2018 Q4 Newsletter

"Nowhere to run to, baby,

Nowhere to hide.

Got nowhere to run to, baby,

Nowhere to hide.”

Martha and the Vandellas, 1965

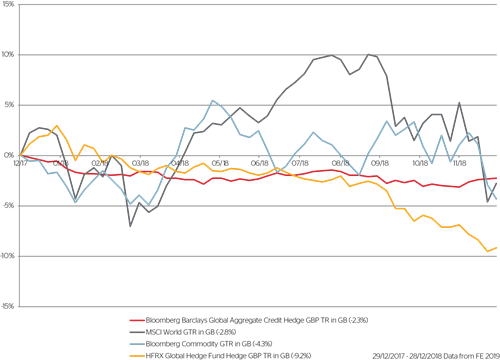

Historically, and as a general rule, investing across a range of assets results in a broad array of outcomes. If stocks struggle, then bonds rally; if investors are nervous, then gold strengthens. That, however, has not been the case recently! In general, everything – bonds, stocks and commodities – has toughed it out and many investors have felt that (other than cash) they have had nowhere else to hide and certainly nowhere to run.

Given this backdrop, we are pleased to report that events have had limited impact on our portfolios. For the last couple of years, we have highlighted that both equity and bond markets have been trading at valuations in excess of their long-term average. Whilst we can’t (and haven’t tried to) forecast the short-term direction of markets or political outcomes, we can recognise excessive valuations and position portfolios accordingly. For instance, three years ago we reduced the equity exposure in our Balanced Portfolios to about 50% and have held approximately this weighting ever since. Not only that, but we have also taken profits in holdings that have been trading particularly expensively, such as some of the global equity holdings, like Lindsell Train and Fundsmith. On the bond side, we have also increased our high-grade bonds and cash to around 20%.

Increased volatility in markets, although broad, hasn’t all occurred at the same time. And it would be remiss not to mention Cryptocurrency, in a year when some of the major names have shaved over 70% from their 2017 prices – more than many asset classes fell during the peak of the Credit Crunch! We avoided the asset class completely; however, the fall will serve as a stark and painful reminder to investors to know what you own and why you own it.

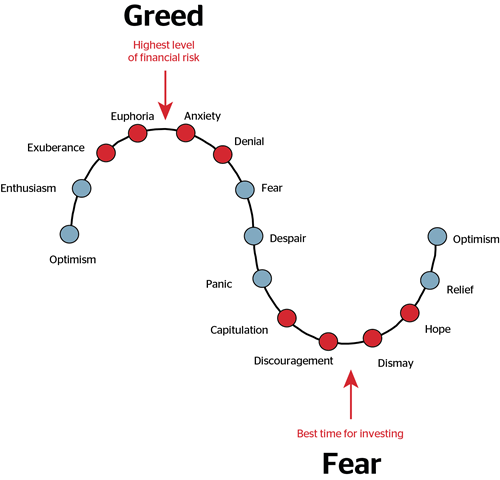

Whilst UK stocks (particularly domestic-facing ones) have struggled all year in the face of Brexit, other areas such as emerging markets suffered in the first six months of the year and have actually outperformed over the last few months. This, in our view, is the result of valuation disparity: emerging markets have actually suffered for a number of years and are now trading at a discount to their long-term average – as well as at a bigger than normal discount to developed-world markets. There have been some great long-term investment opportunities and we have gradually topped-up our emerging market and Asian holdings. Initially this was painful, but buying stocks into a sell-off always is. Nevertheless, a key component of achieving long-term investment success is having the conviction to buy low. Which is easier said than done. The following diagram, illustrating the psychology of investment cycles, is used widely and you may well have seen it in our commentaries before.

The key to achieving successful investment returns is to buy when assets are cheapest. Of course, there is no way to know when the market is at its nadir, so the best strategy is to buy when markets are falling – as emotionally painful as this may be. As long as you have done your research and are filling your shopping trolley with high-quality assets that are both easy to understand and will stand the test of time, this strategy should deliver strong returns over the longer term.

