Weekly update - A right Royal mess?

I try very hard not to lower myself to reading tabloid reports of ‘sensational’ events. I also try very hard not to use social media for anything other than good and very seldom, if ever, express any form of political, religious, or other potentially controversial or divisive, point of view. It’s not that I don’t have my beliefs and opinions, and I am far from the most passive man on the planet, but I cannot abide wasting my time throwing my two cents onto a table of discussion about a subject that none of the parties that are sat arguing at have any control or voice of authority over.

Imagine the genuine sense of disappointment in my own self then, as this week, the one in which most new year’s resolutions are reckoned to fail, I find myself reading what Piers Morgan has to say on Twitter about what the Daily Mail has termed ‘Megxit.’

It will probably not surprise regular readers to know that it is the numbers behind this Royal saga, rather than the sentiment, that are interesting to me, although the way in which REPAY was written in capital letters (denoting it as some form of punishment) did cause me a wry smile. I am fascinated by others’ perception of numbers, percentages and money and I revel in some of the concepts explored in books like “Freakonomics” and “Thinking, Fast and Slow” and, probably my favourite, “Risk” by Dan Gardner which turn a lot of commonly-accepted norms on their head as they delve into human behaviour and bias.

Let’s start with the repayment of the £2.4million for the house upgrades. I can imagine most Daily Mail readers nodding with satisfaction at this, “Quite right” and “So they bloody-well should” and the like. Is it the case then, that once paid, we are calling Harry and Meghan all square with the royal house? What about the estimated £24m. that was paid by the UK taxpayer for security at their wedding? Or the £7m. security costs, part of an overall Royal family annual amount of £100m., paid last year alone? In the grand scheme of things, £2.4m. won’t really achieve anything except to provide a (misplaced) sense of justice.

That said, those who believe the family is a burden on taxpayers are probably wrong. According to Richard Haigh, of Brand Finance, a UK-based valuation company. “Last year, we valued the boost to the UK economy from Harry and Meghan’s royal wedding in Windsor at almost £1billion” and in its latest report on the monarchy from 2017, Brand Finance estimated that the family is responsible for more than £500m. in annual tourism.

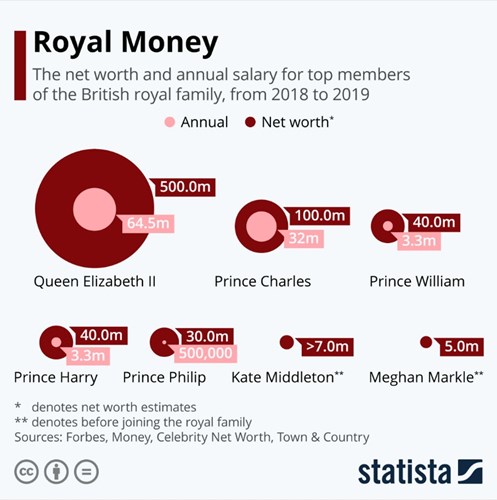

We should note that Meghan is the only person on this chart (ok Kate was a buyer for Jigsaw and the family Party Pieces business before marrying her prince) that has made her own money ... being paid a reported £37,000 per episode for more than 100 episodes of Suits, for example. Her earning power as a (rumoured) Disney voice over actress in the future should be quite something to behold ... if Owen Wilson being paid £2m. for his role as Lightning McQueen in “Cars 2” is anything to go by. I’m sure her and Harry will be just fine now they no longer receive public funds for royal duties and no longer use their HRH titles or represent the Queen formally as they break away from being senior royals.

What of the Royal Remainers, then? Clearly, Her Majesty rules the financial roost ... but I was quite surprised that the £500m. number was ‘so small’ ... I mean, JK Rowling made up some stuff about a kid in glasses with a wand and has earned herself a couple hundred million more than this, so what’s the story?

In writing today, I found the answer. If everyone except me already knew, I do apologise; if not, welcome to the concept of the “The Crown Estate”. This is a collection of lands and holdings in the territories of England, Wales and Northern Ireland within the United Kingdom which belong to the British monarch as a corporation sole, making it the "Sovereign's public estate", which is neither government property nor part of the monarch's private estate. Some 25% of the estate’s net £330m. annual income goes to the Queen with the rest to HM Treasury.

If the Queen was to own the Crown Estate as well as the Duchy of Lancaster (a private trust governed by the same ownership rules), Forbes estimates that she would be the richest person in the UK (and the third-wealthiest woman in the world) with a net worth of more than $25 billion. Even that number doesn’t take into account the value of the Royal Collection Trust, which, with its Fabergé eggs and Rembrandt paintings, could be worth in excess of a billion dollars.

Here are some more facts and figures that I found for your Monday:

$18.7 billion: The real estate owned in by the Crown Estate and its Scottish counterpart. The Queen technically owns this portfolio of commercial and industrial properties, but she cannot sell any of it.

$4.7 billion: According to Czech real estate agency Luxent (!), the value of Buckingham Palace, the 775-room residence of the United Kingdom’s sovereigns since 1837.

$600 million: The value of Kensington Palace, the childhood home of Queen Victoria and the residence of young royals for more than three centuries, according to Luxent. The Duke and Duchess of Cambridge and their three children live in Kensington Palace 1A, a 20-room, four-storey “apartment.”

$145.6 million: The combined assets held by Prince Charles’ charities, which support economic, environmental and social causes in Britain and around the globe.

$46.7 million: The amount spent on charitable activities in 2018 by Prince Charles’ philanthropic organisations.

$31.5 million: The value of Princess Diana’s estate at the time of her death, according to her will. The bulk of that sum went to her sons, Princes William and Harry, each of whom inherited a share on their 25th birthday. The remainder was split between her 17 godchildren and her former butler Paul Burrell, who received £50,000

1,762: The number of offshore wind turbines that are part of the Crown Estate.

200 billion: The number of times the image of the Queen on UK postage stamps has been reproduced. The design has not changed since 1967 and is believed to be the most reproduced work of art in history.

$2,423,050: The amount an unused Mauritius “Post Office” twopence from 1847, which mirrors the piece widely regarded as the most valuable stamp in the Royal Philatelic Collection, sold for in 1993. The prized collection, which has never been appraised, also boasts one of two 1854 Bermuda “Perot” stamps still in existence, the other having last sold for $340,000 in 1996.

$1,039,758: The auction price of the 1955 Rolls-Royce Phantom IV belonging to Queen Elizabeth sold at Bonhams’ Goodwood Revival Sale in September 2018.

$583,000: The total earnings of Queen Elizabeth’s champion horses in the past year, according to the British Horseracing Authority.

23,578: The number of gemstones showcased in the Crown Jewels, which are housed in the Tower of London. The Sovereign’s Sceptre with Cross has been used at every coronation since Charles II’s in 1661 and boasts the Cullinan I diamond, the largest top-quality cut white diamond in the world, weighing 530.2 carats.

And with those eye-watering numbers, I’ll sign off.

Have a great week!

FINANCIAL PROMOTION: The value of investments and the income derived from them may go down as well as up and you may not receive back all the money which you invested. Any information relating to past performance of an investment service is not a guide to future performance.