2019 Q2 Newsletter

"And I know I'm in too far, too fast

Gotta take it slow

If I'm taking it too far, your heart will never learn to trust

I don't want to go too far, too fast

With nowhere it go."

'Too Far Too Fast'. Brasstracks, 2018

Another quarter gone, another quarter dominated by political antics. From The Donald fist-bumping Her Majesty to Boris’s late-night squabbles with his girlfriend, the media has had a field day.

Once again, we have seen Trump’s brinkmanship as he lifted the threat of tariffs against Mexico in exchange for border-control concessions, triggering hope that this might presage a similarly meaningful climb-down in the much more important US-China tariff negotiations. Hmmm – wishful thinking? In fact, his gaze has seemingly shifted towards Iran, where further economic sanctions have been imposed.

Equity markets appear to have taken most of this in their stride and, as I write, the US market is bouncing around all-time highs. In bond markets – specifically the Dollar bond-market – yields have been bouncing around lows (i.e. valuation highs), so the twin bulls of the bond and equity markets have simply ploughed on! The question, of course, is for how long?

Whilst all of this noise makes for a fascinating read, it only serves to highlight the relative instability of global politics and economics. Given The Donald’s love of keeping it unpredictable, it would be foolhardy to base investment decisions on any US policy premonitions. And, as regular readers know, we place little faith in economic or political forecasters at the best of times. In this environment, conventional predictions have little more than comedy value.

This said, we always need to understand our investment environment. For example, the US bond market has sounded a recessionary siren – in the form of an inverted yield curve. This means that investors receive a lower yield for lending for a longer period. Simply put, they are being paid less for taking on more risk. This combined with the lively political backdrop and the fact that most equity markets (Latin America and domestic UK aside) continue to trade at above-average valuations only serve to reduce upside and increase the downside potential. Accordingly, we consider it prudent to take a defensive approach.

Our priority is always to be sensible with your savings. For now, that means proceeding with caution. We need to maintain sufficient liquidity so that you can get your money back as and when you want it while offering an appropriate level of downside protection should markets fall. Should quality investments become available at attractive valuations in the event of a market correction, it is then our aim to be ready to seize the opportunity to buy those cheap assets and lock in future returns.

Cautious Portfolios:

Lower Risk

by Bob Tannahill

Objective: The Cautious Portfolio’s objective is to increase its value by predominantly allocating capital to fixed-income investments. The portfolio can also invest into global blue-chip equities with strong cash-flows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity-weighting of approximately 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

The Income strategy returned 2.4% over the quarter including both capital and income returns.

This was driven by improvements in the markets’ two major obsessions of 2019: Trump’s trade wars and the direction of US interest rates as set by the Federal Reserve (the "Fed"). Over the quarter we had some see-sawing on the trade wars; however, the markets’ read of the mixed signals coming out of the US was evidently net positive.

At the same time, weakening of inflation expectations – almost perversely in part due to the threat of trade wars – was enough to get the Fed to reverse course and hint at a possible change of direction (from raising to cutting interest rates). Much to The Donald’s delight, no doubt…

In fact, one could argue that by stoking fears of a trade war and then pulling back from the brink, as seems to have happened at the G20 meetings last week, Mr Trump may actually have achieved his goal of getting the Fed to change course without derailing the economy. Whether that is luck or judgement remains a very open question. But, what is certain is that for a president who measures his success, at least in part, via the stock market, it has had the right impact. Whatever the intentions of the actors involved, the effect has been dramatic. The "everything rally", as one commentator recently dubbed it, has seen almost every asset class post strong returns so far this year.

On the equity side, expanding valuations in our global dividend-paying stocks helped to bolster returns over the quarter. We saw roughly equal contributions from higher earnings and from higher valuations of those earnings, which, in addition to a little dividend income, helped that element of the strategy post returns of around 5%.

On the bond side, it was something of a tale of two markets – although moving in the same direction. For Sterling bonds, such as our UK government bonds, the Tory leadership campaign heating up in early May pushed Sterling down and government bond prices up as investors became more nervous. This led to Sterling bonds generally having a good quarter; the currency also acted as an additional tailwind to our global equities.