The oft‑quoted Mr Buffet reminds us to be “fearful when others are greedy and greedy when others are fearful.”

Whilst 2019 will undoubtedly confront us with even more change, both political and economic, one thing that will remain robustly consistent is our investment ethos. We will, as always, continue to invest into high‑quality assets, closely aligned with our investment themes, and then hold them for the long term.

Cautious Portfolios:

Lower Risk

by Bob Tannahill

Objective: The Cautious Portfolio’s objective is to increase its value by predominantly allocating capital to fixed-income investments. The portfolio can also invest into global blue-chip equities with strong cashflows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity-weighting of approximately 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

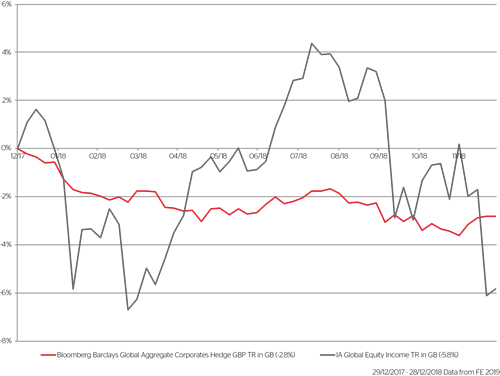

The year that was 2018 is unlikely to go down in many investors’ minds as one to remember, and the fourth quarter was a painful end to a painful year. The Strategy fell 2.5% over the quarter, to end the year down 3.2%. As you can see in the chart, below, the year was a difficult one: both bonds and equities losing money even after adding-back income received. In fact, almost every asset class that pays an income stream ended the year down – making it a very challenging year to deliver an income while protecting capital value.

Looking back over the year, market volatility, which had been falling for a number of years, returned with a bang in February and, despite an admirable effort by the financial media to find a trigger, we remain unconvinced that any single event was the cause. Sometimes markets fall simply because there are more sellers than buyers and 2018 felt very much like a year when the herd was a key factor. After a weak start, investors were barraged with a torrent of news flow covering a huge range of topics from economic data to trade wars to North Korea to interest rates and, of course, let’s not forget, Brexit! This has kept investors guessing and markets bouncing around in response. You can see the main moves over the year in the chart below.

Red – Global corporate bond markets including both capital and income

Black – Average global dividend paying equity fund registered with the Investment Association

Along with this volatility at the headline index level, under the bonnet there have also been a few clear trends that are worth touching on:

Growth assets were favoured over income assets

Across markets there was a strong trend towards growth over income as investors, at least until October, continued to digest President Trump’s pro-growth policies. This caused growth-focused assets to perform strongly – until sentiment changed to focus on a possible recession, which in turn brought equity markets – especially the formerly high-flying tech stocks – down with a bump. While global bonds did their job during the two down-drafts, this combination of market moves left most asset classes in negative territory by year-end.

This created a tough environment for investors, in general, and income investors, particularly, as dividend-paying stocks struggled in the middle of the year when growth was in vogue and then fell again in the fourth quarter in the largely indiscriminate market sell-off.

The UK continued to suffer from Brexit

Over the year the UK suffered heavily with UK equities ending down 8.8% and sterling falling around 7% versus the US dollar. We have been fairly well insulated from these issues thanks to our global approach. Nevertheless, it seems to us likely that at some point markets could reach a moment of maximum pessimism on Brexit and UK assets could then stage a recovery. On the currency side, we have taken steps to dampen the impact of sterling moves on our portfolios. On the equity side, our global managers are keeping an eye out for value in the UK. Nothing has emerged in our preferred sectors yet.

Against this backdrop, how did our underlying funds fare?

Our equity funds outperformed the average global equity-income fund over the year despite the disappointing issue we had in the first quarter with Blackrock’s fund (which we exited in August). In addition, our decision to top-up the equity weight in March, following the sharp first-quarter sell‑off, added to portfolio performance.

