Boscher's Big Picture - Is the recovery stalling or pausing for breath?

In his latest commentary Kevin Boscher, chief investment officer, looks at Covid-19, the US election, fiscal packages, large cap growth stocks & 2021

The performance of global equity markets has been mixed over the past quarter. The US and emerging markets have generally continued their recovery, whilst the UK and Europe have lagged. In addition, September has been a tougher month for many stock markets due to a number of factors including a renewed spike in the number of confirmed Covid-19 cases across Europe, the failure of US Congress to agree another fiscal package and the looming November presidential election. Mega-cap growth stocks, which have led the recovery since the March lows, have also seen the biggest declines over recent weeks.

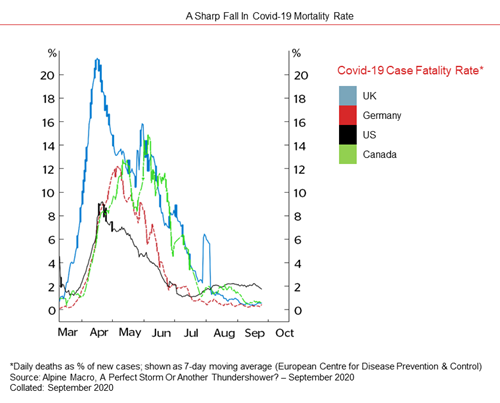

It’s true that rising coronavirus infections in Europe are an obvious concern and threaten the ongoing economic recovery. However, importantly, hospitalisations and, in particular mortality rates, are staying surprisingly low. Fatality rates across most developed countries are significantly lower than was feared and predicted at the start of the pandemic. There are most likely a number of reasons for this such as increasing infections in younger and healthier people, better treatment protocols and procedures and improved preparedness of hospitals and health staff. In addition, the rapid increase in testing has inevitably led to higher detection levels, which has enabled the case fatality rate to converge to the true rate, which might have been low to begin with.

Whatever the reasons, the sharp decline in mortality rates has strong implications for public policy. Although the policy response varies from country to country, any restrictions or lockdowns are likely to be significantly less draconian and more measured than what occurred back in March. With improved knowledge and more accurate data, governments are better able to balance the short-term health risks against the longer-term and severe threats to the economy, jobs, social structure and health. Some countries are also joining Sweden in opting for “herd immunity” and managing the health risks through a number of measures. It goes without saying that the imminent availability of a vaccine, which remains a realistic hope, would be a game changer for the global economy, policy and financial markets.

The failure to pass another US fiscal package poses a material threat to the economic recovery, since removing fiscal subsidies today could lead to a significant decline in disposable income. US consumption accounts for about 70% of GDP, so any hit to consumers would likely have a material impact on growth. To some extent, most middle-income Americans can run down their savings to sustain their spending, but the lower income earners would again bear the brunt. Hence, more fiscal subsidies are required to bridge the income gap, which is why Fed chair Powell is pleading with politicians to take aggressive action quickly. The good news is that both sides are still talking but there is a growing risk that electioneering and the Senate focus on appointing a new Supreme Court judge will delay any deal until well past the election. If this is the case, then it is not all bad news since falling unemployment, rising consumer confidence and increasing investment should partly offset the decline in fiscal support.

Next month’s presidential election remains too close to call and Trump appears to be closing the gap. Trump looks to have been more effective in energising his base whilst Biden’s campaign has been largely uninspiring so far. It would appear that the race will likely be very tight and the probability of either candidate winning a landslide is small. This means that the odds of a contested result are rising and the risk of political or social instability are increasing. In a recent press briefing, President Trump refused to commit to a “peaceful transfer of power”, raising the spectre of a potential constitutional crisis or social unrest. In my view, this is the biggest risk for the US and global economies and financial markets at present. Having said that, the US system is designed to force a result within weeks of an election and it will be unlikely that Trump can cling to power if he loses. Whilst there is a risk that an unconvincing or unpopular result will trigger street protests, hopefully this would not be long lasting and history suggests that such an outcome would have little longer-term impact on markets. In addition, whatever the result, the new President and Congress will need to focus on ensuring the recovery continues and both monetary and fiscal support will stay very supportive.

The recent weakness in stock markets could last a bit longer, especially if Covid-19 hospitalisation or death rates start to rise or the US election ends in chaos. However, I believe the global economic and market recovery remains on track beyond the short term. The broad trend in the world economy is getting stronger and so any weakness in the US arising from a lack of policy support should be temporary. Governments are unlikely to pursue total economic shutdowns again, even if the virus gets worse, and will instead manage the threat. In the meantime, the Chinese economy is bouncing back very strongly from the crisis and is likely to end the year in positive territory. China has virtually eliminated Covid-19 infections and the government has begun to inoculate the population. Also, the Chinese authorities have so far been quite prudent with their fiscal and monetary stimulus and there is lots of scope for China to materially ease policy further over the coming months, if needed.

Elsewhere, monetary and fiscal policies remain hyper-supportive and global reflation is in full force with more stimulus likely. In addition, bond yields and interest rates remain at very low levels and real interest rates are deeply negative. This is very likely to stay the position for several years to come. Many central banks, led by the Fed, are now explicitly targeting higher inflation and this will keep rates lower for even longer. Financial repression, whereby central banks force, and keep, rates very low across the maturity curve and exert pressure on investors to seek more risk, is here to stay. The combination of extremely low rates, plentiful liquidity, lower energy costs, a weaker dollar and pent up demand is a powerful combination and will fuel the ongoing recovery.

A factor in the recent weakness in large cap growth stocks has undoubtedly been a partial reversal of the flood of retail money from “Robin Hood” and options investors on the back of some profit taking or forced margin selling. This may have further to go since some of these trades remain overbought and in need of a correction to work off their excesses. It is also important to remember that stocks often go through a number of 5-10% corrections during bull markets, especially when the conditions are in place for “manias” and “bubbles” to exist, as they are today. However, institutional investors are sitting on a huge pile of cash and with money market rates deeply negative in real terms, there is no viable investment alternative to stocks. At the same time, most sentiment indicators remain subdued indicating that investors are not overly optimistic about either the macro background or market direction.

Hence, it is likely that much of this cash will move back into equities once some of the current uncertainty eases.

I believe that the global economic and market recovery will continue into 2021 on the back of aggressive reflationary policies, plentiful liquidity and the gradual emergence of economies from “lockdown”. Should an effective vaccine for public use be approved in the near future, then we may well see a “recovery boom” take hold. Given the short-term concerns and risks, and in the absence of a vaccine, it is likely that economic activity will recover step by step rather than in a “V” shape, but sentiment and confidence will gradually strengthen. Similarly, stock markets may have further to fall in the short term and it makes sense to offset some of the known threats through holdings in sovereign bonds, including index-linked issues, gold and higher than normal cash levels. For long-term investors, the current uncertainty and market shakeout is creating another opportunity to deploy liquid capital and add to equity positions. If these views pan out, then cyclicals and value plays may well become the new market leaders. However, our preferred long-term themes including technology, healthcare, emerging markets and gold look as strong as ever and should continue to deliver superior returns for our clients.