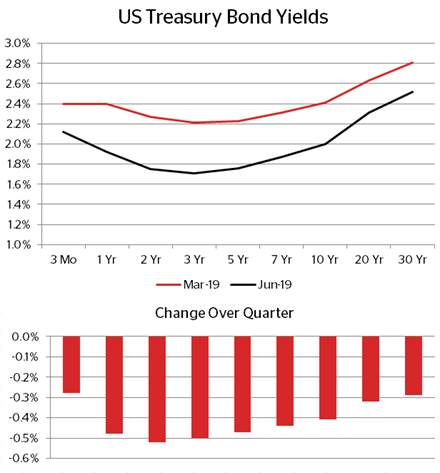

Source: US Department of Treasury

Looking to our global bonds (which are largely Dollar based) the Fed’s shift from a "hawkish" to Trump’s preferred "dovish" was a big positive. As you can see in the charts above, the yield on all US governments bonds fell markedly during the month and the "inversion" of the market (the number of rate cuts implied by current market prices) increased. These drove a broad rally in Dollar bonds especially the longer-dated bonds. Over the quarter, our sole longer-dated Dollar bond fund, Stratton Street’s Wealthy Nations Bond Fund, was our strongest bond performer, rising an impressive 4%. In such a strong environment the laggards were always going to be our most defensive positions: Smith & Williamson’s Short Dated Corporate Bond Fund and our short-dated UK government bond ETF, to be precise. However, these assets did their job admirably in Q4 2018 and we do not have any plans to replace them.

The one quieter area over the quarter was "credit" or corporate bonds. While they had a strong quarter thanks to the rally in government bonds (which drives part of their pricing), investors’ appetite for credit risk (the other pricing factor) was largely unchanged over the period. This saw our more defensive corporate bond funds rising in line with government bonds while our racier "high-yield" bonds (in the form of Oaktree, mainly) posted an unremarkable 1.8%.

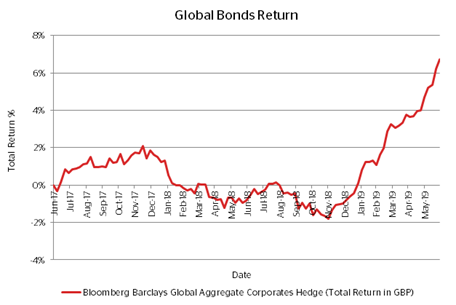

Looking forward, as ever we have no special insight into what the final scoreboard will look like for 2019. We are now halfway through the year and the very strong start naturally makes us nervous! We are conscious, however, that emotions are a poor guide to the future, which is why we always fall back on valuations and the longer term perspective at times like these. The longer-term perspective is that while, after a torrid 2019, bonds might have posted strong recent returns, they are, in part, playing catch-up from 2019. As you can see on the following page, while the return from the low of global bonds hedged back to Sterling might be a whopping 8.7%, their two-year returns are only a little over 3% per annum. Not nearly as impressive, and largely in line with their income yields.

Source: Ravenscroft Investment Management & FE Analytics

The equity side is a similar story, with an average annualised return of just under 8% over two years. This perspective suggests that markets may not be quite as hot as our short-term-focused emotional reaction might suggest.

On the valuation side, markets are back to where they were before the October sell-off last year: on the rich side of the range, but not extreme.

One type of change we remain happy to make is one where we can maintain most of the return potential of an asset while materially reducing our risk. These types of switches become less costly in terms of missing potential upside in a positive scenario when assets are expensive as they are at present. While we have not signed and sealed it yet, we hope to be able announce just such a change in the near future…

Balanced Portfolios:

Medium Risk

by Tiffany Gervaise-Brazier

Objective: The Balanced Portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

The US economic expansion enters its 11th year, making it the longest expansion since 1900. Ten years of monetary stimulus, economic growth and falling unemployment have succeeded in boosting bond prices and stock prices.

Although growth has been solid, concerns about slowing growth ahead and negative impacts from the ongoing trade tensions between the US and China are troubling investors torn between buying bonds (and the inverted yield curve), jumping aboard the equity bandwagon to chase returns or (arguably the most difficult decision of all) doing nothing and harbouring cash.