On the bond side, our overall bond allocation performed in-line with the main indices that we follow, although this was hampered by a rare misstep by core holding PIMCO during the first quarter. Our more diverse bond funds did their job admirably and behaved well in the face of rising interest rates. Of particular note, our material allocation to the more defensive bond funds such as Smith & Williamson’s Short Dated Corporate Bond Fund (-0.7% YTD) and Schroder’s Strategic Credit Fund (-1.8% YTD) performed exactly as planned.

Looking forward, 2019 is set to start on a much better note, from a valuation perspective, with equities and high-yield bonds both kicking‑off the year at more attractive prices than we have seen in some time. As ever, we are following this situation closely. If current market trends continue, you can expect to see us doing some bargain-hunting in the January sales.

Balanced Portfolios:

Medium Risk

by Tiffany Gervaise-Brazier

Objective: The Balanced Portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

As 2018 draws to a close, the one thing that stands out for us is the return of volatility. Many factors, including accommodative central bank policies, have dampened volatility over the last few years. This is not the normal course of market movements and volatility reminds us that, even in years where market returns look to be stellar, there can be fairly large swings in returns and sentiment. This quarter was no exception, with broader markets suffering a 5.5% decline in October. We are pleased that the Strategy protected on the downside and fell less than 3% in comparison.

A quote from Mark Twain puts this year of investing into perspective: “October: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August and February.”

The Strategy ended 2018 down approximately 2%. The key question on investors’ minds is Brexit. What will be the outcome? Will we vote again? What will happen to sterling? The answer is that we simply do not know and will not attempt to hazard a guess. What we do know is that the world will keep consuming and global companies will keep producing: people will wake up in the morning and brush their teeth using Colgate; shower with Dove soap; eat their Marmite on toast; put on their Nike trainers; and use their Apple technology products – to name but a few of the global brands to which you have exposure in your portfolios.

All the while, we have been reviewing our Global Equity Income allocation – of which a large proportion was held through the Blackrock Global Equity Fund – and we made the decision to sell this holding in December.

Blackrock had been a strong contributor to performance since it was introduced into the Portfolio in 2013. Along with most global equity income funds, the Fund suffered during the rotation towards more growth-focused stocks, such as Technology, earlier in the year. In addition, the Fund has always had a material position in a number of major tobacco companies, which have come under pressure this year. The Tobacco industry is undergoing change as firms position themselves for the next generation of products and regulatory responses are being carefully watched, which creates uncertainty. As is our normal practice, we went to see BlackRock following these developments in order to examine their current thinking and were comfortable that their rationale and positioning remained sound. However, only 6 weeks later we re-visited the team and discovered that it had dramatically reduced its allocation to the sector. For us, this meant that Blackrock wasn’t quite sticking to its knitting in its process and this raised a red flag.

Historically, the specific class of the BlackRock Fund held in the Portfolio had been the hedged version. The reason for this was as a result of the decision to have a more balanced currency exposure. Accordingly, and in order to keep this hedge in place, we switched our holding in the Fidelity Global Equity Income Fund to the hedged class.

We have been researching a number of global equity funds for some time now in order to complement our existing exposure. Everything that we look for in terms of open and transparent management, fundamental bottom-up stock picking, and long-term holding periods is satisfied by our new addition, the Guardcap Global Equity Fund. The Fund’s process has been built over the last 20 years and is very much a team-based approach. The clear-cut process has been reflected in the performance: the Fund has outperformed its relevant benchmark in 6 of the last 8 years and we strongly believe that performance like this only comes from a robust repeatable process. The team’s process is driven by long-term thinking and long holding periods, which is akin to our own approach. We therefore introduced the Fund at an initial 5% weighting in the Strategy.

Earlier in the year we made some slight adjustments to our bond allocation due to low bond yields and interest rates and inflation threatening to rise. Put another way, it seemed to us that they are much more likely to rise than fall from here.

