Ravenscroft weekly update - Spring is in the air

After a winter of discontent in economics, politics and stock markets, it seems the sun is shining once again.

Trump is making friends with China whilst May’s powerbase is arguably increasing with the Labour threat looking to be in disarray. A Brexit deal could well be in the offing with positive implications for UK stock-markets and the currency, indeed GBP FX call options are said to have spiked ten-fold in the past week as investors rush to protect themselves against a sterling spike. Sadly a Brexit delay is more likely as Amber Rudd demonstrates a similar level of insubordination as Chelsea goalkeeper Kepa!

Brexit and Trump have dominated our recent commentary and whilst they provide endless car-crash style viewing, they are also becoming somewhat tiresome for all. Whilst politics has a short-term bearing on financial markets, it is important not to become distracted when there are more powerful long term forces at play. Increased volatility will always provide both short-term opportunity and risk but at Ravenscroft we instead try to focus on indisputable long-term investment themes such as demographics, globalisation and technological development.

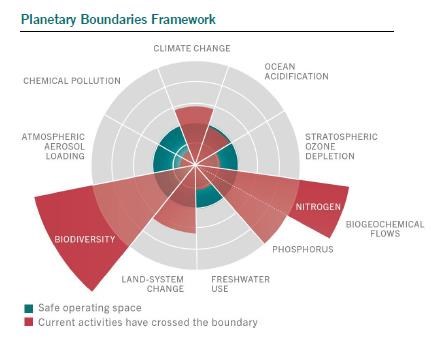

As Europe basks in unseasonably warm weather (expect another UK record this week), 2019 could well become the warmest year on record, albeit hardly surprising to anyone other than the myopic Trump given four of the five hottest years on record have been in this decade. A timely point to remind investors that we are now in the Anthropocene - the Human Epoch. In true human fashion, we can’t agree whether this started 12,000 years ago, 70 years ago or even at all, but our environmental fund managers all agree that we are witnessing the great acceleration in human driven geological and ecological change. The pace of this change is unheralded and unlikely to reverse anytime soon. As Unilever tell us, they will have 300 million more emerging market mouths to feed in the next two years.

SOURCE: Steffen et al, March 2015, Stockholm Resilience Centre

The effect of climate change is not yet considered as severe as the planet’s potentially catastrophic loss of biodiversity but they are undoubtedly interlinked (all the earth’s prior great extinctions believed to have been caused by climate change). The speed of climate change in the Anthropocene is a serious concern and this has implications for all businesses, governments and individuals. As we have heard in the recent weeks, Superdry is struggling to sell its puffer jackets whilst Greggs cannot sell its vegan sausage rolls quick enough, but at least we can turn the fossil-fuelled heating off.

One of our investment themes is the “future consumer” and as part of this we seek to invest in a positive trend of sustainability and scarcity of resources. It is important we understand the impact environmental matters have on our key investment themes of the consumer, health and healthcare, infrastructure and technological development. We would of course be pleased to speak about stock ideas in these areas or about our preferred environmental fund managers. They are doing excellent work in allocating capital to companies with low environmental impact or driving the development of environmental solutions. This is undoubtedly another structural growth market but one where significantly more investment is needed.

Enjoy the sun!

FINANCIAL PROMOTION: The value of investments and the income derived from them may go down as well as up and you may not receive back all the money which you invested. Any information relating to past performance of an investment service is not a guide to future performance. Fluctuations in the rate of exchange may have an adverse effect on the value, price or income of non-sterling denominated investments. The fund has a concentrated portfolio which means greater exposure to a smaller number of securities than a more diversified portfolio. The fund may experience greater volatility as a result of this.