If we strip our philosophy right back, the Balanced strategy is designed to offer investors long-term capital appreciation via a combination of global equity and fixed-income investments. The strategy is no stranger to political and economic uncertainty, having been created in 2008!

The equity weighting is divided into two camps: defensive, global, large and mega-cap stocks; and theme-orientated equities, such as Brown Advisory and our Polar Capital exposure to Healthcare and Technology. Even during a slowdown, robust companies will continue to pay their dividends, continue to sell their products to an ever-increasing audience and continue, perhaps most importantly, to improve their global reach. It is these companies that we want to own at sensible valuations and hold throughout.

The purpose of bond allocation within the Balanced strategy is to reduce the volatility of the portfolio whilst generating a yield. Given where we are with current bond yields (low), we are focusing mainly on liquidity, i.e. the ability to sell such assets should we wish. Owning diversified and short-dated bond funds with excellent liquidity allows us to be proactive when (re-)allocating assets. This, combined with our slightly elevated cash holding, will enable us to move quickly should equity valuations retrace and attractive entry points for our preferred assets appear. We agree with Warren Buffett when he said "cash combined with courage in a time of crisis is priceless." Now, we aren’t saying we are at crisis stage, but alarm bells start to ring as you exceed all-time market highs.

In terms of performance, the strategy has produced a pleasing 10.2% return year-to-date. The performance can be attributed predominantly to the global equity allocation (via Fundsmith, Lindsell Train and GuardCap) and our thematic allocation, particularly our technology exposure. Our global equity income fund (Fidelity) took the top spot in June, returning 4.6%.

We recently met with the managers of the Brown Advisory Latin American Fund and were interested to hear their findings from recent trips to the regions. There has been a lot of publicity surrounding a long-awaited pension reform in Brazil and it looks as though a resolution will be reached by year-end. Given the headwinds that Argentina suffered last year (following devaluation of their currency and other political and economic factors), the region is looking relatively cheap on a valuation basis and therefore Brown is looking to make opportunistic purchases. Brown Advisory Latin American is currently at a 4% weighting in the Balanced strategy.

At risk of sounding like a broken record, we urge our investors to be mindful of their investment time horizons during these times of uncertainty. If you are able to afford to take a long-term view of your investments, you are able to ride out periods of volatility. The portfolio’s large allocation to some of the world’s best global brands, while not immune to political and economic events, is unlikely to be materially impacted in the long term. In reality, such market-leaders will continue to drive their global footprint, sell their plethora of products to an ever-wealthier emerging consumer and thus continue to deliver for you, their shareholders. In short, these companies will stick to their knitting… and so shall we.

Growth Portfolios:

Higher Risk

by Samantha Dovey

Objective: The Growth Portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

The second quarter of 2019 has all been about Trump, Tweets and Trade War. In an era of social media domination, the impact of narrative on the movement of stock markets and individual companies seems to be more and more prevalent. Take Elon Musk’s tweet about taking Tesla private back in August 2018: over the following weeks the Company’s shares fell 30%. In fact, American economist and Nobel Laureate, Peter Shiller, is so convinced of the influence narrative has on investors’ decisions and thus the impact on markets that he is conducting his latest study on it.

Using a more trivial example, back in February 2018 influencer Kylie Jenner tweeted her displeasure with social media platform Snapchat: "Sooo does anyone else not open Snapchat anymore?" she asked her 27.6 million(!) Twitter followers, "Or is it just me... ugh this is so sad." Snapchat’s parent company "Snap Inc." immediately fell 6.1%, wiping out $1.3bn in market value.

In a position not historically short of influence, Donald Trump now has arguably even more power to unsettle the Federal Reserve, move entire stock markets and potentially upset nations through the click of a single button (no, not that one!). From the morning of his inauguration Trump has sent out over 8,628 tweets. The first tweet on the morning of the 20th of January 2017 was posted at 7:31 am, technically before he was sworn-in as President. "It all begins today!" Trump wrote, "I will see you at 11:00 A.M. for the swearing-in. THE MOVEMENT CONTINUES – THE WORK BEGINS!".