In light of this, and given recent market volatility, the bond allocation in the Portfolio – currently at 50% – needs to maintain a defensive stance with plenty of liquidity whilst trying to generate a return. In addition, given the uncertainty of the Brexit negotiations, the longer dated gilt (10-yr) is showing a little more volatility in the near term. Consequently, we have decided to re-allocate 1.5% of this position into the shorter dated gilt (3-yr) to balance the weighting to 5% in each fund. When compared with long‑duration bond funds of a similar credit quality, a shorter duration stance allows for a lower sensitivity to rising rates, which we believe to be prudent in the current environment.

Elsewhere in the Portfolio, we have used this year’s turmoil in emerging markets to take our position in the Arisaig Emerging Consumer Fund up to 4% on cheaper valuations and have trimmed the more expensive equity positions, such as Lindsell Train, Fundsmith and Polar Healthcare, on the back of strong performance.

Growth Portfolios:

Higher Risk

by Mark Harries

Objective: The Growth Portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

The last quarter of 2018 saw the return of more significant levels of volatility. Throughout October markets were shaken by a wave of higher interest rates, geopolitical uncertainty, fears about slowing growth and trade war speculations. As a result, we saw the broader markets suffer a 5.5% decline. November saw slight recoveries across markets; however, the noise of October was not forgotten for long as the second half of December saw the return of higher volatility levels. Despite the turbulence, it was pleasing to see the Growth Strategy protecting on the downside, falling 6% over the quarter in comparison to the broader market. The Strategy ended 2018 down approximately 2.9%.

Across the final quarter, we saw investors rotate out of Technology and higher-growth sectors into more vanilla Utility stocks, bonds and cash. The excellent returns generated from some of the Strategy’s global blue-chip holdings (our core “shopping trolley” stocks) that investors were favouring at that time was mostly offset by particular weakness in our Technology and Emerging Market holdings. The pull-back in Technology likely resulted from the hike in government bond yields and the Federal Reserve’s incremental interest rate rises. Within the Strategy this weakness was felt in our Polar Capital Technology holding – which went from being one of our consistent winners throughout the year to one of our worst performing Fund’s in October, down approximately 11%.

The impact of the global tariffs and speculation surrounding the US-China trade war continued to be felt in emerging markets across the board; returns were also softer due to the strength of the US dollar. Particular weakness was felt in India, and specifically within the Strategy’s Alquity Asia holding, which has a 25% exposure to this region. Ongoing adverse media surrounding the country, coupled with some negative stock specific news of one of their largest private banks, Yes Bank (in which Alquity Asia has a ~3% position), saw the Fund suffer a double-digit decline during the quarter.

As our investors will know, volatility presents opportunity.

Amidst the sell‑off, we used the rotation out of Technology and weakness in the Emerging Markets to top-up our exposure where value had presented itself. As a result, we brought our positions in the Polar Capital Technology Fund and the Alquity Asia Fund back to their target weightings of 5% and 4%, respectively.

Further to our pragmatism, one of our global thematic holdings, the Pictet Global Environmental Fund, fell ~10% during October as the global trade war appeared to impact stocks associated with energy efficiency. The Fund was trading below its 10-year P/E average, so we took the decision to top-up our exposure from a 2.5% weighting to 3.5%.

Throughout the last quarter, the Polar Healthcare Opportunities Fund continued to outperform both the sector and its peer group to deliver stellar returns. Healthcare as a sector outperformed throughout 2018 as a consequence of its defensive nature – returns generated largely from large-cap healthcare stocks and pharmaceutical companies. Despite the favourable outlook for Healthcare, with merger and acquisition activity having the potential to accelerate into 2019, we remain aware that some of the growth-orientated stocks the Healthcare Fund seeks to own provide their own potential for increased volatility. We are therefore mindful that the Fund needs to be weighted appropriately within the Strategy (currently ~5%) despite valuations appearing attractive at present. Nonetheless, we met with the Polar Healthcare team in December and remain confident in their abilities going into the New Year.

