2019 Q4 Newsletter

"I can see clearly now the rain is gone

I can see all obstacles in my way

Gone are the dark clouds that had me blind

It’s gonna be a bright (bright)

Bright (bright) sunshiny day"

'I Can See Clearly Now'. Johnny Nash, 1972

Like many of you, I’m not sure why the beginning of a new year, decade, century or even millennium has been decided as the best place to conduct a retrospective. It’s a bit arbitrary, but everyone else does it so here goes!

We don’t look back on our 2010 commentary with much enthusiasm. It was, after all, early days in our abnegation of all things predictive and we were still – despite our determination to do otherwise – sneaking furtive peaks into our (very cloudy) crystal ball. Ten years on, we can definitively state that we don’t know what’s going to happen next week, never mind in 2029, so we’re over it.

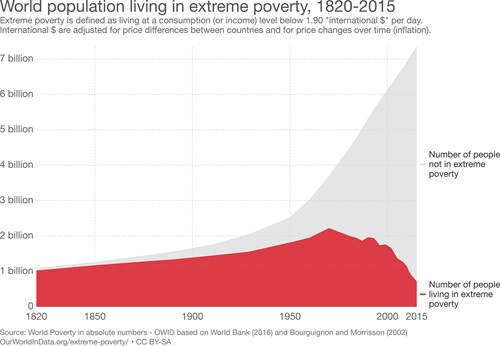

The decade began in the depths of despair about the events of 2007/8 with all sorts of hyperbolic references to the end of capitalism. As you are no doubt now tired of hearing from us, nothing has reduced poverty so far so fast as the global adoption of market-driven policies, which we can loosely define as capitalism. To misappropriate Churchill, it’s the worst form of economic and political system except for all those other forms that have been tried from time to time. The chart below, compiled by University of Oxford economist, Max Roser, neatly illustrates the issue.

We don’t have reliable figures for the reduction after 2015, but the trend is clear enough for the UN to have set its goal for complete eradication of poverty by 2030. This is truly remarkable when one considers the chart in 1820, which you can extrapolate backwards for the whole of human existence; I don’t need to tell you that quality of life certainly doesn’t get any better in the preceding years! We cannot overemphasise how lucky we are to be living at this point in history and things are only going to improve. No, this will not be the end of inequality – the next battle – but that is also well within the compass of our ingenuity.

What has all this got to do with your portfolio and our funds, you may ask. Well, I can think of no chart that so neatly illustrates our investment credo. Simply put, we’re betting on grey. (By the way, that sharp gradient in population increase is also beginning to moderate as those who come out of poverty have fewer children. Japan’s and Russia’s populations are now actively shrinking. So much for Rev Malthus).

What happened during the 2010s? Economic chaos at the start, no little political chaos at the end and a ten-year bull market in the middle. To say nothing of the plethora of technological advances that have underpinned every aspect of our lives since. Remember, before 2010 there was no iPad or iMessage, no Netflix streaming, no Uber, no Tesla, 3D printing was niche and unaffordable, gene editing was a pipedream, AIDS was considered a death sentence.

I could go on and on about things we now take for granted that didn’t exist or were unaffordable just ten years ago. Which is precisely the point why we remain bullish about the future despite being completely unable to predict its path from one moment to the next.

And I didn’t mention BREXIT (once)!

Cautious Portfolios:

Lower Risk

by Alex Chambers

Objective: The Cautious Portfolio’s objective is to increase its value by predominantly allocating capital to fixed-income investments. The portfolio can also invest into global blue-chip equities with strong cash-flows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity-weighting of approximately 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

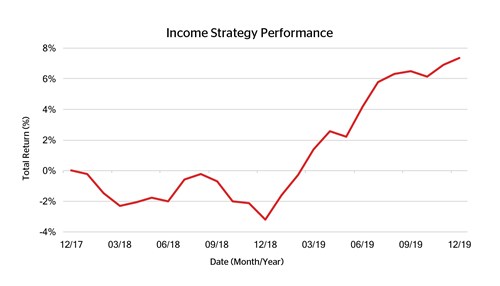

The Income strategy returned 0.8% over the quarter, bringing the return for the whole year to over 10%. This has been the Strategy’s best year, which is very pleasing, but rather than rest on our laurels, we’d like to take this opportunity to discuss some of the reasons behind this performance.

Markets generally had an extremely strong first quarter, following a hard sell-off in the fourth quarter of 2018 that culminated in a trough almost exactly at the 2018 year-end. Global financial assets then contributed to a market bounce and the effect was to deliver a strong tailwind to overall performance this year. Other tailwinds have included the Federal Reserve loosening monetary policy and improvements regarding US & China trade talks. In addition, blue-chip equity earnings have been strong over 2019 – a focus for many investors.

