2020 Q2 Newsletter

“ Thought you were clever when you lit the fuse,

Tore down the house of commons in your brand new shoes,

Composed a revolutionary symphony,

Then went to bed with a charming young thing.

Hurrah, hooray! cheers then, mate.

It’s the Eton Rifles.

Hurrah, hooray! an extremist scrape with the Eton Rifles.”

Eton Rifles – The Jam 1979

Sup up your beer and collect your fags

by Mark Bousfield

The last few months have revealed an awful lot about the state of our world, bringing out both the best and, sadly, the worst of the human condition. At Ravenscroft, I am delighted (in my albeit biased opinion) to say that we have been on the better side of that equation. The team rallied to ensure that our clients’ interests remained paramount throughout lockdown – and that the business continued to function as if nothing had changed.

We are fortunate in Guernsey to have been free of COVID-19 for more than two months, now, which means that we are all back in the office and that business is truly back to normal.

Nevertheless, our Jersey office is currently semi-populated with the UK offices slowly filling up post 4 July. We have some distance to go to return to complete normalcy, but we are well on the way.

During the pandemic there has been example after example of people at their best: from the relentless efforts of front-line nurses and doctors in the NHS (and similar organisations the world over) to small gestures of kindness between communities, neighbours and strangers. On the flip-side, some have seen the chaos as the perfect opportunity to cash in. They have not let a good crisis go to waste…

Cyber-criminals took advantage of weaker security as many businesses transitioned to working from home while other individuals hoarded vast swathes of PPE (and toilet paper) in search of a quick buck. Governments also tested both extremes: from those politicians working swiftly to safeguard populaces and economies to others that chose to ignore the pandemic entirely and simply advocate more vodka and saunas (Belarus).

These differing policies applied to different societies yielded disparate results, but also served to highlight deeper problems that have been bubbling away under the surface for many years.

Paul Weller’s lyrics from 1979 remain heartfelt for many. Just look at the wider reaction to Black Lives Matter, which has metamorphosed from a condemnation of perceived (American) systemic racism to a much broader (Marxist) rejection of today’s global political economy.

The vandalism of monuments to the likes of Winston Churchill and George Washington, allied to the desire to purge institutions of any historical figures that do not meet today’s “woke” criteria, are very real, if anti-historical and misconceived, expressions of anger. This isn’t simply a rejection of the silver-spoon establishment – even if the protests have, ironically, largely been peopled by the privileged middle classes – it is broader than that.

The call for change raises deeper questions of capitalism itself. I fear that they will only be exacerbated by the recent huge injection of cash into the global economy by governments and their central banks. In the face of a global pandemic and collapsing financial system this was the right thing to do. That much was a lesson both identified and implemented from 2008. However, and just as in 2008, the outcome has, once again, been a broadening of the wealth divide. Money pumped into the system has resulted in support for asset prices and values. The asset-rich have become net beneficiaries. The MSCI Global Equity market is, once again, bouncing around all-time highs. The money, as they say in the US, is going more to Wall Street than Main Street.

For us it is simply an ongoing discussion of poverty versus inequality, which fuels misguided political arguments in favour for equality of outcome as opposed to equality of opportunity. Regular readers will know that we repeatedly advocate for capitalism aligned with Schumpeter’s views of ‘creative destruction’ rather than the ‘crony’ version with its coddled elite. Anything else discredits the most successful economic and political system (by any chosen metric) humanity has ever seen. This issue is not going away and will continue to intensify if left unaddressed: evolution, if not yet revolution.

Now, more than ever, we need to ensure we are invested in themes that stand the test of time with the capacity to navigate change while staying relevant. As you would expect, we remain committed to our core themes and strive constantly to identify newer ones, such as environmental solutions. The world is slowly overcoming the current pandemic. In doing so, a bigger picture is being revealed that will, I am sure, bring change and with change comes opportunity.