As we begin 2019, many investors will be feeling understandably wary about what political and economic changes may lay in store. The meeting of world leaders at the G-20 summit in Argentina at the beginning of December set a positive precedent going into the New Year; however, and as ever, we will not attempt to predict the future or position the Growth Strategy based on political or economic noise.

Some equity prices have climbed higher than they were a year ago and, although some of the more cyclical areas of the market have been weak, such as the Industrials and Energy sectors, current uncertainty highlights the need for broad diversification and careful portfolio management. Whether it is policy mistakes or macroeconomic risk, we consider it even more important to maintain a cautious stance; this will allow us to make ongoing adjustments to the Portfolio in response to changing valuations and investment environments.

We are therefore going into 2019 neutrally weighted (invested 75% into global equities and 25% into global bonds) since this positioning will enable us to act both efficiently and effectively should pockets of value present themselves. If we do see opportunity arise, we will move swiftly to take advantage; however, until that point, we remain circumspect and are happy lagging our less cautiously positioned peers in an upward market.

Global Blue Chip Portfolios:

Higher Risk

by Sam Corbet

Objective: The Global Blue Chip Portfolio invests into approximately 25-30 global blue chips that are in line with our long term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long-term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

The fourth quarter will go down in history as one investors will no doubt be keen to forget. In the run-up to Christmas, the MSCI World Index fell almost 16% before recovering slightly to close the quarter down 11.4%. This brought total equity returns for 2018 to -3.0%, the first negative year for global equity markets since 2011.

The Global Blue Chip Strategy fared better following a period of noticeable outperformance during the latter half of 2018 – predominately as a result of strategic overweights to the Consumer Staples and Healthcare sectors and lack of exposure to the Energy and Financials sectors.

You may recall that our allocation towards the more conventionally defensive sectors had acted as a headwind earlier in the year as the more growth orientated assets continued to flourish. During times of such exuberance, our stringent investment process ensures we continue to allocate capital to the companies that, we believe, are most undervalued – despite the temptation to follow the crowd. This can often mean we take the contrarian stance and, as such, there will be periods where our valuation-driven strategy is at odds with the market momentum and we underperform. During such periods, we have often explained that companies which possess high-quality, defensive characteristics (stable earnings and cash-flow production) cannot be discounted indefinitely. Such companies offer better downside protection (as they possess the attributes that enabled them to weather all manner of storms) and it was pleasing to see the market recognise these qualities in practice during Q4 and for our investors be rewarded for their patience. The Global Blue Chip Strategy ended the quarter down 5.9% and up 2.0% for the year. For stock-specific insight into this quarter’s contributors/detractors please refer to Ben’s Stock in Focus.

As we turn our attention towards 2019, we would like to assure our investors that our investment process does not involve trying to profit by making highly speculative calls on the short-term directions of markets. Instead, we focus on companies that possess attributes that enable them to stand the test of time, led by management able to successfully navigate its ever-changing operating environment while benefiting from secular growth trends and growing value for shareholders.

With this in mind, the Global Blue Chip Strategy is packed full of such businesses, which, following the recent rout in markets, is trading on a forward-looking price earnings multiple of 16.9x – the cheapest it has been since Q3 2015. This remains at a premium to the broader market (now trading on a multiple of 13.4x); a premium we believe worth paying for, since the Portfolio is of significantly higher quality than the broader market albeit with the more defensive characteristics we seek.

As active managers, we continually look to take advantage of any opportunities an indiscriminate sell-off presents and which would allow us to allocate capital to our preferred holdings at attractive valuations.

During the December lows we were gifted such an occasion and were able to add to the Strategy’s holding in Alphabet – taking the Company to a 3% position. We will remain similarly disciplined in 2019, but poised to act should such opportunities present themselves.

