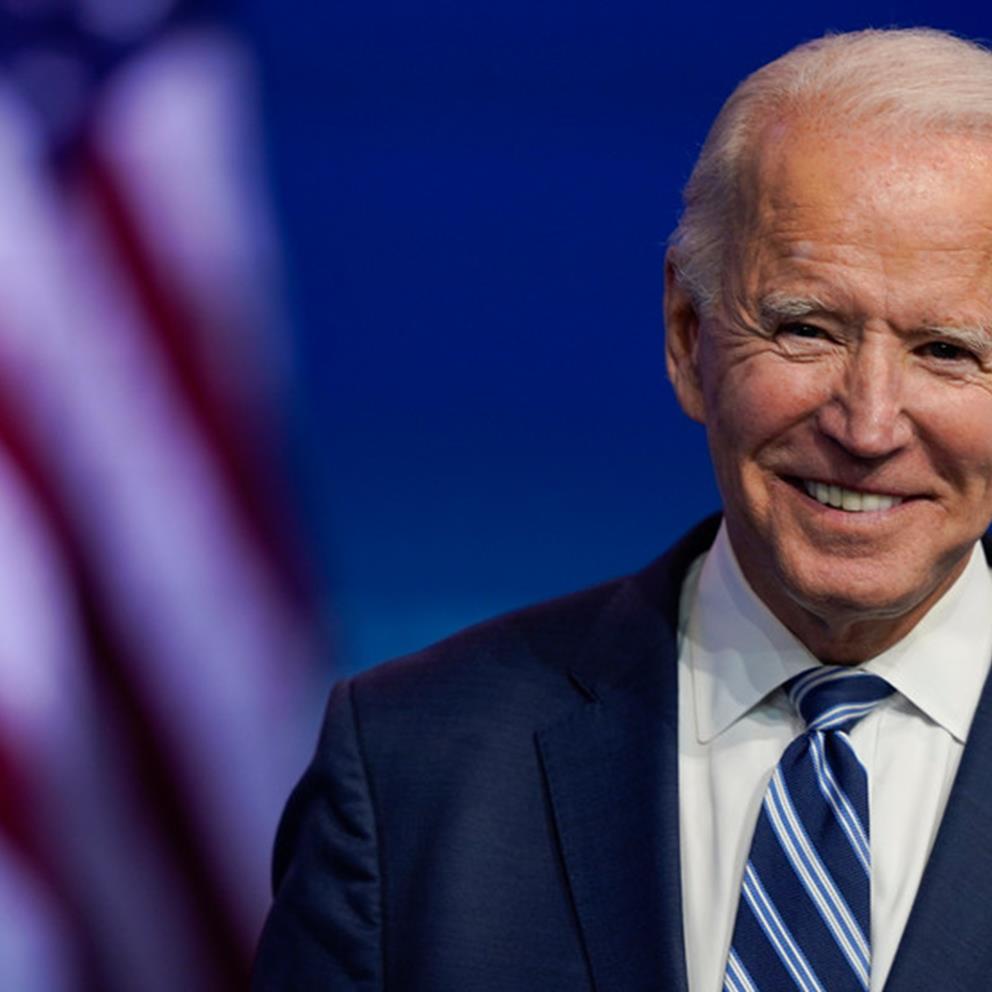

Weekly update - Biden & blue chip brands

In this week’s update, Holly Warburton from our discretionary investment team looks at the impact of a new president on the Blue Chip companies in our Huntress Funds

It has now been a couple of weeks since the United States voted in their new president, Joe Biden, and although one person in particular has yet to formally acknowledge the result, markets have certainly had the time to react. With announcements of two highly effective Covid-19 vaccines immediately after the election and in quick succession of each other, the much-anticipated political outcome has not really had a chance to be the focal point yet.

Now, as regular readers will know, such an event has very little impact on how our discretionary portfolios and Huntress Funds range are managed; preferring to navigate markets without predicting or positioning portfolios in an attempt to benefit from political events, although we choose to be mindful of any potential impact these proceedings may have.

Biden’s key policies highlighted throughout his campaign included: investing into green energy and the prevention of global warming, building on international relations and immigration, tax increases and healthcare rights - but how could these policies impact our selected Global Blue Chip companies? In this note, we briefly discuss some of the key changes he has proposed and the possible impact they may have to a selection of our holdings within our direct equity strategy and the Global Blue Chip Fund.

Firstly, his view on climate change couldn’t be further from that of Trump’s, he has referred to it as an existential threat, and is vowing to re-join the Paris Climate Accord and rallying the rest of the world to do the same. Along with a proposal to invest into green technologies research, he plans to fund more tax credits for those who buy electric vehicles (EVs) - a topical subject in the UK this week! – and dramatically increase the number of public charging points. This has the potential to help manufacturers of EVs, including our new holding BMW, which are investing billions into developing electric models but are still selling small numbers relative to the incumbent petrol/diesel powered vehicle. Currently, approximately 20% of BMW sales revenue come from the US[1], but with the Company’s commitment to its electrification strategy, its strong brand identity, technical prowess and Biden’s broad EV support, this certainty has the potential to greatly improve.

‘Big tech’ has also been a talking point throughout the election, with many policies likely to impact the industry from anti-trust pressures to immigration, but there is yet to be a definitive decision about whether the net effect will be positive or negative. Optimistically, Silicon Valley are said to be pleased about Biden’s more open stance on immigration, as the industry on the whole relies on skilled workers and engineers from outside the US – perhaps tellingly, the CEOs of Google and Microsoft, who are both immigrants, and the workers at those firms (both Blue Chip holdings) are said to have donated three times more to Biden's campaign than to Trump's[2]. In a similar vein, as an attempt to build on international relations, he is expected to take a softer approach on issues relating to China and ongoing tech war; don’t expect a repeat of Trump’s take on TikTok, which is expected to reduce the risk of companies losing sales from a key Chinese market. This should be positive news for companies such as Intel, as from a revenue perspective, the majority, approximately 27%[3], comes from mainland China. Conversely, the main concerns are likely to be higher corporate taxes (this won’t just affect the tech sector) and increased regulations.

Healthcare has long been a contentious issue in the US and that is without the added complication of a global pandemic! It is expected that Biden will take his time to change any healthcare policies with the primary focus being a Covid relief bill and the wide deployment of an effective vaccine. Roche and new addition Regeneron are both in the spotlight as key providers, in terms of testing kits and drugs that assist patients recover from the illness respectively, working in partnership to offer a solution to the US. Not only was Regeneron’s experimental therapy used to treat Trump, they are said to be in touch with the US Food and Drug Administration and Joe Biden’s Covid-19 task force daily as they wait for final approval[4]. After that small feat (!), the focus is likely to fall back to the Affordable Care Act (ACA), a law which Obama passed in 2010[5] with Biden by his side as vice-president. Biden is said to want to continue to build on this reform to increase competition, reduce costs, and make the system clearer for the US public.

As with any presidential change, it is likely to cause initial uncertainty for markets as they weigh-up the pros and cons of the new candidate’s policies. However, we are comforted to know that many of our selected companies have been through this multiple times before and are in a position to adapt and evolve to the ever changing landscape.

[1] Factset

[2] https://edition.cnn.com/2020/11/04/tech/big-tech-joe-biden/index.html

[3] Factset

[4] https://www.aljazeera.com/economy/2020/11/17/regeneron-roche-tested-manufacture-of-covid-drug-trump-used

[5] https://www.healthcare.gov/glossary/affordable-care-act/