Weekly update - all about the rates

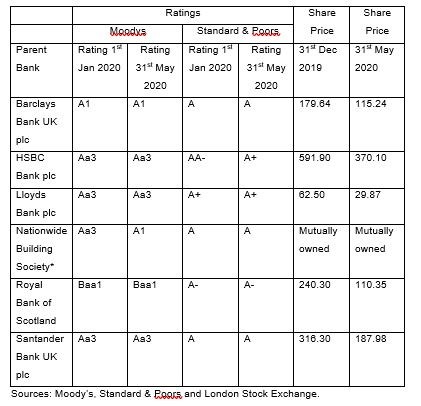

In our last issue, we looked at Treasury Bills which are short-term Government debt and which carry the same very high credit rating of the UK Government. In this issue, we re-visit the subject of bank credit ratings to see what changes have taken place since March when the UK and Guernsey entered lockdown. In short, there has not been much change, which at first seems surprising given the falls in banks’ share prices since the beginning of 2020. The table below covers the major UK deposit takers showing share price changes and ratings changes from 1st January 2020 to 31st May 2020.

*Nationwide Building Society was included for rating comparison purposes but as a mutually-owned entity any shares in Nationwide are not listed on any stock exchange.

As you can see, only HSBC and Nationwide have had a rating downgrade over the period under review. In both cases, the respective rating agencies cited the higher credit risk triggered by a prolonged coronavirus induced slowdown as being the main reason for the rating downgrade. Our cash management team deals with a wide range of banks on behalf of our clients. We subscribe to the ratings services of Moodys and Standard & Poors and actively monitor all ratings. We remain comfortable with all the counterparties we deal with particularly as increased regulation has meant that bank balance sheets have been strengthened significantly over the last decade. We consider that the latest developments should be monitored but that no action is required at present. Turning now to look at interest rates, we were amused at a recent presentation when a client expressed surprise that sterling interest rates were still positive.

No doubt readers are aware that the Bank of England reduced Base Rate to 0.10% on 19th March 2020 which is the lowest level ever. Base Rate is the interest rate the Bank of England pays on the deposits which banks operating in the UK are obliged to place with the Bank of England. However it is up to those banks to decide what interest rates they pay on deposits placed with them by their customers. These interest rates vary for a number of reasons.

The main reason is supply and demand. If a bank has a need for deposits to match assets on its balance sheet then that bank is likely to increase the rate of interest it pays because it has a demand for deposits. Another significant factor which determines what interest rates a bank will pay for a deposit is the duration of that deposit. Generally speaking, the longer the duration of the deposit the higher the interest rate. Banks like to take longer term deposits because they help in a bank’s solvency calculations. Shorter term deposits are a drag on the solvency calculation whereas a longer term deposit is a boost to the solvency calculation.

So, clients of Ravenscroft Cash Management who are strategically able to allocate cash to a longer term horizon, but want to remain in cash, will still receive a positive nominal interest rate.

The term “nominal interest rate” was used deliberately because for many years the real rate of return has been negative. The real rate of return is the nominal interest rate minus inflation. So with UK inflation targeted at 2.0% and Base Rate at say 0.75%, then the real rate of return would be -1.25% (0.75% minus 2.00%). However, the coronavirus induced slowdown means that prices of certain goods and services have fallen which in turn means that the rate of inflation has fallen. Some economists predict that inflation will fall to zero this summer, and if that is the case then the real rate of interest will be positive for the first time in many years.

Of course many readers will then ask “what about negative interest rates”?

The Bank of England is on record as having studied the case for negative interest rates as part of its armoury for hitting its target of 2.0% inflation. There is no cast iron proof that negative interest rates work but they do damage banks’ profitability and therefore both their reserves and ability to make loans. Our view is that, at the moment, the Bank of England will focus on increasing Quantitative Easing to provide banks with the liquidity to increase lending and thus help businesses and individuals increase economic activity. We would not rule out rates going negative but think that UK economic conditions would have to worsen further for this to happen. As our Channel Island readers will be aware, the islands are slowly returning to normal, albeit a new normal with limited off-island travel and self-isolation for anyone arriving. Jersey moved from Level 3 to 2 last week and Guernsey moves from Phase 4 to 5 on Saturday. With no social distancing in Guernsey, we will see all the Ravenscroft team back in the office next week and are looking forward to meeting with clients face to face instead of over the phone or via video call. Some of our Jersey team are also now back in the office but adhering to social distance requirements. Hopefully it won’t be long before our colleagues in the UK are back.

But no matter where we are working from, we continue to be here for our clients.