will embark on the expected spending boom since the outlook is still hugely uncertain.

Consequently, companies are unlikely to increase investment significantly until the Covid-related confusion clears – and before they have more clarity regarding the longer-term prospects for supply and demand. For similar reasons, banks are likely to stay cautious about significantly expanding credit.

From a monetarist perspective, US money supply is firing on all cylinders and theory dictates that “inflation is always and everywhere a monetary phenomenon.” This school would argue that excess money will eventually lead to a pick-up in the velocity (circulation) of money, which is a key component of rising inflation. This could happen over time, but, again, is not a given.

Surging money supply does not automatically lead to higher prices if the excess funding is saved rather than spent, which has been the case for most of the past two decades. Like everything in economics, you have to look at both demand and supply. Even if the supply is increasing, the demand for money can fall resulting in higher savings and falling velocity. Indeed, it is becoming increasingly evident that the velocity of money is largely a function of interest rates and has therefore collapsed along with falling price-inflation.

It’s incredibly difficult to look through the Covid-related haze and determine the future path of inflation with any degree of certainty. Not even central banks have much conviction, although they clearly lean towards the current uptick being transitory. We need to remember, however, that both governments and central banks want higher inflation to grow their way out of the debt problem.

Having been in the disinflation camp for the past 20 years or so, I am struggling to change my views. I am watching three things in particular: first, will consumers actually go on that massive spending spree and draw down of their savings? Second, will the huge US fiscal spending plans materialise and persist beyond the next year or so? Third, will we see the second-round effects coming through over time? I am also conscious that the inflation picture in the US is likely to be quite different to that in Europe and Asia. With China modestly tightening, it’s possible that any excess US spending will be accommodated by a widening trade deficit and/or a weakening Dollar rather than through higher inflation.

In the meantime, global reflationary momentum continues apace and I remain positive on both the economic and market outlook. Markets always find lots of reasons for concern, but I still expect equities to “climb the wall of worry” and grind higher over the next 12-18 months with the rotation into value and cyclicals continuing. Our long-term themes based around the ageing demographic, increased healthcare spend, technological revolution, environmental challenges and growing wealth of the emerging consumer remain very attractive investments. In the near-term, we could see some weakness due to a number of factors; however, any weakness would likely prove to be another opportunity to add to equity weightings, as has been the case for some time. Longer term, caution is required as rising inflation on a persistent and structural basis is probably the key risk that threatens the optimistic macro picture and markets. Hence, we need to monitor this risk closely and ensure that we have the appropriate balance in our portfolios as we navigate our way through the fog.