Boscher's (Bite-Sized) Big Picture

by Kevin Boscher

The global economy and financial markets have been through an extremely compressed cycle over the past few months. We have seen an unprecedented economic contraction, a collapse in equity prices, resulting in the quickest bear market on record, a remarkable recovery and a huge injection of economic stimulus. Investor sentiment has also gone through a roller coaster ride, from being bullish in January to apocalyptic in March, back to a cautious optimism and then more recently, renewed fears. Here’s a bite-sized review of the key talking points this quarter.

Impact of a Second Wave

There are genuine concerns that a second wave of infections will occur as economies reopen and border controls are relaxed. Certainly this is a real risk and the renewed spike in infections across America has spooked investors. However, this is not really a second wave, but a continuation of the first wave. The root cause of these new trends is that many US states have prematurely opened their economies without strict social distancing guidelines. The evidence from Europe and Asia, where lockdown exits are largely proceeding without incident, confirms this viewpoint. In any case, moving forward it is likely that policymakers will try to strike a balance between public health needs and economic interests, even if a serious second wave does emerge. Although it is difficult to make sense of all of the information, especially given that top scientists have different and competing views, countries are in a much better position to manage the virus. Hospitals are better prepared, testing capacity has increased, contact-tracing is being ramped up, immunity is building and money and effort is pouring into finding vaccines. This means that governments, businesses and consumers are better equipped to deal with another outbreak than they were several months ago.

Inflation or Deflation?

We have seen unprecedented levels of monetary and fiscal support over the period which has been a massive boost for both the economy and markets.

Historically, equities and other risk assets usually benefit when a surge of liquidity is pushed into a weak but recovering economy coupled with falling inflation, extremely low interest rates and high unemployment. We saw that after the bursting of the Dotcom bubble and the 2008 Global Financial Crisis. Some believe that the huge expansion of new money will cause inflation. However, arguably, inflation stems from aggregate demand exceeding supply and COVID-19 is primarily a deflationary shock, since it has resulted in a collapse in both consumer spending and capital investment at the same time as supply chains have been interrupted. Even if consumption and investment recover faster than expected as economies emerge from lockdown, the anecdotal evidence from China is that the supply side will likely recover at a much faster rate than demand. This will keep inflation low and so price deflation in the US and Europe certainly remains a possibility before this cycle ends.

The United States of America

It would be amiss of us not to mention Trump especially as we edge closer to the US election in November. And, surprisingly, although Trump’s managed to alienate a large part of the US and global population (not just for his handling of COVID-19), a win for opponent, Joe Biden, and a Democrat-controlled House could set off alarm bells for the stock market. Investors would likely fear higher taxes, more regulation and an avalanche of social programmes. Having said that, this would be a bit of a double-edged sword since a Biden administration would likely be less confrontational or unpredictable on the global stage, which could help rebuild trust and cooperation between the US and its allies.

Despite all of this, markets have recovered surprisingly well over the past few months. And although, there are plenty of reasons to be cautious; the most recent data emerging from Asia, Europe and the US would seem to suggest that economic activity is picking up quicker than expected.

Cautious Portfolios:

Lower Risk

by Alex Chambers

Objective: The Cautious portfolio’s objective is to increase its value by predominantly allocating capital to fixed income investments. The portfolio can also invest into global blue chip equities with strong cash flows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split with a maximum equity weighting of approximately 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

The Cautious strategy returned 7.2% over the quarter, which, in stark contrast to Q1 2020, was one of the best quarters for the strategy since inception. This brings the performance for the year near to positive territory, up from a trough in the middle of March of over 10%. This is largely attributable to the market’s swift bounce back from the decline caused by the coronavirus pandemic and the accompanying fear, panic and, ultimately, selling of assets across the board by investors globally. One of the aids to the market’s strong performance was the US Federal Reserve’s decision to print money in order to support companies and provide support to the economy. The money printing seemingly had no limit and it was clear that the Federal Reserve would provide as much support as needed during this tough period.