Asset Class in Focus:

It's Bonds, Bob, but not as we know it...

by Samantha Dovey

As Bob “the Bond” Tannahill highlighted in his Cautious Portfolio review, income-producing assets in general have had a tough year. We were recently asked why our most defensive strategy was down the most in 2018. The answer was strikingly simple: when nearly all income-paying assets are down, and 75% of the Portfolio is invested in an asset class that is down 2.4% for the year, you should be worried if the Income Portfolios were positive.

So, what is the asset class, I hear you ask. Well, it is bonds….yes, bonds. “I thought they only ever went up,” is the usual response we get; but, alas, that is not the case!

In fact, 2018 has been the worst calendar year for global corporate bonds in the last 10 years – worse even than 2008 for some indices. Bonds have ground down over the year causing a lot of pain, but they do not tend to grab the headlines like Facebook or Google and so are easily overlooked.

What have we done with our bond allocation in the face of this challenging environment?

As you would expect, we have stuck to our process. We have built bond allocations that both provide an income stream whilst also defending capital in the broadest range of possible scenarios. We have not bet on bond yields rising or staying the same, but tried to find safety and income from a diverse set of positions from the best-managed funds that we can. Then, as usual, we have closely monitored those funds: analysing performance, portfolio allocations and holding regular calls and meetings with the managers to ensure they are sticking to their knitting and not taking undue risks with your money. When we monitor performance, we look at funds both individually, as well as from a portfolio point of view, with the aim of answering a few key questions:

Have the funds performed as we would have expected given the conditions?

Has the manager responded to changes in conditions as we would have expected?

Within these questions we look at the relevant benchmarks, with the headline index for global corporate bonds being the Bloomberg Barclays Global Aggregate Credit Index (hedged into Sterling).

Have our allocations beaten the headline index?

I am pleased to say that the answer is yes; so, whilst the overall return is negative, our bond fund managers have, on average, outperformed. While the outperformance may not seem like much consolation in a negative year, those shorter-term losses will roll-out over time and, in the long run, that little bit of active management adds up to additional performance that is well worth having.

Why have bonds been painful?

All markets tend to move due to factors outside of our control, whether it is a tweet from Trump, the cloud that is Brexit (or not) coupled with trade wars, 2018 has had its fair share. What we should remember when we buy a bond – say, a 10-year government bond – is that we want to know that we are paying a fair price. The “right price” depends on what interest rates do over the next 10 years, which is where the challenge of managing bonds comes in.

And for the bond nerds… (Don’t put them to sleep now, Bob!) What affects interest rates over the next decade is primarily inflation and economic growth, since these are the forces that will drive central banks’ decisions about short-term interest rates. On that front, we have seen the Federal Reserve gently raising US dollar interest rates since 2015 – which was proceeding relatively calmly until Donald Trump appeared on the scene in the summer of 2016. By December 2017, when he signed his Tax Cuts and Jobs Act into law, markets began to take seriously the possibility that US consumer spending and corporate profits might be boosted at the price of higher government borrowing. This is a recipe for higher bond yields and, as a result, lower prices. In fact, between the summer of 2016 and the end of September 2018, the yield on the bellwether 10-year US Treasury bond rose 1.9%, which is a huge move. For context, if we cast our minds back to the economic boom we saw leading up to the global financial crisis in 2008, the same bond only saw a rise of 2.1%. On top of that, we had a whole host of other issues such as the trade war with China – which appears to be buying less US bonds (possibly in retaliation) which may have contributed to higher bond yields.

What does this mean looking forward? Going forward, we will continue to strive to own the best managers in the spaces we want to own and to “tweak” our positions based on valuations. As some of you may have noticed, our high-yield bond allocation has been cut over the last twelve months because it had become expensive; a change that has served us well in December. As I write this, however, high-yield bond prices have fallen to two-year lows, so we are starting to see some value again. If prices get towards the lows seen in February 2016, we may add to the asset class again.