Over the last two years the total return figure for the Strategy is around 8%. The significance is that an annualised return figure of around 4% is in line with our long-term expectations for this portfolio.

One of the lessons we can take from the past year (and a bit) is that 2018 – where performance was not as robust – serves as a reminder that when valuations are high, risk is elevated accordingly and sell-offs will inevitably occur. That is precisely why we are defensively positioned and have been increasingly so over the course of 2019. Examples where we took some risk off the table in Q3 include the rotation from longer to shorter-dated high yield and a 2.5% reduction in equity exposure on valuation grounds.

That said, 2019 also reminds us that elevated valuations can persist for longer than we may expect. This is why we remain fully invested, even if defensively. Looking at valuations over the past two years, there hasn’t been a great deal of change in equity multiples, bond yields or spreads. This also explains why, over a longer timeframe, the Strategy has delivered (by and large) what we would expect.

Going forward we will stick to our knitting and keep trimming if areas of the market look expensive; equally, we will also be ready to add if we see a correction and thereby an attractive entry point.

Finally, we’d like to thank you for your ongoing support. We look forward to continuing to work for you in 2020 and wish you and your families all the best for the New Year.

Balanced Portfolios:

Medium Risk

by Tiffany Gervaise-Brazier

Objective: The Balanced Portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

While resolutely averting our gaze from the macro-economic and geopolitical landscape that we have navigated in 2019, the Balanced Strategy returned over 12% for the year. The continued equity market rally is seemingly being driven by a handful of factors: policy easing from the Federal Reserve; fears of a recession; and, what can be generally be characterised as a ceasefire in the trade war. We simply do not know if there will be further economic expansion, if there is a recession looming, the outcome of Brexit or if there will be a resolution to the US/China trade wars. It is equally unclear how long these factors will remain in play; although, to us, it would seem difficult for all three to continue to co-exist and for markets and/or currencies to remain unscathed.

The important point is that whatever the outcome of any of these highly unpredictable events, the highest quality businesses (with a global presence) will continue to sell their products to an ever-increasing audience and continue to improve their reach driven through their ability to innovate. It is these companies that we wish to own and thus our job (and that of our underlying managers) to identify and gain exposure to them at sensible valuations. The Balanced Strategy performance over 2019 can be attributed predominantly to the global equity allocation (via the Fundsmith, Lindsell Train and Guard Cap funds) and our thematic allocation, particularly our technology exposure. Even so, both bonds and equities posted double-digit returns in 2019 – a rare occurrence!

This year, much of the volatility due to uncertainty has been priced through currency. Fed rate-cutting and the UK general election have led to a stronger dollar and weaker pound. Consequently, the Strategy benefitted from its (truly) global revenue streams. In the midst of dramatic headlines and ensuing panic, this can often overlooked by investors when interpreting currency movements.

While the fourth quarter seemed to have brought calmer markets at the headline level, beneath the surface this was not the case. In September, particularly, energy (+4%), financials (~+4%) and utilities (~+2%) rallied while our preferred sectors of technology, healthcare, the emerging consumer and consumer staples, (where we are more heavily invested than the broader market indices) posted negative or flat performance. Nevertheless, we are pleased that the Strategy outperformed the Mixed Asset 20-60% equity index, as measured by the Investment Association (1.7% vs 0.7%), which could be considered a relevant peer group benchmark.

Our emerging market exposure (via Brown Advisory Latin America) has experienced a tumultuous year, but we remain optimistic for the region and strongly believe that emerging markets will continue to provide substantial growth relative to developed markets in the future. Better demographics and productivity catch-up can only lead to the creation of more emerging consumers with disposable income to spend on goods and services. Crucially, they will start to consume the global brands and household names that we affectionately refer to as the ‘shopping trolley stocks’ at the core of our equity allocation.

Broadly speaking, the Balanced Strategy currently has a 50:50 bond (and cash)/equity split. Our objective is to participate in market gains while, most importantly, cushioning losses during market falls. This we achieve by owning quality companies at justified valuations. At the risk of sounding like a broken record, we are not seeing any meaningful value in our preferred assets. Accordingly, unless there is a valuation correction, the Strategy will remain defensively positioned. Instead of chasing returns, we will continue to “proceed with caution” into 2020.