Source: www.hedgeye.com

We made some changes to the strategy over the quarter. In the last quarterly update, we wrote about the sale of Muzinich Asia Credit Opportunities in February. We continue to favour the emerging-market bond space and believe that this sector of the bond market offers good diversification from the portfolio’s core bond allocation. However, we made the decision to sell as we wanted to increase the emerging-market exposure, but did not want to actively increase the portfolio’s exposure to China – to which this Muzinich fund has a bias.

As an alternative in the space we selected a new global emerging-market bond fund run by Pictet Asset Management; its return profile and diversification benefits are comparable to the Muzinich fund with a materially lower weighting to China. The Pictet fund is run by an experienced and capable team with plenty of resource in this area of the market. We implemented a 5% position in two tranches while reducing cash and selling the short-dated gilt position to fund the purchase.

Turning to the performance of the underlying holdings in the portfolio, as expected in a strong rising market the different assets behaved in line. The three equity income funds were the best performing funds with Ninety One (formerly Investec) and Guinness delivering around 15% returns over the 3 months in question and Fidelity, which runs a slightly more cautious equity income portfolio, 11%. Looking at the fixed-income holdings it was a similar theme whereby the holdings with greater credit risk and/or a longer time until maturity performed better than those with comparatively less of those characteristics.

Going forward, the portfolio maintains its relatively defensive stance since we are cognisant of the fact that there could be more volatility to come in global financial markets while the world economy navigates choppy waters.

This stance has helped the strategy to outperform the sector (IA Mixed Investment 0-35% Shares Sector) by around 1% over the year so far and this is mainly down to the sectors the strategy invests in and the high-quality businesses it seeks to own.

Balanced Portfolios:

Medium Risk

by Tiffany Gervaise-Brazier

Objective: The Balanced Portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

Mid-way through the year is a good time to pause for breath and reflect on the sheer volume of news, data and swings in sentiment that investors have faced in 2020 and to reflect on where we are since the sell-off in Q1. More importantly, we consider it paramount to explain to investors how we are positioned to navigate the coming months.

The Balanced strategy has returned 0.7% since the start of the year. We are very much continuing with our ‘proceed with caution’ stance and, currently, the portfolio has a 47% allocation to equities (shares in companies), 38% to fixed income investments (bonds) and 15% in cash and equivalents.

Since the end of March, markets have made a strong recovery. However, not a lot has changed in terms of the fundamentals of our preferred companies despite some sectors now showing double-digit returns for the year. These exposures sit within the strategy’s thematic equity allocation and have been the standout performers thus far due to the reliance that has been placed on both the Technology and Healthcare sectors through the pandemic.

In Q1, we wrote about liquidity concerns as investors’ appetite for risk waned and global credit markets came under pressure. The subsequent return in confidence is owed predominately to the vast fiscal easing by governments rather than a reversal of the damage caused by the global pandemic. Accordingly, we are focusing on owning quality companies with strong balance sheets that can weather this storm by providing excellent liquidity to investors. In addition, in the bond proportion, the government bonds allocation has acted as a good ballast against the mix of investment-grade corporate bonds and a small higher-yielding allocation.

There is no doubt that the U.S. Federal Reserve’s (the Fed) response to COVID-19 has been unprecedented. Its balance sheet has increased by nearly 3 trillion USD since the start of March, meaning that it has grown more in this short period than it did in the five years following the 2008 Financial Crisis. In just a few weeks the Fed has slashed interest rates to zero, re-started asset purchases and begun directly lending to businesses, while providing support to state and local municipalities in order, literally ‘to keep the lights on’ whilst the world took an enforced pause to deal with the global pandemic.

As we mentioned last month, we are seeing value appear in emerging markets and, more specifically, Latin America. We are in regular contact with our managers in the region and, following an update from the team at Brown Advisory, made the decision to top up our exposure in May. This year has been tumultuous for Latin America, but we remain optimistic for the region and strongly believe that emerging markets will continue to provide substantial growth relative to developed markets in the future.

All of these factors only reinforce the need to remain patient in our asset allocation decisions to protect the portfolio (and clients) from the sharp bouts of volatility that we are seeing as investors’ sentiment swings.

