What is your portfolio doing about coronavirus?

Over the last six weeks the world as we know it has changed more than we would have thought possible just a few months ago. I don’t know about you but I am having to ration my news intake at present to avoid getting overly gloomy about the world. One industry which has taken to the coronavirus outbreak with gusto is the 24 hours news cycle and it is now bombarding us with ever more terrifying infographics. What they don’t cover however, bar airing the odd emotional YouTube video by an exhausted healthcare worker, is the gargantuan effort that has gone on, largely behind the scenes, to prepare for, and now to fight the virus. That is a shame as it is that massive effort that will ultimately save lives.

To give an example from our little microcosm of Guernsey, we have seen a massive effort by our one and only hospital to setup, in just a few weeks, a whole second intensive care unit as well as, somehow, managing to more than double the number of available ventilators and have on-island testing up and running at an impressive speed. On a much larger scale, similar efforts are underway in other jurisdictions, with the massive new Nightingale hospital being setup in London’s Excel centre and the US Navy hospital ship docked in New York harbour being very visible examples. To support such efforts though we need equipment (from the infamous “PPE” to ventilators), medications and ultimately a vaccine and this is where your portfolio can help.

As many of you will know technology and healthcare are two of our long-term investment themes and we are very pleased to be able to say that many of our portfolio companies are hard at work today on this pressing issue. So we thought we would buck the news trend and share with you some of the great work they are doing to support the heroic efforts of our doctors, nurses and myriad of other healthcare workers on the front lines.

Building more ventilators

A key bottleneck in healthcare systems globally is expected to be the availability of ventilators in intensive care units. These devices are crucial in keeping the severely ill alive while their bodies fight the infection. The UK went into this crisis with a little over 8,000 ventilators but have indicated that they need a further 30,000 machines to help meet the expected peak demand. In your portfolios we have three of the companies; BAE Systems, Microsoft and Unilever who are part of “Ventilator Challenge UK”, which is one of the leading efforts to provide 10,000 of those vital ventilators. In addition, in the US, medical devices firm Medtronic has made the design of one of its existing ventilators available for free to help in the manufacturing effort over there.

Producing a vaccine

The long-term solution to this crisis ultimately lies in a vaccine. So far the pharmaceutical industry has responded at a speed never before seen. Initially, China publicly releasing the virus’ RNA code in early January, just under a month after the first known patient fell ill – a speed that was unthinkable when SARS hit the world in 2003. This was then followed by an unprecedented reaction from the global pharmaceutical industry with the chief scientific officer of Johnson & Johnson, a long-standing portfolio stock, being quoted in the Wall Street Journal as saying:

“We have never gone so fast with so many resources in such a short time frame”.

We are pleased to be able to report that the firm now has a leading vaccine candidate. If trials go well, it plans to ramp up production with the aim of creating more than 1 billion doses by the end of next year.

Finding treatments

With a vaccine still a way off however, despite the industry’s best efforts, in the interim effective and safe treatments will be crucial for the most severe cases. Several of the companies that we invest into on your behalf are active in this area including:

- Roche which is testing their Actemra arthritis drug with the first results due in the summer.

- Novartis is testing their Jakavi drug to see if it is effective in reducing the severe immune overreaction that some COVID-19 patients suffer with.

It’s not just healthcare

The technology sector has a role to play as well. A key factor in helping us all leave lock down and begin to return to some type of normality will be our ability to find new infections and then to trace their contact history in order to isolate any secondary infections and prevent a resurgence of the virus.

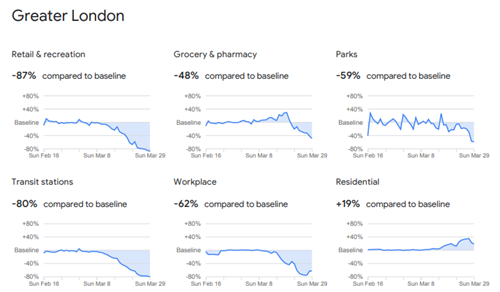

This has been a key part of poster child South Korea’s response with an app on smart phones to warn you if the person you sat next to on the bus yesterday has tested positive for coronavirus. We are all aware of Silicon Valley’s ability to track us and, in this time of crisis, they are turning this advertising machine over to the public health cause. Within your portfolios, both Google and Facebook are now competing to make the best use of their user data. Facebook has made a large amount of information available to governments and universities via its “Data for Good” programme to help them understand the effectiveness of social distancing strategies and the spread of the virus. While Google has made publicly available what it is calling “Community Mobility Reports” which you can see online to see how compliant your area is being. Below is the report for greater London:

Source: https://www.google.com/covid19/mobility/

We have even had a few surprises!

While nobody will be surprised that stocks like Reckitt Benckiser, again in your portfolios as part of our consumer brands theme, are producing products like Dettol as fast as they can, I was surprised to hear that luxury brands firm LVMH had joined the fight. Although traditionally known for more rarefied products such as Moët Chandon champagne or Hennessy Cognac, LVMH has turned some of their factories over to the production of hand sanitiser. I am still trying to find out if it will be sold under the Louis Vuitton brand!

Source: https://thehauterfly.com/lifestyle/louis-vuittons-parent-company-lvmh-is-going-to-be-producing-sanitisers-and-will-distribute-them-free-of-cost-to-health-authorities-this-is-the-need-of-the-hour/

Doing the right thing

In this time of crisis, we are heartened to see the firms we have selected on your behalf doing the right thing and taking a long-term view. The courage to do the right thing, even if it may come at a short-term cost, is exactly the sort of long-term thinking that we believe serves you, our clients, and our communities best in the long run. We believe it shows the sort of quality management teams that we want to have in our investee companies.

I hope you enjoyed this note, that it provided a bit of light relief from the normal news gloom and shows that there are glimmers of hope. From the team at Ravenscroft, I would just like to finish by wishing you and those around you all the best in this difficult time. I am pleased to be able to say that all our team and their families are currently safe and well. So take care, thank you for choosing Ravenscroft and as ever we are here if you need us.

With best wishes,

Bob Tannahill, Multi Manager, global Huntress fund range

e: rtannahill@ravenscroftgroup.com

FINANCIAL PROMOTION: The value of investments and the income derived from them may go down as well as up and you may not receive back all the money which you invested. Any information relating to past performance of an investment service is not a guide to future performance.