This Christmas, give the best gift that money can buy… time

I will concede that the title might be a bit clickbait and I will disclaim now, within the first sentence, that I unfortunately do not possess the secret to eternal youth (I can recommend some good face creams though).

This article won’t be based on giving time in the literal sense, of more weeks and months alive on planet earth, but more in the context of investing and, while there are obviously other important factors to consider, how time can be your best friend when it comes to growing the value of money.

Many of you, like me, will have children, grandchildren, nieces, nephews, godchildren and so on. Rather than buying them the latest toy or tech trend for Christmas or for their next birthday, have you ever considered giving them the gift of time? I will explain…

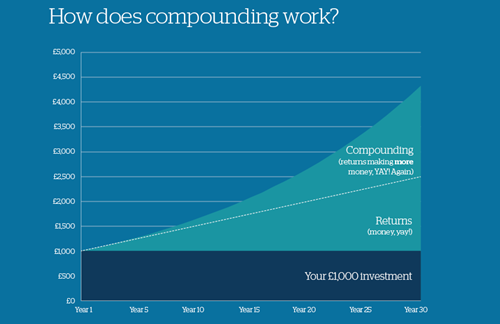

I have written many times about the power of compounding and how getting a return on your return is an extremely powerful force. The chart below sums this phenomenon up very succinctly:

This illustration clearly shows the difference between investing and not investing. Admittedly the example is hypothetical and simplified – investments can obviously go down as well as up and the journey is rarely this smooth – but the force of compounding is powerful and should not be ignored. As illustrated above, when you get to the point that your returns are generating returns, your investment pot starts to grow exponentially. This undoubtedly requires a level of patience– Charlie Munger famously noted that “the big money is not in the buying or selling, but in the waiting”.

Could you be in a position to gift this concept to someone in your life? Most children under the age of 18 are not, in my experience, in a position to be thinking about investing. But could/should you be doing it on their behalf? Many people that I speak to are already saving for the children in their lives but have not necessarily considered investing on their behalf.

During the pandemic, there was an overall increase in the number of millennials and Generation Z taking control of their finances and investing, which was partly due to reduced spending as they were stuck at home. While these age groups (up to 25 and 26-40 respectively) are well-positioned to start investing – the phrase ‘better late than never’ still holds true – there’s no denying that earlier investment allows your money to work harder.

Warren Buffet “I made my first investment at age eleven. I was wasting my life up until then.”

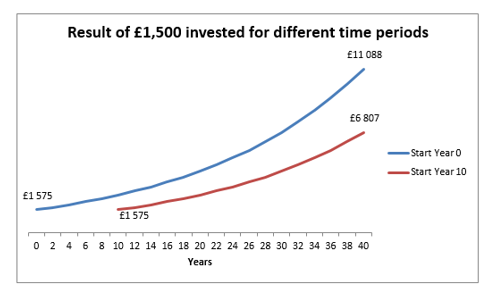

The chart below is another way of looking at how the amount of time an investment is left for can meaningfully affect the value over the longer term:

Giving the gift of time could help your child pay towards further education, buy their first home, or even start their first business.

At Ravenscroft we provide a means for people to put money aside for future generations and we aim to make the process as straightforward and administratively low maintenance as possible. If you would like to discuss the opportunities available to you, please do get in touch.