Conclusion

Whilst bonds may not be deemed ‘sexy’, like high growth technology shares, they are employed to carry out the important job of maintaining stability in portfolios during uncertain times. We are pleased to be able to say that our bonds have done that job in 2018. Again, if we look at the graph in the Cautious Portfolios section, the path which equities cut this year has been bumpy to say the least. While bonds at times can look pedestrian in comparison to assets like equities, it is important to remember the old adage that assets go down as well as up. Because if trouble eventually arises and we plan to access our money any time soon (or if we simply prefer not to see too much volatility in our portfolios), it is always good to have a few ‘boring bonds’ in the mix.

Stocks in Focus:

by Ben Byrom

In this quarter’s Stocks in Focus we take a look at our best and worst performers in 2018.

Whilst the market fretted over the health of the FAANGs we had little to worry about medical device manufacturer Medtronic whose regular beat of expectations on both the top and bottom line helped push its stock price higher throughout the year. Top-line growth was aided by favourable conditions in its home market – where large medical companies with broad product ranges are able to take market share – and good international progress, primarily in emerging economies. Bottom-line progress came mainly from cost cuts and margin improvements as the Company continued to benefit from its 2015 acquisition of Covidian.

Hallmarks of a quality business and sound management come in a variety of forms; but the most important, in our view, is being nimble and prescient enough to recognise and react to changing trends within your industry. One of Medtronic’s latest acquisitions was of an Israeli robotics company called Mazor. Robotic surgery is a growing segment within Healthcare as users grow comfortable with the notion that a machine (not a human) is doing the surgery. The fact of the matter is that robotics are far more precise, efficient and predictable than humans, thereby reducing error rates and promoting recovery times. In a procurement environment where the focus is very much on value for money and quality of patient outcomes, robotics would seem to be a ‘no-brainer’. Whilst the Mazor acquisition is unlikely to move the dial on a revenue basis in the near term, it marks an exciting move into a potentially disruptive asset that will help differentiate its spinal product portfolio from the competition, potentially lifting sales in the process. As we know from our monitoring of Stryker, another player in robotic surgery (mainly hips and knees), the adoption of robots in hospitals leads to other robotic and product portfolio sales, especially if they form an integral part of the continuum of care in a specialised area. We will monitor with interest Mazor’s progress and see whether it helps drive Medtronic’s top-line.

Swiss luxury goods company Richemont was one of the worst performing stocks in the portfolio and our largest detractor in terms of contribution. Over the last decade, luxury goods businesses have benefitted from growing exposure to aspirational consumers, particularly in Asia and more specifically China.

Increasing exposure to the emerging regions offer companies huge growth opportunities, but it does come with a greater sensitivity to the EM consumer and a heightened cyclicality in sales.

Despite fantastic reported numbers throughout the year, investors have started to get increasingly worried over the China/US trade war and a slowing Chinese economy – an important growth driver for the Company. Whether the stock’s price action turns out to be a harbinger of doom for China, only time will tell. What we are confident in acknowledging is the fact that stocks are quick to price-in threats, often before they actually materialise. Richemont now trades on 17.9x 1-yr forward earnings estimates. It is also worth bearing in mind that the Company is cash rich, amounting to CHF3.30 per share and placing it on a net of cash valuation of 17x – a similar valuation the Company hit when it bottomed out in June/July of 2016 after a two-year decline that had been driven by China’s crackdown on gifting and corruption which impacted the sales growth of luxury goods in the region. During that sell-off we saw hallmarks of quality in the behaviour of management. Instead of panicking and allowing retailers to offload unwanted inventory at a discount, Richemont stepped in and bought the inventory back off them. This action achieved two things:

1) it kept a good rapport with its distribution network by working with its retail partners through a period that was clearly quite difficult for them; and,

2) it protected the prestige of the brand. Management clearly believed that it was best to take a short-term hit to profitability than take a potentially longer-term blow to the appeal of its brands and ultimately their product’s desirability and pricing power.

With 2019 now upon us we look forward to the raft of quarterly announcements that will start filtering through towards the back end of January. We will no doubt touch on some of them in next quarter’s write‑up.