Weekly update - Polar opposite

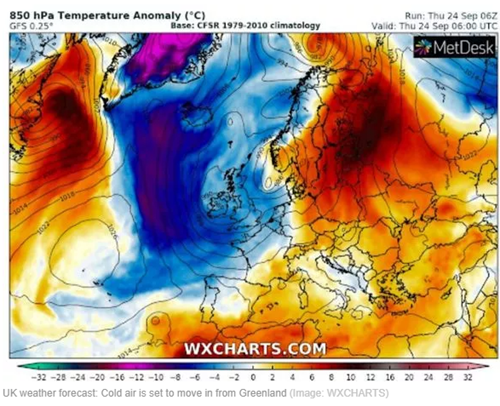

2020 has certainly been a year of extremes. In the space of just a few days last week, we have gone from basking in board shorts in late summer heat to donning fleeces to protect against an icy Arctic blast. Earlier in the month, Jersey made a record for the latest day in the year to hit 30 degrees celsius. Meanwhile in the US (always one to do things bigger and better!), Denver went from an 101F heatwave to blizzards and below freezing temperatures within 24 hours. And if that isn’t extreme enough, the 2020 Atlantic Storm season looks to become one of the stormiest on record as the slightly less than sinister sounding Wilfred has long since fizzled out leaving us delving into the Greek Alphabet for only the second time in history. Beware which way the wind blows!

Source: NOAA and MetDesk - 28th September 2020

Similarly in the stock markets, despite enormous economic, political and social damage wrought by Covid-19, certain sectors and markets are seemingly enjoying a never-ending Indian summer whilst others are left frozen out in the cold.

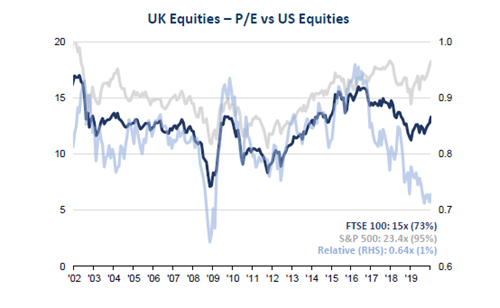

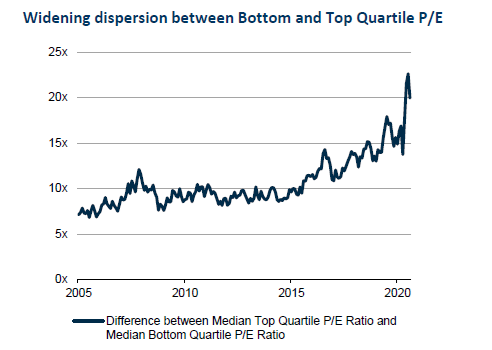

Tech heavy US markets have outperformed almost every other major exchange despite Donald Trump’s questionable handling of the crisis and a looming US election which is as close a call as any. The Nasdaq leads global equity markets up 22% year to date and contains many businesses who are clear beneficiaries from the crisis, although an additional $3 trillion of QE4 USD liquidity has no doubt helped puff things up further. These dollars have to go somewhere and will flow most freely to the most liquid assets. The effect of this is to increasingly polarise financial markets between the haves and the have nots. By contrast, already underperforming UK markets have become cheaper still with the FTSE-100 falling 22% year to date in perfect but less than summery symmetry. It stands to reason that with technology representing just 1% of the FTSE All-Share versus over 20% in the US S&P 500 (Source: Herald Investment Trust) that UK markets would likely underperform. However it is not just the markets that are increasingly polarised, it is the stocks within them.

Take food retail as an example, clearly a global beneficiary of the Covid crisis, as people eat out less and stockpile more, sales have surged. However the two biggest retailers in the UK by market capitalisation show stark contrast in performance and valuation. Both Ocado and Tesco are now c. £21bn companies. Both are major online food retailers, with Tesco actually being the much larger. 2020 has been a hot year for Ocado with the shares leading the FTSE-100 and rising 121%. Cooler and decidedly less cool Tesco shares have also outperformed the broader market but by contrast their shares have actually fallen 8% in 2020 despite the retail behemoth’s revenues jumping over 9% at the latest count. Ocado could of course become a global success story and attain a far higher valuation, but they are scarcely profitable and do not yet even dominate their domestic market. Tesco meanwhile has long since taken that particular crown and it’s £4bn of annual EBITDA is some 100x that of Ocado. It seems the market would rather pay for a story than fact which, if nothing else, must make Ocado shares riskier as the future is notoriously hard to predict.