All this makes investing on the fundamentals that little bit more difficult, since, on the whole, the market is not always judging companies on results, but rather more on what is being tweeted and insinuated.

With all of this going on, the Growth strategy posted 4.8% over the quarter, bringing the year-to-date figure to a healthy 12.9%. There have been plenty of discussions surrounding performance over the first half of the year: have markets gone too high, too fast; are valuations too expensive; should we be trimming equities; how are bond managers assessing the Fed and interest rates? However, when you take into account the sell-off that occurred during the last quarter of 2018, the performance of the strategy comes in at a more reasonable 5.8%.

The performance profile of the portfolio has on the whole followed the market, which has undeniably been driven to some extent by The Donald’s tweets! Equity and bond markets continued their upward trajectory in April, our global equity funds outperformed the MSCI World Index and the technology biased funds within the theme allocation of the strategy performed very strongly. The star performer of the month was Lazard Global Equity Franchise, which posted a 7.5% return. The Fund had a 4% allocation to Qualcomm, an American semiconductor and telecommunications equipment company, which rallied 54% after announcing that its legal dispute with Apple had been resolved. Elsewhere in the strategy, the growth-centric bond allocation of the portfolio performed well given the risk-on appetite of investors throughout the month.

On the 5th of May 2019, President Trump threatened to raise tariffs on $200bn Chinese goods; this was enough to send panic through the market. By the 13th of May, the MSCI World Index had fallen nearly 4% – the Information Technology sector taking the brunt of the tweet, falling over 6%. The pain was felt within the portfolio via our thematic exposure to the Polar Capital Technology Fund, Pictet Global Environmental Opportunities Fund and RobecoSam Smart Materials Fund, all of which fell somewhere between 3% and 6%. In fact, not one of our global equity funds were positive over this period; however, by the end of May some of the global funds were back in positive territory, as were the emerging market funds. Unlike April, when our growth-orientated, less defensive, bond allocation aided the performance of the portfolio, the strategy’s bond allocation did not provide any solace during May, since only PIMCO Global Investment Grade Credit posted a positive month.

June was saved by concerns over the trade war with China abating, coupled with the dovish statement from the Fed about its approach to policy: it announced that it would "act as appropriate to sustain the expansion." This injected a surge of optimism back into equity markets and sent them up 5% across the month of June alone. The funds that had been hurt by the trade war tweet in May rebounded strongly, posting gains of 4% to 7%.

You may gather that what has been most noticeable over the last 18 months is the increase in volatility. Just looking at some of the more trade-sensitive funds, such as RobecoSam Smart Materials, from September 2018 to the end of June 2019, versus the 12 months prior to September 2018, volatility has increased by approximately 30% to 40%. The world, on the other hand, has only increased by 7%.

The impact of volatility is, of course, not all bad. As many of our investors know, sensitivity in markets can present buying opportunities if valuations are right. We are continually re-assessing the strategy, endeavouring to trim positions should they become expensive and to add to them should they look cheap.

In the meantime, as ever, we are sticking to our knitting, ignoring the market noise and concentrating on valuations to ensure that we are positioned to take advantage of market movements.

Global Blue Chip Portfolios:

Higher Risk

by Holly Warburton

Objective: The Global Blue Chip Portfolio invests into approximately 25-30 global blue chips that are in line with our long term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long-term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

Despite the global backdrop of trade wars, political and environmental protests, and President Trump (and his constant stream of tweets) markets have continued on their upward trajectory throughout Q2 with all market sectors posting positive and fairly consistent returns.

The performance of the Technology and Consumer Discretionary sectors stood out and this was reflected in the portfolio through our holdings in Microsoft, Visa, LVMH and Richemont. The performance of our luxury holdings is a testament to the strength of the emerging consumer, in a period that could have easily been overshadowed by China growth concerns and ongoing trade discussions; both companies posted double-digit revenue growth with Asia contributing the most. The exposure to these companies is monitored closely since sentiment towards luxury stocks can change swiftly, especially as growth fears from these important regions are likely to be impacted by economic or social unrest. So far, the protests in Hong Kong, a key market, have not sparked any concerns.

