Is now the right time to invest?

While the world tackles one of the biggest public health crises in living history, investment commentators are beginning to consider that the pandemic will last far longer than first anticipated and that we are now facing one of the most challenging and uncertain environments for financial markets that we have experienced for decades.

Whilst the meltdown in risk assets over recent weeks has been brutal and fast, it has prompted an aggressive response from global policymakers; with governments and central banks trying to ensure that businesses can continue to function, exist even, as economic activity slows or, in some cases, collapses as a result of coronavirus restrictions.

Despite the uncertainty, we have welcomed a significant number of new clients at Ravenscroft, many asking us, “is now the right time to invest?” Our answer will always be caveated by an understanding that we believe it impossible “to time” markets accurately, especially when their prices, in no small part, are being driven by fear and emotion, as is the case now. However, what we can learn from previous crises is that the global economy will recover, probably sooner and more quickly than most people expect, and that some very attractive investment opportunities are appearing for long-term investors. Indeed, Warren Buffet, one of the world’s richest men, famously said,

“Be fearful when others are greedy and greedy when others are fearful”.

Most people are more cautious than they think they are when it comes to investing and are not always sure how long they can afford to be invested for. We consider this important and so will ask, “When will you need the money and how do you plan to use it?” If you can invest into a diversified portfolio and save regularly then history shows us that over the last 10, 20, 30, 40 and 50 years you would have enjoyed positive returns.

What do we mean by a diversified portfolio?

Investment diversification describes investment in different asset classes to make up an investment portfolio, although the phrase may also be used to describe the manner in which risk is spread within each asset class.

Some of the more familiar asset classes are outlined below:

- Equities: shares in companies that entitle holders to share in the profits through dividends, if paid, and share price performance;

- Bonds: debt instruments that governments or companies issue to borrow money and promise to pay back later, usually at a specified date and with a fixed periodic interest rate paid on the amount invested;

- Property: residential and/or commercial buildings; usually held in a fund

- Gold: physical bars and coins or funds holding gold assets;

- Cash: held in the portfolio as a strategic position and available for investment as and when attractive opportunities arise

Investment is based on risk versus reward, with the understanding that the more a person takes of the former, the more that they will, ultimately, expect to receive of the latter. Of course, as both investment professionals and investors ourselves, if we knew into which asset class we should put our hard-earned money, we would do it tomorrow! We don’t and therefore we always recommend an asset allocation that suits an investor’s personal circumstances (age, stage, wage and objectives).

Under what is known as modern portfolio theory, the overall risk of a portfolio can be reduced, and the overall returns actually increased, by investing in asset combinations that are not correlated: that is to say that they don't tend to move in the same way at the same time so that any volatility experienced in a particular asset class does not have an extraordinary impact on one’s savings. A phrase we use regularly at Ravenscroft is “know what you own and why you own it.”

How regular is regular, and why is it important?

Let’s start by answering the second part of why and that is compounding, which is, in short, making profit on your profit. Albert Einstein heralded compound interest as the most powerful force in the universe. In his words,

“compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn't, pays it.”

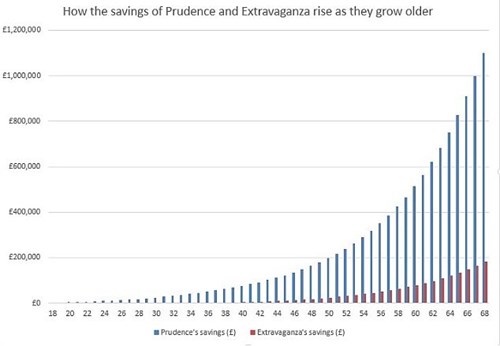

The key to benefiting from compound interest is not necessarily how much money someone can put aside, as much as it is how soon they should start doing so. The longer the amount of time that savings can be left to grow, the better. To explain this, let us look at two sisters, Prudence and Extravaganza (source: www.thisismoney.co.uk).

Prudence starts saving at just 18 years old; diligently putting away £20 per week. This example assumes, for simplicity, that her investments, over time, return a round average of 10% per year. Now not only is her initial investment growing by 10% per year, but she is also still adding £20 per week; just over £1,000 per year. Extravaganza doesn’t get around to saving her £20 per week until she’s 38 – so a full 20 years later than her sister. Assuming the same investment returns as Prudence, the two scenarios are illustrated in the chart below.

(Source: www.thisismoney.co.uk)

What this shows is that it’s not necessarily how much you save, as long as you are saving and investing regularly (be that weekly, monthly, quarterly or annually) and start doing so as soon as you can.

So while it might be more fun sat next to Extravaganza at a dinner party (post lockdown obviously), Prudence is really the one we should be asking “is now the right time to invest?”. Who knows. What we do know is the sooner the better.

This article appeared in Connect Jersey magazine