Ravenscroft supports Likewise Group in move from TISE to AIM

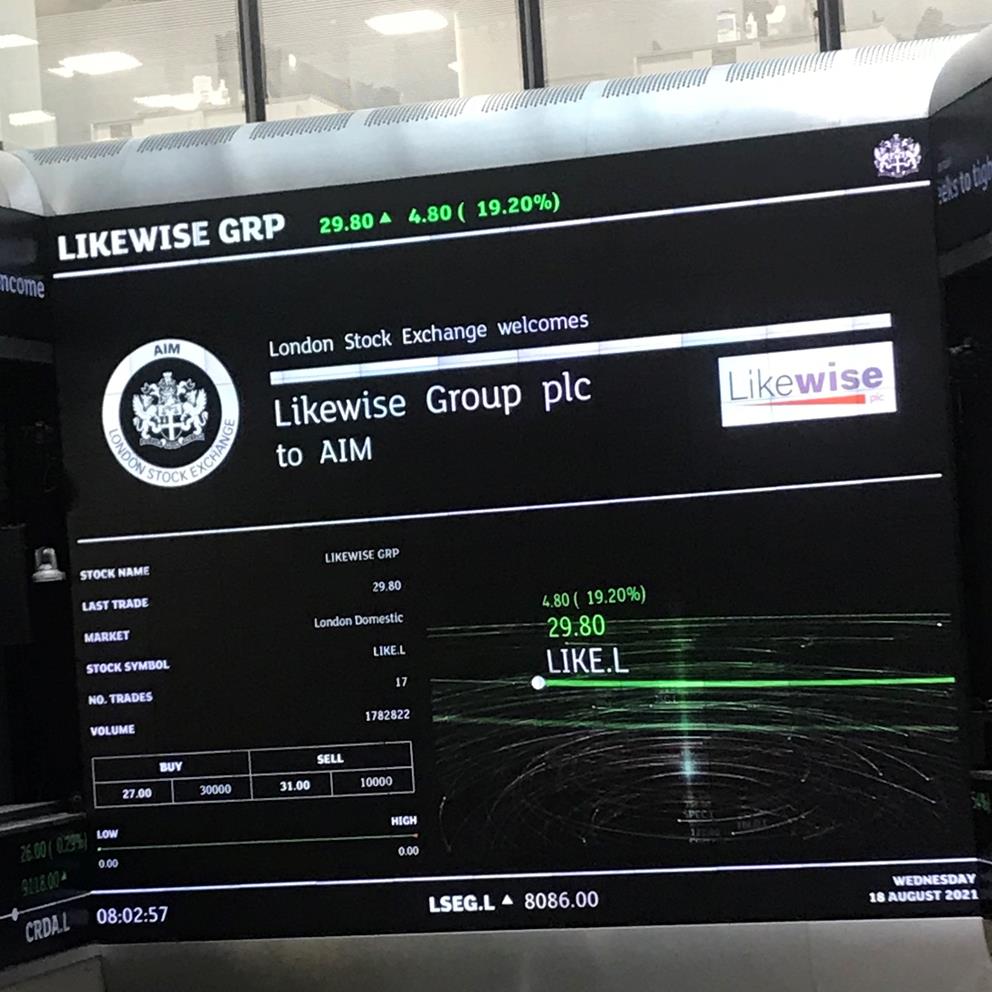

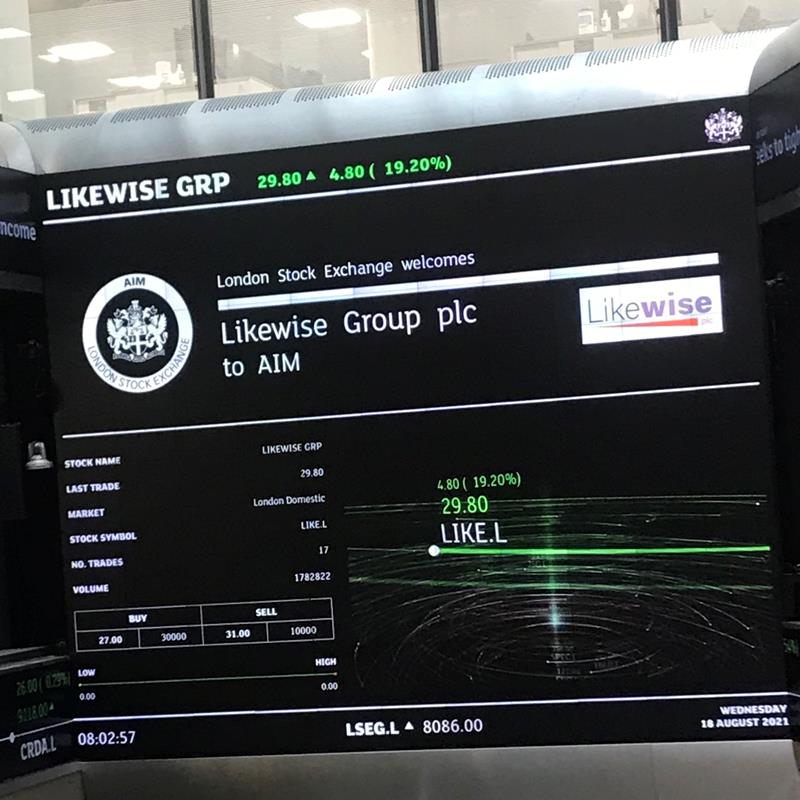

Ravenscroft has helped Likewise Group PLC, the fast-growing UK floor coverings distributor, to list on the AIM market of the London Stock Exchange and raise £10 million for future growth. At the Placing Price of 25 pence per share, Likewise’s market capitalisation was approximately £48.1 million, and the value has risen since.

Likewise had been listed in the Channel Islands on The International Stock Exchange (“TISE”) in January 2019, with Ravenscroft acting as listing sponsor. Ravenscroft has now acted as joint broker with London’s Zeus Capital for the placing of £10 million new shares, raising £4.5 million from Ravenscroft clients.

‘Likewise is delighted to be listed on AIM in order to create access to capital and accelerate our growth aspirations. We would like to thank all our advisers, particularly Ravenscroft and TISE, Zeus Capital, Gateley Legal and Crowe UK,’ said Tony Brewer, chief executive of Likewise.

‘We very much appreciate the endeavours of our excellent management and staff to establish the business in the last three years. Particular thanks to our suppliers and customers for their support in our brief history to date and we look forward to continue developing that relationship to our mutual benefit in the future.’

Likewise’s success has been through challenging the industry’s established competitors by providing access to a wide choice of flooring from multiple manufacturers across the globe at competitive prices for its customers. The directors believe they have an opportunity to build a business of national scale and over time become a strong alternative to the current larger industry competitors within the sector.

Ravenscroft will continue to be involved with Likewise as a consultant as the group moves forward with its expansion and Jon Ravenscroft, group CEO of Ravenscroft, said Likewise’s success demonstrated the benefits of listing on TISE as a gateway.

‘Having previously listed on TISE in January 2019 with a market capitalisation of £12 million, Likewise has been able to take advantage of the many benefits of being listed and this has led to them completing a number of acquisitions and raising additional funds,’ he said.

‘TISE is a fantastic enabler for companies wanting to raise capital but who are not yet suitable for AIM and we hope more companies will be inspired to follow the same path. Having worked with the Likewise team for three years, we congratulate them all and look forward to continuing to be a part of its future success.’