Microsoft is another stock which announced double-digit growth. Often seen as a laggard in a new Tech era dominated by the FAANGs, the Company’s transition under CEO Satya Nadella is a testament to the fact that even the biggest companies can continue to reinvent themselves in order to fend off competition and remain relevant in an ever-changing world.

The only trading activity within the strategy was the introduction of Waters Corporation after it hit our pre-identified entry price based on valuation work we conducted as part of our in-depth research process. Waters is a life-science company producing speciality measuring instruments such as liquid and gas chromatography machines, mass spectrometers and thermal analysis equipment. These instruments play a critical part in the scientific analysis and understanding of different compounds and are widely used by the pharmaceutical and biotechnology sectors, government agencies and academic research facilities and across a broad variety of industrial companies. More insight into this new holding can be found in this quarter’s Stock in Focus.

Finally, it would be remiss not to make mention – along with the rest of the team – the other main news of the quarter: liquidity. Given the strategy’s focus on global, large-cap business, liquidity could be taken for granted. However, it is something that we monitor regularly to ensure that our promise to clients of easy access to funds is upheld, regardless of market conditions. In every liquidity review since the portfolio’s inception (at current investment levels) the portfolio’s direct equity positions can be fully liquidated in a day. This assumes positions are liquidated in an orderly fashion taking up no more than one third of normal daily trading volumes. As we aspire to grow, we monitor how increased assets under management would impact this liquidity profile. Should, for example, the portfolio grow to $5bn in size, we estimate that roughly 85% of the portfolio could be liquidated within one working week under normal trading conditions.

Theme in Focus:

Global Brands: The Brand (R)Evolution

by Shannon Lancaster

The marketing environment for brands over the past twenty years has become significantly more challenging.

Before technology entered our lives and the internet became an everyday essential tool, scale was on the incumbent’s side and potential innovators were often deterred by their inability to compete for shelf-space and struggled to get in front of potential customers. From an investment perspective, this made some companies a fairly safe bet: think dominant players, repeat customers and high barriers to entry. Fast forward to the present day, there is no doubt that modern technology has helped to erode a large part of the competitive advantage that used to exist.

There is no denying it, how we make our choices as consumers has transformed over the past few decades. With rapidly changing distribution channels and consumer tastes – combined with the switch in who has ultimate control over a brand’s narrative from once all-powerful Madison Avenue marketing teams to today’s general consumer – the reality is that brand strategies are futile if they cannot build a meaningful relationship with the consumer.

Traditionally, companies valued consistency as the most important principle of branding. Today, however, brands must find a way to continually reinvent themselves while maintaining their identity in order to keep in touch with the ever-changing consumer trends.

Touch Points and Brand Advocates

We have a come a long way from the linear marketing models of the past. Gone are the days of cold calls, door-to-door selling, big budget television adverts and Mad Men-style campaigns. We are now in the era of social media influencers, YouTube sensations, devoted online followings and personalised targeted advertising.

Through these channels, brands are no longer restricted to conventional advertising paths and funnels. They now have the ability to approach customers as individuals and utilise the two-way conversation provided by social media to build meaningful relationships with their customers – an incredibly powerful tool. The consumer journey, which was traditionally viewed as having a beginning, middle and end, has been disrupted. The ‘journey’ is now an infinite process. Social media has created a perpetual engagement machine that allows for multiple brand touch-points.

In addition to this, the existence of these platforms has greatly reduced the cost of acquiring consumers – the ultimate goal of any advertising. A company no longer needs a substantial marketing budget to create a powerful brand. A strong online presence that connects with consumers or a viral video can change a brand’s fortunes overnight. Of course, the fickleness of this online world can work both ways. A brand that has spent years offline building a strong reputable brand can quickly be eclipsed by a young and hungry start-up. Occasionally, companies will be faced with their worst nightmare, an army of irritated social media users: think the ‘Beach Body Ready?’ tube campaign disaster; Pepsi’s Kendall Jenner blunder or Nivea and their ‘White is Purity’ marketing mess. Although the issues may not cause permanent reputational damage, a movement of disgruntled customers can quickly render a brand obsolete. The online community can be savage, swift and brutal in its crucifixion of brands.