While fundamentals, valuations, earnings and economic growth will dominate in the end, the short run is a different matter. The swift equity market recovery has taken many investors by surprise and it appears they are scrambling to be fully invested to take advantage of the ‘recovery’. For us there have to be limits to how long this rally can continue. Ultimately, markets will be forced to focus on the challenges facing the global economy going forward. When they do, we will be ready.

Our focus continues to be on owning quality global businesses able to weather the storm – as opposed to chasing returns in what may be a short-lived rally.

Growth Portfolios:

Higher Risk

by Georgie Fletcher

Objective: The Growth Portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

Following a torrid start to the year, Q2 brought a nice reprieve. The Growth strategy regained most of its losses incurred during the Q1 sell-off as it returned 14.1% for the quarter against the IA Mixed Investment 40-85% Shares Sector at 13.1%. This brings the strategy and sector to -1.2% and -4.3% year-to-date respectively. Whilst this strong rebound has been pleasing, it has been surprisingly fast! This simply continues to remind us that we are no clearer on the future course of markets and thus that our defensive positioning will stand for the time being.

Strategy Changes & Top-Ups

At the beginning of the quarter, we topped-up our Latin America exposure to 5% and increased our Technology allocation to 4%. At the time of trading we believed Brown Advisory was valued at similar levels to where it was after the 2008/2009 Global Financial Crisis.

As regular readers will know, we expect open, honest and transparent communication from our underlying fund managers. Throughout the pandemic we have been in close contact with them to ascertain portfolio positioning, changes and views on underlying investments. On the back of these meetings in June we increased Arisaig Global Emerging Markets Consumer and First State Asian Growth to 6% each.

Both funds invest in quality companies that exhibit robust balance sheets coupled with low levels of leverage – both also expect to benefit from the digitalisation age. First State has always been run very conservatively whilst Arisaig tends to act differently to mainstream emerging market (EM) or global funds; for this reason, we view both holdings as defensive EM exposures.

The February/March sell-off gave First State the opportunity to focus the portfolio into some high-quality names that had fallen, as well as initiating positions in some e-commerce names. Similarly, Arisaig considers that markets are now once again prioritising high-quality, resilient, business models with balance sheet strength, characteristics that are prerequisites for entry into its portfolio. These decisions clearly proved beneficial as: First State posted 8.3% and Arisaig 6.1% (in sterling terms) for June.

Performance Highlights

Our decision to top up the Polar Capital Healthcare Opportunities Fund last quarter proved fruitful as the Fund took part in April’s equity market rally, posting 16.1% in sterling terms versus the MSCI World Index’s 9.0%.

Over the sell-off there was a clear distinction between investors’ appetite for value versus growth. Valuation-sensitive portfolios suffered severely: the MSCI Value Index was down -21.8% over the period and Lazard Global Equity Franchise (our value-bias exposure) -28.3%. Conversely, the MSCI Growth Index and Fundsmith Global Equity were only down -9.3% and -7.8%, respectively.

During Q1 we saw investors pile their money into the security of growth-orientated, large-cap names and out of value stocks. However, as equity markets began to recover this quarter, we saw a change in sentiment which benefitted a number of Lazard’s holdings – the Fund consequently outperformed, posting 13.1% for April.

Pictet Global Environmental Opportunities has performed extremely well since its introduction to the portfolio, consistently outperforming on the upside. However, what also became apparent throughout the sell-off was the downside protection provided by Environmental, Social, and Governance (ESG)-focused companies as Pictet’s valuation fell approximately half that of the wider global equity market. The Fund’s defensive qualities have continued to shine through this quarter; it is up 7.6% year-to-date.

ESG has been an area of focus for some time now and we expect many investors will be looking towards these companies going forwards. Why would the average investor accept anything less than a high ESG score when it can outperform and protect on the downside? Where opportunity permits, will be seeking actively to deploy further cash to those funds that prize these criteria.