Growth Portfolios:

Higher Risk

by Samantha Dovey

Objective: The Growth Portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

I thought I would take this opportunity to use the quarterly update as a year-in-review, since 2019 has been quite eventful to say the least. Nostradamus predicted that an asteroid was going to collide with Earth and destroy the world in February 2019. This didn’t take place!

Something else that didn’t take place was Brexit on 29 March because Parliament could not agree on Theresa May’s ‘deal’ with the EU. She subsequently stepped-down from leading the Conservative Party (and, thus, as Prime Minister) and was replaced by Boris Johnson in July. He then played much harder ball with both Parliament and the EU with regards to obtaining a ‘deal’ and got what he wanted by the end of October. When his last-minute agreement was rejected by Parliament, Boris successfully goaded the opposition parties into a full-blown general election on 12 December, where the Conservatives gained a landslide victory.

Boris wants to “Get Brexit Done” (for those that have not seen his Love Actually political advertisement, you should; it is rather fun) and the UK will leave the EU on the 31 January 2020. But, as with everything, the devil will be in the detail of the trade deal to be negotiated with the EU, for which Boris has set a hard deadline of 31 December 2020. Fingers-crossed I am not still writing about Brexit this time next year…

And that was just the UK! If you turn left or right out of Gatwick, the political upheaval has been just as entertaining: whether looking at the USA 2020 election warmup; the Argentine upset; or, the China trade wars.

Despite this, markets have been relatively buoyant with both bonds and equities returning double digits for the year (bonds 10%; equities 23%). We have to go back to 2012 to see this sort of performance. I am thus pleased to report that all underlying funds within the Strategy were positive for the year, although some had a smoother ride than others.

The stand-out performers for 2019 were Polar Technology and Pictet Global Environmental Opportunities Fund, both posting in excess of 30%. Despite the USD/GBP currency headwind of 5%, both returned more than 37% in USD terms. The overarching theme of these funds is ‘man-as-innovator.’ Innovation, whether in the form of internet-of-things and artificial intelligence or solving climate change, means that these funds are more important now than they have ever been.

The one fixed-income change we made over the year was selling OakTree Global High Yield for Royal London Short Duration Global High Yield. The sale took place at the end of July and the purchase on 1 August; the rationale was fully documented in our factsheets. OakTree had a fantastic start to the year (on the back of a difficult 2018) and by the end of July had posted +8.5%, but spreads for high-yield were fairly tight and we thought it prudent to take some of the longer-dated exposure off the table and therefore bought RLAM. Since the switch, RLAM is marginally behind OakTree. But it has achieved this with 20% of the volatility of OakTree and only 5% of the relative drawdown – everything we want at this point in the cycle.

We are pleased to report that the Growth Strategy posted over 14% for the year.

Global Blue Chip Portfolios:

Higher Risk

by Ben Byrom

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chips that are in line with our long term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long-term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

Whilst we are pleased with 2019’s performance, it did fall short of the peer group and its benchmark, the MSCI World. Driving us to analyse how we lost out on 2% when the Strategy is up 20% is the desire to do better next time. This quarterly pinpoints: why we think we marginally underperformed; how we have adjusted the process; and, the influence these changes have had on our decision-making during this quarter.

Unbeknown to us, the seeds of underperformance were sown (or, depending on your point of view, the seeds of outperformance weren’t) during the latter stages of Q4 2018. Then, global markets were in a tailspin after Jerome Powell miscommunicated the Fed’s stance on US rates. That quarter would finish as the worst for stocks since Q3 2011 when Europe stared into the abyss of financial ruin – how times have changed!

Regular readers will know we don’t engage in sector rotations or flip between ‘value’ and ‘growth’ stocks – to do so would mean having to own companies we simply don’t like (on a fundamental basis). Our decision-making process is dominated by valuation and made on a case-by-case basis. In our world, the stocks we own and watch are categorised as either ‘cheap’, ‘fair value’, ‘priced-to-perfection’ or ‘outright expensive’ and we went into Q4 2018, on average, priced-to-perfection and crawled into 2019 a smidge under fair value.

During Q4 2018 our valuation discipline meant we didn’t top-up Apple at $140 (it fell just shy to $142 in early-Jan 2019), nor Nike at $65 (its intra-day low of $66.53 materialised on 20 December 2018), or Visa at $120 (it would bottom out on 24 December at $121.60). Had we, with perfect hindsight, caught these lows and topped up these stocks by the intended 1% we would have earned a 104%, 53% and 55% return respectively (in USD). This 3% allocation alone would have closed the performance gap. Had the money to fund these top-ups come from the cash weighting, a further 0.75% in performance would have materialised due to the reduction in ‘cash-drag’. How frustrating!

