Weekly update - All about the rates

Pierre Paul, head of our cash management team, which last week was named Investment Specialist of the Year by Captive Review, explains more about rating agencies and what they mean for investors.

Bank accounts; we all have one (or more!) and most of the time never think about the safety of the money in those accounts so long as there is enough to pay the bills, tap your card in the shop and draw cash from the hole in the wall. Historically a bank failure meant depositors losing some or all of their balances and whilst unfortunate, most failed banks were relatively small, therefore the systemic impact of failure was limited. Investigations into the failure might lead to new legislation and tighter rules but very little in the way of compensation for depositors. More recently, bank mergers and acquisitions turned high street banks into systemically important financial institutions and, when Northern Rock, RBS and HBOS went bust in 2008, the authorities realised that they could not stand by and watch millions of depositors lose their savings due to the failure of these regulated banks. Consequently, taxpayer-funded bailouts secured Northern Rock’s depositors and kept Lloyds (the new owner of HBOS) and RBS afloat.

Subsequently, many commentators argued that bailouts create a moral hazard, meaning depositors don’t need to be concerned about the financial stability of a bank and could therefore chase the highest interest rates, safe in the knowledge that if the bank goes bust then the authorities will provide a rescue package. This led to the authorities demanding the main high street banks split their retail business from their corporate business; the safer retail operations becoming “ring-fenced” from the riskier corporate banking activities. Depositors with the ring-fenced arms are now afforded the greatest protection but the lowest interest rates.

But what of the days before ring-fenced banks and limited access to financial information from the myriad of banks that once proliferated as countries used the power of the Industrial Revolution to expand trade and economic development? In those days there was very little financial protection, and sensitive information was in the hands of a small number of insiders who were able to move quickly to secure the safety of their cash - leaving outsiders to suffer the losses!

An 1837 financial crisis saw the formation of mercantile credit agencies who would rate the ability of merchants to pay their debts and eventually led to the publication of separate ratings guides by John Bradstreet in 1857 and John Dun in 1859. Credit information on merchants was useful but as the United States railroads grew, they were often funded via the issue of corporate bonds which led the credit agencies to rate these railroad bonds. The growing railroad industry led to a massive increase in companies issuing securities, which resulted in companies founded by Henry Varnum Poor and John Moody publishing compilations, in 1907 and 1909 respectively, of financial data about railroad and canal companies and their bonds. In 1913, John Moody’s company expanded its focus to include industrial firms and utilities and began to start using the letter-rating system familiar to today’s bond investors.

Those early names still exist; Dun & Bradstreet provides commercial data, analytics and insights for businesses, and the rating agency names of Moody’s and Standard & Poor’s remain today’s industry leaders from their humble beginnings of assessing the credit worthiness of merchants and of the bonds of the railroad companies that opened up the Wild West.

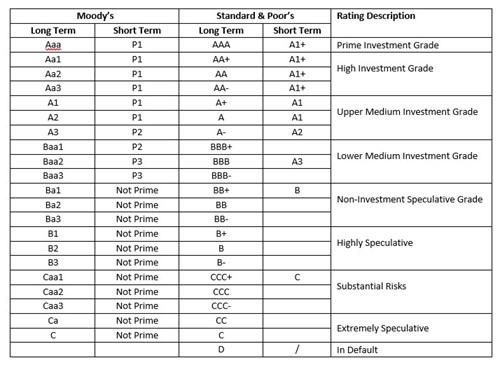

More prosaically here is the ratings league table, which is now used to compare the credit worthiness of governments, banks, building societies, corporates and their associated bond issues:-

The coveted “Triple A” rating is limited to a handful of Governments and Supra-National entities such as the European Investment Bank and their respective bonds.

Ravenscroft Cash Management team only deals with “Investment Grade” banks and we subscribe to Moody’s and Standard & Poor’s which gives us the right to use their ratings in our Client Agreements, in client reports and in articles.

Being a subscriber does not make us complacent about bank safety and the security of our clients’ cash as we are always alert to trends which may indicate systemic or institutional stress, be that signalled by unusual interest rate activity or by good old coffee house banter.