Moreover, brands themselves are no longer the loudest voices in these conversations around their own fate. The power is now, to a large extent, in the hands of social media-savvy consumers and influences; a brand’s ability to convert them to advocates is therefore vital if these companies are going to continue to dominate in the 21st Century.

Remaining Relevant

In order to stay pertinent, brands must not be static; they must actively engage with the consumer and intertwine themselves seamlessly with their lives.

If we look at some of the most iconic names in the business today, it appears they have almost stood still over time – effortlessly using their status as power brands to rest on their laurels. Unfortunately, to be truly iconic they must be innovative. And to be innovative they must be flexible and forever improving. To be a successful brand in 2019 means balancing brand identity and agility, which, let’s be clear, is no easy feat. A great example of this is Coca-Cola, which has consistently kept up with changing consumer demands without losing its authenticity. It was one of the first companies to use a well-executed brand strategy to expand globally. Coca-Cola’s brand has withstood wars, recessions, and a multitude of trends in the beverage industry, including, most recently, the rise of the millennial consumer. That is not to say there haven’t been challenging times (or that there won’t be in future) but management’s track record of navigating turbulent times has, so far, been pretty good.

Brave Branding

There is no doubt about it, the digital age and all that comes with it is revolutionising the marketing world. So how can investors harness the power of iconic brands to bolster returns? While we can access these global brands through all our funds, one particular area of interest to us is the emerging-market consumer and their interaction with brands. We invest in an emerging-market consumer fund managed by Arisaig which places great emphasis on monitoring how brands in emerging markets are dealing with these digital changes. By recording consumer data trends and engaging with the management of its underlying companies, Arisaig can see which brands are succeeding.

Great brands are fearlessly marching into new eras and markets. They view these changes as opportunities not threats. They can see that the current marketing environment gives them a chance to emerge as innovators and leaders in consumer experience. In 2003, Philip Kotler, the father of marketing, said, "The best advertising is done by satisfied customers." Here we are 16 years later and the quote couldn’t be more relevant. Companies willing to use the channels available to them in effective, engaging ways to build a customer base of vocal brand advocates are ultimately those that will succeed – and that you should be actively seeking to own in your portfolios.

Stock in Focus:

Waters Corporation

by Ben Byrom

If you’ve ever wondered how to separate compounds into their different molecular elements, then wonder no more! We have introduced a life-science company that has enabled scientists to achieve such alchemy for over 60 years.

Waters Corporation is a life-science company headquartered in Milford, Massachusetts, USA, that has carved out market-leading positions in the design, production and support of chromatography, mass spectrometry and thermal analysis machines.

Chromatography is the go-to technique when separating compounds into their respective molecules. Whilst there are many ways to separate molecules using chromatography – the chosen technique will largely depend on the desired separation – the methods employed are essentially the same. The purified elements are then sent through a detector for analysis. Any requirement for more thorough analysis involves the use of a mass spectrometer. A mass spectrometer accelerates ions (molecules that have been charged – usually by stripping an electron off) into a vacuum chamber and deflects them using, for example, a magnetic force as they make their way to a detector; ions can then be identified by their mass-to-charge ratio. Again, while the principles are the same, there are many different types of mass spectrometer; selection will depend on the type of analysis to be conducted. Given the synergies between chromatography and mass spectrometry all manufacturers now offer interconnected devices allowing for a much faster and efficient analytical workflow in the laboratory.

There are numerous end-markets with demand for these analytical instruments, particularly the development of new drugs, chemicals and materials. They are also important in forensic toxicology analysis (environmental testing, pollution control, criminal investigations, drug abuse, etc.) and Quality Assurance/Quality Control processes to ensure that products, whether imported or exported, meet rigorous health and safety regulations.