So, what can we all take from this feedback?

The market’s thinking is not too dissimilar to our own – which is comforting. After-all, there was no single day where prices bounced simultaneously; market participants decided independently when enough was enough on each individual stock at various times through December and January. It’s just a shame that the collective thinking wasn’t a few dollars lower!

Discipline is important – even if it frustrates. In the words of Warren Buffet “price is what you pay and value is what you get” and we believe value to be an important factor in determining the success of an investment over the long term. Being disciplined on valuation prohibits the temptation to chase prices.

Adopting a broader approach to decision-making. Softening our hard line-in-the-sand on a case-by-case approach will allow us to capture opportunities that may otherwise have eluded us (see above). The aim of making such decisions while accommodating the broader opportunity set is to create a better potential return profile for investors.

With the third point in mind, we carried out the following trades during the quarter:

Initiated a position in Oracle, vendor of the relational and autonomous databases and a host of commercial infrastructure and software-as-a-service offerings, at a very attractive valuation. The market is clearly frustrated with the pace of execution in converting on-premise licence-owners into cloud-based, subscription members – a move that would cut client costs and double Oracle’s revenue just by converting the existing client base. Time and patience are rare commodities on Wall Street, but we possess both; especially when we view Oracle’s opportunity in the context of the broader portfolio. When pitched against consumer staple holdings, for example, Oracle’s current revenue growth was on a par ~3%-4% p/a (the source of Wall Street’s irritation), yet it was trading on two-thirds the valuation with a defined strategy to double revenue by selling a better product to just its existing customer base (let alone others). It was time to find room for Oracle.

Initiated a position in Illumina, the DNA sequencing machine manufacturer. On the face of it, the stock is outright expensive. However, the view changes after taking a harder look at the opportunity set and potential for growth – please read Oli’s Stock in Focus, below, for more detail. In the context of the broader portfolio, the attractive rates of return on offer at current levels (in both absolute terms and relative to other potential positions in the life sciences and med-tech sector) were compelling enough to take the plunge.

Sold Rolls-Royce. A well-used tactic of management is to let investors down gently on issues they are unable to correct, preferably over extended timeframes. We consider that the Company has hit an impasse on its Trent 1000 issue that could both jeopardise the platform’s profitability and put the Company’s business model at risk. With our investment rationale at the point of breaking we knew it was time to cut losses and move on.

Trimmed Walt Disney after a strong run. Following the Analyst Day in April and the eventual launch of Disney+ in November, a lot of optimism has been built into this once cheap, iconic entertainment firm. With programming costs and investment set to increase, investor allure may be tempered given Disney’s ‘priced-to-perfection’ valuation. It was time to recycle some of those box-office profits.

Well, that about wraps things up for 2019 leaving us only to thank all of you for your continued support. We look forward to working with you in 2020.

Fund in Focus:

Royal London Short Duration Global High Yield Bond Fund

by Shannon Lancaster

The final new addition to our portfolios and funds in 2019 was purchased in July 2019. We initiated a position in Royal London Short Duration Global High Yield Bond Fund across all strategies. The Fund focuses primarily on short-duration sub-investment-grade bonds with an expected maturity of less than two years. The current duration of the fund is 1.1 years, with a yield of 4.6% and it produced over 5% return in 2019.

The Fund was introduced as a replacement for Oaktree Global High Yield Fund. The Oaktree Fund is a longer duration high-yield bond fund, meaning that it has the potential to behave more equity-like and therefore more volatile than a shorter duration fund. We considered it was prudent to shift into a more defensive fund in this sector. The rotation into a shorter duration high-yield product means we are taking risk off the table.

Team

The Royal London team consists of lead manager Azhar Hussain and deputy manager Stephen Tapley with four key individuals in supporting roles. Azhar and Stephen also work closely with Royal London’s broader fixed-income portfolio management and credit research capabilities. The team has been working together for a long time and Azhar, the lead manager, has been running this strategy for over 15 years. The team’s focus on credit and liquidity has placed them head-and-shoulders above the majority of the competition, especially when spreads widen.

Investment Process

The Fund is managed using a disciplined credit investment process focusing on security selection combined with top-down analysis. Their value-orientated approach seeks to exploit the inefficiencies that can be found within high-yield credit markets globally.

The analysis starts with a quarterly economic review which covers all major economic regions and focuses upon key variables such as growth rates and inflation. This meeting is also used to develop their outlook scenarios, including long-term default, yield and interest rate forecasts which help to shape their investment strategy.