The impact of the coronavirus pandemic has consequences far beyond the efforts to quarantine and come up with a vaccine. While is it too soon to predict the full extent of the damage to economies, there are reasons to be hopeful. Governments seem to have learnt from previous demand-driven recessions and central bank monetary policy stimulus has been both quick and aggressive.

For us, the global crisis alters nothing: we continue to stick to our knitting, focusing on our preferred areas of exposure. The investments within the Growth strategy remain aligned with our global investment themes such as global brands, increasing demand for healthcare, technological advancement and increasing consumerism, particularly in the developing world. We continue to believe in the durability of these irrefutable trends and believe that many of the businesses we seek to own will continue to stand the test of time and emerge profitably post-coronavirus and beyond.

Global Blue Chip Portfolios:

Higher Risk

by Ben Byrom

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chips that are in line with our long-term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

The rally from the March lows has been nothing short of impressive with the MSCI World Total Return (net) rising 19.8% in GBP terms for the quarter. In comparison, the Global Blue Chip portfolio rallied 12.5%. On a year to date basis, the strategy is up 3.6% versus a market return of 1%.

The main reasons for the strategy’s under performance through the second quarter are very much a role-reversal of the reasons why the strategy fared so well through the ‘Corona-crash’ sell-off during February and March. Our overweight preference for the more defensive areas of the market such as large-cap consumer staples and healthcare businesses have lagged a market that has largely shrugged-off the devastating economic and social effects of the virus along with the implemented containment measures.

The narrative very much seems to be one of ignoring 2020’s earnings ‘blip’ while focusing on the long-term earnings potential of the market. After all, a share in a business doesn’t just give you a call on next year’s earnings, but the earnings potential of that business over its lifetime. This long-term view is something we have subscribed to since inception, considering it a more suitable approach when investing in an environment obsessed about who would outperform whom from one quarter to the next.

We therefore saw the Corona-crash as our moment to buy into great businesses that we had been monitoring at genuine value prices. Sadly, the unprecedented moves by the Fed and other central banks stabilised the stress and restored confidence at price-points above those we were prepared to pay. Frustratingly, therefore, we did not affect many changes in the portfolio, so our broad positioning did not change that much.

The continual tensions between monetary stimulus, economic activity and the changing narrative that justifies an increasingly expensive equity market will be played out in financial markets for months, if not years, to come. Volatility is likely to be a by-product of this tension and, as we noted in our early note ‘Navigating the exit from lockdown’, we would still look to capitalise should opportunities arise.

The main contributors to the strategy’s performance over the quarter were our technology holdings, which dominated the top of the list of our best performing holdings. Apple, surprisingly, topped the bill as the supply-chain disruption anticipated in China didn’t materialise – and whilst hardware sales took a hit, it wasn’t as big as anticipated and the ‘active installed base’ rose to an all-time high. The read-through was that services will continue grow as a proportion of total sales, driving future growth as it benefits from more content and functionality through the App store, Apple Gaming, Apple Music, Apple Pay and Apple TV.

Another impressive mover was Microsoft, which is our feature in this quarter’s ‘Stock in Focus’. Work from home has certainly benefitted the ‘Cloud First, Mobile First’ mantra that Satya Nadella has worked hard to promote to employees, customers and investors since he took the helm in 2014. The growth during lockdown in Microsoft Teams, its collaboration workspace app, embodies how the COVID-19 pandemic has brought forward in just a matter of weeks working practices and mindsets that would otherwise have taken years to materialise.

Satya Nadella (CEO of Microsoft). Source: Google Images

For cloud-based ‘Software As A Service’ companies, such as Microsoft, this pull forward to the future has, in turn, created a sustainable boost to its commercial value – read our ‘Stock in Focus’ to find out why we think this.

Healthcare stocks dominated the bottom five detractor list as investors rotated out of strong performers. Why Healthcare with the COVID virus still at large? We suspect the answer lies in the battle lines that will be drawn up in the accelerating US Presidential electoral campaign. Nonetheless, Healthcare is one of the few areas where we do see value. Long term, we think innovative pharmaceutical companies will continue to attract investment as the desire to treat unmet needs drives drug discovery and strong free-cash-flow generation. Increased uncertainty during Q3 may well provide opportunities to pick-up cheap cash-flows in an increasingly expensive marketplace.