Waters categorises its end-customers as: Pharmaceutical; Government and Academic; and, Food and Industry. Pharmaceutical customers account for over 56% of total revenues – over the past three years they have been the fastest growing category with revenues compounding at 7% per annum whilst the others have grown at around 4%. Despite Pharmaceutical’s weight in its customer portfolio, no one customer makes up 3% and all segments are keeping up with the growth of its end-markets. In these terms, Waters is both well diversified and aligned with good growth trends.

Whilst we haven’t touched on its Thermal Analysis capabilities (the TA Division accounts for 12% of total sales), the division’s business model operates in a similar fashion, i.e. it sells TA instruments and supports them through training and maintenance programs. If we consolidate all instrument sales they make up 49.8% of the Company’s total revenues, down 2.5% from 3 years ago. As the installed base of instruments grows the repeat purchase element of services and consumables has accelerated. The repeat purchase element of Waters sales profile has grown its share of total sales from 47.7% to 50.2% over the last three years. This incremental change in its product mix is having a positive impact on profitability with margins and free cash flow rising.

At 28% of revenue the US is Water’s biggest geographic market; Europe is close behind at 27%. However, the company’s major growth market

is China, which currently accounts for 18% of revenues and has grown at over 16.5% CAGR over the last three years, driven by strong demand in areas of food safety and pharmaceutical development. Although the CAGR number looks impressive the y-o-y reality is much more volatile and this can impact the stock’s price accordingly.

From a capital allocation perspective Waters is not a serial acquirer of businesses, preferring organic growth opportunities through the reinvestment back into its business. It has, however, been a big buyer of its own stock with buy-backs adding some 3% a year to earnings per share over the last 10 years. In Q4 2018 we saw a material acceleration of its authorised buy-back program with over 40% of that year’s repurchases occurring in the fourth quarter alone. The buy-back was significant, as it was comparable to the amount of money spent in total on repurchases over the previous four years. Whilst this spending coincided with a drop in Water’s share price, we think this to be more accidental than opportunistic. The reason we suspect this to be the case is because in January of this year repurchases were given a pleasant boost by the Board who authorised a $4bn repurchase program with a 2-year time limit. Whilst the latest authorisation replaces all previous programmes and is not pursuant to existing authorisations, given the deployment of some $747m (buying-back 3.3m shares) in Q1 alone, I doubt we’ll need the full 2 years to see this program exhausted.

Management intend to fund this aggressive buy-back program by increasing the Company’s net-debt-to-EBITDA to 2.5x. During 2018, the Company repatriated $1.8bn of matured short-term investments that were taxed at lower interest rates as a result of the 2017 Tax Act. Some $850m of this was used to pay down the Company’s long-term debt level, reducing its net-debt-to-EBITDA to 0.5x. In short, Waters has considerable headroom to fund further repurchases from the proceeds of debt.

We’re not completely surprised to see Waters spend such amounts on buy-backs. For one, the Company doesn’t pay a dividend. Two, the Company doesn’t have a huge product portfolio to invest a great deal of money into and whilst R&D budgets have risen as a percentage of overall sales (and in absolute terms) management obviously considers enough is being spent to maintain market position. Finally, and probably most importantly, our work on executive compensation highlights the importance total shareholder returns ("TSR") have on the overall remuneration package. In order for performance stock units to be earned the Company must deliver a greater TSR than a pre-established comparator group of companies – a mix of industry peers and direct competition.

All-in-all, we consider that Waters is a well-managed business operating in a niche segment of the life-science market. It is a ‘picks-and-shovels’ type business providing the analytical tools and support to businesses or organisations operating in these areas. As Water’s product-mix incrementally increases its exposure to service plans and repeat-purchase consumables, we should see a continuation of the current operating leverage (over the last three years’ reported sales, operating income and earnings per share have grown 6%, 8.7% and 12.7% respectively). Clearly, buy-backs are having an impact and, with the operating base of this business continuing to grow, stock bought today should look even better in five years’ time. With buy-backs seemingly set to continue for the foreseeable future, we should, providing the market ascribes a similar multiple, see a materially higher share price, too. Nevertheless, we will be keeping a close eye on borrowings and how they might impact the integrity of our investment case.