The next stage in portfolio construction focuses specifically on the companies themselves and as value investors, the managers emphasise the importance of research and believe that individual stock selection will be the largest and most consistent contributor to performance within the funds. The research process is comprehensive and focuses on their in-depth research of each bond in which they invest.

As part of this process they focus on:

• The cash flows of the company

• Its access to the debt markets

• The covenants and security of the debt issues

• The motivations of management and the owners

Conclusion

Overall, the purpose of the new fund addition is to provide downside protection, especially when high-yield spreads widen. The team at Royal London is experienced in this short-duration segment of the high-yield market and can identify opportunities that offer the potential to earn a disproportionate income for the risk and level of volatility that they are bearing. We are pleased to have added Royal London to our stable of funds and hope to be working with them for many years to come.

Stock in Focus:

Illumina

by Oliver Tostevin

For Global Blue Chip portfolios and the Fund, we recently made an initial investment in Illumina. This note sets out to give an explanation as to why we like this business for the coming years.

The investment case revolves around genomics – the study of the genome – and we’re especially interested in the human genome. The genome can be seen as a sort of blueprint that provides the set of instructions for the construction and functioning of an organism. Each ‘instruction’ is represented by individual genes, whereby the process of ‘gene expression’ is how those instructions get turned into particular proteins – the stuff of which we are made. Every cell in your body contains a full set of these instructions/genes, with two copies of each, one inherited from each of your parents. It is estimated that the human genome contains 20,000 to 25,000 separate genes.

Very slight variations between our genomes form a large part of the explanation as to why we are not all the same (there are other explanations, too, such as environment – the ‘nature versus nurture’ argument – but we don’t need to get into that now). While genes can explain, for example, why you have a particular eye colour, they can also be instrumental in understanding and treating disease. Through genomics, sick patients can often be diagnosed far more quickly, leading to much better patient outcomes. While genomics can also be instructive in tailoring the best available treatment for the disease in question – for example, in cancer, which is considered a ‘disease of the genome’. Moreover, as we discussed in a previous note here, genomics is now a vital part of coming up with innovative new medicines and treatments.

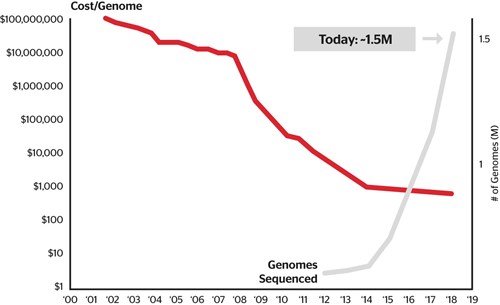

It cannot be overstated just how much this field has advanced in the last 15 years or so and how our understanding has improved. The process by which a genome is read is called ‘sequencing’. In the 1990s there was a US-government sponsored initiative to sequence a complete human genome for the first time. When the Human Genome Project came to an end in 2003, it had taken 13 years and cost almost $5bn (adjusted for inflation).

Enter Illumina, the leading manufacturer of sequencing systems:

Using Illumina’s top of the range system, Novaseq, a human genome can be sequenced in a matter of days and at a cost of less than $1000 – quite an improvement on 13 years and $5bn! Illumina’s mission statement is ‘to improve human health by unlocking the power of the genome.’ The company has relentlessly driven down the cost of sequencing by constantly improving the performance of its products. Further, Illumina believes it will get the cost down to $100 per genome on Novaseq. Today, Illumina accounts for 90%, or more, of all genomes that are sequenced.

Clearly, as the above chart shows, there is a relationship between the cost of sequencing and the amount of sequencing that is done. And we are now at the stage where mass adoption is starting to take place. Illumina believes (as do we) that sequencing will increasingly become part of the standard of patient care in the coming years and will be carried out as a matter of course. For example, the UK is leading the way in this regard: several years ago the UK government began an initiative to sequence 100,000 genomes within the NHS using Illumina’s equipment. Last year, this was expanded to five million, within five years. The US is close behind with its own initiatives, while Illumina says that it is in discussions regarding similar projects all around the world.

There’s an old adage in the investment world, that when there’s a gold rush taking place, it’s generally best to be the one selling the picks and shovels (i.e. the underlying technology) rather than being a prospector. We see Illumina as a picks-and-shovels seller. What’s more, whenever Illumina sells a system to a customer it sets the scene for future sales because the systems require ‘consumables’ (e.g. reagents and ‘flow cells’) every time a sequencing run is undertaken. In fact, these consumables now account for the bulk of Illumina’s sales.

When one considers that fewer than 0.02% of people in the world have had a genome sequence, we believe that there will be plenty of work to keep Illumina busy.