Fund in Focus:

Pictet Short Term Emerging Market Corporate Bond

by Shannon Lancaster

Last quarter, within the Cautious strategy, we sold out of the Muzinich Asia Credit Opportunities Fund in favour of the Pictet Short Term Emerging Market Corporate Bond Fund (which we have affectionately dubbed “Shorty”). Pictet sits alongside our other short-dated credit funds (Royal London Short Duration Global High Yield and Schroder Strategic Credit Fund) that together provide a strong level of income for the portfolio.

The emerging-market corporate bond market has rapidly developed into a globally significant asset class over the past decade. Emerging-market corporate bonds offer an attractive yield, high credit-rating, low duration and provide a very strong risk/return profile. With an estimated yield and duration of around 5% and 2.4 years, we see the “Shorty” fund as a very attractive opportunity within this asset class.

Team

Pictet has been managing emerging-market debt since 1998 and launched its first emerging-market corporate bond strategy in 2012, before launching this particular fund in 2014. The Fund is managed by Alain-Nsiona Defise and Luke Chua, who are a part of a team of 15; they also benefit from access to a dedicated China debt team based out of Hong Kong.

The team’s process has three core pillars:

1. Credit selection is the key to long-term results because that’s where the inefficiencies are in a market, which is often invested into from a top-down perspective.

2. Local knowledge is also vital. The team meet issuers, speak their languages and cover the world regionally (as opposed to looking at the world sectorally). This is something we really appreciate after hearing similar points from other emerging-market teams.

3. Identification of idiosyncratic risk is vital.

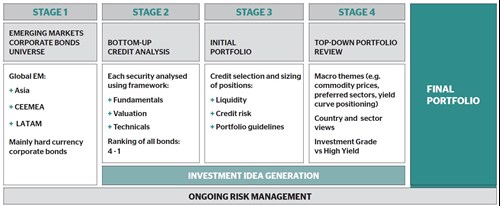

The Fund is made up of (you may have guessed) short-term emerging-market corporate bonds with an average BB rating and a maximum portfolio duration of 3 years. The team places an emphasis on bottom-up assessment of fundamental sector and single-name issues, complemented by a top-down portfolio review. We like that the investment process has a strong focus on credit selection and performance is primarily driven by the results of a screening process as part of the fundamental, valuation-based, and technical security selection process. Performance has been very strong year-to-date with the Fund returning just under 5% versus the relevant sector at just over 2%. Over three years, “Shorty” has produced ~12% against the sector at ~8%.

Investment Process

Those who have read any of our previous ‘Fund in Focus’ musings will be familiar with our love of a solid, repeatable investment process and “Shorty” does not disappoint. It consists of four stages, beginning with screening the universe of emerging-market short-dated corporate bonds. The credit analysts then perform a thorough assessment of each bond looking for strong fundamentals, attractive valuations and good technicals to rank each security. Following this comes credit selection and sizing of positions, which take into account liquidity and portfolio guidelines. At the final stage the team considers any broader global themes that may influence positioning.

Overall, we believe the Fund will be a great addition to the Income strategy since it has a seasoned, well-resourced and knowledgeable team operating under a solid process with a strong track record.

Source: Pictet Asset Management, September 2017.

Stock in Focus

Microsoft

by Sam Corbet

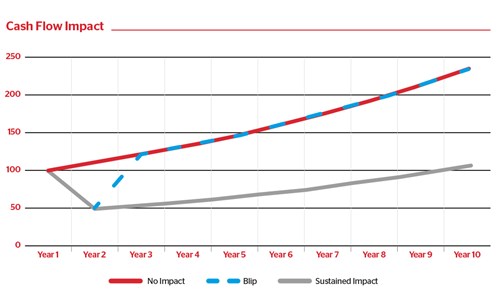

This quarter’s stock in focus delves into Microsoft – the strategy’s third-best performer during the quarter and top performer year-to-date (having returned 39.1% to the end of June, in sterling terms). In June, we penned an article More of the same please that outlined the approach we were taking when assessing the impact COVID-19 could have on the value we were assigning our underlying businesses. In it, we used the chart below to illustrate how we had allocated each of the strategy’s holdings to one of three broad categories: No Impact, Blip and Sustained Impact.