Source: Tellworth British Recovery & Growth Trust IPO docs & Exane BNP Paribas - 28th September 2020

The consensus view is that UK equities are generally cheaper than their global counterparts although the global investment community does not currently seem interested in taking advantage of this valuation disparity as asset flows continue to leave UK equities by the billions. This has led to the demise of some of the most renowned and high profile supporters of UK equities including Neil Woodford and Alistair Mundy and the giant funds of Invesco’s Mark Barnett and M&G’s Tom Dobell. It is not just between markets and sectors where price dispersion is at record levels. Whether positively or negatively impacted by COVID, virtually all UK market sectors trade at a discount to global markets (Source: Tellworth/Exane BNP). World leading UK listed consumer goods, pharmaceuticals and tobacco companies unfortunate enough to be listed in the UK all trade more cheaply than their global peers on most metrics. Pricing anomalies do however provide opportunity.

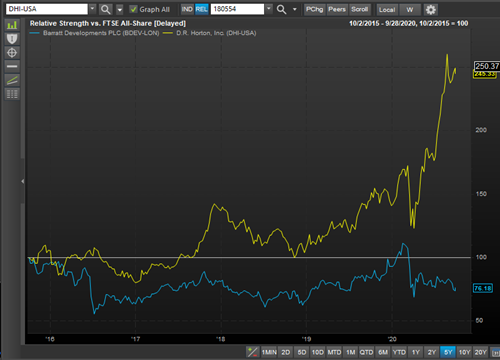

One sector we follow particularly closely is house building. It is a sector likely to benefit from Covid-19, both in the form of record low interest rates and therefore mortgage affordability and also from record fiscal stimulus as governments seek to kick start their stuttering economies by stimulating a sector which directly boosts the domestic economy and is close to everyone’s hearts.

Just as Margaret Thatcher won over a new generation of voters from encouraging a new generation of home owners (before moving out of Number 10 to her new Barratt home), the current government is using the Maggie Playbook and has become the most pro-housebuilding government since her time. The structural dynamics of new home construction are similar in the US and UK, if anything the UK has a larger structural shortfall due to decades of under-build post the Thatcher era. Both countries are not building enough new homes to house the increase in population and house-builders cannot expand output quickly given the long lead times and so typically they sell everything they build. Despite dire predictions, house prices have surged in both nations and last week US housing inventories fell to their lowest levels since 1963. Again though the performance of the largest US House-builder D.R. Horton bears a stark contrast to that of the largest UK house-builder Barratt Developments. Both are excellent businesses in their own right, they both enjoy many of the same trends and both have experienced a full V shaped recovery in trading in 2020, however their respective share price performance since the onset of the Covid-19 crisis in March is not just from a different continent but a different planet, with the hot D.R Horton outperforming a decidedly chilly Barratt by over 100%. Barratt shares are down 37% year to date and have even underperformed the FTSE All share despite having minimal balance sheet risk and essentially not losing any sales.

Whilst we expect both companies to benefit from the crisis and its aftermath, we believe the better opportunity and more importantly risk / reward profile lies in the unloved UK with Barratt.

The greatest single determinant of future equity returns is the starting price one pays (per Nobel prize winning economist Robert J. Shiller) and on any metric we consider Barratt to be cheap notwithstanding the risks of a slower UK economic recovery and a protracted regional or indeed national lockdowns.

Please note past performance is also not necessarily a guide to the future performance of an investment.

Continuing the house-builder discussion, one “bear case” we regularly hear when discussing the sector is that it will suffer from rising unemployment which is undoubtedly a major consequence of the COVID crisis. Clearly this has a negative impact but we believe it is less important than mortgage availability and affordability which has never been better. Unemployment is also much higher in the US than the UK and ultimately people have to live somewhere, with someone somewhere either paying the rent or mortgage cost. One sad outcome of Covid-19 is a sharp rise in homelessness in the UK as people lose jobs, suffer broken homes or escape domestic abuse. Homelessness was already a rising trend pre-crisis and now it is believed that 320,000 people are either sleeping rough or in homeless shelters across the UK making this one of the major problems of our time. We are therefore pleased to be able to participate in the IPO of HOME REIT, a new £250m London listed investment trust seeking to convert and invest in homeless accommodation across the nation and rewarding investors with a healthy dividend yield funded by 100% government backed cash-flows.

Sources: Factset unless stated - 28th September 2020

FINANCIAL PROMOTION: The value of investments and the income derived from them may go down as well as up and you may not receive back all the money which you invested. Any information relating to past performance of an investment service is not a guide to future performance.