Source: Ravenscroft Investment Management Ltd. (Chart uses fictional data – for illustrative purposes only).

This is clearly an oversimplification. In reality, the extent of the impact on cash-flows will be specific to each company and dependent on the effectiveness of any actions management has taken (and continues to take) in order to best protect these businesses from the current storm.

In January, as the virus started to gather momentum, we carried out an appraisal of the collective of businesses within the strategy. This determined that Microsoft sat firmly in the “No Impact” bucket. The resilience of Microsoft’s business should be reassuring to investors. However, in our opinion, the label we attributed to the business underplays the effect the pandemic has had on Microsoft’s intrinsic value. We believe Microsoft to be among a rare group of companies whose ability to generate future cash flows has actually improved as a result of the pandemic. This improvement stems from the acceleration of cloud adoption – driven by the sudden realisation of the benefits associated with being able to (securely) furnish your workforce with the tools it requires to remain productive anywhere with a working internet connection. In its latest earnings call, Satya Nadella (Microsoft CEO) revealed that the company had “seen two years’-worth of digital transformation in two months”.

Unlike many of the other businesses whose short-term cash-flows also improved (often as a result of “pantry stockpiling”) the increased adoption of Microsoft’s services is unlikely to be temporary. One of the advantages of software offered via a subscription model (as is the case for the overwhelming majority of cloud-based software) is that new features become available to the customer as soon as they have been implemented. This periodically delivers the user with features that help improve their efficiency. It also provides the company with greater cash-flow predictability – Microsoft no longer has to worry about its customers choosing to forgo an update and the loss of revenue associated with this decision. The transition to the cloud should therefore be seen as both a win for the customer and a win for Microsoft.

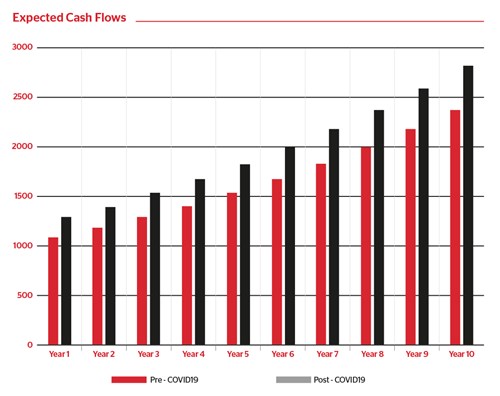

The outcome is that Microsoft has become a recipient, today, of new users that we didn’t anticipate it securing until later. As the chart below illustrates, under such a circumstance we can effectively pull forward the cash-flows from the years where such user levels were expected. Given that we generally believe in valuing businesses by estimating the cash that the business will bring in over the rest of its life, it should be clear that Microsoft warrants a higher valuation today than it did prior to the health crisis (the sum of the black bars is larger than the sum of the red).

Source: Ravenscroft Investment Management Ltd. (Chart uses fictional data – for illustrative purposes only).

Value should not be confused with price. Whilst Microsoft may warrant a higher valuation today, whether it continues to offer investors good value is dependent on where the share price is trading in relation to intrinsic value. At its current price we believe Microsoft to be fully valued; consequently, we made the decisions to trim the strategy’s allocation during the quarter, taking Microsoft from a 4% allocation down to a 3% weighting.

Going forward, we will continue to size the position in line with our capital allocation process (detailed as part of Navigating the exit from lockdown). This steers us towards owning more of a business when the discount-to-intrinsic-value is large – and less as that discount declines. Microsoft remains a core holding within the Technology and Innovation sub-sector and we continue to monitor developments closely for signs of any changes that would alter the value we are able to attribute the business.